Brazil’s long-forgotten mergers and acquisitions market finally looks poised for a comeback, investment bankers, and private equity firms say.

“There’s a clear improvement in confidence, which increases people’s will to carry out these kinds of transactions,” Amaury Bier, chief executive officer of investment firm Gavea Investimentos Ltda., said by phone from Sao Paulo. “There is this sentiment that Brazil will probably improve, that it has reached the bottom and it’s starting to improve.”

Renewed enthusiasm is everywhere: Business and consumer confidence indexes have rebounded; stock prices are up 66 percent in dollar terms this year, and the currency is the best performer in the world. More importantly, investing in Brazil has become a more predictable enterprise, with the real’s one-month implied volatility — a measure of expected price swings — plummeting to an annualized rate of 15.8 percent, from about 28 percent earlier in 2016.

A key final piece to the puzzle may also be closer to falling into place. The Senate voted early Wednesday to put suspended President Dilma Rousseff on an impeachment trial that could permanently remove her from office and strengthen her successor’s hand as he seeks to break through congressional gridlock to rein in a budget deficit. Acting President Michel Temer hasn’t yet driven through any major policy proposals amid concern that painful spending cuts or unpopular reforms could weaken Senate support for his administration before a final impeachment vote.

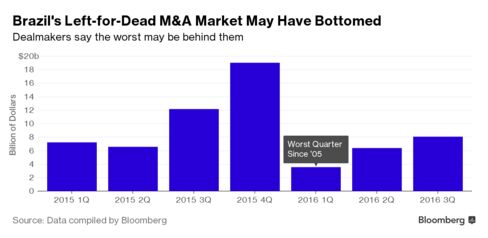

In M&A markets, signs are emerging that dealmaking activity may have bottomed out. The $3.59 billion in Brazil deals in the first three months of the year was the worst quarter in more than a decade, but activity has been slowly rebounding from that level, rising to $8.18 billion so far in the third quarter, data compiled by Bloomberg show.

Inbound mergers and acquisitions — those that involve a foreign buyer targeting a Brazilian asset or company — have surged to $4.71 billion this quarter. While that may pale compared with Brazil’s boom years when Brazil averaged about $9 billion of cross-border M&A a quarter, it’s sharply better than the third quarter of 2015.

Luiz Felipe Alves, founding partner and chief executive of investment banking boutique Cypress Associates, said foreigners are showing much more interest in Brazil these days, in part because there are few better investment options. Of the eight deals he said his firm is near closing, seven involve foreigners. What’s more, new advisory mandates haven’t stopped pouring in, he said.

“First of all, there’s more clarity on the solution to the political problems,” Alves said. “Secondly, there’s a need to allocate capital. The world has a lot of repressed capital.”

Alves cited low-interest rates in Europe and the U.S., especially relative to inflation, as well as uncertainty in other major emerging markets.

Brazil is coping with its worst recession in more than century, but that’s not it’s the only problem. Inflation has also been hovering stubbornly above the central bank’s target range, and federal police and prosecutors have jailed hundreds, including top executives, under the nation’s biggest corruption scandal.

Renewed interest in acquisitions also helped Bier’s Gavea Investimentos, which has a private-equity arm, to sell a 32 percent stake in food processing company Camil Alimentos to Warburg Pincus for an undisclosed amount last month.

“Risk perception toward Brazil is falling, pushing foreigner investors to come back here,” said Ricardo Amatto, a partner at the Sao Paulo-based head-hunter 2Get, which has seen a bounce in demand for CEOs and chief financial officers as private-equity firms make more acquisitions. “As things got less clouded after Rousseff’s suspension, uncertainty faded.”

Recent Articles on M&A

Source: Bloomberg.com