Cisco Systems is in advanced talks to buy out Airtel-Vodafone Idea’s WiFi joint venture (JV) for an enterprise value of ₹200 crore, according to sources aware of the matter.

A team of executives from the US technology and networking company was in India last week to finalise the deal negotiations.

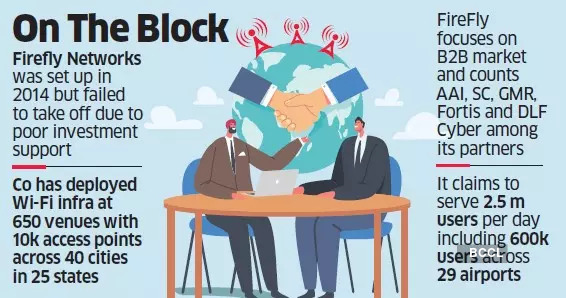

The Airtel-Vodafone Idea JV was set up in 2014 and named FireFly Networks. However, industry insiders claim the collaboration failed to take off as neither of the partners committed investments to the company.

Cisco is likely to retain the existing management of FireFly Networks, which is led by its chief executive officer Raj Sethia, a former Vodafone executive, according to sources cited earlier.

“Cisco does not comment on rumours,” the San Jose, California-headquartered company said in response to ET’s queries.

Vodafone Idea and Sethia declined to comment. Airtel had not responded to ET’s queries until press time.

FireFly’s management has been scouting for investors for the past 2-3 years as Airtel and Vodafone have not been keen on infusing fresh funds due to negligible focus on public WiFi infrastructure, according to sources ET spoke with.

Vodafone Idea CEO Ravinder Takkar last month indicated that the telco may exit the JV and revealed that both itself and Airtel were not focusing much attention on the company.

FireFly focuses on the B2B market and counts the Airport Authority of India, Supreme Court of India, GMR, Fortis and DLF Cyber among its partners.

The company, which also counts Cisco and Indus Towers among its partners, has WiFi infrastructure deployed at 650 venues with 10,000 access points across 40 cities in 25 states. It claims to serve 2.5 million users per day including 600,000 users across 29 airports in the country.

“Public WiFi is not price competitive in India and is not a priority for telcos. While public WiFi is important and needed in India, the business case for it has always been poor. One hopes that Cisco can improve the business case,” Mahesh Uppal, a telecom analyst and director of Com First (India), told ET.

FireFly networks, which competes with US-based Boingo Wireless, also has contracts with its parent companies Airtel and Vodafone Idea for which it deploys WiFi infrastructure for data offloading in areas where demand is high but cell tower capacity is low along with indoor public spaces.

When FireFly was set up, its sponsors were aiming to meet the shortage of wireless network capacity due to less availability of 3G spectrum. However, Reliance Jio’s nationwide 4G services launch at affordable rates a year later reduced the requirement for data offloading as telcos then invested heavily in expanding their wireless 4G coverage, which addressed the capacity requirement.

Ashwinder Sethi, principle at Analysys Mason, told ET that acquisition of FireFly Networks could offer synergies to Cisco as it looks to tap the private network for enterprises opportunity in India. Private networks globally have been deployed over a mix of LTE/5G networks as well as over WiFi/FTTx. “So the WiFi capabilities of FireFly could enable Cisco a faster time to market on the private network side,” Sethi said.