(The following statement was released by the rating agency) FRANKFURT/LONDON, August 01 (Fitch) Fitch Ratings has withdrawn WGZ BANK AG Westdeutsche Genossenschafts-Zentralbank’s Long-Term Issuer Default Rating (IDR) of ‘AA-‘, Outlook Stable, and Short-Term IDR of ‘F1+’ following the bank’s merger with DZ BANK AG Deutsche Zentral-Genossenschaftsbank (AA-/Stable/F1+). DZ BANK acquired WGZ BANK in accordance with the merger agreement signed on 12 April 2016 based on an exchange ratio of 67.6 DZ BANK shares for one WGZ BANK share valuing the combined entity at EUR17.6bn. The enlarged DZ BANK is now the sole central institution of Genossenschaftliche FinanzGruppe (GFG, the German cooperative banking group, AA-/Stable/F1+) and intends to complete WGZ BANK’s integration by end-2018. WGZ BANK was a member of GFG’s mutual support scheme, as is its legal successor DZ BANK. Therefore, WGZ’s creditors continue to benefit from the mutual support scheme’s comprehensive coverage. Fitch does not rate WGZ BANK’s outstanding notes. The merger between DZ BANK and WGZ BANK was also why DZ BANK was excluded from the European Banking Authority’s 2016 EU-wide stress test. The IDRs of all 1,029 member banks of GFG’s mutual support scheme are aligned with GFG’s IDRs, in line with Fitch’s approach to rating mutual banking groups backed by mutual support mechanisms. Beside the enlarged DZ BANK, members are predominantly small local Volksbanken and Raiffeisenbanken based and operating in Germany and DZ BANK’s major banking subsidiaries, which are product suppliers to local banks. KEY RATING DRIVERS The ratings were withdrawn because WGZ BANK ceased to exist as a legal entity on 31 July 2016. As a result, Fitch will no longer provide ratings or analytical coverage for this issuer. GFG’s and DZ BANK’s ratings are unaffected by the merger. We do not assign Viability Ratings to GFG’s members. RATING SENSITIVITIES Not applicable Contact: Primary Analyst Patrick Rioual Director +49 69 76 80 76 123 Fitch Deutschland GmbH Neue Mainzer Strasse 46-50 60311 Frankfurt am Main Secondary Analyst Christian Schindler Associate Director +44 20 3530 1323 Committee Chairperson Christian Scarafia Senior Director +44 203530 1012 Media Relations: Elaine Bailey, London, Tel: +44 203 530 1153, Email: [email protected]. Date of relevant rating committee: 22 January 2016 Additional information is available on www.fitchratings.com Applicable Criteria Global Bank Rating Criteria (pub. 15 Jul 2016) here Global Bank Rating Criteria – Effective from 20 March 2015 to 15 July 2016 (pub. 20 Mar 2015) here Additional Disclosures Solicitation Status here Endorsement Policy here ail=31.

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: here. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY’S PUBLIC WEBSITE ‘WWW.FITCHRATINGS.COM’. PUBLISHED RATINGS, CRITERIA, AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH’S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE ‘CODE OF CONDUCT’ SECTION OF THIS SITE. FITCH MAY HAVE PROVIDED ANOTHER PERMISSIBLE SERVICE TO THE RATED ENTITY OR ITS RELATED THIRD PARTIES. DETAILS OF THIS SERVICE FOR RATINGS FOR WHICH THE LEAD ANALYST IS BASED IN AN EU-REGISTERED ENTITY CAN BE FOUND ON THE ENTITY SUMMARY PAGE FOR THIS ISSUER ON THE FITCH WEBSITE.

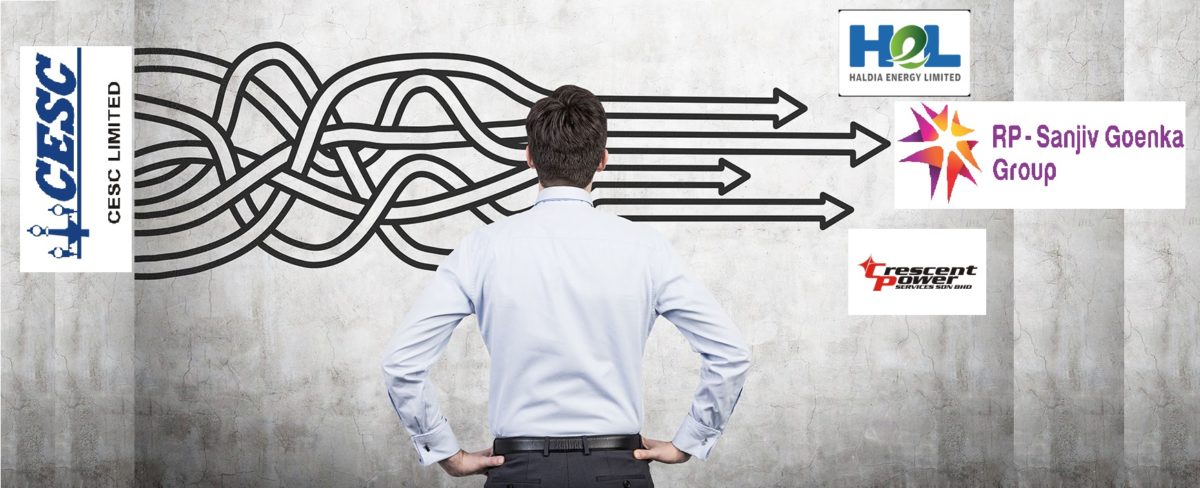

Recent Articles on M&A

Source: Reuters.com