NEW DELHI | MUMBAI: The government has kick-started its biggest fund mobilisation through asset sales by appointing merchant bankers to divest minority stakes held in listed and unlisted companies through the Specified Undertaking of the Unit Trust of India (SUUTI). Three merchant bankers — Citi, Morgan Stanley, and ICICI Securities — were shortlisted from dozen-odd candidates on Saturday.

Three more – HSBC, JM FinancialBSE -2.85 % and SBI Capital Markets – have also been selected should any of the first three runs into a conflict-of-interest situation, said people aware of the development.

The exercise, once completed, could help Finance Minister Arun Jaitley mop up over $10 billion and bankroll flagship projects of Prime Minister Narendra Modi or narrow the fiscal deficit which is expected to widen after the implementation of the Seventh Central Pay Commission recommendations on government employee salaries.

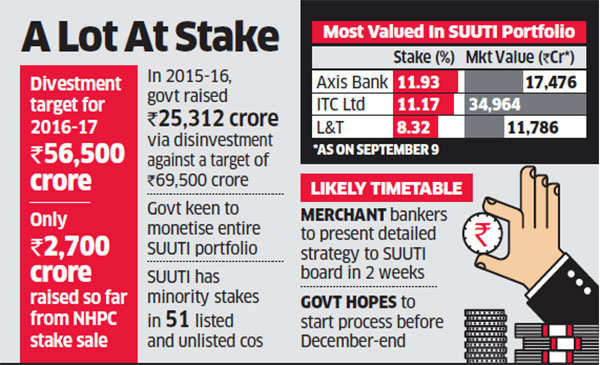

The government set a disinvestment target of Rs 56,500 crore for 2016-17. So far this financial year, it has garnered about Rs 2,700 crore from a stake sale in NHPC Ltd., according to official figures. The government recently issued revised requests for proposals (RFPs) for “attending, assisting and advising on the SUUTI holdings for a period of three years.”

The selection process was finalised by the SUUTI board in Mumbai after two-day long presentations from bankers. A senior government official confirmed that the selection process is over. “This was done in a transparent manner and scores assigned to bankers on various parameters were disclosed to all participants,” the official said.

The merchant bankers will present a detailed strategy to the SUUTI board in the next two weeks on the proposed disinvestment. “The board will examine this and suggest changes,” the official said. The government hopes to start the stake sale before December-end. “There is no fixed timeline. We will take a call depending on the market conditions,” the official added.

In March 2014, the government sold a 9% stake in Axis Bank held through SUUTI for over Rs 5,500 crore. In addition to the 51entities, SUUTI is likely to consider selling other unlisted, illiquid and thinly-traded equity shares, according to the official communique sent to the bidders.

The merchant bankers were initially not allowed to enter into any competing transaction for the entire three-year period for which they were being hired and they had approached the Department of Investment and Public Asset Management for a change in the clause.

Consequently, department officials relaxed the rules for merchant bankers that would manage the stake sales, allowing them to enter into a competing transaction with a private company, provided they notify SUUTI as and when they enter into any conflict-of-interest situation. However, for that phase, the bankers will not be considered for managing the sale of these three companies.

“We will now plan, strategise, time and sequence the issuances. This is an important milestone,” said an official involved in the process. “The mandate also involves choosing the route to market as well. The share sales will be either through offer for sale, block deal, bulk deal, regular sale through the stock exchange or any other-other mechanism, subject to the Sebi rules.”

DIVESTMENT LINEUP

As part of its larger divestment plan, the government has lined up stake sales in Rashtriya Chemicals & Fertilizers Ltd. and National Fertilizers LtdBSE -2.13 %. It may also sell holdings in iron ore mining company NMDC Ltd., trading companies MMTC LtdBSE -1.84 %. and State Trading Corp. of India Ltd. and Oil India Ltd. Plans for the sale of the government’s residual stake in Hindustan Zinc LtdBSE -2.68 %. and Balco is still in a limbo.

ET VIEW: Wind up SUUTI swiftly

The government’s plan to expedite the sale of shares of companies that it holds through SUUTI makes sense. There is no point eternally waiting for the market to zoom for offloading these shares and the process must be crystal clear. The estimated revenue of $ 10 billion is significant, and giving pricing freedom will enable the government to maximise revenues. Potential investors can, say, submit bids over and above the floor price. Each bidder can be allocated as many shares as she has bid for beginning from the highest price, and then going down till all the shares are done in.