Jet AirwaysBSE 0.17 % plans to raise $100 million, or almost Rs 680 crore, in US dollar-denominated debt by March 2017 to refinance rupee-based loans, so that it can almost halve its borrowing rate, a person familiar with the airline’s plans said.

“The airline will keep refinancing more expensive rupee debt whenever possible,” said the person, adding that the move will help cut Jet’s borrowing rate to 6-7%.

He did not divulge if the country’s second-biggest airline by market share has initiated talks with any bank for dollar debt.

Jet has for several years looked at raising overseas loans, but all of its recent overseas debt deals have been done with the support of Abu Dhabi-based Etihad Airways, which holds 24% stake in Jet Airways. In October this year, Jet received nearlyRs 700 crores from a special purpose vehicle created by Etihad in the form of non-convertible debentures, and the funds were used to refinance debt.

Before that, Jet had last year raised $150 million from a consortium of Gulf banks including Abu Dhabi Commercial Bank PJSC, Commercial Bank International PJSC, Ahli United Bank BSC and Arab Banking Corporation BSC. It also raised $150 million from HSBC. Both the loans were raised with Etihad’s backing.

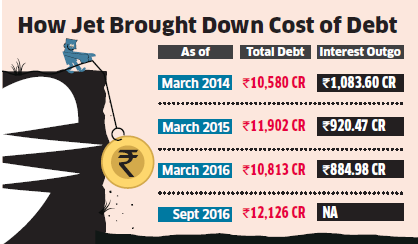

While Jet’s debt has only increased in recent years, overseas loans have helped it cut consolidated finance costs to Rs 885 crore as of March 2016, when 85% of its total debt was in dollar denomination, from Rs 1,083.60 crore two years earlier. ( See How Jet Brought Down Cost of Debt ) As of September 30, however, the share of dollar debt fell to 80% of its total debt of Rs 12,126 crore.