A consortium of buyout private equity specialists KKR and pension giant Canada Pension Plan Investment Board (CPPIB) have emerged as the strongest contender to take over Bharti Infratel, India’s largest listed wireless tower owner after the two week long deadline for exclusive talks with another Canadian financial powerhouse Brookfield Asset Management Inc. ended inconclusively last Friday, said people involved in the matter.

In a stock exchange notification on October 25th Bharti AirtelBSE, 0.96 % said it has taken board approval to explore monetization of a significant stake in Infratel. It, however, did not provide much colour in terms in the quantum of stake that it plans to divest or the value. Sunil Mittal-controlled AirtelBSE 0.96 % currently owns 71.96% in the company while the rest is held by public shareholders.

The exercise is an attempt to give Bharti, India’s largest telecom operator, more financial flexibility to combat deep pocket rivals like Mukesh Ambani-owned Reliance Jio Infocomm, due for commercial next year, and Vodafone.

ET was the first to report about the potential transaction in its Oct 31st edition.

The current market cap of Bharti Infratel is Rs 70, 303.61 crores ($10.4 billion). Most expect a 10-15% premium if a sale for control eventually takes place.

It is however not clear if KKR-CPPIB, the original contenders for the transaction, have also entered into an exclusivity as yet. No final agreements have also been reached, and there’s no certainty the discussions will result in a transaction, according to the people. The Bharti board also have still not decided if they will give up control or dilute a minority stake, the sources added.

Suitors like KKR have expressed their desire to own a 51% stake, making the company a independent infrastructure provider. Sources in the know said, Airtel ideally has been looking to divest up to 40% stake to a consortium of financial investors making them the single largest shareholder block. Depending on the valuation and the premium offered by the investors, it may also give up management control. Considering the size and scale of the potential transaction, KKR and CPPIB are looking to team up. A consortium approach may also help them avoid the open offer trigger. “A 51% stake means a $5 billion cheque size plus a control premium. Very few investors may want to take such a large bite, so a consortium seems most likely. It suits both the buyer and the seller,” said an official in the know and added, “This is poised to be the largest tower deal in the country till date,”

Bulge bracket private equity funds such as the Blackstone Group and Carlyle Group have been looking to invest in telecoms infrastructure assets and did look at investing in Bharti Infratel, but decided to opt out.

CPPIB is an investor for both Blackstone and KKR and was expected to act as a catalyst for the co-investment.

“There are very few prized telecom asset with such scale available in India. Naturally, now many global strategic and PE funds are waking up to the opportunity now. Some like Crown Castle have evaluated India for a long time but stayed away. But with players like American Towers consolidating in India and with the data boom expected in the near future Infratel will be much sought after,” said an investment banker specializing in the sector.

However, Bharti Group may also have the option to put the process on hold if the demand comes bellow their expectations, one of the sources involved in the process said.

A Bharti spokesperson told ET, “The company declined to comment beyond its initial statement of October 25, 2016, that was issued to the stock exchanges.”

Both KKR and CPPIB declined to comment.

PRIZED ASSET

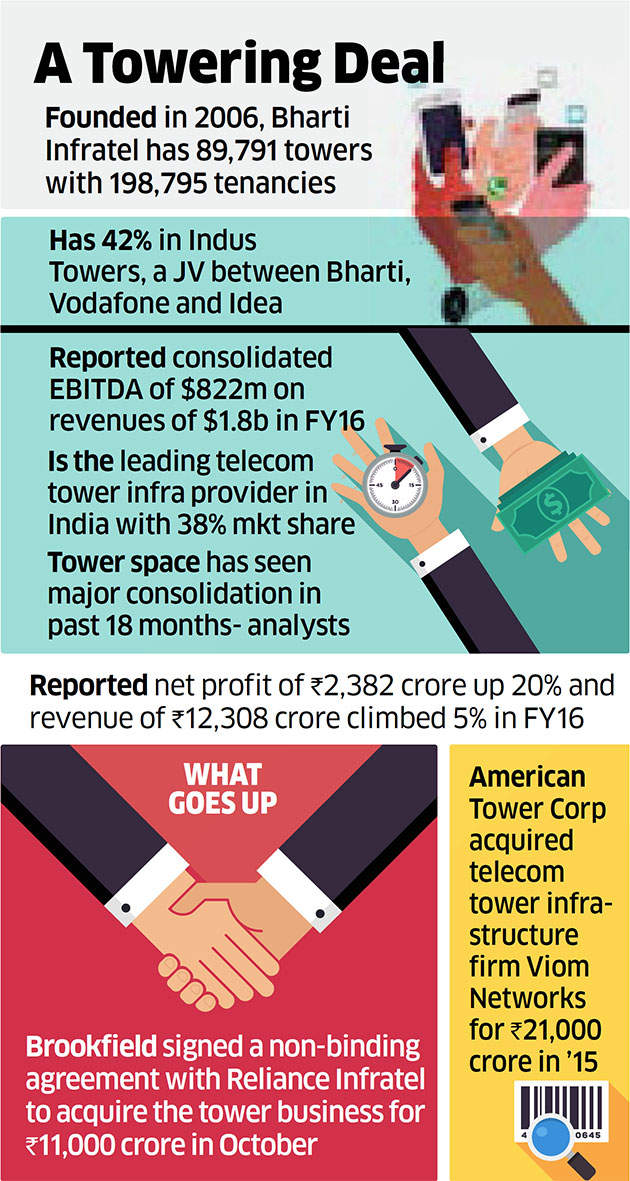

Infratel, including Indus Towers, is the leading telecom tower infrastructure provider in India with 38% market share. Backed by parent Bharti and by virtue of 42% stake in Indus Towers, Infratel shares a strong relationship with Bharti, Vodafone, and Idea, which account for 74% telecom revenue market share and are aggressively expanding their 3G/4G footprint. On a consolidated basis, Infratel has 89,791 towers with 198,795 tenancies, implying a sharing factor of 2.21. Bharti Infratel’s average monthly rental per slot leased is also on the higher end of the industry at Rs 34,000.

In FY16, the company earned consolidated EBITDA of $822m on revenues of $1.8 billion. In Q2 FY17 the revenues were $494 million and EBITDA of $218 million as per its latest disclosures.

Telecom analysts reckon there is a very good possibility of Bharti bringing down its stake in Infratel from the present 71% to 51% and de-leverage its balance sheet and this could bring down its net FY18e net debt /EBITDA to 1.7x from 2x (and if it were to add the recent auction related debt then net debt/EBITDA would come down from 2.1 x from 2.5x).

If Bharti Airtel sells 40% stake in Infratel, then we consider it to be longer term positive for the company, Bank of America-Merrill Lynch analysts Sachin Salgaonkar and Karan Parmanadka said in a note on Nov 16. “This is because it could eventually improve stock’s liquidity and could also reduce the market perception that majority of control of tower-co remains in the hands of telcos and potentially lead to re-rating. It is uncertain if the cash payout/buyback would remain high at such levels if Airtel does not have a controlling stake in the entity.”

KKR along with Temasek were part of a clutch of investors who had put in $1.25 billion in Bharti Infratel through a mix of equity and convertible debentures in December 2007. Of that, KKR alone had pumped in $250 million. It fully exited the company in 2015. Infratel was its maiden exit in India, giving it an estimated 70% return in rupee terms over a 7 year period. CPPIB is also one of the leading LPs of KKR globally and has in recent years emerged as a large infrastructure investor in India.

Recent Articles on M&A

Source: Economic Times