Ever felt so hungry, it wasn’t until after inhaling the entire sleeve of Oreos that you finally processed how much sugar and fat you just recklessly consumed? The titans of Corporate America may be right there with you.

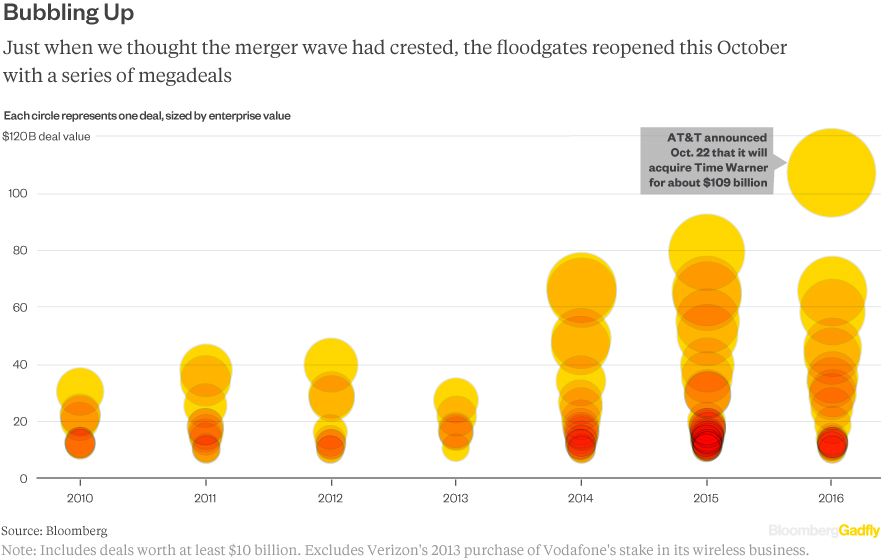

Companies in the U.S. have been gorging on super-sized, debt-heavy acquisitions for more than two years because they are starved for growth and have few alternatives. It seemed to be a phenomenon of 2015 that would cool this year, but the deal space has heated back up again.

The biggest one on that chart above is AT&T Inc.’s takeover of Time Warner Inc., which will transform the phone company into a media behemoth. It follows AT&T’s purchase of satellite-TV provider DirecTV and somehow makes that $67 billion transactions look like peanuts by comparison.

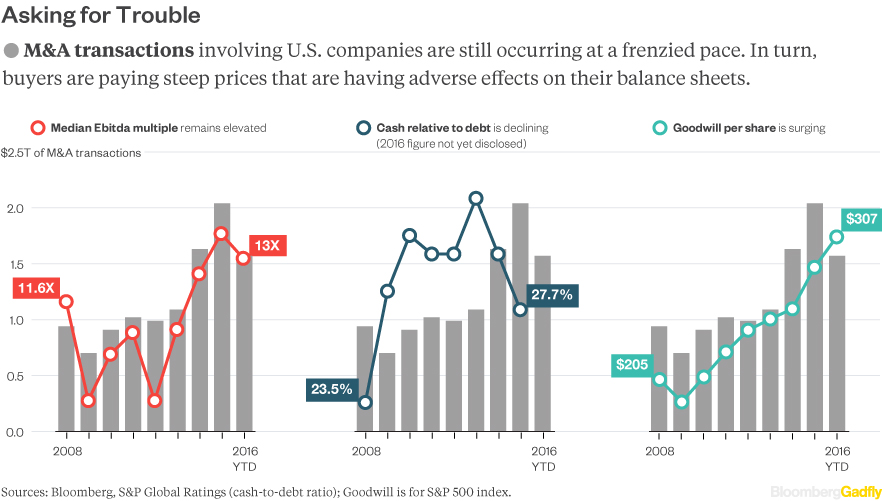

This M&A trend isn’t necessarily a bad thing in itself. As the health edict goes, most things are fine in moderation. The problems arise when acquirers pay too much and become less healthy as a result of the debt burden.

It’s impossible to truly assess a merger’s success or failure until a couple of years after it closes. But we are seeing some broad, early warning signs:

Maybe these large deals will end up doing what they set out to do: grow companies’ top and bottom lines. But history shows us that more often than not, megamerger hopes aren’t fulfilled. And this boom hasn’t created much value yet, either: In the midst of two of the most robust years for M&A, led by the U.S., the S&P 500 index is only barely up.

Here’s the thing: Management teams can’t stretch their balance sheets and slash expenses in perpetuity to create an illusion of growth for shareholders. That’s just the reality. Investors need to accept it.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Recent Articles on M&A

Source: Bloomberg.com