When Argentina’s Mauricio Macri won the presidency late last year, MBA Lazard’s head of Latin America thought merger and acquisition activity would take off toward the second half of this year. The flurry of deals has arrived.

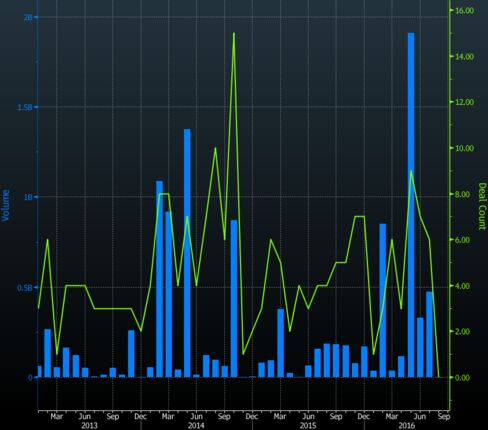

Deals in Argentina year-to-date have nearly quadrupled to $3.8 billion with 16 completed transactions and another 19 pending, according to data compiled by Bloomberg. The deal list is led by Pampa Energia SA acquiring assets from Petroleo Brasileiro SA and Fintech Telecom LLC buying Telecom Argentina SA.

MBA Lazard has seen a strong increase in interest and deals not experienced since 2006, Matias Eliaschev, managing partner, said in an interview in Buenos Aires. MBA Lazard, which advices on M&A deals through five offices in Latin America, has hired more bankers in Argentina this year to meet the surge in demand, the 40-year-old said.

Energy, telecommunications, and consumer goods are the areas with most potential for future deals, while interest in financing infrastructure projects is also on the rise under Macri’s government, Eliaschev, who previously worked at the International Finance Corp. in Washington and at HSBC before joining MBA Lazard in 2007, said.

Argentine companies are also appealing targets because most of them still have plenty of room to grow in terms of market share, a key element in company’s valuations. Financial firms are also attractive since Argentina is trying to incorporate more people into the banking system, which at about 20 percent, is currently one of the lowest in the region.

Lost Decade

MBA Lazard advised on a $575 million deal for Coca-Cola Co. to buy a soy-based beverage line from Unilever PLC.

Argentina, Colombia, Peru and now Brazil are the bright spots for deals in the region for different reasons, he said.

“While the region was living a boom of foreign investment, Argentina was not an appealing market,” he said. “Now that the government is normalizing the situation, Argentina becomes attractive due to the size of the population and of the middle class. The question isn’t whether the foreign investment will come or not, but when.”

Latin America as a whole is recovering from a painful 2015 in terms of deals. After the worst year M&A activity since 2009, deals in the region are rebounding as the market sees commodity prices leveling off which is bringing bid and ask prices closer together, he said. Deals in Latin America are up 2 percent to $74.7 billion year-to-date from a year earlier led by utilities, according to Bloomberg data.

Regional Rebound

“Bidders and sellers are again having similar valuations, which facilitates deals,” Eliaschev said. “The fall in commodities prices also generated devaluations which at the end of the day have generated attractive prices in dollar terms.”

Corruption investigations from Brazil to Chile have also led to companies putting more assets up for sale and trying to slim down to focus on core businesses, he said. Brazilian oil giant Petrobras sold a stake in an offshore oil field for $2.5 billion to Norway’s Statoil ASA last week and is pledging to divest $15 billion of assets as it tries to recover from the so-called Car Wash corruption probe.

“The second half of the year is very promising,” he said.