Rockwell Collins Inc. is making its biggest-ever acquisition in a bet that airplanes will get smarter, as everything from lie-flat seats to toilet valves send live data to in-flight crews and maintenance workers.

“It sets us up for the future,” Ortberg said in an interview Sunday. “We’ve made major investments in next-generation airplanes. That trend is going to translate into the interiors of aircraft.”

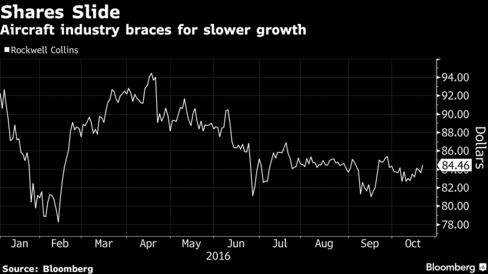

The transaction vastly broadens a product portfolio that has been centered on aircraft communications and computing equipment since Cedar Rapids, the Iowa-based company was spun out of Rockwell International in 2001. The deal, which is slated to close in early 2017, is the latest in a spate of mergers involving suppliers to Boeing Co. and Airbus Group SE, which are squeezing costs as they brace for slower growth following a decade-long sales cycle.

“It’s an opportunity to build a smarter plane,” Richard Aboulafia, an aerospace

analyst at Teal Group, said by telephone. “Given the pricing pressure, you’ll probably see more deals like this.”

Share Reaction

B/E Aerospace investors will get $34.10 in cash and $27.90 in shares of Rockwell Collins common stock, for a total consideration of $62 a share, the companies said in a statement Sunday. That’s a 23 percent premium over B/E Aerospace’s closing price on Friday. With the assumption of $1.9 billion of debt, the purchase comes to $8.3 billion, according to the statement.

B/E Aerospace jumped 16 percent to $58.70 at 9:36 a.m. Monday in New York, while Rockwell Collins fell as much as 4.2 percent to $80.88 for the biggest intraday decline in six months. B/E Aerospace gained almost 20 percent this year through Friday, while Rockwell Collins had declined 8.5 percent.

B/E Aerospace is the largest supplier of aircraft cabin equipment, ranging from modular lavatories to luxurious seats as expensive as a Ferrari. On a proforma basis, the combined manufacturer would have had almost 30,000 employees, $8.1 billion in revenue and $1.9 billion in earnings before interest, taxes, debt and amortization for the 12 months ended Sept. 30, 2016, according to the statement.

The savings flowing from the merger, pegged at about $160 million, would mostly come from combining suppliers and eliminating overlapping headquarters functions, Ortberg said. Those so-called synergies don’t include the potential boost to sales that would open up when the companies are combined, Ortberg said.

“At first glance, we find it difficult to clearly see how Rockwell Collins could extract $160 million,” Epstein said.

‘Smart Cabin’

Rockwell Collins has a base of business-aviation dealers that could offer to retrofit private jets with B/E Aerospace’s interiors. The Wellington, a Florida-based company has very strong ties with airline customers that Rockwell Collins may be able to leverage to sell more of its avionics equipment and inflight entertainment systems.

The end result may translate to better inflight service. For example, sensors in luxury seats in first- and business-class cabins could notify flight attendants when a passenger is waking up on a long-haul flight and ready for a hot towel or glass of orange juice.

“The smart cabin is here,” Amin Khoury, co-founder and chairman of B/E Aerospace, said in an interview Sunday. “It’s not something that may happen in the future. It’s happening now.”

The boards of both companies have approved the transaction, which will still need to pass muster with shareholders. Werner Lieberherr, B/E Aerospace’s chief executive, will be named executive vice-president and chief operating officer of a newly created aircraft interiors division after the merger closes. Khoury will stay on as a consultant to Ortberg.

Fourth-Quarter Earnings

Separately, Rockwell Collins said profit from continuing operations in its fiscal fourth quarter rose to $1.58 a share, up from $1.38 a year earlier, according to a statement on Sunday. Analysts expected adjusted earnings of $1.57, according to the average of 17 estimates compiled by Bloomberg.

Sales in the period rose 4.4 percent from a year earlier to $1.45 billion, trailing the average analyst estimate of $1.48 billion. Equipment sales were hurt by lower planemaker production rates, including Airbus’s A330 widebody jetliner, the company said. For its 2017 fiscal year, the company said it expects revenue between $5.3 billion and $5.4 billion — that’s on a standalone basis, and doesn’t account for the deal with B/E Aerospace.