The government finally rescued Yes Bank, the country’s biggest-ever banking failure, by asking state-run State Bank of India to infuse Rs 7,250 crore and take 45% stake in the bank. Reserve Bank of India cleared the ground for the takeover. Proactively, the central bank had unveiled a draft reconstruction scheme on March 6 for the capital-starved Yes Bank and even superseded the bank’s board for 30 days on the ground of a “serious deterioration” in its financial position and the absence of a viable revival plan. The government had even put a sudden moratorium on cash withdrawals. While the country’s largest lender may have rescued Yes Bank, the crisis clearly indicates the level of financial stress in the banking and financial sector.

If one looks at Q3 FY20 results of YES Bank LTD published soon after the announcement of the reconstruction scheme, it is crystal clear that the bank net worth is wiped out fully with negative capital hence in common parlance it has collapsed and cannot continue to do its business without augmenting its capital and have the confidence of its creditors including all current, fixed deposit and saving account holders.

Crumbling of a bank this size can have loss of confidence in the whole financial systems which could lead to a collapse of multiple institutions and companies. After the bank on its own failure to get the investors in the last six months to avoid its collapse, the government has no choice but to come out with the bailout plan in the form of the scheme.

The Central Government has notified the “YES Bank Limited Reconstructed Scheme, 2020” (Reconstruction Scheme) in the exercise of powers conferred by sub-section (4) and sub-section (7) of section 45 of the Banking Regulation Act, 1949 which came into force on 13th March 2020.

Reserve Bank of India (RBI) has the power to make an application to the Central Government for an order of moratorium in respect of Banking Company when RBI is of the opinion that there is “Good Reason” to do so. Banking Regulation Act, 1949 does not list down the specific events on the occurrence of which RBI may make an application to Central Government for an order of moratorium. RBI has discretionary power to make such application to Central Government. During the period of moratorium if the RBI is of the opinion that it is necessary in the interest of stakeholders, it may prepare a scheme for –

- the reconstruction of banking company

- the amalgamation of banking company with other banking institutions.

RBI on March 6 placed in public domain a draft reconstruction scheme inviting suggestions and comments from the public including the banks’ shareholders, depositors and creditors before 9th March 2020. Timeline provided for submitting the suggestions o the draft reconstruction scheme RBI was a too little.

According to the Banking Regulation Act,1949 Reconstruction scheme prepared by the RBI will override provisions of the all other laws or agreements, awards, or any other instrument.

Features of the Reconstruction scheme

- Authorised share capital of the reconstructed bank i.e. YES Bank will increase to Rs.62,00,00,00,000 (Rs. 60,00,00,00,000 Equity shares and 2,00,00,000 Preference shares.

- Shares will be allotted to the investors at Rs. 10 (Face value- Rs. 2 + Premium – Rs. 8). There will be lock-in period of three years from the commencement of this Scheme to the extent of 75% in respect of ––

(i) shares held by existing shareholders on the date of such commencement;

(ii) shares allotted to the investors under this Scheme:

Provided that the said lock-in period shall not apply to any shareholder holding less than one hundred shares.

- There will be a restriction on voting rights on the shares held by the investors.

An investor, other than the investor bank, may exercise voting rights to the extent of

(i) it’s shareholding; or

(ii) nine per cent. of the total voting rights of all the shareholders of reconstructed bank; or

(iii) as may be decided by the Reserve Bank,

whichever is lower. However, RBI has the rights to allow voting rights even beyond 9% but not exceeding 15% to a particular investor.

All investors including SBI has been given capital gain tax exemption which may arise due to subscription under the scheme.

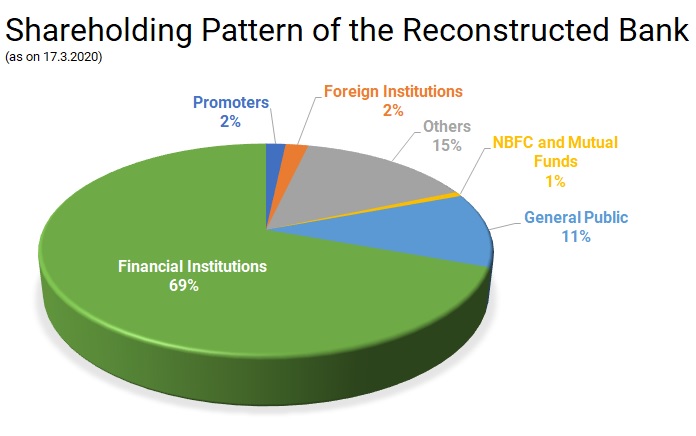

Table 1: Investors of the Reconstructed Bank

| Sr No. | Name of the investor | Amount Invested (I) | Approx. Stake |

| 1. | State Bank of India | Rs. 7250 cr. | 45 % |

| 2. | ICICI | Rs.1,000 cr. | 6 % |

| 3. | HDFC | Rs.1,000 cr. | 6 % |

| 4. | Axis Bank | Rs. 600 cr. | 3.5-4 % |

| 5. | Kotak Mahindra bank | Rs. 500 cr. | 3 % |

| 6. | Damani, Jhunjhunwala, Premji trust | Rs. 500 cr. each | 3% Each |

- Shri Prashant Kumar, former Chief Financial Officer and Deputy Managing Director of State Bank of India, will act as Chief Executive Officer and Managing Director and Shri Sunil Mehta, former Non-Executive Chairman of Punjab National Bank, will be Non-Executive Chairman.

- All employees of the YES Bank shall continue as the employee of the reconstructed bank after the scheme of reconstruction with the same remuneration. There will not be any change in the terms of services w.r.t retirement, determination of office. However, Board of Directors of the reconstructed bank after following the due procedure can discontinue the service of Key Managerial Personnel (KMP).

- There will not be any change in the offices or branch network of reconstructed bank.

- YBL’s Basel III Additional Tier 1 (AT-I) Bonds of Rs. 8,415 crores have been written down.

Legal Analysis

Insolvency and Bankruptcy Code (IBC) V/s Reconstruction Scheme

The Bank and financial institutions are not covered by Insolvency Bankruptcy Code. So waterfall provisions as given under SEC 53 of IBC is to be applied and in most cases when financial creditors are not paid in full, shareholders equity, at least of the promoters is wiped out and reduced to nil and in all other equity shareholders are also compelled to lose major part of their equity, if not 100% as in the case Essar Steel Ltd.

Banks and financial institutions are in unique positions. Creditors and debtors both its customers. Their creditors are all unsecured and general public and corporate holding current accounts and savings accounts. Any bail out /resolution plan in a way it is done for all other industries, might not only not work but also lead the bank to collapse resulting in huge destruction of value for all the stakeholders and loss of confidence in the whole banking system. So going by the process of forming of i) Committee of Creditors, ii) announcing a moratorium on withdrawals, iii) getting Resolution/bailout plan approved by them and iv) finding the resolution applicant and minimum time of 270 days to reach there will be disastrous for the health of the bank and its customers. Leverage is almost ten times of its net worth as compared to around two to three times in any other industry. So even 5% of its assets going bad will cripple the bank severely and 10% of its assets going bad can bankrupt any bank. It has also large exposure inter se with other banking and financial institutions. So, its assets and liabilities components required it to be rescued either by large dose of capital infusion as in the case of public sector banks or merging the bank with some stronger bank.

In any industries business going into financial crisis, one can take some time to take over and revive even if operations are completely closed. But the same is not possible in the case of a bank. Once you suspend or scale down the operations of the bank even for a month, not only the bank will collapse but it will lead to chaos in the whole financial systems and make them run on the deposits of their retail customers and chancing of recovery from lendees will be diluted substantially.

Considering the rapidly deteriorating financial position of the YES Bank Limited relating to liquidity, capital and other critical parameters, and the absence of any credible plan for infusion of capital (no doubt there were couple of announcements by the promoter managing director and new managing director regarding they are getting LOI from various foreign investors) necessitated the RBI to formulate reconstruction scheme in the public interest and particularly in the interest of the depositors.

We all know that business as well as the growth of the Banking Company is dependent on the amount of deposits. People consider the bank as the safest mode for parking their surplus funds and in fact use current accounts to manage their business. If YES Bank would have fallen, it would have definitely affected the confidence of the depositor hence the RBI has tried to revive the same through Reconstruction Scheme which is equal to the resolution plan in the IBC which is also beneficial to all the stakeholders.

Though the objective of the reconstruction scheme is similar to the resolution plan under the IBC, there is a difference in the two. Under the IBC resolution plan is submitted by the resolution applicant and the same is confirmed by the Committee of Creditors and then by the NCLT. Here Reconstruction scheme is prepared by the RBI (post it has identified the resolution applicant) in consultations with proposed investors and comments/ suggestions from the large public are also invited by RBI. In case of the Resolution plan, amount infused by the Resolution Applicant is used to clear the dues of the corporate debtor towards creditors, stakeholders. Amount infused under the reconstruction scheme is used to maintain tier I capital of the bank.

Reconstructions Scheme – Advantageous to the growth of YES Bank and/or Banking System?

YES Bank was in immediate need of funds because of the deterioration in its asset quality, NPA provisioning and mounting losses. As of 31st December 2019, YES Bank has almost Rs. 40,709 crores of Gross NPAs and an eroding balance of deposits. YES Bank could have borrowed money to maintain liquidity, but a stake sale saves YES Bank interest costs, gives it a good buffer to Recover and grow without future cash outflow of debt repayment.

A bank consortium led by a state-run bank will ensure stability in the banking system and can use all the resources at its disposal to recover these loan assets of YES Bank. Collapse of YES Bank would have led to the depositors and even the general public losing confidence in the banks. Swift action by RBI and Government has help avert such dire consequences.

How the scheme is beneficial to all stakeholders of YES Bank?

YES Bank was on the brink of insolvency and if the bank had in fact decided to close down and distribute its assets or sale to any other investor, it is probable that only the priority creditors (employees and other operational creditors, secured lenders, etc.) would be able to recover some or all of their money. Other stakeholders who are lower in the hierarchy like the shareholders, depositors like the fixed depositors, Savings or Current account holders would lose substantial part of their deposits. (DICGC -Deposit Insurance Credit Guarantee Corporation insures only up to Rs.5,00,000 per account. The depositors with higher balances would have lost the rest).

As of 31st March 2019 YES Bank employed about 21,200 people. The scheme ensured their jobs for one year without break. YES Bank was able to avoid insolvency because of the scheme and RBI was able to rescue not only, fixed depositors, saving and current account holders, but also the thousands of employees, in one single stroke.

RBI could and probably did try to get Global or Domestic investors or even SBI or any other bank to acquire YES Bank. But given the poor asset quality (as given in table below) of YES Bank, no investor would want to single-handedly absorb the bad assets of YES Bank.

YES Bank has made huge provisions for NPAs till Q3 – 2019. The enterprise value of YES Bank has obviously taken a huge hit. One needs to look at the table of NPA Ratios status as on 31st December 2019.

Table 2: NPA Ratios of YES Bank as on 31.12.2019

| Particulars | Amount (INR Crores) |

| Gross NPA balance | 40,709.20 |

| Provision made in 9 months ending | 27,710.44 |

| Cl. Bal. of Provision | 31,071.20 |

| Gross NPA to Gross Advances% | 18.87 % |

| Net NPAs to Net Advances % | 5.97% |

Source: Basel III disclosures 31-12-2019

The bank witnessed high slippages from the stressed book and recognised slippages up till March 14, 2020 in the Q3FY2020 results, for which it made accelerated provisions in its Q3 FY2020 results, leading to the depletion of its capital ratios. Post the equity infusion and write-down of the AT-I Bonds, YBL’s capital ratios are likely to improve with CET-I and Tier I of 7.6% and 7.8%, respectively, and CRAR of more than 9.0%. As the regulatory norms require banks to maintain a CCB of 2.5% as on March 31, 2020, ICRA expects additional capital requirements of ~Rs. 9,000-13,000 crore over the next 1-2 years.

Strategy

The government must take care of competing priorities in the interest of the financial systems while coming out with the scheme for the institution, which in some way is considered to be too big to fail. Path selected has been unconventional by inviting competing public sector and private sector banks to join the rescue plan. It made choices like giving control to the largest public sector bank and selecting managing director and chairman who are ex-directors of public sector banks. Next how the restructured YBL is able to operate successfully without losing large deposits and also recovery of all amount lent without any further slippages is the key to the success of the plan.

Previous Such mergers:

The last time when a PSB was brought in to rescue a private commercial bank was in early 2000 when the Global Trust Bank (GTB) collapsed because of its heavy losses in the stock market. The bank had lost a lot of money post the Ketan Parekh scam. In 2004, the RBI designed a GTB merger with the Oriental Bank of Commerce (OBC).

In another instance, in 2010, the RBI encouraged another merger between Bank of Rajasthan and ICICI Bank. The RBI was not comfortable with the Bank of Rajasthan promoter and its inspection unearthed various violations by the bank.

There are some examples in other countries also where other investors have given helping hand to the financial institutions in their struggling period. In the Financial Crises of 2008, in the USA some banks struggled, and Bank of America was the one that was hit hardest. In late 2011, Bank of America was struggling to raise capital, and so Warren Buffett once again stepped up with a deal to invest $5 billion in the bank, getting preferred stock and warrants.

Future of this deal:

Reportedly, SBI is in talks with several Global and domestic investors like investment firms, banks, asset management companies to make investments in YES Bank. And with the recent approval of the Board to raise 5,000 crore capital, seems like the Board may have found new investors

Also, in 2017, 5 associate PSBs of SBI were merged with it. This was, of course, a voluntary step towards consolidation in the Banking sector and it also did benefit SBI. In this case, to avoid a situation like the IL&FS fiasco, SBI was asked by the Govt. and RBI to step in. At present, YES Bank is struggling and this investment doesn’t seem gainful. Nevertheless, over the next 3 years, the consortium may help YES Bank stand on its feet and SBI will take over the bank or they may even hand it over to new investors.

Over the near to medium term, the bank’s ability to improve its deposit franchise and reduce its reliance on wholesale funding will be critical to maintain its scale of operations. The reduced scale of operations could also impact its profitability unless it is able to prune its operating costs as well. Despite the high slippages in 9M FY2020, YBL has overdue advances (SMA) of ~8% of its standard advances as on December 31, 2019. This, coupled with the need to increase the provisions on the stressed investment book, will translate into elevated credit provisioning requirements in FY2021.

The bank’s ability to improve its deposit franchise over the medium term and reduce its reliance on wholesale funding will be critical to maintain its scale of operations as well as profitability. Hence, the profitability will be driven by recoveries from the stressed pool of assets. However, in the near term, the loan book is expected to degrow, which will constrain the operating income growth. The bank’s ability to reduce its operating expenses would be critical for its overall operating profitability. Credit costs will continue to be driven by recoveries as fresh slippages expected to remain high. YBL’s exposure to the corporate sector has been declining but it remained high at 57% of the overall advances as on December 31, 2019 (61.9% as on September 30, 2019 and 65.6% as on March 31, 2019) compared to the banking sector average of ~40%. The high share of corporate advances has impacted the bank’s asset quality.

Conclusion

Not allowing YES Bank to collapse for Indian banking and financial systems is similar to not allowing COVID -19 to infect the large population. The new management needs to define priorities. Identify and communicate the three to five most important ones. Early in the crisis, those might include employee retention, financial liquidity, customer care both depositors and lenders, and operational continuity. Document the issues identified, ensure that leadership is fully aligned with them, and make course corrections as events unfold. Make smart trade-offs. It may not be easy in any way. What conflicts might arise among the priorities? Between the urgent and the important? Between survival today and success tomorrow? Instead of thinking about all possibilities, the best management should use their priorities as a scoring mechanism to force trade-offs.

The above is possible if the bank name the decision makers. In the central command “war room,” it must be established who owns what. Empower the front line to make decisions where possible, and clearly state what needs to be escalated, by when, and to whom. Your default should be to push decisions downward, not up. The management should embrace action, and not waste time to punish mistakes. In triage situations, it’s crucial to have an accurate, current picture of what is happening on the ground. leaders must get situational assessments early and often. One way is to create a network of local leaders and influencers who can speak with deep knowledge about the impact of the crisis and the sentiments of customers, depositors, employees, and other stakeholders. Technology can bring the parties together; and in fact on online payments and use of UPI, YES Bank is the leader. The success depends on how the management can lead with empathy and handle changing dynamics.

Add comment