Stanley Black & Decker Inc. returned to deal-making with a bang this week by agreeing to buy Irwin hammers and Lenox saw blades as part of a $1.95 billion transaction. That may only be the start.

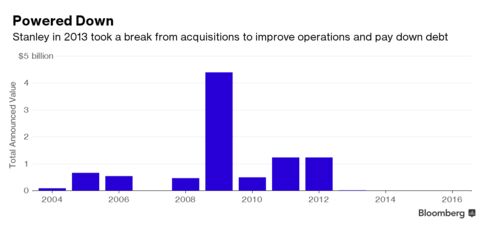

The deal ended a self-imposed moratorium on acquisitions that lasted almost three years as the tool giant looked to repay debt and improve operations. Now Stanley, once a serial acquirer of smaller companies, is poised to lead a wave of deals in the fragmented tool industry.

“Stanley has been a consolidator, that much has been clear, both on the home improvement and personal tools side, as well as in the industrial tools side,” Jeffrey Kessler, an analyst at Imperial Capital, said by telephone. “They’re going to continue to invest heavily, not just through acquisition but through internal improvements, in putting the right brands in the right geographies, and the right brands in the right areas of use.”

Snap-On Inc. and Apex Tool Group could also be buyers, Levington said. Stanley, Apex and Hong Kong’s Techtronic Industries Co. have explored bids for Sears Holdings Corp.’s Craftsman tool business after the company said in May it would consider a sale, Bloomberg News reported last week.

‘Good Shape’

“If you’re looking for industrial end markets that are in reasonably good shape in North America, you could probably point to both the residential and nonresidential construction markets being some of the healthier ones,” Levington said.

A Stanley representative declined to comment. Representatives of Snap-On and Apex didn’t respond to requests for comment.

Potential Deals

The toolmaker remains in the hunt, Chief Executive Officer James Loree said. While the New Britain, Connecticut-based company will be focused on closing the Newell deal, that “does not preclude us from doing an acquisition, say, in another part of the portfolio,” he said Wednesday.

Stanley, which was formed from the 2010 merger between Stanley Works and Black & Decker, is looking to sell its mechanical locks business, which could fetch as much as $1 billion, according to a report Thursday from Reuters. A deal would provide cash for acquisitions while demonstrating Stanley’s focus on the tool business, Kessler said.

“It signals where they’re putting their chips,” he said.