Mumbai: There has been no decision yet on a European joint venture (JV) of Germany’s ThyssenKrupp AG and the Tata group-controlled Tata Steel Ltd, ThyssenKrupp India’s chief executive Ravi Kirpalani said in an interview to Mint Mumbai Tuesday.

“It is too early yet for any conclusive outcome of discussions with Tata Steel,” he said, adding that the parent was in discussions with “other interested” steel manufacturers in Europe as well. Kirpalani said he is not directly involved in any of these discussions.

Tata Sons’s ousted chairman Cyrus Mistry had played a key role in discussions about merging Tata Steel’s Europe operations with those of ThyssenKrupp, and his abrupt removal could affect these discussions, according to analysts. A CLSA Asia-Pacific Markets report on Tuesday said the deal may be delayed.

“All those discussions are at a preliminary stage and we are nowhere close to any sort of fruition of even being able to know whether they will come to something or a preliminary timeline, but certainly discussions are on with large parties to explore the possibilities of consolidation in steel (in Europe),” Kirpalani said.

Tata Steel in March decided to put its entire UK business on sale in the face of a slump in steel demand and prices, but the plan hit a roadblock due to uncertainty stemming from Britain’s decision to exit the European Union (EU).

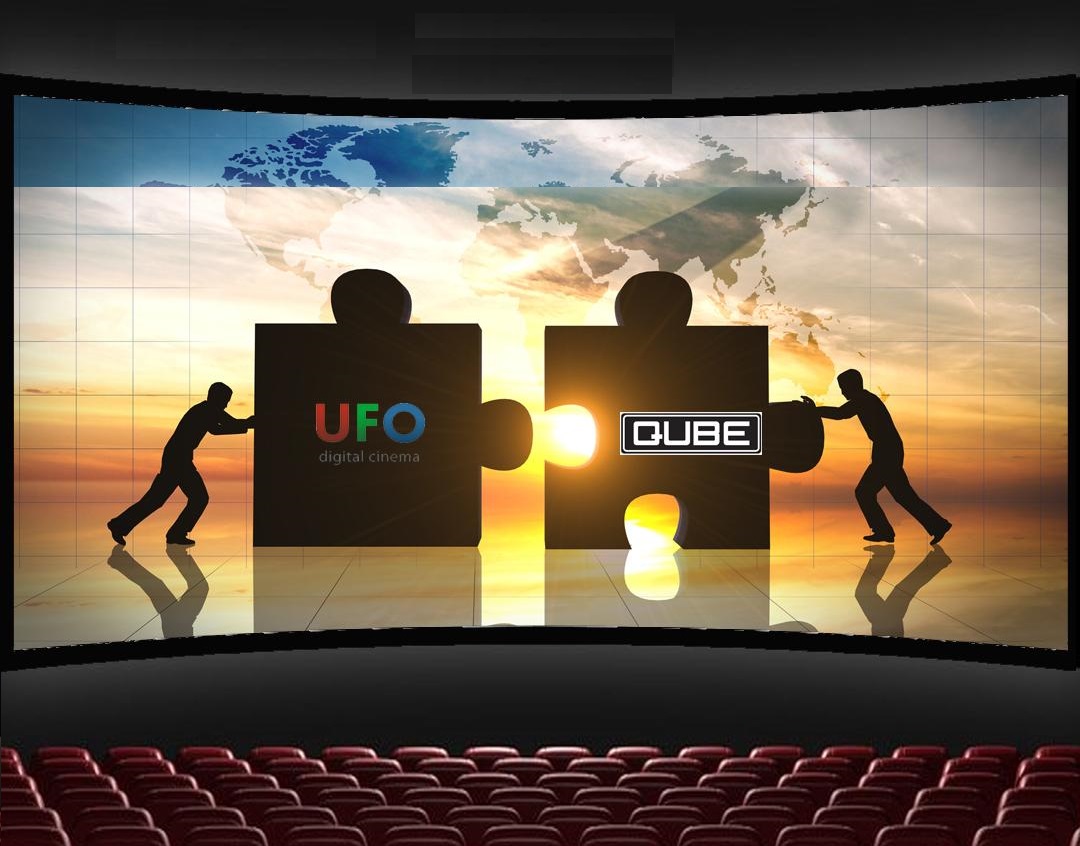

The group eventually halted the sale process in July in favor of discussions for a joint venture with “strategic players in the steel industry, including ThyssenKrupp AG”, the company had said.

An email sent to Tata Steel Wednesday remained unanswered.

ThyssenKrupp last year said it would invest Rs300 crore in setting up an elevator manufacturing plant at Chakan, Pune. Kirpalani said the company would explore further investments in its electrical steel plant in India once the country clarifies its stance on an anti-dumping duty on finished electrical steel products.

Electrical steel made by the company is used in manufacturing motors, transformers, and power transmission equipment.

“We are getting squeezed in between because our raw material prices have gone up (due to anti-dumping duty on raw materials) and there is no duty protection on the finished product… If our raw material continues to be disadvantaged, then we will find it difficult to invest to make a finished product,” he said.

Kirpalani does not see an imminent revival in the private sector investment cycle in India. “People still don’t have the confidence to say that yes we are seeing a turnaround.”

ThyssenKrupp, a German conglomerate with interests in steel, elevators, automotive components, and industrial solutions, had a revenue of €42.78 billion in 2015. The Indian unit, which contributes less than 1% to global sales, has a target to reach $1 billion in revenue over next three years.

A flood of cheaper imports from China and Russia, price volatility and rising raw material prices would keep the outlook for the European steel industry negative over next 12-18 months, Bloomberg said Wednesday, citing a Moody’s report.

Source: Mint