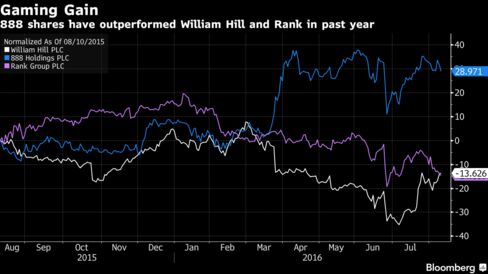

U.K. bookmaker William Hill Plc rejected a 3.2 billion-pound ($4.2 billion) cash-and-stock offer from 888 Holdings Plc and Rank Group Plc, a deal that would take recent industry consolidation to a new level.

The bidders offered 364 pence a share, with 45 percent of that being shares in a new company formed to make the acquisition, William Hill said in a statement Tuesday. That represents a “low premium” of 16 percent to the price before the suitors announced last month that they were considering a bid, it said.

“This conditional proposal substantially undervalues William Hill, is highly opportunistic and does not reflect the inherent value of the business,” Chairman Gareth Davis said in the statement. The “highly complicated” proposal involves “substantial risk” for shareholders, as the merged company would be saddled with 2.2 billion pounds of debt to fund the cash part of the deal, it said.

William Hill shares rose 0.5 percent to 329 pence at the close of trading in London, after rising as much as 7.3 percent earlier when reports of the bid surfaced. 888 fell 1.9 percent to 219.25 pence, while Rank eased 0.9 percent to 211 pence.

The bidders are likely to come back with an increased offer, though may lack the financial resources to pay what William Hill would find acceptable, said Alistair Ross, an analyst at Investec in London.

“I don’t think they will have the cash or the clout to get this deal done,” said Ross, who estimates that the suitors would need to pay about 400 pence a share to succeed.

The proposal from 888 and Rank comprises 199 pence a share in cash and 0.725 shares in the bidding company, the bookmaker said. William Hill investors would own 44.6 percent of the combined entity, which would have annual revenue of about 2.8 billion pounds.

No Pressure

For their part, 888 and Rank have said that a combination would make sense as a consolidation of their online and store-based operations would deliver “substantial revenue and cost synergies.” They didn’t immediately reply to William Hill’s rejection.

For 888, the takeover would mark a reversal of events after William Hill abandoned a possible offer for its online competitor in February last year. 888 was later foiled by GVC Holdings in a bidding contest for Bwin.party Digital Entertainment Plc. CEO Itai Frieberger said in March that deals were “on the agenda,” although the company was under no pressure to make an acquisition.

At $12.9 billion, the volume of gaming-industry deals announced in 2015 was about double that of 2014 and the highest since 2005, according to data compiled by Bloomberg. Recent deals include Paddy Power Plc’s 2.9 billion-pound takeover of Betfair Group Plc.

Citigroup and Barclays are advising William Hill.