Japan’s Yanmar has agreed to buy 18% stake in International Tractors, makers of Sonalika branded tractors, for about Rs 1,600 crore, increasing the Tokyo-based firm’s stake to 30%, in one of the largest foreign capital inflow into India’s core agriculture-related industrial sectors.

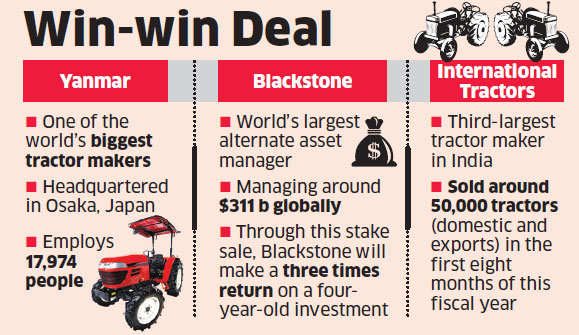

Yanmar will acquire shares held by the world’s biggest private equity fund, Blackstone Group, which will make a rough three times return on a four-year-old investment.

The deal will value the company about Rs 9,000 crore. Blackstone had invested in ITL in 2012 and this exit adds to a series of successful ones the New York-headquartered private equity giant has made in the recent past. The transaction is expected to close in next few months, subject to the receipt of requisite regulatory approvals.

The transaction would be the second Japanese investment into the agriculture-related sector. Earlier in June, Sumitomo Chemicals acquired a majority stake in Excel Crop Care for about Rs 1,386 crore.

ET reported in its June 16thedition that Yanmar is looking to increase its stake in International Tractors.

Yanmar was an early investor in the Indian company having bought the stake in 2005 for Rs 200 crore.

Both International Tractors and Yanmar confirmed the transaction. Confirming this development, ITL Vice-Chairman, AS Mittal said that partnership with Yanmar has and will be a game changer for the tractor industry both in India and overseas.

Naoki Kobayashi, India head and a member of Yanmar Board said ITL is an integral part of the growth strategy for Yanmar and this investment is a testimony towards this commitment.

Sonalika is the third largest tractor maker in the country. Sonalika has sold around 50,000 tractors (domestic and exports) in the first eight months of this financial year.

The company has been working on scaling up its presence in international markets, its exports have grown by 20% to 8121units between April and November this year.