MERCK LIMITED (MERCK INDIA), formerly E. Merck Limited, was set up in India as Merck’s first Asian subsidiary in 1967. The company operates both its pharmaceuticals and chemicals businesses in the country. Merck was also the first Merck Group Company to go public in the year 1981. The company, as of June 2013, has nearly 1550 employees across its Corporate, Pharmaceuticals and Chemicals business with its manufacturing plant in Ponda, Goa commenced in 1983. Spread across nearly 150,000 sq. m., it has facilities for pharmaceutical as well as chemical manufacturing. In addition to manufacturing injectables and soft gel capsules, Merck India is also the largest manufacturer of Vitamin E in the country.

The biopharma, performance materials and life science (BPL) business of the Company, whose operations solely comprise of (i) the manufacture and trading of prescription medicines for the treatment of cardiovascular disorders, diabetes and thyroid disorders; (ii) trading of effect pigments and functional materials for the automotive, cosmetic, plastic and security industries and the manufacturing of materials for the cosmetic industry; and (iii) trading of products for use by the pharmaceutical and bio-pharma industries, including active pharmaceutical ingredients, excipients and bio-pharmaceutical process chemicals. The company is also the only manufacturer of the chemicals, Guaiazulene, Thiamine Disulphide and Oxynex ST for Merck worldwide. The Dehydrated Culture Media plant that was set up in India in 2008 is the first outside Germany. This business shall not be part of the global transaction with P&G.

Other Group companies in India

Merck Specialities Private Limited (MSPL) is the Indian sales organization of the global Merck Group of Darmstadt, Germany. It supplies the Indian market with high-quality pharmaceutical and chemical products. Established in 2005, this subsidiary is wholly owned by Merck KGaA.

Merck Life Science Private Limited (MLSPL) was incorporated in 1986 as a joint venture with Millipore Corporation, USA and became a 100% subsidiary of Millipore Corporation in 2009. Millipore was acquired by Merck Chemicals in March 2010. Merck Life Science Private Limited India is a leading life science company in the country. Most of the big names in pharmaceutical, biotech, research, F&B and education have Millipore as their preferred partner of choice. Millipore India has been consistently featured in the Top Ten Bioscience Service Providers Ranking compiled by respected industry publications, year after year. The building area is spread across 5,0626 sq ft. in Bangalore. It is ISO 9001:2008 Certified facility. The facility comprises of a main building for domestic manufacturing and Export Oriented Unit (EOU) serving both Global & Domestic customers. It is a single location for manufacturing of Standard Tangential Flow Filtration and Chromatography Purification systems

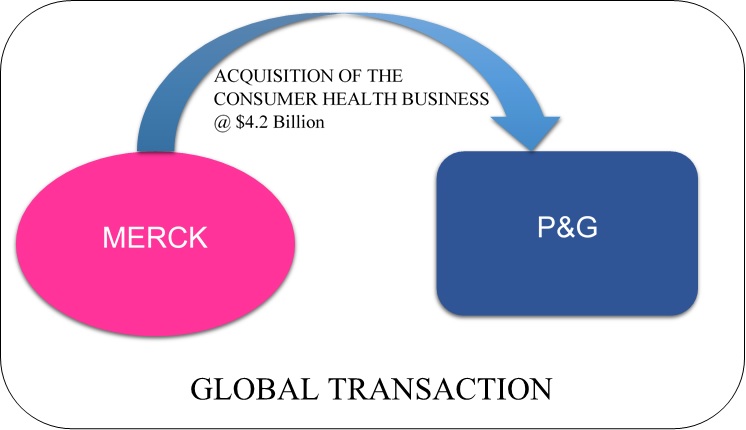

GLOBAL TRANSACTION

Merck, a leading science and technology company, announced that it has signed an agreement to sell its global Consumer Health business to Procter & Gamble (P&G) for approximately €3.4 billion (INR 27,200 crore) in cash. The transaction, which is expected to close by the end of the fourth quarter 2018, is subject to regulatory approvals and satisfaction of certain other customary closing conditions. Merck intends to use the net proceeds from the divestiture primarily to accelerate deleveraging. At the same time, it will allow Merck to increase flexibility to strengthen all three business sectors. The divestment of the Consumer Health business is an important step in Merck’s strategic focus on innovation driven businesses within Bio Pharma, Life Science and Performance Materials. Consumer Health is a strong business that deserves the best possible opportunities for its future development.

Currently, the company carries out the Consumer Health business (CH Business) and the BPL Business. As mentioned above, globally MERCK is selling its CH business to P&G and its affiliates.

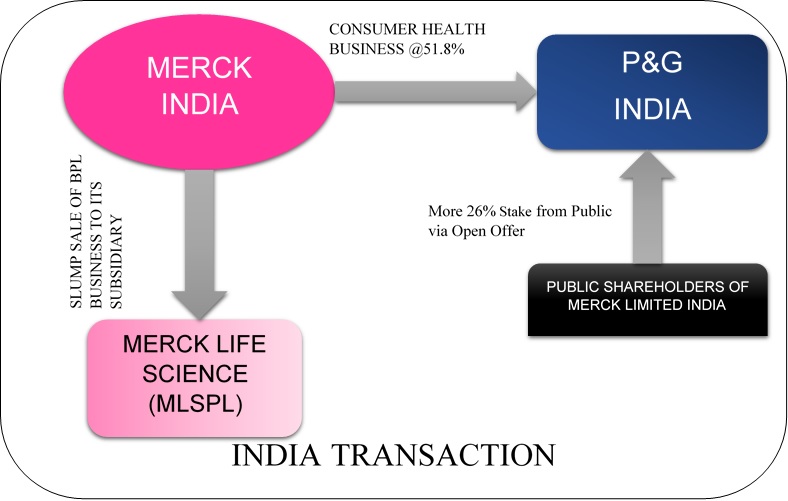

INDIAN TRANSACTION

Merck Promoters and P&G promoters have signed an agreement to sale 51.80% stake in Merck Limited to P&G promoters at value of INR 1,290.19 crore. Pursuant to this acquisition P&G promoters has made an open offer to public shareholders (minority shareholders) for 26% stake in compliance of takeover code.

The board of directors of Merck India has also signed a slump sale agreement with MLSPL (Merck group) to sale BPL business of the company (as being not part of the transaction) at value of INR. 1,052 crore.

As part of the transaction, Merck and P&G have agreed a number of manufacturing, supply and service agreements. Total net contract amount to be receivable by the company is approx. Rs 35 crore per annum. Details are as below:

| Contracts | Terms |

| Manufacturing and Supply |

|

| Transitional services by the Company |

|

| Transitional services to the company |

|

| Transitional distribution services |

|

RATIONALE

- P&G’s global scale and strategic interest in the health and well-being of consumers provide an excellent basis for accelerating growth, leveraging teams’ capabilities and expanding the Consumer Health business profitably.

- This acquisition helps us continue to drive sales and profit growth for P&G by providing the capabilities and portfolio scale need to operate a winning global OTC business.

- Steady, broad-based growth of the OTC healthcare market will help Merck’s Consumer Health portfolio. These leading brands and the great employees of Merck’s Consumer Health business will complement Personal Health Care business.

- Ready manufacturing capacities at Goa and within this transition period of 3 years agreement has been entered for its utilisation.The acquisition of the Consumer Health Business shall help MERCK Ltd (India) to use funds and focus on its BPL Business post takeover by P&G in India.

The prospect of the BPL Business will not be attractive to the Company

- The BPL Business is highly dependent on product and process competence as well as nonexclusive licenses of MERCK and its affiliates globally. The other dependencies include intellectual properties associated with brand, product line extensions, research and development, software, proprietary tools and platforms.

- As such, the BPL Business draws significant synergy and scale benefits from Merck Group’s global operations, which may no longer be available upon the change of control of the Company. In the event of any discontinuation of support of the Merck Group, the Company may not be able to run the BPL Business profitably, and this may have adverse implications from the market, rendering the BPL Business unsaleable to a third party.

- The BPL Business is primarily trading business and is prone to volatility, it requires a disproportionately high level of working capital.

Shareholding Pattern

Table 1: Current Shareholding Pattern

| Particulars | No. of Shares | %age |

| Merck Promoters | 85,99,224 | 51.80% |

| Public | 80,00,158 | 48.20% |

| Total | 1,65,99,382 | 100.00% |

Table 2: Shareholding Post-Acquisition and open offer by P&G promoters

| Particulars | No. of Shares | %age |

| P&G promoters* | 1,29,15,064 | 77.80% |

| Public | 36,84,318 | 22.20% |

| Total | 1,65,99,382 | 100.00% |

Please Note: This is subject to Open offer of 26% stake is fully subscribed

INVESTMENT BY P&G

The Investment by P&G for the acquisition of 51.80% from the Merck promoters is Rs. 1,290 crores. Further investment by P&G for exit to minority shareholders can be Rs. 580 crores net.

Please Note: P&G promoters will be entitled to dividend from the cash flow received by the company for slump sale of BPL business to Merck Group of INR 696 crore (net of taxes), if the same is distributed post transfer of shares

VALUATION:

Table 3: Valuation of MERCK Ltd. (India) CH & BPL Business

| Particulars | BPL Business | CH Business | Total |

| Business Valuation | @697 | *1,794 | 2,491 |

| Additional Consideration for Slump Sale for Taxation and Dividend Tax | 355 | N.A. | N.A. |

| #Slump Sale Consideration | 1,052 | N.A. | N.A. |

@as per valuation report from Valuer

*Calculation based Total value of the company based on acquisition price minus value for BPL Business

# Slump sale price agreed town the parties considering taxation implications

Financials

Table 4: MERCK India Financials

| Particulars | BPL Business | CH Business (Remaining Business) | Total |

| Revenue | 373 | 693 | 1,067 |

| EBITDA | 52 | 132 | 184 |

| EBITDA Margin | 13.8% | 19.1% | 17.2% |

| Enterprise Value /Equity value | 697 | 1,793 | 2,491 |

| EV Multiple | 13.53 | 13.54 | 13.54 |

*Consideration Payable for BPL for Slump Sale is Rs. 1052 which is considering income tax and DDT if distributed to the shareholders.

DELISTING OF BPL BUSINESS

Through slump sale of BPL business to Merck’s Private group company it wants to delist and with fair value including taxation effects on the same.

PRICE MOVEMENT

Post announcement market price has gained almost 60%.

Conclusion

The exit from Consumer Health Business for Merck will help to focus and have funds available for BPL business to be used innovation. However, the company wants this business to be private since it will not generate enough profit being product supplied from holding company on non exclusive rights basis and royalty payable to the holding company for intellectual property. Therefore, the slump sale to the private group company of Merck in India and acquirer has also funded for the taxation which might arise on slump sale in the interest of the company. Whereas the P&G will benefit from expansion of the business with ready infrastructure and fixed contract with Merck group till the transition period to supply goods and services. Going forward with successful implementation of strategy for products expansion it will have consolidation of this business in one listed company in India. For the shareholders on the announcement it has created value and going forward the company may distribute the funds received from the slump sale as dividend to the shareholders.