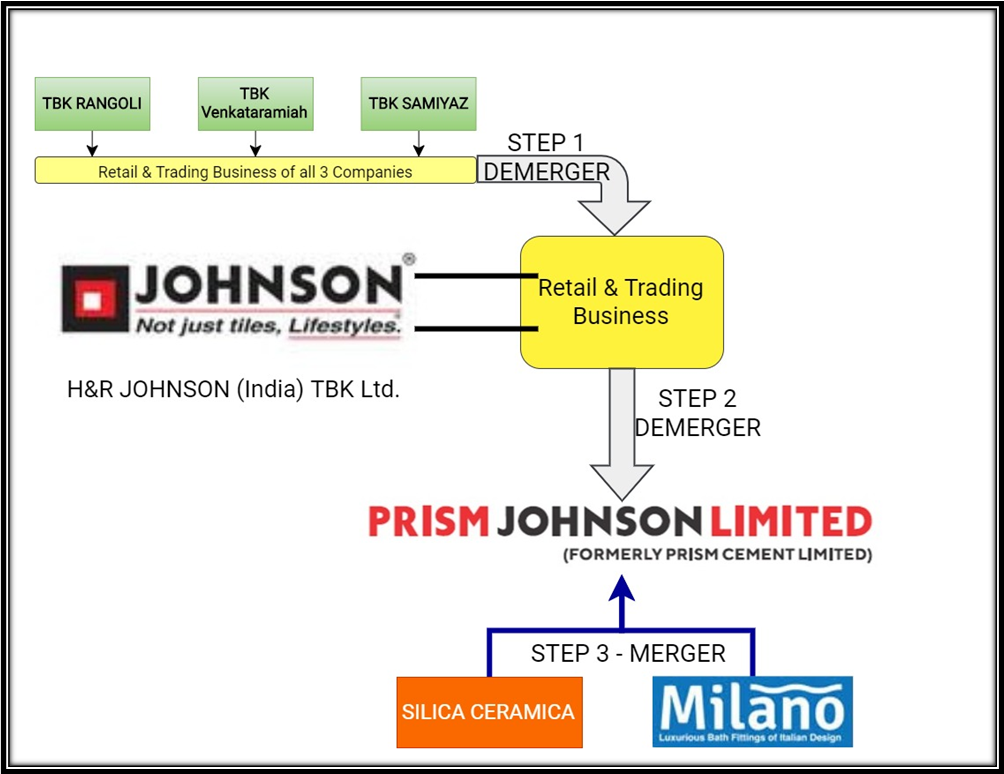

The Board of Prism Johnson approved the demerger of retail business in its 4 arms and the amalgamation of its 2 subsidiaries Milano and Silica Ceramica into itself. Prism Johnson Ltd. (PJL) has decided to simplify its organizational structure and streamline its Tile Bathroom Kitchen (TBK) businesses.

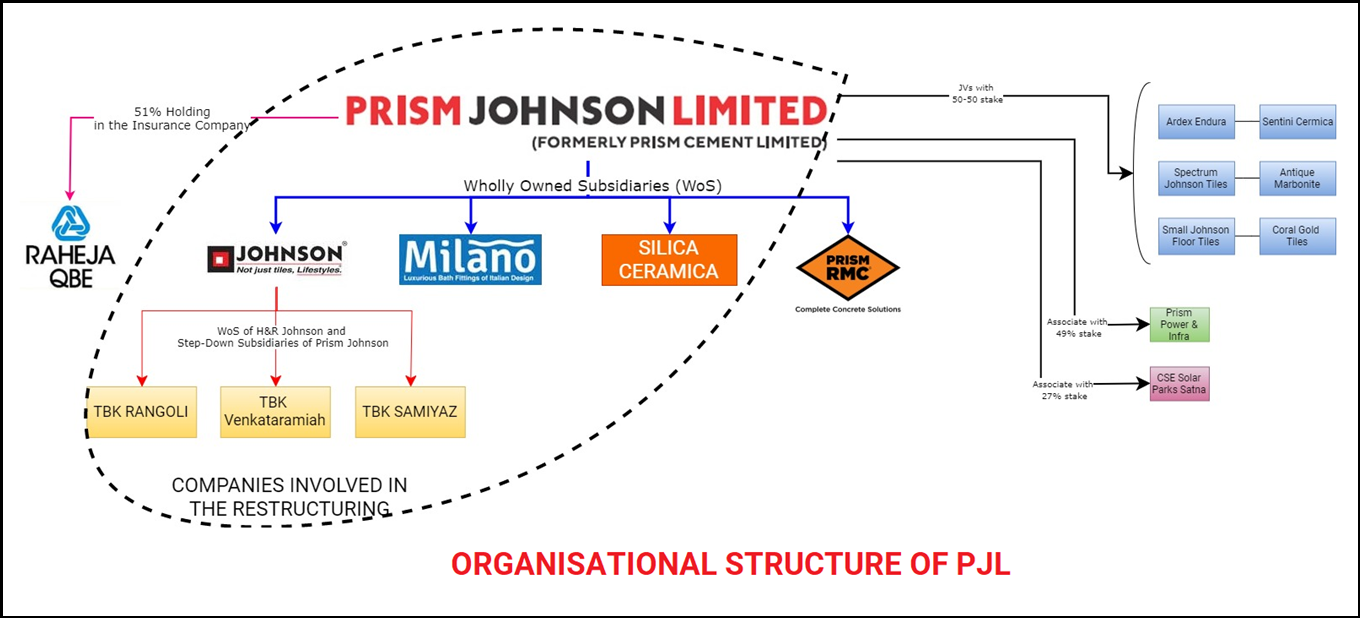

PJL has 5 subsidiaries, 3 step-down subsidiaries (Rangoli, Venkat, Samiyaz) and 8 JVs/Associate Companies. Post this scheme PJL will have only 3 subsidiaries.

Prism Johnson Ltd. (PJL) (formerly Prism Cement Ltd.) is one of India’s well-known Integrated Building Materials Company, mainly operating in 4 divisions Cement, ready-mixed concrete (RMC), tiles, bath, kitchen products (TBK HRJ) and Insurance. Over the years, PJL has launched different product lines, ventured into different industries like coal, solar power and Insurance and has captured strategic markets in different pockets of North India, apart from having a strong national presence. The equity shares of the company are listed on BSE as well as NSE.

All the entities involved in the company are 100% wholly-owned subsidiaries or step-down subsidiaries of PJL. (refer Hierarchy diagram)

H. & R. Johnson (India) TBK Ltd. (HRJ TBK) is an unlisted public company incorporated in August 1996 and engaged in the retail/trading in tiles, bathroom fittings and kitchens & branded tiles display units.

Milano Bathroom Fittings Pvt. Ltd. (Milano) is a private company and engaged in the business of Manufacturing of taps and fittings

Silica Ceramica Private Limited (Silica) is engaged in the business of manufacturing of Ceramic vitrified tiles and glazed vitrified tiles.

TBK Rangoli, TBK Venkataramiah and TBK Samiyaz are engaged in the business of retail/trading of tiles, bathroom fittings & kitchens.

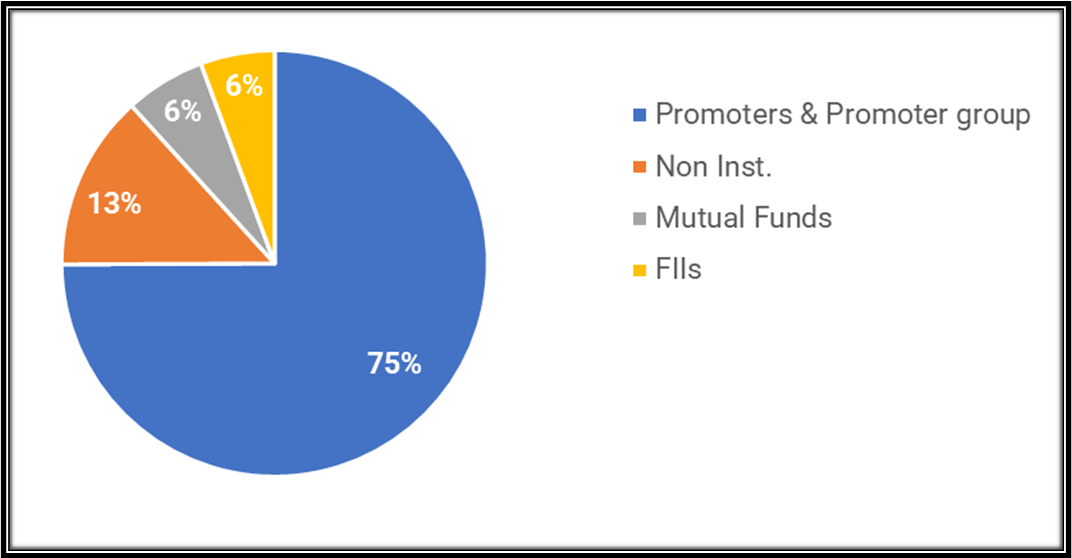

Shareholding Pattern of PJL

The shareholding pattern (source: BSE) won’t change even after the scheme is implemented as all entities involved are wholly owned subsidiaries.

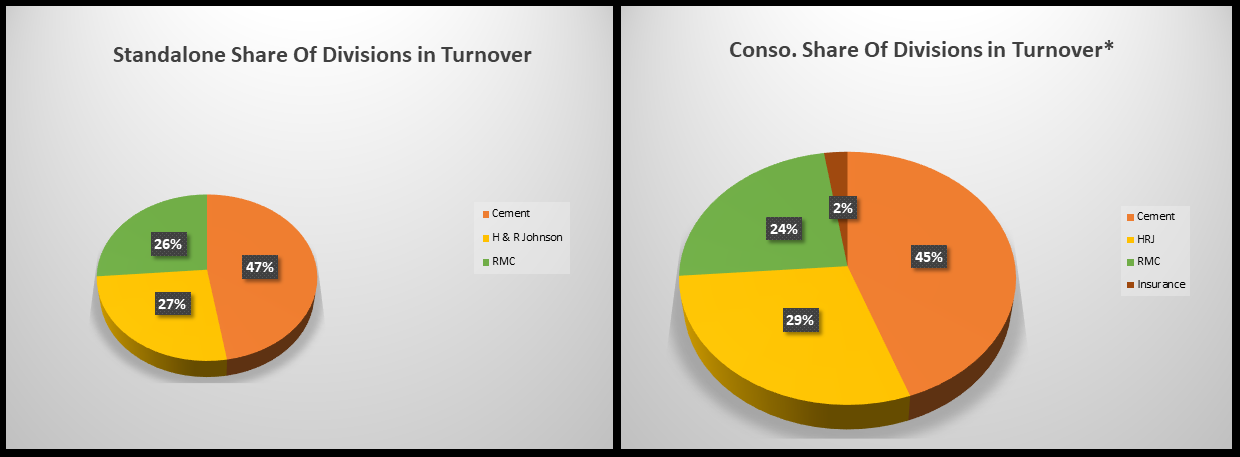

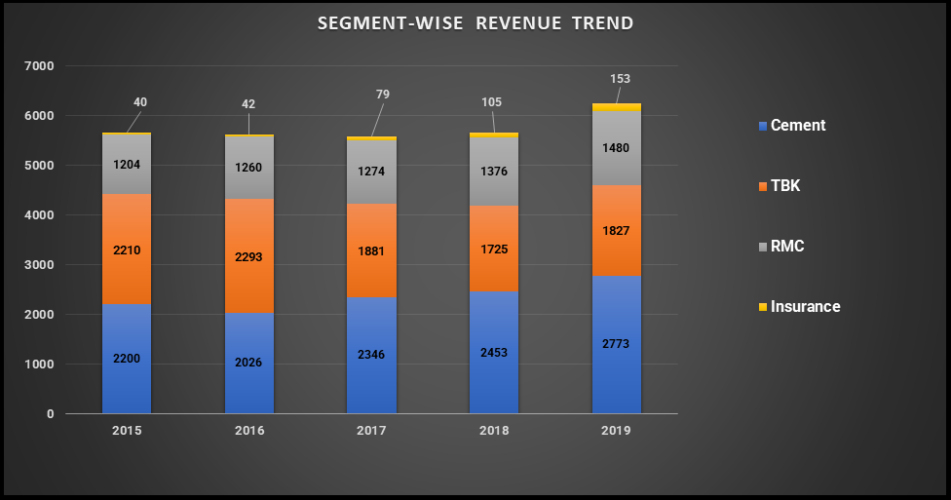

Business Divisions of PJL

Cement division

This division is leading the overall growth in the company and is driving the profits of the company. This division brings major chunk of the revenue for the company. Cement Division utilization levels rate 89% in FY19 (FY18 81%).

H & R Johnson Division

This division has also undertaken efforts and focused initiatives over the past couple of years to augment growth. The Division has added six large format display centers taking the total to 11 display centers in operation across India.

RMC Division

The Division reported 14% volume growth as there was pick up in few pockets of real estate, while the infrastructure segment continues to do well.

The Transaction

- This scheme is mainly targeting the H & R Johnson division of the company which is into TBK retail and trading business.

- The company will demerge the retail/trading business undertakings of 3 of its step-down wholly-owned subsidiaries (namely TBK Rangoli, TBK Samiyaz & TBK Venkat) into its wholly-owned subsidiary HRJ.

- It will subsequently demerge the retail/trading business of HRJ TBK into the ultimate holding company i.e. PJL itself.

- PJL is also going to amalgamate 2 of its wholly-owned subsidiaries Milano and Silica.

- The scheme has also proposed the reduction of share capital of Silica.

The appointed date for the transaction is 1 April 2018

Rationale as per Scheme

- Proposed Scheme would result in simplification of operating structure and lead to the elimination of duplicative communication and coordination efforts across multiple entities in the TBK division of the company.

- Consolidation of the retail/trading business will result in cost savings, rationalization of administrative costs and overall efficient cost management.

- PJL is striving for better manufacturing capacity utilization and improving the scale of manufacturing too. Consolidation of different entities will help in achieving this.

- Many companies are realizing the benefits of logistical efficiency and this scheme will help PJL in logistical alignment, aggregating purchases of different entities, reducing the number of vendors and better supply chain management.

- The scheme will also help in simplifying the forward supply chain and better management of customers and ultimately achieve marketing synergies.

Our Analysis

- The HRJ division (engaged retail/trading of TBK fittings) is clearly underperforming. All the companies involved in the scheme are part of HRJ division and are miniscule when compared to the whole group. This indicates the intention of this scheme is to make the HRJ division efficient and eliminate the inter-company transactions, which will ultimately streamline & optimize GST liabilities, & avoid transfer pricing compliances.

- Parent company’s reason to not do direct merger of step-down subsidiaries with itself may be due to accounting complexities and tax implications.

- One of the major elements of the scheme is a capital reduction of Silica Ltd. using the Securities Premium reserve and subsequent amalgamation into PJL.

1. As per Appendix C – IndAS 103 – Business Combinations, on Amalgamation, “Pooling of Interests Method” is to be used, where all the balances of the amalgamating Company-Silica are to be transferred, as is, to the amalgamated company

Balances in Silica Ltd. as on application date (1 April 2018):

| Particulars | Amount |

| Securities Premium | 151.38 Cr. |

| Retained Earnings | -167.36 Cr. |

2. If Silica was amalgamated, the Free Reserves of PJL would be reduced by 167.36 Cr. In order to reduce this impact, the scheme provides for off-setting of Securities Premium reserve with the debit balance of Retained earnings. So, the net Retained Earnings (151.38-167.36) = (15.98) Crores will only be transferred from Silica to PJL, thereby securing the Free reserves balance of PJL.

Financials:

(Source: Annual Report 2018-19)

As we can see, the change in share is not much in standalone and consolidated which indicates that the subsidiaries and step-down subsidiaries (some of which are included in the scheme) don’t generate significant revenue except for two.

Table 1: Revenue and Profit of PJL – Consolidated and Standalone for FY 18-19 (All Figs in INR Crores)

| Particulars | Turnover | Profit |

| Consolidated Group Revenue (Net of Inter-segment revenue) | 6194.42 | 201.21 |

| Silica* | 129.06 | -30.9 |

| Milano | 56.54 | 6.29 |

| HRJ | 29.15 | -4.3 |

| TBK Venkat | 4.03 | -0.06 |

| TBK Samiyaz | 3.26 | -0.64 |

| TBK Rangoli | 2.73 | -0.06 |

*100% sales are to PJL

As can be seen, all the companies involved in the scheme are very small as compared to the whole group.

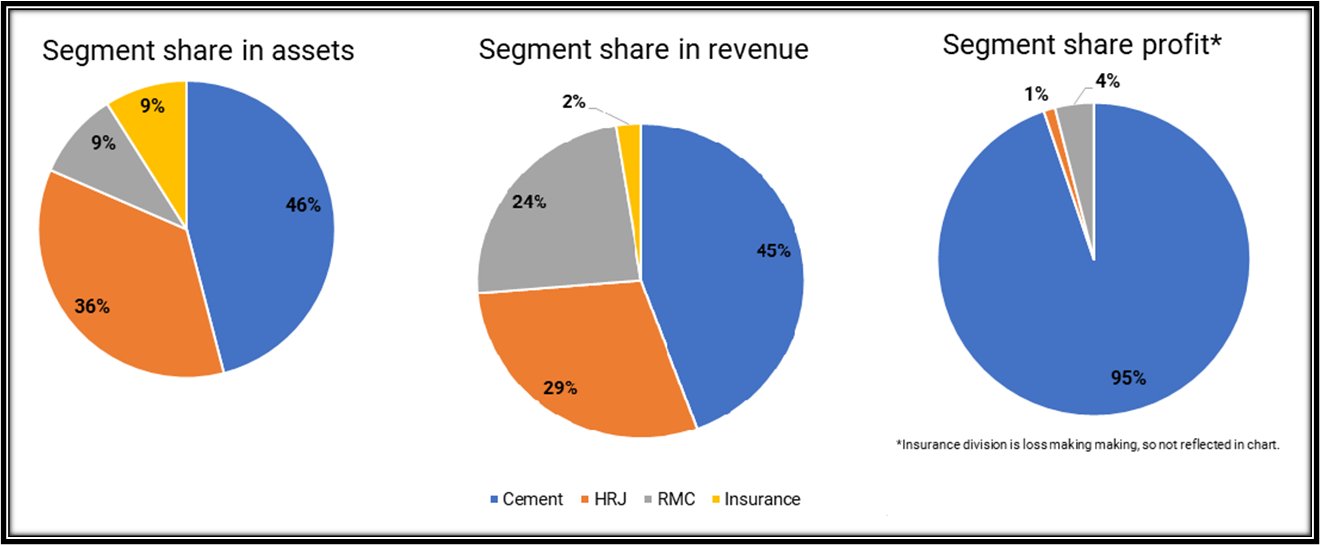

Table 2: Segment-wise Profitability for FY 18-19

| Particulars | Cement | HRJ | RMC | Insurance |

| Profit (A) | 402 | 5 | 17 | -12 |

| Capital Employed (B) | 1541 (60%) | 735 (29%) | 169 (7%) | 106 (4%) |

| ROCE (A/B) | 26% | 1% | 10% | -11% |

The charts indicate that even though the HRJ division has a significant portion of assets invested in it, the profits in that Division are disproportionately less as compared to the Cement division. This indicates that the expenses in the HRJ division are large and thus reducing its profits and margins.

The major expenses cannot be determined from publicly available data.

Taxation

TBK Rangoli, TBK Samiyaz and TBK Venkat has huge balances of negative retained earnings as a result of carry forward of losses.

In order to be able to carry forward these losses, the businesses of these undertakings will have to be demerged. (Sec 72A (4), ITA, 1961). The company cannot opt for amalgamation because carry forward of losses in case of amalgamation is allowed only if the amalgamating company is an industrial undertaking (sec 72A (1)) and neither of HRJ, Rangoli, Venkat or Samiyaz comply with the definition of industrial undertakings given in the Act.

Table 3: Transaction implications on carry-forward losses

| Company | Action | Unabsorbed Depreciation + Losses (Crores) |

| Silica | Amalgamation | 161.53 |

| Milano | 3.45 | |

| H&R Johnson | Demerger of retail/Trading business into PJL | 16.84 |

| Venkat | Not available | |

| Rangoli | Not available | |

| Samiyaz | Demerger of retail/Trading business into PJL | Not available |

| Total | 175.29 |

Maybe the company opt for lower tax rate as recently introduce in Income Tax Act, 1961.

Related Party Transactions:

Table 4: Related Party Transactions for PJL (All figs in INR Lacs)

| Particulars | TBK Rangoli | TBK Samiyaz | TBK- Venket | HRJ |

| Loan from Holding Company HRJ | 88.50 | 19.00 | 82.50 | – |

| Loan from Parent company PJL | – | – | – | 400.00 |

| Loan from KMP | – | 19.00 | – | – |

| Interest Accrued | 48.94 | 23.62 | 39.44 | – |

| Crs. -PJL | 134.35 | 42.98 | 33.25 | – |

| Purchases from Parent Co.- PJL | 192.16 | 232.06 | 340.79 | 10,306.42 |

| Sale of FG | – | – | – | 15,087.00 |

Note: Corporate guarantee for loan taken by Silica is given by PJL amounting to Rs. 21,187 lakhs.

Conclusion

With increasing competition in the TBK business in India, along with increasing demand not only from the public but also from the Govt., the future of the industry seems to be robust. The decision by PJL to streamline the retail businesses and simplify a web of entities, will help it to achieve not only marketing and logistical synergies but also cost savings and operational efficiency.

PJL is operating in multiple industries (Cement, TBK fittings, Insurance), but primarily remains to be a Cement company, where the turnover of cement and RMC together, accounts for more than 60% of the group turnover. Operating in such different industries is not the trend among Cement companies like Ultra Tech, Ambuja, ACC, Binani Cement, etc.

The challenges faced, growth potential, marketing expertise and costs required in the cement industry and TBK fittings (HRJ Division) industry are very different. While the cement division continues to grow, the HRJ division is underperforming.

So, does this scheme indicate that PJL will hive off the TBK retail/trading division and form a separate TBK company in the coming future? Maybe it will invite a partner to drive the growth of its TBK business. Does PJL want to sell off its TBK Retail/Trade business and want to be known and grow only as a cement manufacturing company? All these questions should be answered in the coming future.

Add comment