For the last couple of years, it appears Raymond Limited has relentlessly been trying to simplify its structure & create value for shareholders. The group announced a couple of internal restructurings by calling a step towards creating value for its shareholders. Some of them were withdrawn after the announcements. In yet another similar move, Raymond Limited announced internal restructuring to list its apparel business separately. But this time they also announced selling of their identified Fast-Moving Consumer Goods (FMCG) business to deleverage its balance sheet.

Raymond Limited (“RL” or “Demerged Company”) is a leading Indian textile, lifestyle, and branded apparel company with a wide network of operations in local as well foreign markets. RL is also engaged in the development of residential/ commercial real estate projects. The equity shares of RL are listed on the nationwide bourses. The Non-Convertible Debentures of RL are listed on the Negotiated Trade Reporting Platform of NSE.

Raymond Consumer Care Limited (“RCCL” or “Resulting Company” or “Transferee Company”) is engaged primarily in the business of manufacture and sale of condoms and marketing of fast-moving consumer goods. RCCL is a wholly owned subsidiary of Ray Global Consumer Trading Limited.

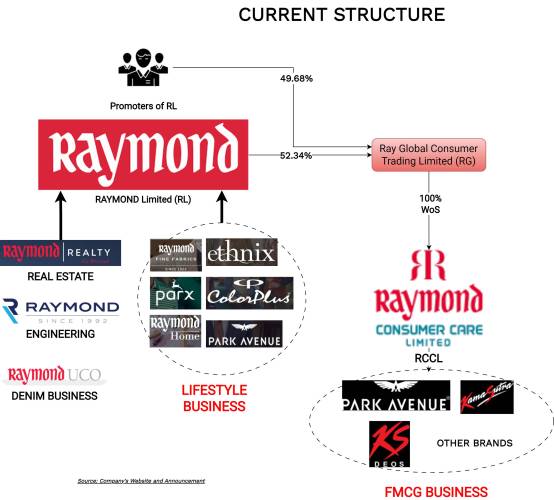

Ray Global Consumer Trading Limited (“RG” or “Transferor Company”) is primarily engaged in the business of investment in shares. RL holds 47.66% of the paid-up equity share capital of RG. Of the remaining 52.34%, 49.68% stake is held by Promoters of RL & 2.65% by other shareholders.

Godrej Consumer Products Limited (“GCPL”) is a part of the Godrej group engaged in FMCG business. The equity shares of GCPL are listed on nationwide bourses.

The Transaction

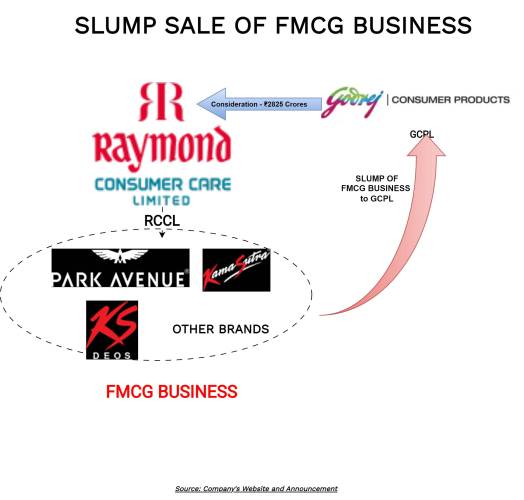

Slump Sale of FMCG Business:

Before the current transaction, Raymond Group in 2018 consolidated its entire FMCG business under a single entity through a composite scheme of arrangement.

On 27th April 2023, RCCL entered into a Business Transfer Agreement (“BTA”) with respect to its identified assets of its FMCG Business with Godrej Consumer Products Limited which inter-alia provides for transfer of FMCG business to GCPL on a Slump Sale basis. The consideration for Slump Sale was INR 2825 crore. On 8th May 2023, both companies announced completion of Slump Sale.

Brief financials of the FMCG Business for FY 2023:

Please note: that the above numbers for Lifestyle Business-RCCL are including Condom Manufacturing facility which is not getting transferred as a part of slump sale to GCPL.| Particulars | Lifestyle Business-RCCL | GCPL- Consolidated |

| Assigned Value (₹ Crores) | 2825 | 1,05,000 |

| MCap/Revenue | 4.54X | 7.77X |

As part of BTA, trademarks of Park Avenue, Kamasutra for FMCG categories were transferred to GCPL while rights pertaining to the same brand for apparel business will continue to be with RL/RCCL. Manufacturing facility relating to Condoms will be retained by RCCL. RCCL will supply condoms as a contract manufacturer to GCPL without any exclusivity.

For RL, this deal will facilitate deleveraging its balance sheet and concentrate on its apparel and emerging Real Estate business along with other businesses such as engineering.

For GCPL, it strengthens its Deodorants category by adding strong Park Avenue brand & forays itself into the condom category. This acquisition allows growth strategy with under-penetrated categories that offer a long runway of growth. Raymond is a leading player in the deodorants and sexual wellness categories with brands like Park Avenue and KamaSutra. According to GCPL, these categories have the potential to deliver double-digit multi-decade growth for them. Apart from growth, GCPL also believes there will be strong scope for improving the margins, brand visibility and cross-selling opportunities along with leveraging distributions of each other.

Why Slump Sale:

Both GCPL & RL/RCCL preferred to Slump Sale over demerger on account of the following key aspects:

- Requirement of Cash to RCCL

- Consideration in the form of cash by GCPL & no equity dilution

- Timely execution of the transaction

Direct Tax:

On direct taxation, Slump Sale will attract direct tax in the hands of RCCL under section 50B of the Income Tax Act, 1961. Though, the net asset value of the FMCG undertaking transferred is not known yet, considering the net worth of RCCL, the net asset value of the undertaking getting transferred likely to be in the range of INR 120-140 crore. Thus, significant part of the consideration of INR 2825 will be part of taxable long-term capital gain in the hands of RCCL. The RCCL has estimated the tax liability of circa INR 625 crores. Thus, the after-tax proceeds available with RCCL will be INR 2200 crore.

For GCPL, it can claim tax shield on the depreciation on the fair market value of the brands it acquired.

Funding the transaction by GCPL:

GCPL will fund the transaction through raising short-term finance. The board of GCPL has approved raising of funds by way of issuance of Non-Convertible Debentures (NCDs) aggregating to an amount of INR 5000 crore. GCPL may further infuse money to strengthen the FMCG business of RCCL. Effectively, the borrowing can be repaid using the profits generated by FMCG business of RCCL it has acquired. Additionally, it will also be likely to get tax shield on the interest payment on NCD raised.

Tentative Valuation for GCPL:

The consideration for the slump sale paid by GCPL is INR 2825 crore. However, as part of undertaking GCPL has received INR 100 crore as cash & cash equivalent and, in coming years, GCPL will claim tax shield on the depreciation on the fair market value of the brands it acquired.

The Net Present Value of tax shield as computed by GCPL is circa INR 400 crore which makes the net consideration of the deal for GCPL as INR 2345 crore (100 crore on account of cash transferred as part of undertaking + INR 400 crore NPV of additional tax shield available).

Upstreaming of the Consideration:

RL effectively owns 47.66% of RCCL thus effectively consideration of INR 1050 crore pertains to them. However, the demerger (as discussed below) will pave the way for availability of entire cash with RL/lifestyle business post demerger in lieu of allotment of equity shares. Immediately after concluding the transaction, RL upstreamed the amount so received through Slump Sale by approving issuance of Non-Convertible Debentures for an amount up to Rs. 2200 Crore) in two or more tranches on private placement basis to Raymond Consumer Care Limited, for repayment of external debt, subject to receipt of necessary approvals required under applicable law. These NCD’s are likely to be part of Lifestyle Business which will get cancelled pursuant to the demerged from RL to RCCL.

Demerger:

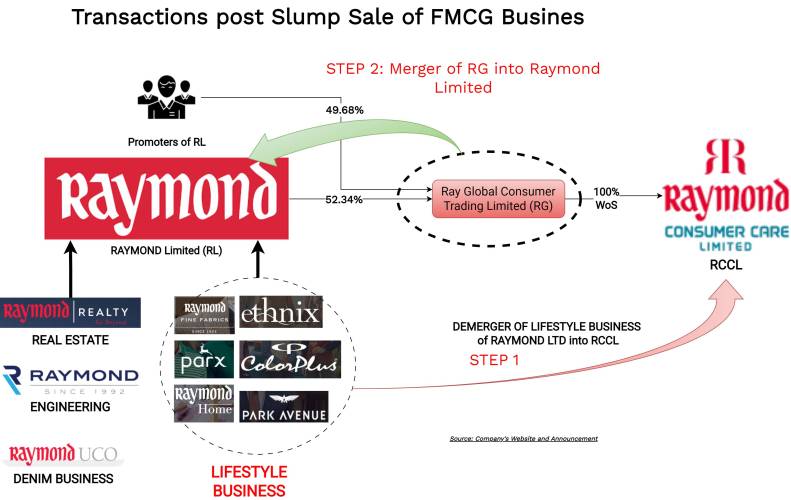

The Board of Directors of RL, RG & RCCL announced a composite scheme of arrangement (“Scheme”) which inter alia provides for demerger of Lifestyle Business of RL into RCCL followed by amalgamation of RG with RCCL.

Sequence of the effectiveness of the Scheme:

- Demerger of Lifestyle business carried by RL through itself and its subsidiaries along with its strategic investment in RG (“Lifestyle Business Undertaking”) into RCCL and consequently issue of equity shares of RCCL to the shareholders of RL

- Amalgamation of RG with RCCL and consequently issuance of equity shares by RCCL to all shareholders of RG other than RCCL

- Reduction & Cancellation of the paid-up share capital of RCCL held by RG and

- Listing of equity shares of RCCL on stock exchanges

The Appointed Date for the transaction is 1st April 2023 or such other date as may be determined by Hon’ble NCLT (National Company Law Tribunal).

Consideration for the demerger:

Four [4 only] equity shares of Raymond Consumer Care Limited of INR 2 each fully paid up for every five [5 only] equity shares of Raymond Limited of INR 10 each fully paid up.

Consideration for Amalgamation:

“Two (2 only) equity shares of Raymond Consumer Care Limited of INR 2 each fully paid-up for One (1 only) equity share of Ray Global Consumer Trading Limited of INR 10/- each fully paid-up.

Share capital of RL & RCCL:

| Particulars | RL | RCCL |

| No. of Equity Shares- Pre-Transaction | 6,65,73,731 | 1,49,00,000 |

| Face Value | 10 | 2 |

| Post-Scheme No. of Equity Shares | 6,65,73,731 | 6,09,23,628 |

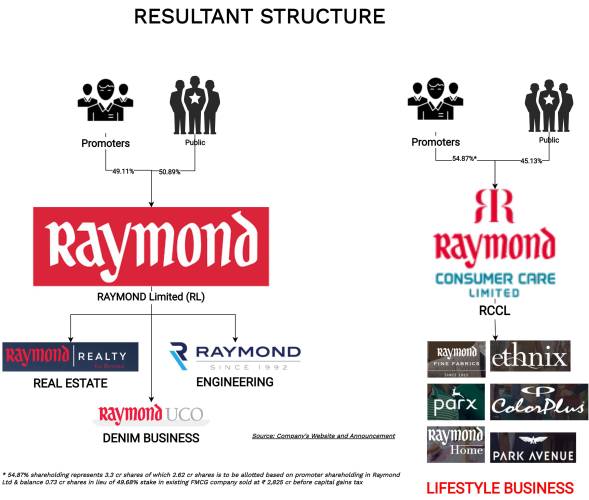

| Promoters Stake | 49.11% | 54.88% |

Please note that the existing share capital of RCCL as held by RG will be reduced and cancelled pursuant to the amalgamation of RG with RCCL. The public shareholders of RL will own circa 44.5% in RCCL post-transaction. Promoters of RL in their individual capacity own 49.68% of the FMCG Business. In lieu of that, pursuant to the merger of RG with RCCL, Promoters of RL will be allotted circa 5.77% additional stake in Lifestyle Business.

Financials

Standalone Financials of RL for FY 2023

INR in Crore

| Particulars | Lifestyle Undertaking | Remaining Business |

| Revenue | 4652 | 1126 |

| % | 81% | 19% |

| PAT | 311 | 98 |

| % | 76% | 24% |

| Net worth | 5 | 1029 |

Valuation

| Particulars | RL-Lifestyle Business undertaking | RCCL | RG |

| Value per equity share (one of the joint valuers) | 1178 | 1439 | 2927 |

| Valuation (INR in Crore) | 7842 | 2144 | 2143 |

RG derives its entire valuation from its 100% stake in RCCL. The Current Market Capitalization of Raymond Limited is Circa INR 10,700 crore. Thus, almost 73% has been assigned to Lifestyle business.

Conclusion:

In the past couple of years, Raymond Group did couple of internal restructurings. In 2021, it has decided to consolidate tools & Hardware business & Auto Component business (through subsidiary) under JK Files & Engineering Limited (WoS of RL). It also filed Draft Red Herring Prospectus for Initial Public Offering but was subsequently deferred.

In FY 2022 & 2019, Raymond Limited announced two different schemes to restructure its Real Estate & Branded Apparels business, respectively. However, both have been withdrawn.

This sale of FMCG business, Raymond Group shall deleverage its balance sheet and focus on its core areas like apparel, real estate, etc. For promoters, they will receive additional stake of circa 5.77% in lifestyle business for their 49.68% stake in FMCG business. For GCPL, its bolt-on acquisitions which will enlarge its offerings and foray into wellness products.