In 2019, following the industry trend, Raymond Limited announced demerger of “Branded Apparel Business” paving the way for its listing. The move was intended to separate the core activity from other activities such as Real Estate, Auto Components, Engineering, etc., which the group transformed over a period. Two years have passed but the company had not received approval from the Honorable National Company Law Tribunal (NCLT).

Recently, Raymond Limited at its board meeting withdrew the scheme and proposed a revised restructuring scheme. The new internal restructuring is totally opposite of what was proposed earlier and seems that it is locking the various businesses under Raymond Limited.

Overview of the companies:

Raymond Limited (Raymond) is India’s largest integrated worsted suiting manufacturer that offers end-to-end solutions for fabrics and garments. Over the span of years, Raymond has transformed from a textile company to a large, diversified group having interests in men’s accessories, personal grooming & toiletries, prophylactics, engineering, and auto components.

Raymond Apparel Limited (RAL) is a Wholly Owned Subsidiary (WoS) engaged in the business of branded B2C apparel.

JK Files (India) Limited (‘JK Files’) a wholly-owned subsidiary of Raymond, engaged in the manufacturing steel files and cutting tools and markets, hands tools and power tools.

Ring Plus Aqua Limited (‘RPAL’) a step-down subsidiary of Raymond Limited engaged in the business of Auto Components.

Scissors Engineering Products Limited (‘SEPL’) a wholly-owned subsidiary of Raymond which holds 89.07% equity stake in RPAL.

The Transaction:

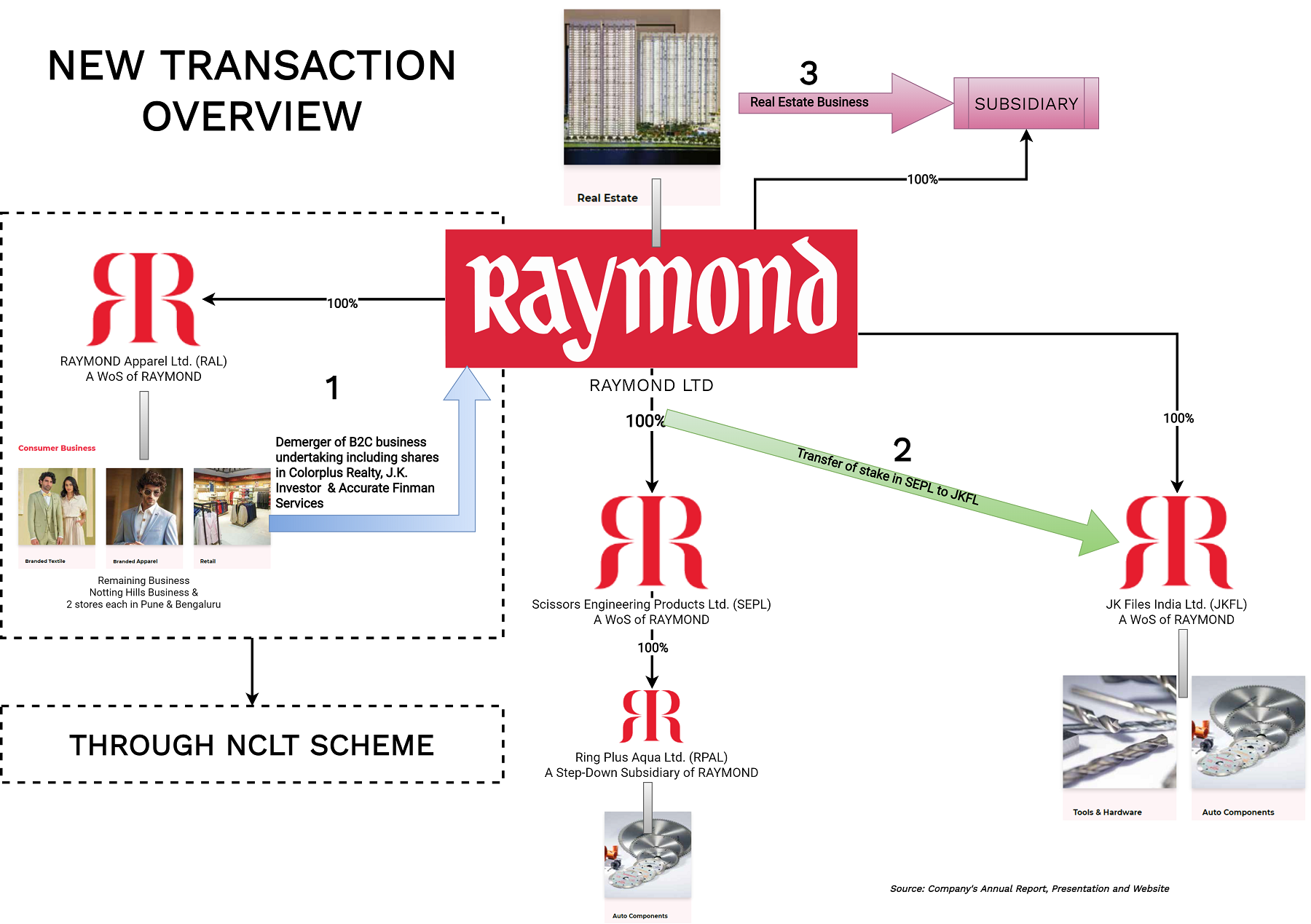

The following internal restructuring has been proposed by Raymond:

- Demerger of B2C business undertaking including shares in Colorplus Realty Limited, J.K. Investor (Bombay) Limited and Accurate Finman Services Limited of RAL into Raymond.

- Consolidation of Tools & Hardware and Auto Components Businesses into JK Files (India) Limited. The Auto Components business being conducted by Ring Plus Aqua Limited (‘RPAL’), a step-down subsidiary of Raymond Limited. Raymond entered into an agreement with JK Files, to transfer its entire shareholding in Scissors Engineering Products Limited, a wholly owned subsidiary of Raymond which holds investment in RPAL into JK Files, thus effectively making RPAL a step down subsidiary of JK Files; and

- Subsidiarisation of the Real Estate Business: The board gave in principal approval for subsidiarisation of a Real Estate Business into a wholly owned subsidiary by way of a slump sale/demerger or any other suitable mode. The Real Estate business shall consist of approximately 40 acres including current resident project at Thane. The balance 40-acre land will continue to be in Raymond Ltd which will be monetized in due course of time.

The Appointed Date for the demerger is 1st April 2021.

As mentioned in the Scheme, the entire B2C Apparel business of RAL will be transferred to Raymond except:

- Intellectual Property Rights in brand/trademark “Notting Hill”.

- The Notting Hills Business and

- 2 Brand Stores located in Pune & Bengaluru each.

There is no explanation provided by the management for not transferring the above three as part of the scheme. The reason for keeping 2 brand stores with RAL could be regulatory challenges in transferring the rights in those properties especially if they are leased properties. Though based on the facts available, the reason for not transferring “The Notting Hills Business” may be to avoid transactions getting covered as merger under Sec 2(1B) of the Income Tax Act,1961.

Rationale of the Scheme:

Some of the rationale as envisaged by the management in the proposed Scheme:

- Consolidation of branded textile business for strong market presence, stronger revenues, reducing business risk etc.

- Synergy benefits in terms of design & innovation, sourcing etc.

- Enhanced Shareholders value

- Focused strategy and specialization for sustained growth and profitability

- Clear strategic roadmap towards improved performance

With the proposed structure and further subsidiarization of real estate & Tools & Hardware and Auto Components Businesses into JK Files, it will be interesting to see how it amounts to improved performance for each of the businesses and creates value for the minority shareholders.

Post-arrangement, Raymond will house Branded textile as well as Branded Apparel Business together in standalone entity. While Lifestyle B2B businesses of Garmenting and High Value Cotton Shirting continue to be in the subsidiaries of Raymond Ltd.

Raymond entered the “Real Estate Business” in 2019 by starting the development of its own land bank in Thane, Mumbai. Due to sea changes in the Real Estate sector in India, a huge opportunity has emerged for organized developers. As a result, Raymond decided to scale up the business significantly. In future, the company will look for Joint Venture/development opportunities.

The consolidation of Auto component business with tools & hardware business was done for the upcoming initial public offering (IPO) of JK Files. After transferring the entire shareholding in SEPL to J K Files, SEPL transferred its 89.07% equity stake in RPAL to JK Files, making RPAL direct subsidiary of J K Files. Subsequently, the name of the JK Files (India) Limited changed to JK Files & Engineering Limited.

The proposed IPO of JK Files will be entirely of an Offer for Sale (OFS) and circa INR 800 crore proceeding from an IPO will be directly received by Raymond.

Accounting treatment:

As both RAL & Raymond are under common control, both companies shall account as per “Appendix C of Ind As-103: Business Combination. The prescribed accounting treatment will be followed by both entities.

Taxation:

The demerger will be a tax neutral transaction as per section 47(vib) read with section 2(19AA). Further, for the transfer of stake of SEPL to JKFL for nil consideration, tax implications may or may not arise.

Note on withdrawal scheme:

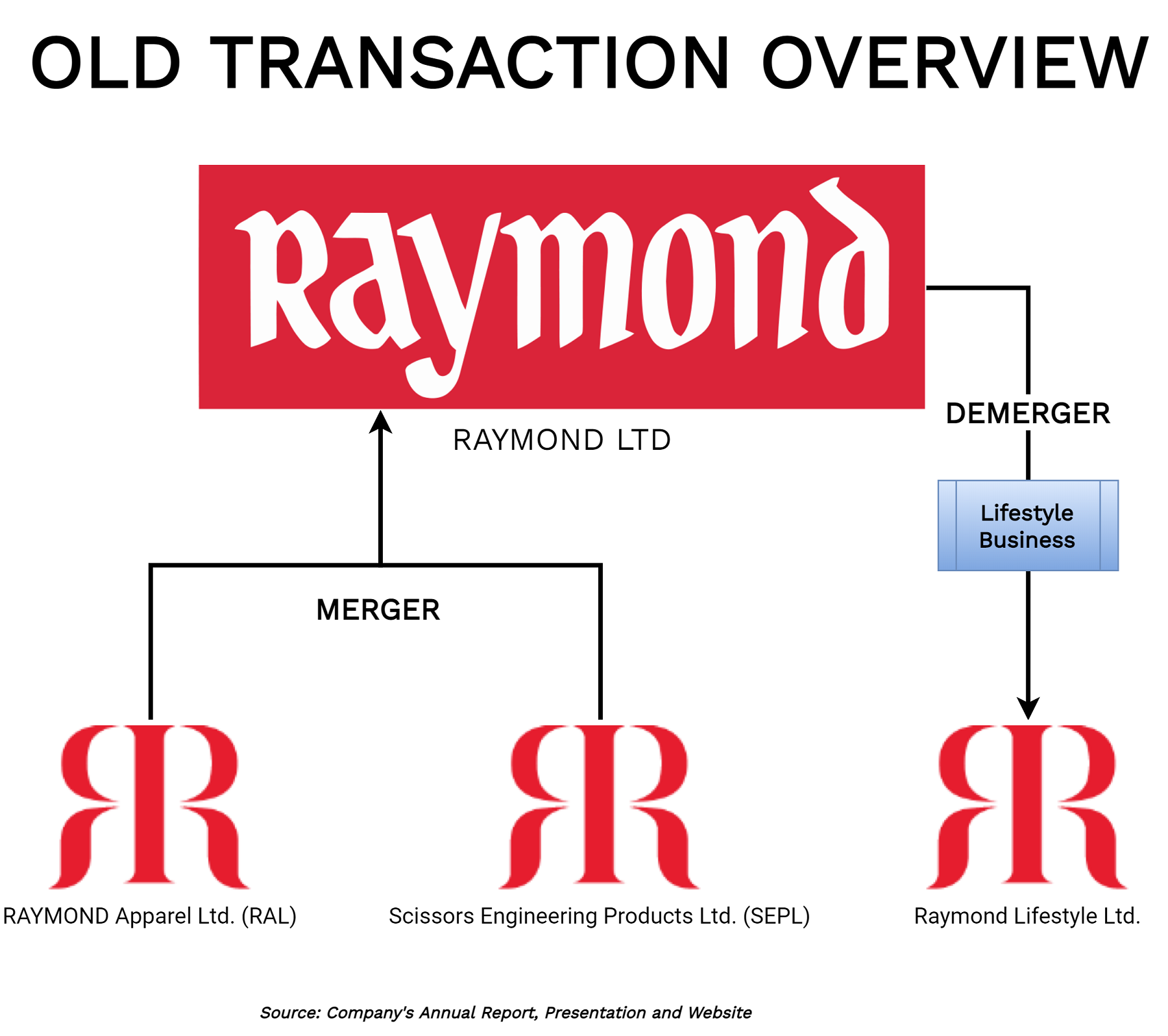

In 2019, Raymond filed a scheme with NCLT for the demerger of B2C lifestyle business into a separate company for unlocking values for small shareholders, but the scheme was withdrawn. The strategy was like the demerger of the Branded Apparel business Arvind Limited and demerger of Branded garment and retail business of Aditya Birla group into separate entities and eventually listing them.

Under the earlier scheme, RAL along with SEPL were supposed to be consolidated under Raymond Limited and Lifestyle business (branded Apparel) was to be housed under a separately listed company with no connection with other businesses.

Financials

The proposed structure shall consolidate the apparels division with the textile division under-listed entity, Raymond. Shirting & Garmenting business shall continue to be operated through subsidiaries. Further, FMCG & Denim business continue to be operated as a Joint Venture/Associate.

Due to the pandemic, the returns on branded apparel and shirting business have totally changed. Even, the margins for the textile division have significantly deteriorated.

Conclusion

Though the rationale envisaged by the management is the same, the earlier announced structure and recently proposed structure are totally opposite.

Under the current scheme, Branded Apparel business is getting consolidated at holding company while the real estate business (part of the land bank) will be subsidiarized. Unlike the earlier schemes, where branded garments are supposed to get listed separately, the proposed structure will continue to house various unrelated businesses under one roof.

The prosed structure will offer operational flexibility for Raymond to use the cash flow generated from its core business for its other business especially “Real Estate”. The subsidiarization of part Real Estate Business could be with the intention to invite strategic partner for part business. The strategy of bringing IPO of a subsidiary will generate good funds for Raymond which can be used to fund the growth of its aspiration real estate business. The consolidation of auto component business with tools & hardware business could be to fetch better valuation for the upcoming IPO of JK files.

Though the reason for reversal of the earlier scheme is not clearly explained, we hope the management will provide a clear strategic roadmap to shareholders soon and will be able to create substantial value.

Add comment