The Indian tractor industry is the largest in the world. Despite pandemic, the domestic tractor sales for the FY (Financial Year) 2021 were the best in the history of the tractor industry. With sea changes, along with tractors, farm equipment market is also pegged for supernatural growth in the coming period.

To reap most of the future opportunity, Japanese Company Kubota Corporation, recently announced the deal with Escorts Limited, being the fourth largest tractor company in India. The deal will pave the way for Kubota to become the largest shareholder in Escorts Limited along with control/joint control. The deal was well-planned and its origination can be traced to 2018.

Escorts History:

Escorts Ltd. (Escort) began its journey in 1948 as an Agri-machinery company and has grown to be one of India’s leading engineering conglomerates with over seven decades of experience. Today, Escorts is the fourth largest tractor manufacturer in India with ~11.6% market share and has a strong brand name offering more than 45 models ranging from 25HP to 80HP. Over the years, the company diversified into other products to emerge as a multi-business entity, with interests in Agri-machinery, railway equipment, industrial and construction equipment.

Kubota Corporation (Kubota) was Established in 1890. Kubota is a global manufacturing company, specialising in agriculture, water and living environment products with a worldwide network in over 100 countries. Kubota’s 2/3rd revenue are from outside Japan markets, and it is having Technology & Volume leadership in <120 HP Tractors. Kubota market share in the Indian domestic tractor industry is 1.9%.

The Proposed Transaction:

In a move to expand its presence in the world’s largest tractor market, Kubota announced that it will take the driver seat in Escort while the existing promoters, the Nanda family will continue to be part of top management.

Step by Step strategy opted by Kubota to expand its presence in the world’s largest tractor market. It started with a joint venture which later deepen by strategic minority investment in Escort. finally, Kubota is taking the driver seat by becoming the largest shareholder & promoter in Escort.

The preparation for this marriage was going on over the past couple of years. In 2018, Escorts and Kubota entered a Joint Venture for technology collaboration and joint manufacturing of high-end, value-oriented utility tractor range. Both entities decided to form a Joint Venture (JV) to establish a new common manufacturing facility with an initial capacity of 50,000. Further, as part of the collaboration, it was agreed that Kubota will export Escorts tractors through Kubota global distribution network in specific markets as mutually agreed.

Taking the relation forward, in 2020, Kubota decided to acquire a minority stake in Escort.

- On 20 March 2020, Kubota decided to invest INR (India Rupees) 1041 crore in Escorts by issue of 1,22,57,688 equity shares at an issue price of ₹ 850/- per equity share on preferential basis translating 9.1% equity stake in Escort.

- In turn, Escort also decided to invest into a private entity of Kubota in India. Escorts approved the acquisition of 2,00,00,000 equity shares of Kubota Agricultural Machinery India Private Limited (KAI), a private company of Kubota Corporation, Japan constituting 40% of the share capital of KAI at ₹ 45 per equity share for an aggregate value of ₹ 90 crores, all for cash.

- Kubota got right to appoint 2 non-executive board members on Escort.

Finally, in 2021, after building the initial relation, Kubota decided to take control/joint control of Escort.

Announced Transaction:

- Escorts will issue 93.64 Lakh equity shares through a preferential issue to Kubota at an issue price of ₹ 2,000 per share aggregating ₹ 1,873 Cr.

- Kubota’s shareholding in Escorts Limited increase to 16.4% from 10% (considering capital reduction of shares held by EBWT (Escorts Benefits and Welfare Trust)).

- Escort name proposed to be changed to Escorts Kubota Ltd.

- Escort will also evaluate possibility of merger of Escorts Kubota India Private Limited (EKI), Escort Finance Limited and Kubota Agricultural Machinery India Private Limited (KAI) with Escort.

Other salient features:

- Pursuant to the preferential allotment, Kubota shall give an open offer to public shareholders for acquiring up to 26% equity stake in the company at a price of ₹ 2,000 per share.

- Nikhil Nanda shall continue as Chairman and Managing Director.

- Kubota and existing promoters i.e., Nanda Family shall have right to appoint 4 non-independent directors each upon effectiveness of Shareholders Agreement. If Kubota’s shareholding in the Company is 40% or more, Kubota shall have a right to appoint 5 non-independent directors.

- Lock-in for shareholding of Kubota & Existing Promoters for 5 years from effectiveness of Shareholders Agreement

- Right of first offer to both Kubota & Existing Promoters.

If no equity shares tendered to Kubota during the open offer, Kubota stake in Escort after both capital reduction (explained in detail below) will reach circa ~19.6%. though after the proposed merger, Kubota’s stake will further increase.

Capital Reduction:

Pursuant to the Scheme of Arrangement and Amalgamation in 2012, 3,73,00,031 equity shares (circa 27.49%) of Escorts had been issued to Escorts Benefit and Welfare Trust with a sole beneficiary being Escorts.

In 2020, after the initial investment by Kubota in Escorts, so as to have no % change in the existing equity holding of the company, the Board of Directors of Escorts Limited approved for selective reduction of the share capital of the Company by cancelling and extinguishing 1,22,57,688 Equity Shares (being the equivalent shares issued to Kubota), held by the Escorts Benefit and Welfare Trust without any consideration.

In 2021, it is further proposed to reduce the entire remaining shares held by Escorts Benefit and Welfare Trust through a selective reduction of the share capital of the Company without any consideration.

Taxation in case of capital reduction:

In the case of capital reduction, taxation is arise in the hands of shareholders as follows:

- Consideration up to accumulated profits available with the company, it is taxed as deemed divided under section 2(22) of Income Tax Act, 1961 (ITA).

- Consideration over and above the accumulated profit will taxed under capital gains.

Whether any tax liability arises in the case of selective capital reduction without payment?

As there is no consideration flowing from the company to EBWT, tax liability is not likely to arise in the hands of EBWT. As in this case, the beneficial owner and payee is the same and also as per BC Srinivasa Shetty 128 ITR 294 (SC), if consideration is not received by the seller and the asset is destroyed, computation mechanism for capital gains fails.

Whether section 50CA of ITA is applicable in this case:

The provisions of section 50CA of ITA are not applicable in case of transfer of listed shares, hence there will be no implications under section 50CA of ITA.

Whether section 56(2)(x) will attract in the hands of remaining shareholders?

Section 56(2)(x) will attract when any person receives anything from any person. In the present case, remaining shareholders are not receiving anything and the company being the sole beneficiary of EBWT, the beneficial interest of the remaining shareholders also remains the same, section 56(2)(x) may not get attracted.

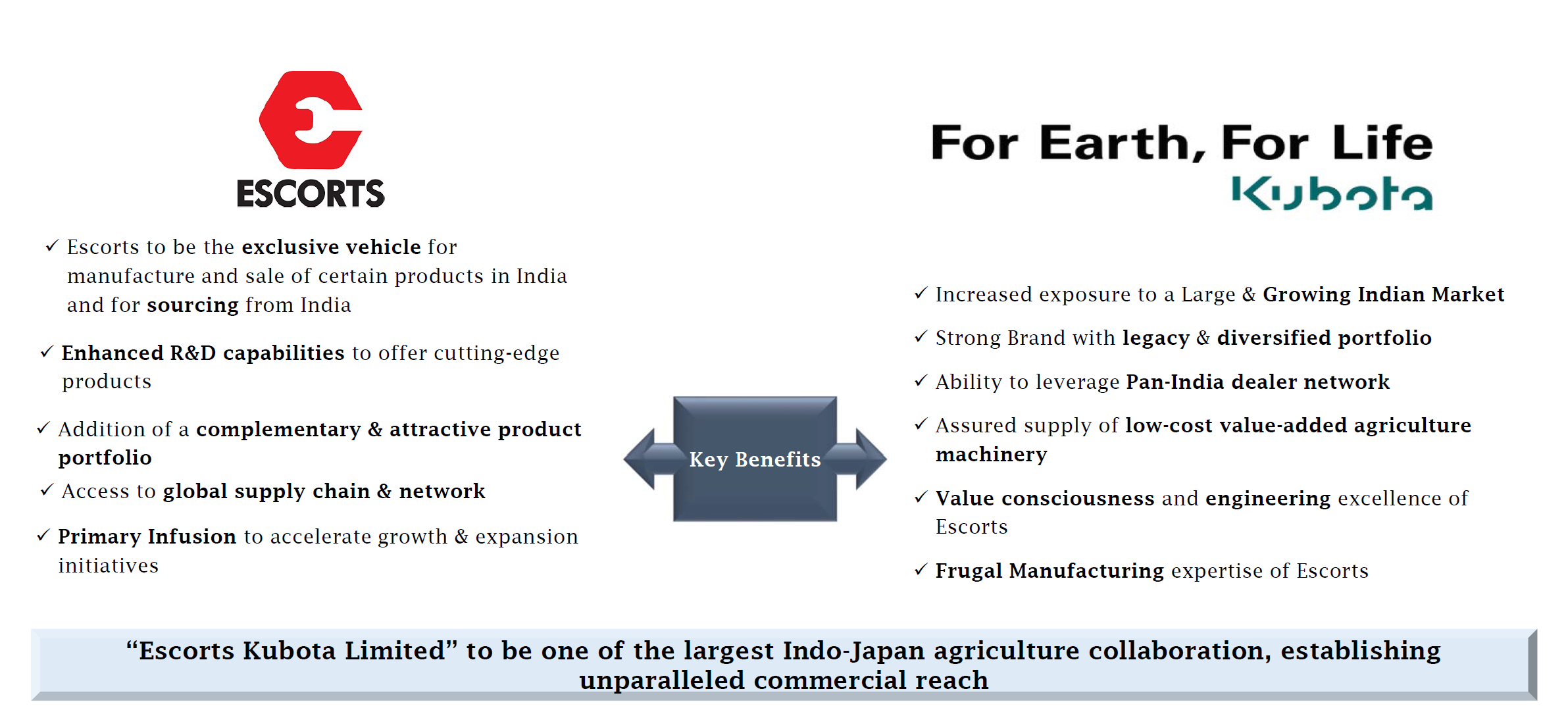

Key benefits of this deals to both companies:

The deal is a win-win for stakeholders of both companies. Escort will get an opportunity to expand its products base, geography, strong research & development of Kubota amongst others. Kubota will take control of the 4th largest tractor company in the largest tractor market. Kubota’s products will be manufactured locally in India, in line with Japan commitment to the ‘Make in India’ vision and to develop domestic best-in-class manufacturing capabilities. With significant funds available, Kubota can work on introducing/cross-selling its products in India.

In future, Kubota may acquire the shares held by existing promoters and further increase its stake in the company.

Conclusion

This friendly takeover by infusion of funds in the company is a Japanese style of one step at a time over a period of three years. Eventually, all Kubota-escorts companies with related businesses will merge with Escorts Ltd. Its real value creation for all the stakeholders by leveraging the strength of both the companies both in India and globally.

Add comment