Recently NCLAT approved the scheme of arrangement of Reliance Jio Infocomm Limited (Jio Infocomm) and ‘Jio Digital Fibre Private Limited’ (Jio Fibre) and ‘Reliance Jio Infratel Private Limited’ (Jio Infratel) and their respective shareholders and Creditors. Scheme was previously approved by the NCLT which was challenged in the upper court “NCLAT’ by Income Tax dept, objections of tax department were eventually rejected by the NCLAT.

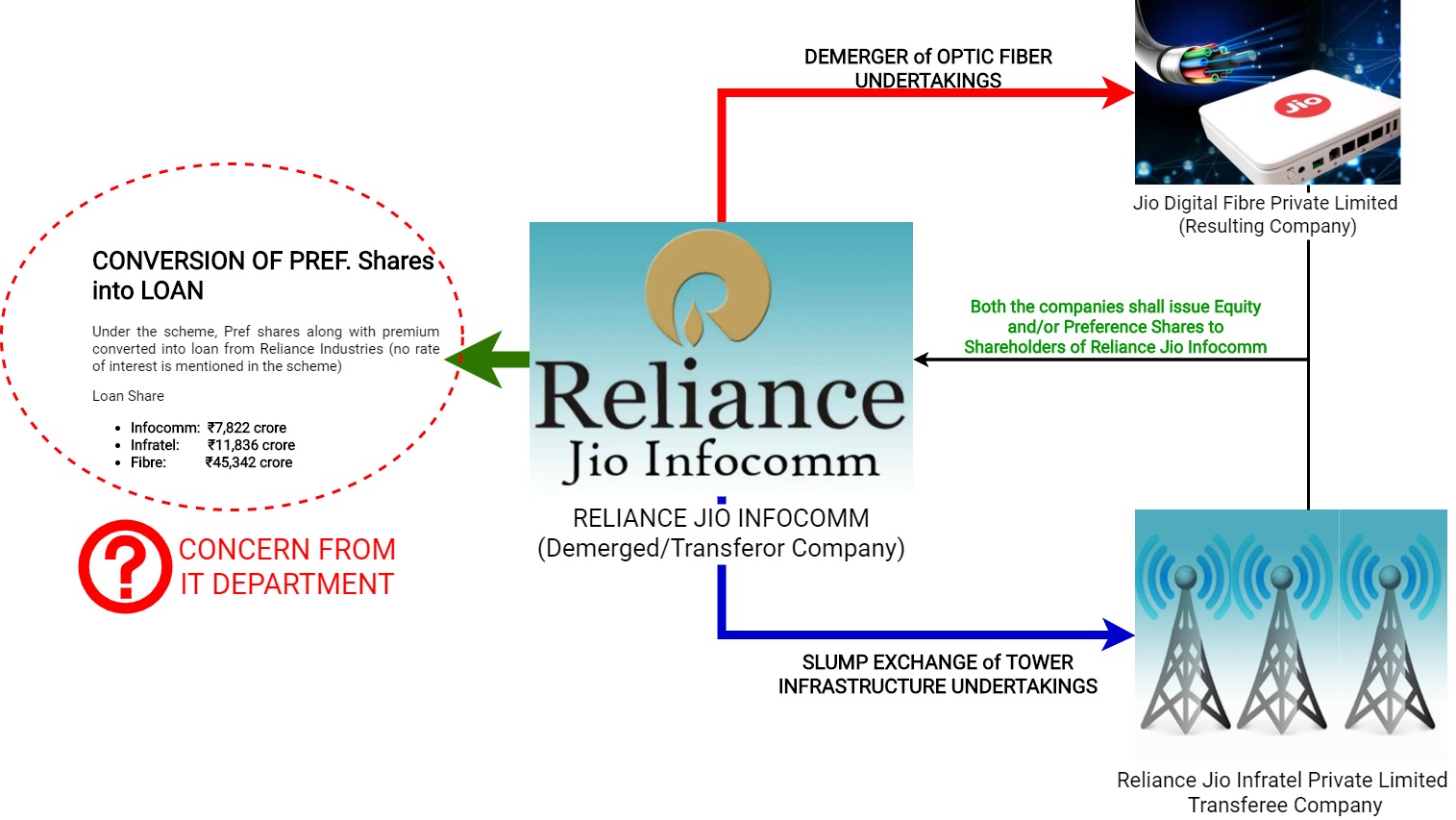

Scheme Details:

There were three different arrangements entered through the scheme, are as follows:

- Demerger of Optic fibre undertaking of Jio Infocom into Jio Fibre

- Slump Exchange of Tower infrastructure undertaking of Jio Infocom to Jio Infratel

- Arrangement with the shareholders of Demerged Company i.e. Reliance Jio Infocom for conversion of Preference share including premium (aggregating to Rs. 65,000 crores) into loan.

The Department raised objections in relation to the third arrangement envisaged through the scheme.

Transaction Overview:

Major concern/Question raised by IT Department:

As per the scheme, preference share capital and corresponding share premium (aggregating to Rs. 65,000 crs) would be cancelled and converted into an equivalent amount of loans from ‘Reliance Industries Ltd.’ And as part of the scheme allotted to three different undertakings i.e. to Jio Infocom Limited -Rs.7,822 crores, Jio Fibre – Rs.45,342 crores and Jio Infratel -Rs. 11,836 crores.

Such conversion is not as per provisions and in violation of Sec 55 (Issue and redemption of preference shares) and Sec 52 (Application of Premiums Received on Issue of Shares) and Sec 66 (Reduction of share capital) of the Companies Act, 2013.

Objections to non-compliance with the provisions of the Companies Act,2013 should have been raised by Registrar of Companies through Regional Director, surprising they did not raise any objections in the affidavit filed by them.

As a result of the conversion of preference shares into loan, the Scheme will result in Tax avoidance and loss of revenue to the government:

Tax Department argued that the conversion of preference shares along with premium will substantially reduce the profitability of Jio Infocomm and will act as a tool to avoid and evade taxes.

Further, it would also bring down the payment of dividend distribution tax (conversion of preference shares into loan and indirect release of the asset) which is again a way to avoid payment of taxes.

NCLAT reply on the Income tax queries:

- On question of Companies Act violation:

Whether any scheme is compliant of Section 55 of the Companies Act or not can be better examined by authorities under the Companies Act. It can be noticed and objected by the Competent Authorities i.e., Regional Director, North Western Region and the Registrar of Companies. And no observation regarding violation of Sec 52, 55 or 66 is made by the concerned authority. So NCLAT did not take objections by the Income Tax Department in consideration.

- On Tax avoidance and loss of revenue to the Government:

Without going to the record and without placing any evidence or substantiate the allegation by appearing before the Tribunal, it was not open to the Income Tax Department to hold that the Composite Scheme of Arrangement is giving undue favour to the shareholders of the company and results into tax avoidance.

The Income Tax Department, which sought for liberty to enquire into the matter, if any part of Scheme amounts to tax avoidance or is against the provisions of the Income Tax has been granted liberty take appropriate steps if so required in the course of income tax assessment proceedings under The Act.

Mere fact that a Scheme may result in reduction of tax liability does not furnish a basis for challenging the validity of the same.

Modification in the scheme:

Petitioner Companies modified the scheme to the effect that the Resulting Company (Jio Fibre) and the Transferee Company(Jio Infratel) shall provide an option to the shareholders of the Demerged Company (Jio Infocomm) and to the TransferorCompany (Jio Infocomm), at their discretion, to receive a part of the consideration in the form of preference shares, for demerger of Demerged Undertaking and transfer of the Transferred Undertaking respectively. It is further submitted that the aggregate consideration envisaged under the Scheme does not undergo any change pursuant to the aforesaid amendment.

Consideration:

We have taken consideration paid during the arrangement from the Mar-19 balance sheet of the respective companies

Demerger

Paid to the Equity shareholders

Add comment