RHI Magnesita, the leading global supplier of refractory products, announced the acquisition of the Indian refractory business of Dalmia Group (Dalmia Bharat Refractories Limited).

RHI Magnesita India Limited (“RHI” or “Acquiree”) is a leading India-based supplier of high-grade refractory products, systems and solutions to the India and West Asia region. The Company is promoted by a leading global supplier of refractory product company, RHI Magnesita. RHI Magnesita India Limited is listed on the nationwide bourses.

Dalmia Bharat Refractories Limited (“DBRL” or “Acquiror”) is a leading India-based producer of high alumina refractory bricks… DBRL provides a complete line of services including refractory design and layout for greenfield projects, refractory application and maintenance. DBRL offers end-to-end refractory products, solutions and services to customers in over 40 countries and is one of the oldest and leading suppliers of refractories to cement plants in India and the Middle East and North Africa region. The Equity shares of the Company are listed on Metropolitan Stock Exchange & Calcutta Stock Exchange.

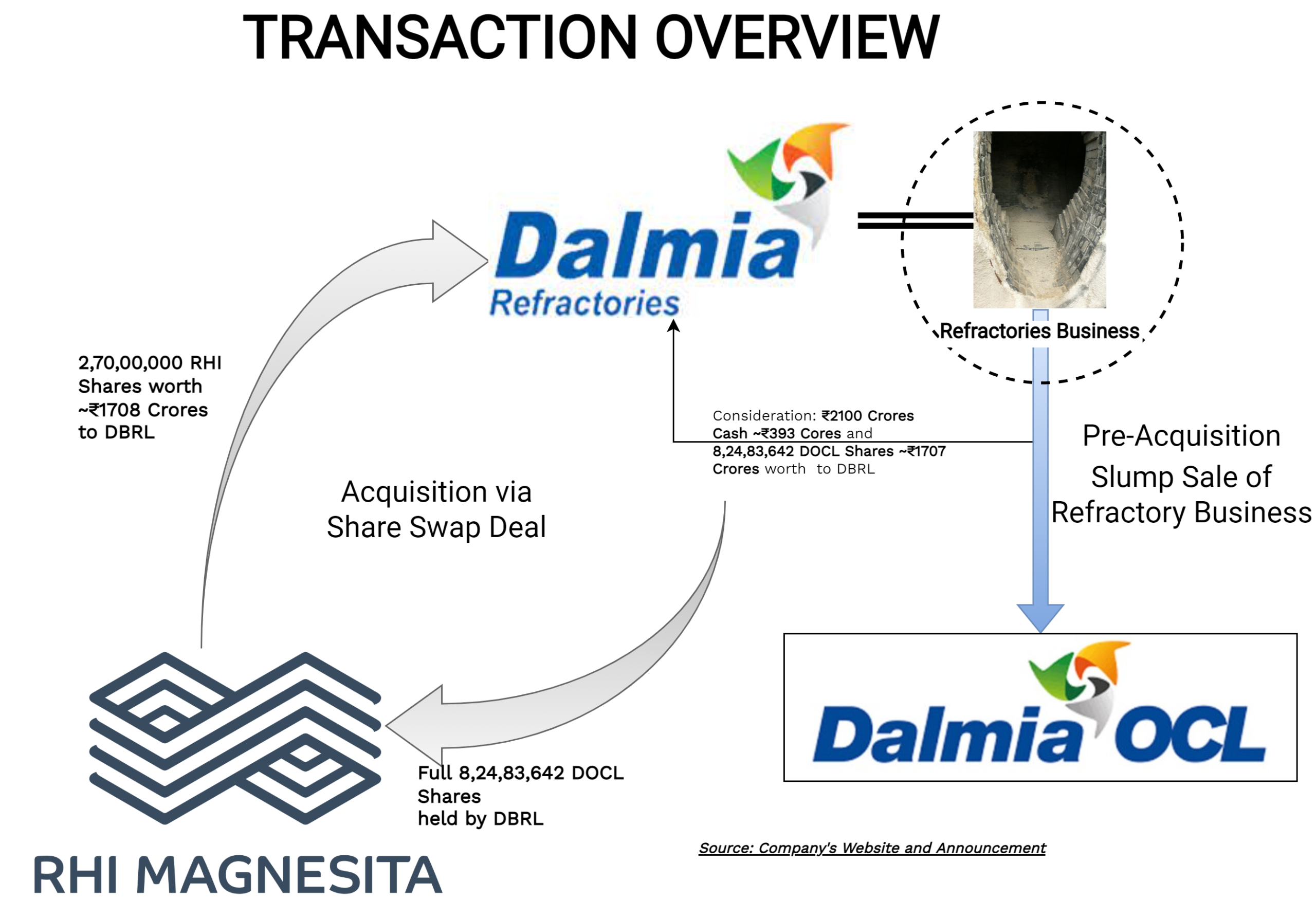

Dalmia OCL Limited (“DOCL” or “Target”) is a wholly-owned subsidiary of DBRL having no active business operations or assets. As part of pre-transaction, Dalmia group will consolidate entire domestic refractories business of DBRL to DOCL by way of a slump sale.

History:

Dalmia Refractory

The refractory business has been a part of the group since 1939 and have acquired a few refractories over the years. The history as mentioned on its website is as below.

To build a stronger, unified, deeply aligned and efficient business machine, effective in March 2022, Dalmia Group consolidated their refractory business under DBRL. The consolidation was carried through two different schemes mainly:

- Transfer of Refractory Division of Dalmia Cement Bharat Limited to DBRL by way of a Slump Sale (Exchange).

- Amalgamation of Dalmia Refractories Limited and GSB Refractories India Private Limited with Dalmia Bharat Refractories Limited.

Before the transactions, DBRL was not having any operations. Thus, effectively entire Domestic as well as Overseas Refractory business of Dalmia Group was consolidated in DBRL. DBRL discharged the consideration for Slump Exchange through issue of Equity Shares plus Compulsorily Convertible Debentures amounting to INR 355 cr & for amalgamation through issue of equity shares amounting to INR 486 crores. The Appointed Date for Slump Sale was 1st April 2019 & for Amalgamation was 1st April 2020.

RHI Magnesita

In 2021, RHI Magnesita group successfully consolidated their 2 private companies into listed entity through merger to create one strong entity that will be refractory market leader in India. Interestingly, in one of its kind, Hon’ble National Company Law Tribunal (NCLT) Mumbai Bench rejected the merger scheme to which companies filed an appeal in National Company Law Appellate Tribunal (NCLAT). The NCLAT by an order dated set aside the order passed by the NCLT rejecting the scheme and directed the NCLT to approve the scheme. Subsequently, NCLT, Mumbai Bench, approved the scheme.

Post-successful consolidation, the group set a strategic business goal of doubling revenue by FY 2026. The company also announced significant capex of INR 400 crore.

Pre-Transaction Step: Slump Sale

[rml_read_more]

Currently, DBRL along with its subsidiaries holds Dalmia Group’s Domestic as well as over-seas refractory business along with some equity shares of group’s other listed entities. As RHI Magnesite is interested in acquiring only domestic business of Dalmia group, DBRL proposes to transfer the entire domestic business to its wholly owned subsidiary DOCL by way of slump sale through execution of Business Transfer Agreement dated 19th November 2022.

The Consideration for slump sale will be circa INR 2100 crore divided into INR 393.29 crore in the form of cash and 8,24,63,642 equity shares of INR 10 each of DOCL along with existing shares aggregating to INR 1707.76 crore.

The Transaction:

RHI Magnesita & DBRL entered into share swap agreement dated 19th November 2022 which inter-alia provides for acquisition of entire share capital of DOCL in exchange of equity shares of RHI Magnesita (to be issued through preferential allotment).

RHI Magnesita will acquire entire 8,24,83,642 equity shares of DOCL held by DBRL for issue of 2,70,00,000 equity shares by RHI Magnesita to DBRL. The share consideration has been valued approximately INR 1708 crore based on RHI per share value of Rs 632.50.

Share Holding Pattern of RHI

Pursuant to the issue of shares, Promoters stake in RHI Magnesita will come down by circa more than 10%. DBRL will own circa 14.36% stake in RHI Magnesita. Currently, Dalmia Group owns around 75% in DBRL & remaining with public.

Rationale for the Acquisition

The acquisition will significantly increase RHI Magnesita’s presence in the fast-growing Indian refractory market, with forecast steel production growth in India of 12% in 2022 and a 7-8% compound annual growth rate until 2030. Through the consolidation of DBRL’s production into RHI Magnesita’s existing operations, significant network optimisation synergies will be captured. The company employs approximately 1,200 people in India and has production capacity of more than 300,000 tons of refractory annually, from five refractory plants and raw material sites. The acquisition will add production capacities in important industrial regions in the south and west of India where RHI Magnesita currently has no assets.

Further, the acquisition will increase RHI’s market share to circa 30%.

Segment-wise details of the Business:

Manufacturing:

RHI has three manufacturing plants located in Rajasthan, Andhra Pradesh and Odisha. The combined capacity is around 160,494 MT. DBRL has manufacturing plants at Tamil Nadu, Gujarat, Odisha and Chhattisgarh. This acquisition will pave the way for RHI to have manufacturing plant in most of the clusters.

Financials & Valuation

Standalone DBRL Figures for H1-Fy 2023

Figures for FY 2022

Export business of DBRL clocked revenue of Circa INR 290 crore for FY 2022 with EBITDA of 37 crore. Acquisition likely to create immediate value to RHI shareholders. Revenue per share will increase to 157 per equity share from Rs 124 per share and with economies of scale & other synergies, RHI will likely have improved EBITDA and also return on capital employed in Dalmia’s Refractory business.

Taxation

Pursuant to the slump sale dated 19th November 2022, DBRL will have to pay capital gain tax as the consideration is significantly higher than the net assets getting transferred. Further, it looks slump sale will happen at higher value than the share swap. This is due to some part of the consideration in slump sale is to be discharged through cash which may likely to be discharge after share swap. The cash will provide liquidity to DBRL to discharge tax liability on slump sale. The proposed share swap dated 19th November 2022, though taxable in the hands of DBRL, tax liability will be nil/miniscule...

Conclusion

In its Annual report for FY 2022, DBRL did set target to become India’s leading refractory business by 2025 and one-billion-dollar global refractory business by 2030. But within few months, it announced the divestment of its domestic business to RHI. It is sale of domestic business to RHIL but structured as first slump sale to 100% subsidiary i.e., DOCL for consideration of cash plus shares followed by transfer of 100% control of the subsidiary to RHIL, by way of share swap. For RHIL, as it can be seen from multiple acquisitions and consolidation in last decade, is one more step to become refractories behemoth to serve its customers with strategic pan India manufacturing facilities and also to diversify its customer base & strengthening its market share in India.

Going ahead, DBRL will be left with growing global refractory business along with ammunition in the form of 14.36% equity stake in RHI which it may use to expand its international operations or reward shareholders.