The board of Directors of Mehta Group Companies, Gujarat Sidhee Cement Limited and Saurashtra Cement Limited has decided to merge a promoter holding company of respective companies. Both schemes are twins in all aspects and hence discussed together.

Gujarat Sidhee Cement Limited (GSCL) is a Mehta Group Company involved in the manufacturing of Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC) types of cement and clinker. The Company markets cement under the brand name “Sidhee”. The company is listed on BSE Limited & NSE Limited.

Saurashtra Cement Limited (SCL) is a Mehta Group Company involved in the manufacturing of Portland Pozzolana Cement (PPC), Ordinary Portland Cement (OPC) types of cement and clinker. The Company markets cement under the brand name “Hathi”. The company is listed on BSE Limited.

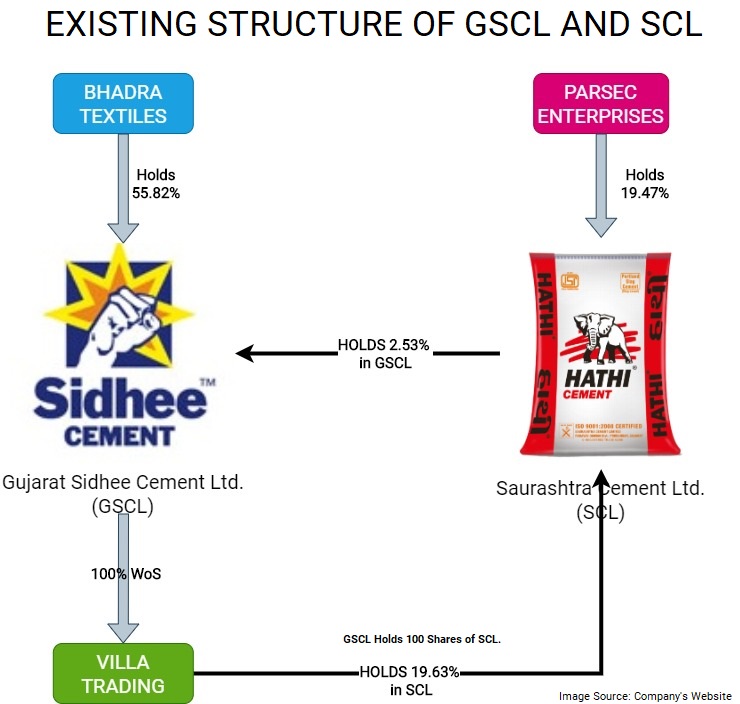

Bhadra Textiles and Trading Private Limited (“Bhadra Textiles”) is a promoter group company holding 55.82% stake in GSCL.

Villa Trading Company Private Limited (“Villa Trading”) is a wholly-owned subsidiary of GSCL. Further, Villa Trading also holds 19.63% stake in SCL.

Parsec Enterprises Private Limited (“Parsec”) is a promoter group company holding 19.46% stake in SCL.

Bhadra Textiles, Villa Trading and Parsec don’t have any significant assets except for the stake in the companies mentioned.

Existing Structure:

The Transaction

From Appointed date 1st April 2020, both SCL & GSCL will partly collapse the holding structure through different schemes and

- Merge Bhadra Textiles & Villa Trading into GSCL

- Merge Parsec into SCL

The consideration issued for the respective mergers will be equal to the stake held by the transferor companies in the listed companies. i.e. GSCL will issue 4,88,00,000 (equivalent to 55.82%) to the shareholders of Bhadra Textiles and SCL will issue 1,35,38,370 (equivalent to 19.46% stake) to the shareholders of the Parsec. Villa Trading being Wholly owned subsidiary, no shares will be issued. As a result of this, the pre-post share capital and Promoter holding of both GSCL and SCL will remain the same. However, due to the merger of Villa Trading with GSCL, GSCL will directly hold circa 19.46% in SCL.

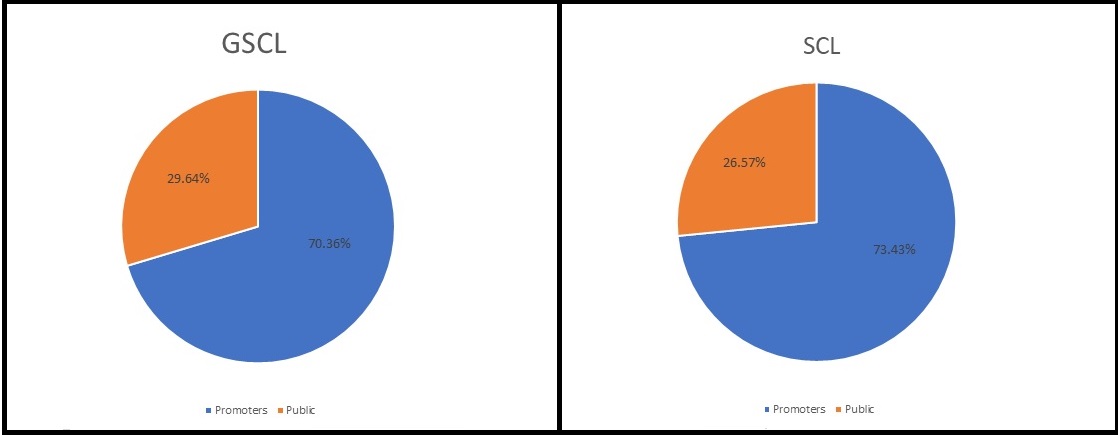

Shareholding Pattern ofGSCL & SCL:

In GSCL, out of promoters 70.36% holding, Bhadra Textiles and Trading Private Limited holds 55.41% stake while SCL holds 2.53% stake in GSCL. In SCL, Parsec holds 19.47% while GSCL through Villa holds 19.63% stake. As a result of proposed re-structuring, GSCL will directly hold 19.63% stake in SCL.

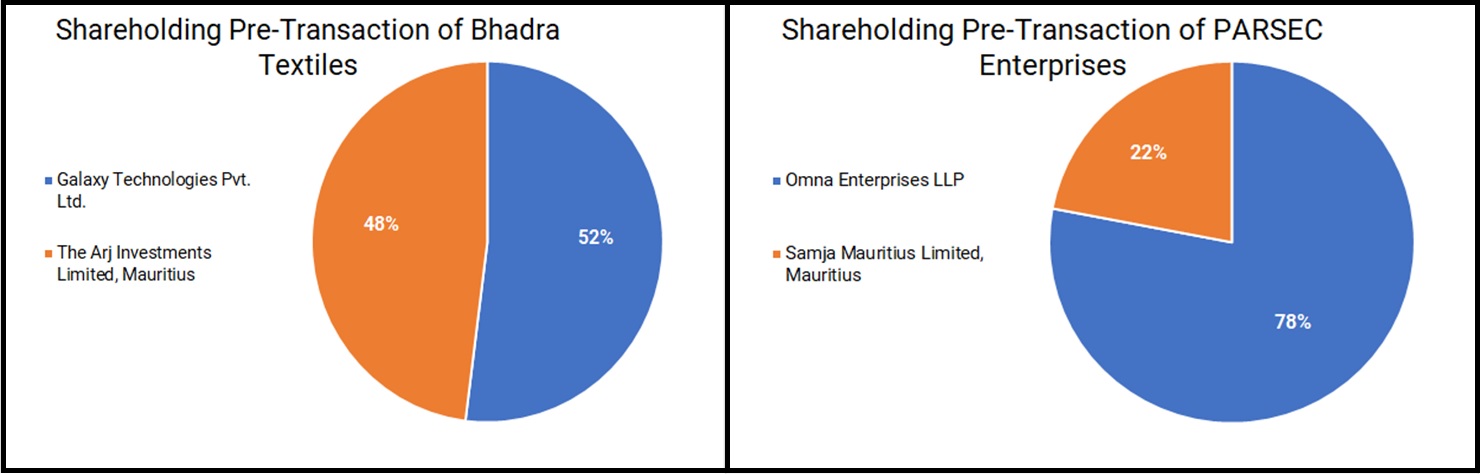

Shareholding Pattern of Bhadra Textiles & Parsec:

While as a result of the transaction, other promoter group entities will consolidate their holding in GSCL & SCL. The shareholders of Bhadra Textiles & Parsec i.e. Other promoter group entities will get shares of SCL & GSCL. Currently, Arj Investment Limited, Mauritius holds circa 1.3% in GSCL. Post Transaction, it will hold 27.8% stake in GSCL. Similarly, Samja Mauritius Limited holds 11.5% stake in SCL which will become 15.8%.

Earlier Re-Structuring

Saurashtra Cement Limited

SCL was a Sick Industrial Company, pursuant to section 3(1)(o) of the Sick Industrial Companies (Special Provisions) Act, 1985 (SICA) and is registered with the Board for Industrial and Financial Reconstruction (BIFR). The order for its revival came in 2013. In 2015, the board allotted 180,00,000 equity shares of INR 10 each (partly paid-up INR 5 each) to the promoters in compliance with the BIFR order. Parsec became a shareholder as a result of this allotment. The total amount received by the company was INR 9 crores. Further, during the same year, the company redeemed 13% Optionally convertible Cumulative preference shares at par amounting to INR 6.87 crores.

In 2019, SCL, out of its five subsidiaries, four companies namely Pranay Holdings Limited, Prachit Holdings Limited, Ria Holdings Limited and Reeti Investments Private Limited have been merged with SCL.

Gujarat Sidhee Cement Limited

Hon’ble BIFR vide its order dated 6.12.2012 issued on 16.1.2013 sanctioned the Modified Draft Rehabilitation Scheme of the company inter-alia consisting of following main points:

- Reduction of paid-up capital by 75%.

- Fresh infusion of equity capital of INR 50 crores consisting of 5 crore equity shares of ` 10/- each at par to the Promoters, associates, etc.

- To complete the jetty at a revised cost of INR 59.72 crores.

Capital Reduction & Infusion of Shares

GSCL’s paid-up Share Capital was reduced by 75% from INR 144,61,54,080/- consisting of 14,46,15,408 fully paid-up Equity Shares of INR 10/- each to INR 36,15,38,520/- consisting of 3,61,53,852 fully paid-up Equity Shares of INR 10/- each

In compliance with the said order, Bhadra Consultancy Private Limited, a Promoter Company has invested INR 28.80 crores in March 2015 towards the purchase of 2,38,00,000 equity shares of the Company at par fully paid up and 2,00,00,000 equity shares of the Company at INR 2.50 per share

Conclusion

The proposed re-structuring though will be executed through the different schemes, is identical both in terms of structure and drafting. The restructuring will reduce the entity layer for the promoter group and consolidate its listed companies holding in promoter group entities.

From long, the demand for consolidation of Mehta group’s listed operating companies is going on. The proposed restructuring will give direct holding of SCL in GSCL. Overall, the restructuring could also be a step towards the consolidation of SCL & GSCL in the future.

Add comment