The Securities Exchange Board of India (‘SEBI’) has issued the SEBI (Delisting of Equity Shares) Regulations, 2021 (New Delisting Regulations) on June 11, 2021, superseding the erstwhile SEBI (Delisting of Equity Shares) Regulations, 2009.

In the consultation paper on review of SEBI (Delisting of Equity Shares) Regulations, 2009, SEBI has mentioned the following key objectives for the review of delisting regulations –

- Enhance disclosures to help investors to take informed investment decisions

- Refine process

- Rationalize the existing timelines, so as to complete the delisting in time bound manner.

- Streamline the delisting regulations to make it robust, efficient, transparent and Investor’s friendly.

- Plug gaps

- Update references to the Companies Act, 2013 and other securities laws

In this article, we will discuss some key changes made under “New” Delisting Regulations

Pursuant to Regulation 3 of the New Delisting Regulations, these regulations are applicable for the delisting of Equity shares & Equity shares having superior rights from all or any of the Recognized stock exchange.

SEBI has allowed certain listed Companies to issue shares with superior rights by amending the SEBI LODR (Listing Obligation and Disclosure Requirements) in July 2019 and the same also can be delisted under this New Delisting Regulations.

Recognized Stock exchange includes both Regional Stock exchange and Stock exchange having nationwide trading terminal i.e., BSE (Bombay Stock Exchange) and NSE (National Stock Exchange) and regional stock exchange.

New delisting regulations do not apply to the delisting of shares pursuant to a resolution plan approved under Section 31 of the Insolvency and Bankruptcy Code, 2016, subject to satisfaction of certain conditions.

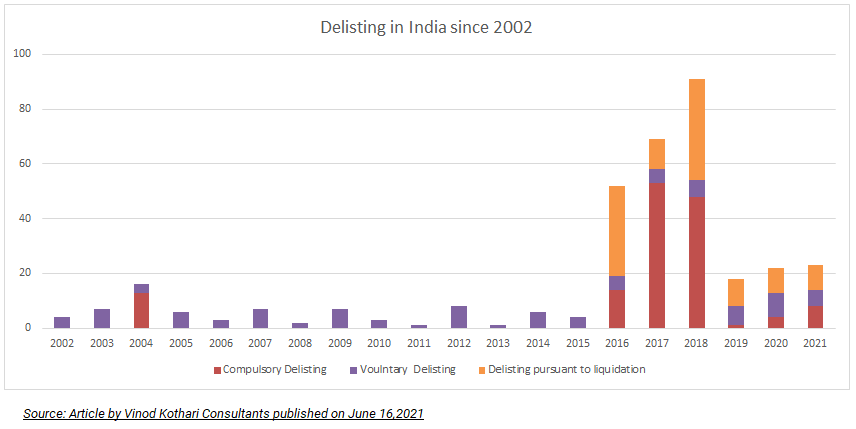

Statistics

Overview of the Key Changes: –

1. Enhancing Disclosure: –

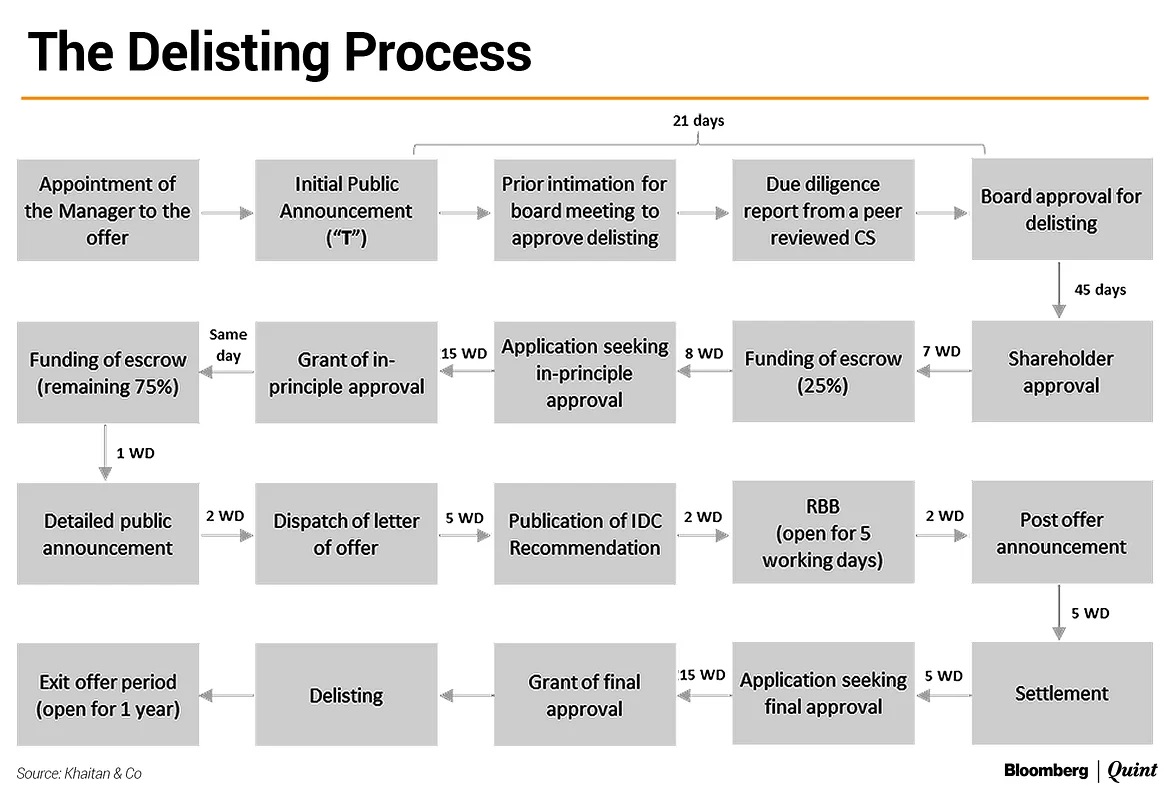

In the erstwhile regulations, it was the duty of Board of Directors to disclose the intention of the acquirer to delist the Company. Since the delisting of shares from all the stock exchanges is price sensitive information and also to align the provision of disclosure with the Takeover Regulations, under New Delisting Regulations, Acquirer is required to make an initial public announcement on the same date when he decides to voluntary delist the company. Acquirer includes the promoter and the acquirer as defined under Takeover regulations.

2. Due-diligence by Company Secretary: –

To ensure that there is no conflict of interest, in case of the delisting where exit opportunity to public shareholders is required to be given, New Delisting Regulations requires appointment of peer-reviewed company secretary to carry out due diligence and submit the report to a board of directors before granting approval by the Board of Directors.

3. Role of Independent Directors: –

New Delisting Regulations requires the company to form a committee of independent directors and provide a reasoned recommendation on the proposal of delisting. Along with the reasoned recommendations, voting pattern of such committee is required to be given. This amendment is also in line with the Take Over Regulations where committee of independent directors is required to give reasoned recommendations on the open offer given by the acquirer.

4. Indicative Price: –

To show the strong intention of the acquirer to delist the Company, New Delisting Regulations allows the acquirer to mention the “Indicative Price” which shall not be less than the floor price calculated in terms of Regulation 8 of Takeover Regulations. Indicative Price shows promoters’ intention to pay more. If the indicative price is given and price discovered through Reverse Book Building is less than the indicative price, Acquirer is bound to acquire shares at indicative price only.

5. Escrow Account: –

To ensure the seriousness and preparedness in the delisting offer and ensuring financial capability of the acquirer, acquirer is required to deposit 25% of the consideration calculated on the basis as given under Regulation 14 within 7 days of the approval given by the shareholders and remaining 75% shall be deposited before making detailed public announcement.

6. Special provisions for a subsidiary company getting delisted through scheme of arrangement: -`

New Delisting Regulations allows such subsidiary companies to get delisted without following the normal delisting procedures provided the listed holding entity and subsidiary company are in the same line of business and it fulfils other conditions as given under Regulation 37 of the New Delisting regulations.

Some of the key conditions are as follows –

- Post scheme of arrangement Subsidiary Company shall become wholly owned subsidiary of the listed holding company. The listed parent entity shall integrate the business of the listed subsidiary with that of its own by providing a share swap to all shareholders of the listed subsidiary through a scheme of arrangement.

- Shares of the listed holding company and the subsidiary company are listed for at least 3 years and shall not be suspended at the time of delisting.

- Subsidiary Company has been listed subsidiary of the listed holding company for the last 3 years.

- No further restructuring shall be undertaken by the listed holding company for a period of 3 years from the date of the Order of the Tribunal approving the scheme of arrangement. Subsidiary Company shall have the same meaning as defined under the section 2(87) of the Companies Act, 2013.

In the Consultation paper on “Amendment to SEBI (Delisting of Equity Shares) Regulations, 2009” for the scheme of arrangement SEBI has observed the following points which are main reasons for providing the exemption from delisting procedures to the listed subsidiary company –

- There are various listed holding companies and their listed subsidiaries which are in similar in similar line of business, and which have created significant incremental shareholders value.

- Merger of these two companies would help the to achieve the intended synergies but the same may not be always possible because of following reasons –

- Industry Specific Constrains (E.g., Licenses Conditions)

- Value Destroying transaction cost

- Cultural differences.

SEBI vide circular dated 6th July 2021, has given the following criteria for the purpose of defining

“Same line of business”: –

- Principal Economic Activities of both the Companies are under the same group under the National Industrial Classification (NIC) Code, 2008.

- At least 50% revenue from operations of both the Companies must be generated from same line of business as per the Audited Financial Statements.

- At least 50% of net tangible assets of both the companies must be invested in the same line of business as per the Audited Financial Statements

- In case of change of name of the listed entity, company will have to wait for the 1 year after changing name and ensure that at least 50% of the revenue, calculated on a restated and consolidated basis, for the preceding one full year is earned by it from the activity indicated by its new name.

- Statutory Auditor and SEBI Registered Merchant Banker of the respective company are required to certify that all criteria as mentioned above are getting fulfilled.

Though listed subsidiaries will get delisted without following the long method of delisting including reverse book building method, there will be dilution in the shareholding of the promoter and public shareholders of the listed holding company post scheme of arrangement.

Companies like Bajaj FinServ Limited, Ambuja Cements Limited can evaluate this option for delisting their subsidiaries.

7. Special provisions for delisting of shares on Innovators Growth Platform: –

Regulation 36 of New Delisting Regulations require that, in case of the Companies listed on innovators growth platform, delisting offer will be deemed to be successful if shares tendered reaches 75% of the total issued shares of that class and at least 50% shares of the public shareholders as on date of the board meeting in which such delisting is approved are tendered and accepted instead of the 90% requirement. Further, reverse book building method is not required to be followed for such companies.

8. The New Delisting Regulations specify the timelines for the entire process, making it less cumbersome and time-bound: –

Timeline is provided for the following events-

- Passing of Board Resolution

- Passing of Special Resolution

- Opening of Escrow Account

- Application to stock exchange seeking in-principal approval

- Disclosure of Outcome of Reverse Book Building

- Release of shares in case of failure of offer

- Payment on successful delisting

- Final application to the stock exchanges after successful delisting.

Delisting Process under New Delisting Regulations: –

Conclusion

In a delisting offer, Reverse book building allows public shareholders to tender their share at a price of their choice above a certain floor price. The price at which the acquirer is able to cross ninety percent of the share capital of the company becomes the final delisting price. It is choice of an acquirer to accept or reject the price discovered through the Reverse Book Building method. This makes the process of delisting fairly one-sided. Statistics also show that many delisting offers have failed on account of exorbitant premiums demanded by the public shareholders through the reverse book building process.

Since the New Delisting Regulations allows the Acquirer to quote the “Indicative Price” public shareholders can get the indications about the price which can be given by the Acquirer to acquire the shares and they can quote the price nearby the indicative price in Reverse Book Building method. This might increase the chance of success of delisting offer.

Add comment