Simpson and Company Limited (“Company”) is a subsidiary of Amalgamations Private Limited. Company is engaged in the business of manufacturing electrical equipment, general and special purpose machineries, transport equipment. Company filed a petition under section 61 and under section 66 of the Companies Act, 2013 with the Hon’ble NCLT, Chennai Bench.

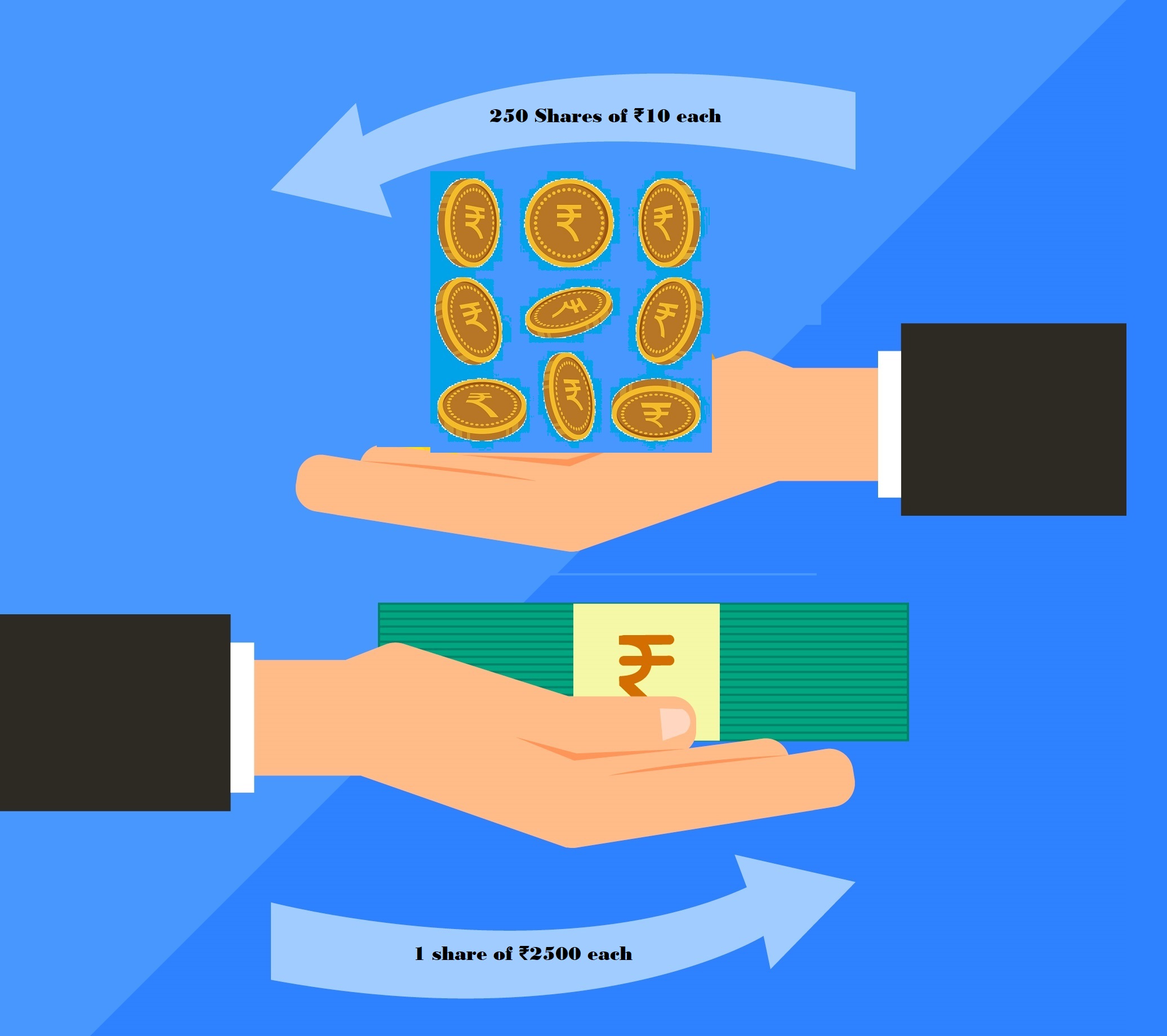

The company wanted to consolidate its paid-up equity share of Rs 10 each into a share of Rs 2500 each by consolidating 250 shares of Rs. 10 each into 1 equity share of Rs. 2500 each. Since consolidation will result infractions, which will be paid off, as result there will be change in voting rights and hence the company filed a petition before Honorable NCLT, Chennai Bench as required under provisions of Sec 61(1) (b) to confirm such consolidation and the consequent variation of voting rights. As it also results in a reduction of paid-up capital it filed a petition under Sec 66 for reduction of capital also, in our view by way of abundant caution.

We have analyzed the decision passed by the Hon’ble National Company Law Tribunal, Chennai Bench (“NCLT”) vide order dated 13th July 2021 confirming petition under Sec 61(1)(b) allowing full consolidation but in case of reduction of capital, it modified the resolution by allowing reduction to the extent and only for those shareholders who are ready to go ahead with reduction at the price of Rs 14860 per share offered by the company and consolidating fractions of other shareholders in the name of the trust to be created for their benefits.

Sequence of events: –

| Sr No. | Particulars |

| 1. | Board of Directors of the Company passed the resolutions for consolidation of shares and reduction of capital in their board meeting dated 25th September 2019 |

| 2. | Extra Ordinary General Meeting for passing resolution under section 61(1)(b) of the Companies Act, 2013 was held on 7th November 2019 where 63 members were present out of total 185 shareholders. Out of shareholders present and voting – a. 12 Shareholders holding 99.86% of shares voted in favor of the resolutions b. 47 shareholders holding 0.14% of shares voted against the resolutions c. Voting of 4 shareholders was declared as invalid. |

| 3. | The Company filed petitions under section 61(1)(b) and section 66 of the Companies Act, 2013 |

| 4. | Certain shareholders filed compliant with Regional Director about the valuation done by the registered valuer. |

| 5. | The Regional Director filed a common report dated 16th September 2020 having no negative observations except referring to the complaints received by him from shareholders. |

| 6. | Certain shareholders filed objections with the NCLT in the course of hearing mainly on the valuation of shares and Company filed reply against the objections |

| 7. | NCLT passed order allowing consolidation under Sec 61(1) (b) as it is and reduction of capital under Sec 66 with modification. |

Objection raised by the shareholders: –

Objections raised by 29 Shareholders are summarized as follow: –

Main objection was that Consolidation of equity shares is with the sole object of expropriating the shares of small shareholders.

- Valuation is not carried out in accordance with the section 247 of the Companies Act, 2013 since the Registered Valuer carried out valuation without detailed “Due-diligence”.

- Consideration offered of Rs.14,860 per share in reduction of capital was very low considering the fair value of the assets of the Company and financial performance of its subsidiaries. In their opinion value per share is from Rs 50000 to Rs 500000.

- Majority of the Minority shareholders present in the meeting voted against the resolutions. Resolution is ought to have been passed since more than 95 % shares are with the promoters. Since the explanatory statement of notice of general meeting evident for the benefit of promoters and their relatives, they should not have participated in the voting.

- Explanatory Statement under section 102 of the Companies Act, 2013 does not disclose the reasons of consolidation and reduction and how it is beneficial to the stakeholders of the Company

Submission by the Company against the objections raised by shareholders: –

- Section 247 of the Companies Act, 2013 is applicable only if the valuation is mandatorily required under the provisions of the Companies Act, 2013. Since the valuation is not mandatory under section 61 (For Consolidation) and 66 (Reduction of capital) of the Companies Act, 2013 section 247 is not applicable.

- Company has arrived at the given consideration based on the valuation report given by registered valuer and the same has been confirmed by the SEBI registered merchant banker.

- Proposed Consolidation would provide an option to take easy exit from the Company at fair value. Since the Company is unlisted hence its shares are illiquid .

- In the rationale for the proposed consolidation and reduction, Company has mentioned about reduction of the compliance and administrative activities and to reduce the procedural compliances

Summary of the NCLT Judgment: –

- NCLT has not commented anything on the procedural compliances like passing of resolution in general meeting, under the Companies Act,2013 done by the Company under the section 61(1)(b) and section 66 of the Companies Act, 2013

- NCLT has also mentioned that it is unable to find in appropriateness in the Valuation of Rs.14,860 per share. The shares of the company do not carry any liquidity and there cannot be the taker of the shares for Rs.14,860,higher the price higher will be the liquidity discounting factor.

- To safeguard the interest of dissenting minority shareholders who are not willing to accept consideration of Rs. 14,860 per share offered by the Company, the Company shall create a trust in which fractional shares shall be vested for the benefit of dissenting shareholders.

- NCLT allowed the consolidation of share capital of the Company under section 61(1)(b) without any modification and considering the objection raised by the shareholders on valuation of shares, allowed the reduction of capital with modification.

Analysis of the submission by the parties and the NCLT Judgment: –

Consolidation of Shares: –

Pursuant to section 61(1)(b) of the Companies Act, 2013 in case of consolidation of shares, approval of shareholders is required and if the consolidation is resulting into change in voting %, approval of NCLT is also required. In this case, Company filed an application with the NCLT since there was change in voting % of the majority shareholders. Though change in voting % is minute, in this case, which is less than 1 %, approval of NCLT is required. Further, section 61(1)(b) does not prescribe the provision when fractional shares are arising because of the consolidation of shares. Since all the procedural compliances are complied with, NCLT allowed consolidation of shares of the Company without any modification.

Reduction of fractional shares: –

To provide complete exit to the shareholders, Company passed resolution under section 66 for the reduction of the fractional shares by offering consideration of Rs.14,860 per share to the shareholders holding fractional shares. Further, company has taken the approval of shareholders for reduction of capital under section 66 as a part of the resolution under section 61(1)(b) only.

To provide complete exit, Company passed a resolution for mandatory reduction of fractional shares. If the main motive of the Company was to consolidate the share capital, Company should voluntarily give option to shareholders to continue holding fractional shares, either through creation of trust or otherwise.

Considering the main objective of the Company was to consolidate the share capital and considering the objection of the shareholders, NCLT allowed the reduction of capital but with some modification. NCLT has validly ordered that fractional shareholders shall be given option, either continue holding of shares through trust or accept the consideration of Rs. 14,860 per share.

Conclusion:

The decision is harmonious interpretation of various provisions of the law which is win-win solution for all concerned. Hon’ble NCLT attempted the same by this order while allowing consolidation to reduce administrative and compliance hassles and cost and providing exit to group of small shareholders who wanted to exit at price offered by the company and for dissenting small shareholders creating trust and allowing them to participate in the future growth of the company through a trust. This is the first time where NCLT has ordered creation trust for the benefit of shareholders having fractional shares. The Honorable NCLT rightly did not attempt to go into a well-settled principle by honorable Supreme court in the case of HLL Ltd that the judiciary is not qualified to look at the valuation arrived at by experts.

As far as reduction of capital is concerned, NCLT took the same stand as NCLAT in the case of Atlas Capco Ltd.

We believe that promotors owning more than 90% shareholding are entitled to have full control by providing exit to all the small shareholders. We believe the scheme under recently notified Sec 230(11) is better solution to give exit fairly to all small shareholders and promoters to get full control of the business for future growth.

Add comment