Strategic Debt Restructuring – A short in the arm for banks

With rising non-performing loans (NPAs) or stressed loans of banks, the Reserve Bank of India (RBI) has come out with Strategic Debt Restructuring (SDR) scheme which will enable banks to recover their bad loans by converting the advances into equity and taking control of distressed companies. Conversion of outstanding debts can be done by a consortium of lending institutions known as the Joint Lenders Forum (JLF) which may include banks and other financial institutions.

The central bank’s move will provide the much-needed mechanism to tackle the issue of bad loans which has affected the public sector banks the most in the last few years.

CONDITIONS APPLY

- At the time of initial restructuring, the JLF must incorporate an option in the loan agreement to convert the entire or part of the loan including the unpaid interest into equity shares if the company fails to achieve the milestones and critical conditions stipulated in the restructuring package.

- The decision on invoking the SDR by converting the whole or part of the loan into equity shares will be taken by the JLF within 30 days from a review of the account. Such a decision will have to be well documented and approved by the majority of the JLF members (minimum of 75% of creditors by value and 60% of creditors by number).The decision date will be called as the reference date.

- After the conversion, all lenders under the JLF must collectively hold 51% or more of the equity shares issued by the company.

- The JLF must approve the SDR conversion package within 90 days from the date of deciding to undertake SDR.

- The conversion of debt into equity as approved under the SDR must be completed 90 days from the date of approval of the SDR package by the JLF.

PRICING

The conversion of outstanding debt into equity will have to be done at a ‘Fair Value’ which will not exceed the lowest of the following,

subject to the floor of ‘Face Value’

- Average closing market value for 10 trading days preceding the reference date.

- Break-up value i.e the book value as calculated in the company’s latest audited balance sheet.

POST CONVERSION

- JLF and lenders should divest their holdings in the equity of the company as soon as possible.

- On divestment of banks’ holding in favor of a new promoter, the asset classification of the account may be upgraded to ‘Standard’ with certain other conditions.

- The new promoter should not be the person from to erstwhile promoters and the new promoters should acquire at least 51% of the paid-up equity capital of the borrower company. Some relaxation has been given to non-resident acquirer where the foreign direct investment (FDI) cap is below 51%.

SOME OTHER PROVISION

As this is a special scheme, some exemptions will be given to lenders when they convert the loan into equity. The said conversion of the debt will be exempted from the Securities and Exchange Board of India (SEBI) (Issue of Capital and Disclosure Requirements) Regulations, 2009 and Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011. Moreover, these shares shall be exempt from the requirement of periodic mark-to-market and such conversion shall not be treated as investment in associate. The RBI’s SDR scheme has bought some ray of hope for those banks that are saddled with loans of debt-laden companies. The scheme will give a chance to banks and financial institutions to reduce their ever-increasing NPAs.

Multiple Benefits

Stakeholders

The SDR scheme will provide relief to various stakeholders of debt laden companies. As bank will take over the business of the company and will sell it

afterward, the process of inducting new management will improve the company’s operations. It will also result in improving cash flows and the market capitalisation of the company will rise.

Banking/Financial Institutions

The SDR scheme is beneficial to banking/ financials channels that have lend to companies and are now facing problems of repayment. Rising NPAs have hit the profitability of state-owned banks. In many cases of restructuring, borrower companies are not able to come out of financial stress due to operational or managerial inefficiencies despite substantial sacrifices made by the lending banks. The SDR regime will help such banks/financial institutions to take control of distressed entities and sell it to the new promoters in the next 18 months. This would help in reviving the company and increase the chances of recovering the advances made by banks.

Opportunities for consultants

It would be difficult for lenders to closely monitor the performance of the company, as the circular requires. Further, assessing and evaluating

professional management across a wide spectrum of industries is outside the core competency of banks. Further, banks have to sell their stake in the company in 18 months after taking control of it so as to classify its debt to “standard”. From monitoring the company to an advisory for finding new promoters, lenders will have to depend on outside agencies for this task, which will create new opportunities for consultants.

Intensifying Merger & Acquisition

The push to sell companies under the SDR scheme is set to increase a rate of mergers and acquisitions of financially stressed companies. Due to heavy debt on its books, many debt-laden companies are looking for SDR option for their revival. If banks fail to sell their stake in these companies within a period, consequences are huge. The industry is facing major headwinds due to falling commodity prices, sluggish demand and slowing economy. Major companies are growing inorganically to stay in the competition. These major companies may show their interest to acquire financially- stressed firms.

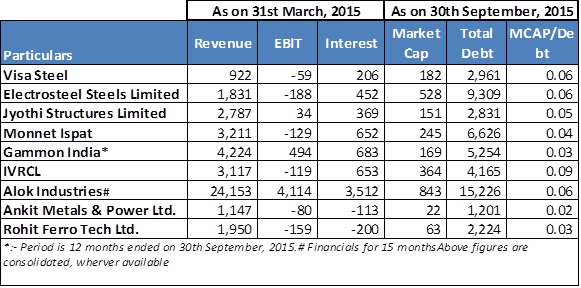

Till date few companies announced their restructuring under SDR:-

INR in crore

ISSUES REGARDING SDR

- Many accounts run into problems, not because of inefficient managements but due to problems like weak demand, cheap imports, overcapacity etc. In such cases, effecting a management change is not likely to substantially improve the troubled company’s performance.

- To sell their stake, banks have to find new promoters within 18 months. Chances of turning around a financially-distressed company in 18 months are quite bleak.

- To classify their lending as “Standard” banks may sell a company in a hurry to new promoters without proper due diligence which may further deteriorate the company’s financials.

- Getting required authorisation from existing shareholders and creditors is expected to be a time-consuming process. This may prove to be a major bottleneck if the lenders plan to operationalise the SDR scheme.

- The ability of banks to find new buyers will be critical in some companies where the condition of the company is critical.

- The new promoters may be unwilling to accept the existing terms on the debt.

- Unions might protest the change in management as it may affect their pension or bonuses.

Conclusion

Under SDR, banks will get control of these companies and need to find buyers within 18 months to upgrade their lending classification as ‘Standard’. Hence the scheme is set to increase the number of mergers and acquisitions of financially stressed companies. If banks fail to sell these companies within a deadline, repercussions are huge. Thus, JLF will try to convince big fishes to acquire these debt laden fishes giving a golden opportunity for big fishes to grow inorganically at rock bottom price and strengthen their position.

According to news reports, lenders are close to the finalising a new owner for Kolkata-based Electrosteel, the first company where the SDR mechanism was applied last year. This could be a landmark for all other companies/banks who are trying for SDR.

The key to the success of SDR scheme is to create a shell within each bank consisting of professionals experts in financial structuring, M&A, technical

expertise and also industry domain. For smaller banks, it may be necessary to take help of professional firms having required skill sets.