The fitness industry in India is largely an unorganized, fragmented and unstructured sector. More recently, it has been witnessed that many mom-and-pop structures are making way for organized retailing in the gym business and the trend will only accelerate in the coming times. Big and established fitness chains and gyms are already diversifying their product and services portfolios to tap into the market in every way possible and reach out to potential customers.

Many are using the franchising model to scale up their operations and tap into a larger client base. Spiralling healthcare costs and specialized medical interventions have pushed people to turn to prevention as a viable option, rather than cure.

The fitness Industry in India is worth INR 4,500 crore (organized plus unorganized) and is growing at 16.18% annually and is expected to cross INR 7,000 crore by 2017. The industry is fragmented with majority of the market dominated by unorganized and independent gym outlets. The organized or modern fitness retail (fitness equipment’s and outfits) is around 28% currently but growing a 22-27% yearly growth rate.

The market share of top 5 players in India is around 15% compared to 40% in Japan and Singapore and about 20% in China, Australia, and New Zealand.

Following are the top players in India in this industry:

- Talwalkar’s Gym

- Fitness First

- Gold’s Gym

- Fitness One

- Ozone Fitness and Spa

The organized players in India have huge scope of consolidation and going forward.

TRANSACTION

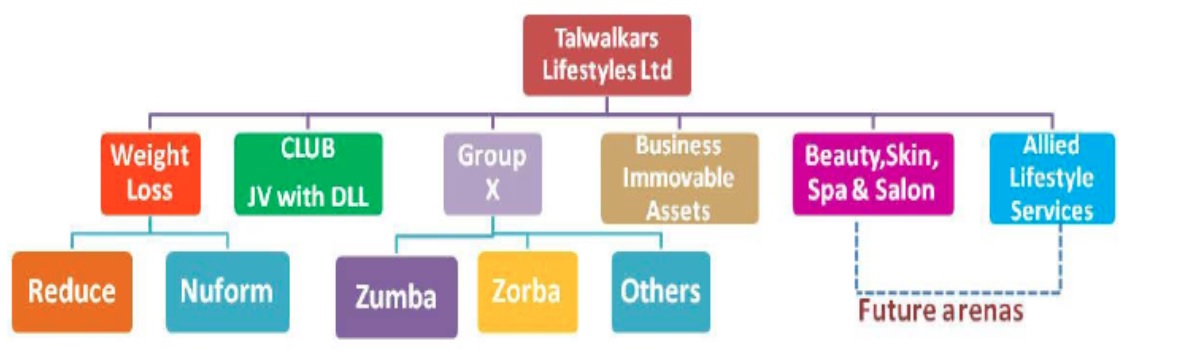

The Board approved Scheme of Arrangement between Talwalkars Better Value Fitness Limited (‘TBVFL’ or the ‘Demerged Company’) and Talwalkars Lifestyles Limited (‘TLL’ or the ‘Resulting Company’) for the demerger of Gym Business of TBVFL to TLL and its Name Swap. The Swap Ratio for the demerger is 1:1.

Please Note: Gym Premises and Loans, borrowing and other liabilities towards such gym premises owned by the demerged company including diet, nutrition based weight loss programme like, reduce, nuform, yoga, physiotherapy, Zumba, Zorba, other allied lifestyle and wellness activities will be retained in the Demerged Company. Brands such “HIFI, Power World GYM, and Talwalkars will be transferred and owned by Gym Entity i.e. Resulting Company.

RATIONALE

GYM Business

TBVFL will hold the Gym business operated by the company or through its subsidiaries and franchisees.

- It will be into core gymming and will not venture into the wellness segment.

- It aims to increase its health centres from 198 gyms to 300 gyms in next 3 years through its various formats

- It will continue consolidating its leadership position in India and expand and emerge as a strong player in Asia.

- It will expand both organically and inorganically through acquisitions or strategic tie-ups.

- Separately, PWG Sri Lanka plans to inaugurate about 100 gyms across the length and breadth of Sri Lanka in next 3 years.

Whereas the Lifestyle Business

- Reduce: Potential to grow to INR 1000mn revenue in 4-5 years.

- Nuform: Potential to grow to INR 500-600 mn in 4-5 yrs

- Group X Activities (Zorba): Potential to grow to INR 400-450mnin 4-5 yrs

- Merchandising: Potential to grow to INR 300-350 mn in 4-5 yrs

- DLL Joint Venture:

Envisaged development of 7-10 clubs across India starting with Pune, Maharashtra. It has already acquired a land parcel for their first club. This club will be able to accommodate 4,500 families.

As on 31st March total revenue from the above business is INR 506 mn,

ABOUT TALWALKAR

In 1932, Mr. Vishnupant Talwalkar opened the doors of Talkwalkars to the city of Mumbai. The promoters of the company possess an experience of over five decades in the Indian fitness industry. The company’s fitness centres are offered in five different formats which are Talwalkars Premium Gym, Talwalkars Gym, HiFi, Power World Gym and Zorba Studios. Apart from world class gymming experience backed by professional trainers, its value-added services include Nu Form (time-efficient weight loss programme), Reduce (diet-based, easy diet programme), Transform (holistic fitness programme), Zumba® (aerobics and Latin dance-inspired fitness programme), Zorba (yoga), spa, massage and aerobics.

The company has executed various franchisee agreements with various entities for gymnasiums located at different parts of the country. The Talwalkars’ health centres are spread across 198 fitness centres across 85 cities in India and over 1,80,000 members, making it the market leaders in the organised gym market. It has total of 18 Gym franchises in India.

The company is one of the largest organised fitness companies in South Asia. The company is the only listed proxy of India’s fitness sector. The company democratised the organised gym sector across 72 non-metro and non-Tier 1 cities.

The company operates on various business model subsidiaries, franchisee, and associates. In subsidiary, the capex is limited to ownership i.e. 51% and TBVFL has the right to buy out its subsidiaries at 3.5x EV/EBITDA. The HiFi pays an upfront royalty of Rs. 2mn and an ongoing royalty of 6-8%. In Franchisee model: upfront fee plus share in profits. In associates, PWGL Capex is limited to ownership i.e. 49.50% and share of associates. For use of Trademarks Licensed: Sharing of related advertising expenses.

STRATEGIC PARTNERSHIPS OF TALWALKARS FOR EXPANSION

| Format | No. of Fitness Centres |

| TALWALKARS | |

| Owned | 103 |

| Subsidiary | 9 |

| franchised | 18 |

| Subtotal | 130 |

| HIFI | |

| HIFI | 25 |

| Subtotal | 25 |

| PWG | |

| India-owned | 20 |

| Sri Lanka-Co-ownership | 20 |

| Subtotal | 40 |

| ZORBA | |

| Zorba Studios | 3 |

| Subtotal | 3 |

| TOTAL | 198 |

POWER WORLD GYM

Talwalkars bought 49.5% stake in Sri Lanka’s Power World Gyms worth Rs. 48.68 Mn. The net worth of the company was Rs. 50.82 Mn. PWG was launched in 1994 by TalavouAlailima, a former South Asian Games medalist and Sri Lankan record holder in the shot put and discus throw. PWG operates seven gyms in and around Colombo under the brand ‘Power World’ and manages three in-house gyms for Sri Lankan companies. It claims to have about 8,100 members. Power World Gyms (3750 to 4000 sq. ft.), which are generally located in pockets of metros and mini-metros targeting a sporadic audience.

GYM TREKKER

Talwalkars picked up 19% stake in GymTrekker for an undisclosed amount. The investment into GFPL enabled TBVF to tap the fast-growing online sales channel and further strengthen its existing online presence, the partnership combined TBVF’s strong brand power as a health and fitness player and Gym Trekker’s emerging online presence for gym and fitness centre discovery platform.

GFPL currently has over 3500 fitness listing, 200 multi-tenure deals and 1000 online members in the GymTrekker Portal. GFPL also sells nutrition and fitness equipment online through its GymTrekker Store.

INSHAPE HEALTH AND FITNESS PRIVATE LIMITED

Talwalkars acquired 51% stake in Chennai-based Inshape Health and Fitness Private Limited (IHPL) worth Rs 5.58 Mn. Inshape was launched in 2003 as Jigs n Jogs by A N Rajendran. It operated three gyms in Chennai and claimed to have about 2,000 members. This investment has enabled Talwalkars to further strengthen their presence in a fitness conscious Chennai Market.

ZORBA_the Yoga

Talwalkars bought 51% stake in Chennai’s Zorba yoga studio chain. This is the second such deal in the southern city and the fourth strategic deal in as many months. Talwalkars said the investment into Zorba will strengthen its wellness and fitness offerings in the Chennai market and enable the company to expand its yoga training activities across multiple locations in India. Zorba, launched in 2013 by Sarvesh Shashi, offers six courses and eight alternative therapies in yoga, Zumba, posture correction, and healing. The company runs three centres in Chennai that offers healing ailments for diseases such as asthma and diabetes.

DAVID LLOYD LEISURE

POST DEMERGER

| GYM BUSINESS | LIFESTYLE BUSINESS |

|

|

Please Note: Above Offered services are within the fitness centres premises and studios

FINANCIALS

| BALANCE SHEET AS ON 31.3.2016 | Lifestyle Business(Rs. in Mn) | Gym Business(Rs. in Mn) |

| Shareholders’ Funds | 1544 | 2588 |

| Long Term Liabilities | 1457 | 2069 |

| Current Liabilities and Provisions | 0 | 374 |

| Total | 3001 | 5031 |

| Fixed Assets | 1962 | 2979 |

| Cash Including Investments | 450 | 750 |

| Other Current Assets | 335 | 318 |

| Non-Current Assets | 253 | 983 |

| Total | 3001 | 5031 |

| PROFIT AND LOSS FOR FY16 | Lifestyle Business | Gym Business |

| Total Revenue | 506 | 2043 |

| Operating Cost | 158 | 974 |

| EBIDTA | 348 | 1069 |

| Profit After Tax | 151 | 384 |

| Ratios | TBVFL | Lifestyle Business | Gym Business |

| Debt Equity | 0.78 | 0.94 | 0.69 |

| ROCE | 12.22% | 7.39% | 15.10% |

| ROE | 12.92% | 9.81% | 14.84% |

| Particulars | Lifestyle Business (Post Demerger) | GYM Business (Post Demerger) | Talwalkar Pre-demerger |

| Book Value | |||

| Net worth bifurcation as on 31st March 2016 (Rs. In Mn) | 1,544 | 2,588 | 4,132 |

| No. of Shares (Mn) | 30 | 30 | 30 |

| Book Value per Share | 52 | 87 | 139 |

| Estimated Market Price Post Demerger | |||

| PAT (Rs. In Mn) | 151 | 384 | N.A. |

| Market Cap. (Rs. In Mn) | 2,265 | 5,760 | |

| Estimated Market Price | 76.00 | 194.00 | |

Please Note: All the above working are of Segregated LIFESTYLE AND GYM BUSINESS as on 31st March, 2016

ANALYSIS

- The company has continually raised funds by way of issuing shares to Qualified Institutional Placements approx INR 42.37 crore per share price INR 205 in the year 2013 and INR. 107.49 crores per share price INR 305 in the year 2016 for expansion of business both organic and inorganic.

- The company has been also issuing debentures and redemption of the same on year to year basis. The approx INR 100 crore are outstanding as on 31st March 2016 and which has been used mainly for expansion of business both organic and inorganic.

- Therefore, the company is continuously maintaining debt Equity at the same level by using combination of both source of funding Equity and debt.

- But there is decrease in promoter’s stake due to additional allotment to Qualified Institutional Investors and sale by them in the open market from 59.49 stake in the year 2012 to 37.95 %stake in the year 2016.

- Since its inception, Talwalkar has acquired many small-time companies dealing in fitness and health clubs, located in various parts of the countries. By doing this they entered in various geographic locations of India, thereby expanding its customer base and making itself popular in the fitness industry. The main intention was to acquire as many gyms as possible and provide Talwalkar’s quality gym services, this helped them create a strong brand value among people.

- Later, Talwalkar went on to provide popular lifestyle services such as Zumba and Zorba by acquiring stakes in the Chennai-based fitness companies plus the company shook hands with Sri-Lanka based PWG which made Talwalkar expand its base down south.

- There is a significant increase in EBITDA percentage due increase in sales because of partnerships taken up with many entities for introduction of many health solution services as mentioned above.

- In April, the company announced to open 33 Zorba renaissance studios in 25 cities in the span of 60 days. Currently, the yoga and wellness industry in India is measured at INR 490 bn and is speculated to rise by 20% in next five years. Aiming to capture this growth and further spread the yoga wellness the premium Zorba chain will witness an expansion of 100 to 120 studios in India as well as in overseas market like Dubai, London, New York, and more through alliance

- The company announced inauguration of 10 gyms in Sri Lanka as part of their overseas expansion plans in association with PWG. Further over the next three years, the company plans to inaugurate about 100 gyms across the length and breadth of Sri Lanka.

CONCLUSION

The company has entered lifestyle wellness business which has huge margin mainly by acquisition. Whereas for GYM business the company has used strategy for expansion by way of organic and inorganic growth. For the expansion of the business, the management has not overleveraged the balance sheet of the company as it maintained debt equity ratio by balancing equity and debt finance. Now the GYM Business which is ready for another level of growth, the management wants to separate from the lifestyle business. So, the Demerger will segregate main core Gym business from Lifestyle Wellness business which is at nascent stage. After demerger Talwalkar, will be able to focus on its core gym business and install two times the number of gyms it has currently, while on the other front the company will strengthen its revenue from non-gym business with focus on club business with joint partner David Lloyd Leisure. The Qualified institutional investors supporting the management by investing even at higher price than market price will be hoping for good exit at later date.