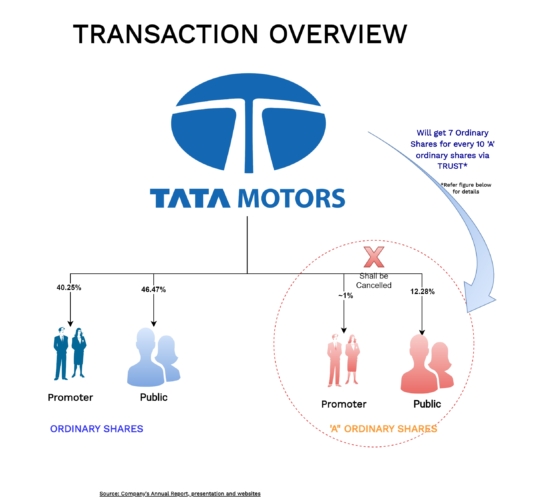

In 2008, Tata Motors Limited had issued equity shares on right basis with differential voting rights. This was one of the few issuances of differential voting rights shares by any listed company. Later regulators restricted issuances of shares with differential voting rights, resulting in a few examples of listed companies with differential voting rights. As on date, Tata Motors Limited is the only large listed company having equity shares with differential voting rights. However, the board of directors of the company has decided to extinguish the differential voting rights shares in exchange for its ordinary equity shares.

Tata Motors Limited (TML), a vehicle manufacturing arm of Tata Group is directly and indirectly (through subsidiaries and joint ventures is engaged in the business of design, development, manufacturing, and sale of wide range of commercial, passenger and electric vehicles. The ordinary equity shares, “A” ordinary shares (differential voting rights shares) and non-convertible debentures are listed on nationwide bourses.

The Transaction

The Board of Directors of Tata Motors has passed a resolution which inter-alia provides for cancelling and extinguishing the “A” ordinary shares by issuance of ordinary shares to the holders of “A” ordinary shares. As this is an arrangement with shareholders of the “A” ordinary shares the company, the proposed extinguishment will be executed through a Scheme of Arrangement (“Scheme”) under section 230-232 of the Companies Act, 2013 and other applicable provisions.

Salient features of “A” ordinary shares”:

- Carry 1/10th the voting rights of ordinary shares in case of vote by poll or postal ballot (equal votes in case of vote by show of hand) and

- Are entitled to dividends at 5% percentage more than the aggregate rate of dividend declared on the ordinary shares in any financial year.

Since listing of “A” ordinary shares, Tata Motors has paid dividends to its ordinary as well as “A” ordinary shareholders several times and as per the terms, “A” ordinary shareholders received an incremental dividend rate.

Rationale as envisaged under the Scheme:

- The discount of valuation of “A” ordinary shares to its ordinary shares has been increased since listing, which understates the company’s market capitalization, complex ownership structure and increases administrative cost for the company.

- Preserve liquidity of the company (discussed later in the article).

The Appointed Date for the transaction is an effective date. As no assets & liabilities are being transferred and it’s a mere exchange of shares for “A” ordinary shares, the appointed date can only be the effective date.

The Consideration:

The consideration for extinguishment of “A” ordinary shares will be paid in the form of new ordinary shares to be issued by Tata Motors hence there is no cash outflow. Consideration other than cash will have the following key benefits amongst other:

The swap ratio will be 7 fully paid-up ordinary shares of INR 2 each for every 10 fully paid-up “A” ordinary shares of INR 2 each.

Equity Share capital of TATA MOTORS as on date:

| Particulars | Pre-scheme | Post-Scheme | |

| Ordinary Equity Shares | “A” ordinary equity share | Ordinary Equity Shares | |

| No. of paid-up shares of INR 2 each | 3,32,14,90,582 | 50,85,02,896 | 3,67,74,42,609 |

| Promoters stake | 46.39% | 7.67% | 42.64% |

| Promoter’s combined voting rights | 45.81% | 42.64% | |

As promoters holding of “A” ordinary shares is only 7.67% compared to ordinary shares holding of 46.39%, on implementation of the scheme, promoters cumulative voting rights will decrease from circa 45.81% to 42.64%. The ordinary shares will be increased by circa 35.59 crore shares while total equity shares (including DVR’s) will be reduced by circa 4% which will be EPS (Earning per share) accretive.

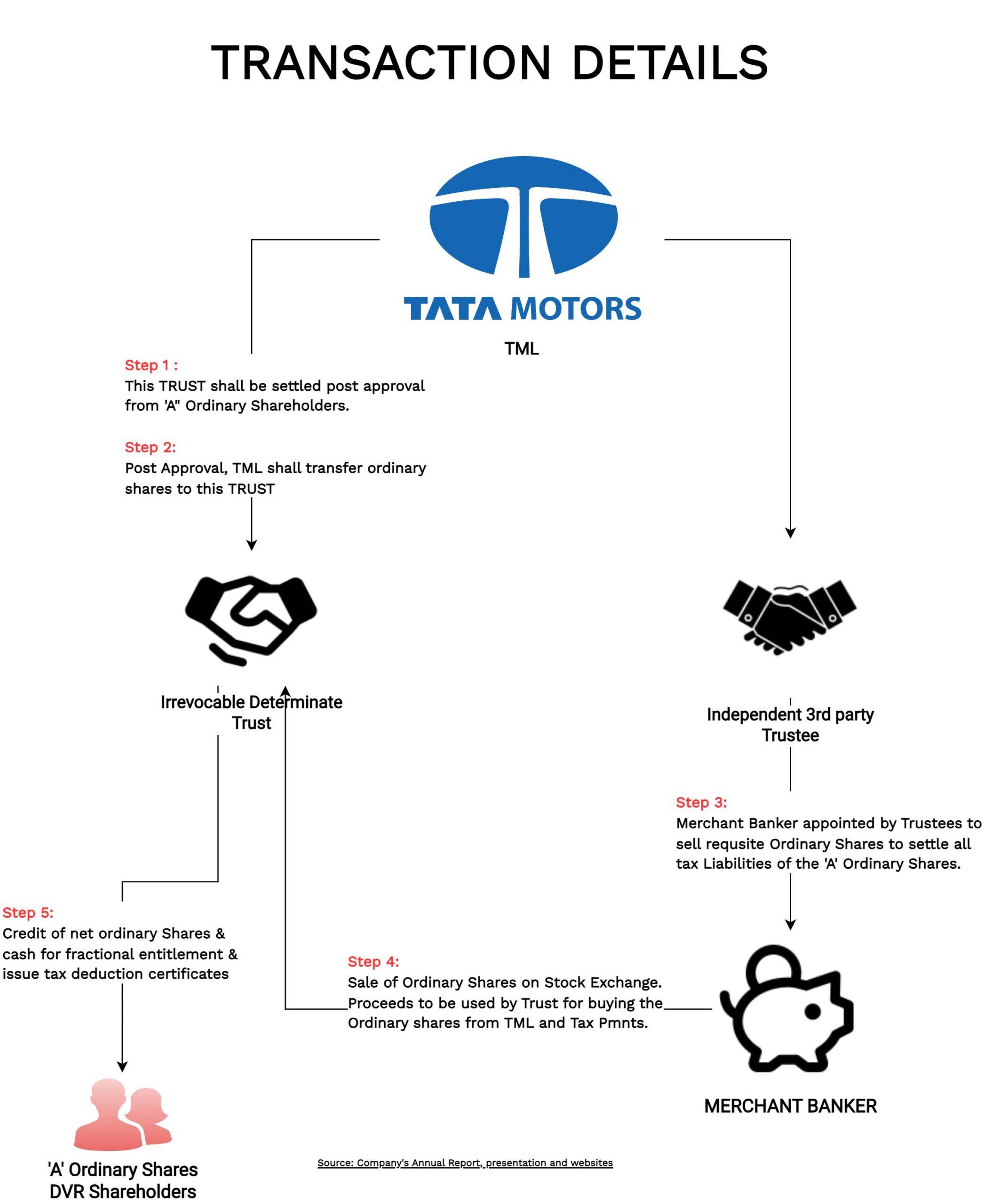

Process of implementation of the proposed scheme:

What is interesting & complicated in the entire scheme of things is discharge of consideration through a “Trust” on behalf and benefit of each of the “A” ordinary shareholders. Before the effective date, Tata Motors will settle a trust. The trust will receive the new ordinary shares issued pursuant to the scheme. Post receipt of shares, trust will sell such appropriate number of shares to pay the withholding tax & other sale transaction charges (other than transaction execution charges) on entire transaction. The trust will distribute the remaining shares proportionately to erstwhile A” ordinary shareholders. The following table explains the structure of the execution of the scheme.

Why Trust Structure in between:

The structure could be on account of many possibilities like for example:

- To achieve no cash distribution.

- To take care of Section 67 of the Companies Act, 2013 having restrictions not allowing to issue/hold its own shares.

- Avoid the hassle of recovery of withholding tax from various retail and small shareholders.

The trust also takes care of other things like fractional issuance etc. Through Trust, Tata Motor will implement the exchange seamlessly and without any cash flow.

Direct Tax aspect

As stated by the company, cancellation of “A” ordinary shares will be taxable in the hands of “A” ordinary shareholders. The tax on the said transaction will be divided into two parts:

- Deemed dividend to the extent of accumulated profits available with Tata Motors on effective date and

- Capital gains on remaining amount (if held as capital asset).

Tentative Tax calculations based on FY 2023

| Particulars | Amount in crore |

| Tentative Accumulated profits | 5009* |

| Tentative consideration for “A” ordinary shares | 21,392 |

| Deemed Dividend | 5009 |

| Amount to be considered for Capital gains** | 16383 |

*: excluding capitalized profits if any. Further, the amount will change based on the actual amount as on the Effective Date.**The consideration is equivalent to value of Tata Motors Ltd ordinary shares received, in exchange, which is Rs 601 per share on 31st August 2023. Further, the amount will change based on the actual price of Tata Motors’ ordinary shares as on the Effective Date.

To the extent of the amount of accumulated profits available with the Company, the consideration will be charged as Deemed Dividend and the consideration above that would be considered for working out capital gains in the hands of the shareholders. This was so held by the Hon’ble Supreme Court in G. Narasimhan [[1999] 236 ITR 327 (SC)], i.e., that any distribution over and above the “accumulated profits” would be chargeable to capital gains tax in the hands of the shareholders.

Under section 194 of the Income Tax Act, the company needs to withhold an amount equivalent to 10% of the total dividend. Thus, circa INR 500 crore will be required to be paid by the company (in our case trust) as withholding tax.

Likely taxability aspect in the hands of shareholders based on the assumptions and price as on 31st August 2023:

| Particulars | % |

| As deemed dividend | 23.40% |

| As capital gains | 76.60% |

Please note that this calculation will change based on actual numbers as on effective date.Thus, for resident shareholders, one will receive.

| Particulars | No. of Shares |

| No. of Ordinary Shares for every 10 “A” ordinary shares | 7 |

| Likely deemed dividend component | 23.40% |

| Net Shares likely to be received by resident minority shareholder for every 10 “A” ordinary shares (withholding taxes on deemed dividend part) | 6.83 circa |

In addition, the trust will also pay short term capital gain on any gains arising on account of appreciation of prices on shares sold for generating withhold tax.

For the holders of “A” ordinary shareholders, it will make more sense than selling “A” ordinary class of shares & buying the requisite ordinary shares as there will be significant tax savings compared to that of through scheme.

| Particulars | Through Exchange | Through Scheme |

| Assumed Consideration (price as on 30.8.2023) | 403.25 | 403.25 |

| Purchase Price (Assumed) | 200 | 200 |

| Nature of Tax | Capital Gains | Deemed Dividend + Capital Gains |

| Total tax amount | 24.5 | 61.5 |

| Net Amount receivable | 378.7 | 341.8 |

Notes:a) The benefit of section 112A may not be applicable in the case of exchange through scheme.

b) Grandfathering benefit has been ignored in case of sale through exchange, there may be a possibility of additional tax saving on account of that.

c) In the case of exchange of shares through scheme, the consideration value will likely to be fair value as on effective date.The capital gain will be worked out based on the above after considering the purchase price and date of purchase of “A” ordinary shares by each of the shareholders. Additional Questions which need to be understand:

- Will “A” ordinary shareholders get benefit of Section 112A/ 111A of the Income Tax Act, 1961?

- Entitlement of grandfathering provisions for “A” ordinary shareholders?

Accounting Treatment:

As envisaged under the scheme, Tata Motors will account for the reduction of the ‘A’ Ordinary Share capital in its books of accounts in accordance with the requirement of the Accounting Standards by debiting the ‘A’ Ordinary Share capital account by the face value of the ‘A’ Ordinary Shares, debiting the securities premium account for the difference between face value and fair value of the “A” Ordinary shares and crediting share adjustment account.

Tata Motors will account for the issuance and allotment of the New Ordinary Shares in its books of accounts in accordance with the requirement of the Accounting Standards by crediting the Ordinary Share capital account by the face value of the New Ordinary Shares, crediting the securities premium account for the difference between face value and fair value of the New Ordinary shares and debiting share adjustment account. Thus, the equity share capital will be reduced to the extent of paid-up value of lessor equity shares issued in lieu of existing “A” ordinary shares and equivalent amount will be credited to securities premium account which shall usher in no change in net worth of the company (except for transaction charges paid by the company).

| Particulars | Number |

| Existing number of “A” ordinary Shares | 50,85,02,896 |

| New Ordinary shares to be issued for cancellation of “A” ordinary shares | 35,59,52,027 |

| Difference | 15,25,50,869 |

Valuation

The relative valuation as worked out by the appointed registered valuer & supported by the appointed merchant bankers for exchange of “A” ordinary shares with Ordinary shares is as follows:

| Particulars | Ordinary Shares | “A” ordinary Shares |

| Vale arrived per share | 632.8 | 445.8 |

The valuation arrived for “A” ordinary shares were at circa 70.45% of the fair valuation arrived for the ordinary shares translating to a discount of 29.55%.

Average discounting of “A” ordinary shares to ordinary shares:

| Particulars | Discount to ordinary shares |

| On issuance | 10% |

| On the day of the announcement | 43.1% |

| For last 3 years | 52.2% |

| For last 5 years | 52.2% |

| For last 10 years | 45.1% |

The appointed valuer has used the weighted average price discovered using two methods, the discounted cash flow method, and the market price method to arrive at a fair exchange ratio. Interestingly, when the right shares were issued, they were issued at a discount of only 10% while the underlying discount given now is circa 30%. It is also pertinent to note that the valuer has assigned a premium compared to the discount prevailing on the announcement date.

Conclusion

The proposed scheme of cancellation of “A” ordinary shares in exchange of ordinary shares is one of the one-of-a-kind schemes proposed by Tata Motors. Currently, Tata Motors is the only large, listed company having listed differential voting rights equity shares and with the proposed reduction scheme, this will be the end of an era of the listed differential voting rights shares. A shareholder of “A” ordinary shares must understand the nitty-gritties under direct taxation if one wants to continue to hold till Effective Date.

As the company is Tata Group company, “A” ordinary public shareholders shall decide whether swap ratio giving 30% discount is fair to them as a DVR holder hardly got additional dividends over a period since issue.