Tata Steel Limited, one of India’s largest steel manufacturing companies announced mega internal restructuring of its subsidiaries which will inter-alia usher in consolidation.

Over a period, Tata Steel Limited expanded its operations through greenfield & brownfield acquisitions. Like any other large steel companies, it also grabbed the opportunity of acquiring distressed company under BIFR (Board for Industrial and Financial Reconstruction) & IBC (Insolvency & Bankruptcy Code, 2016). In one of the very first acquisitions under IBC, Tata Steel Limited acquired Bhushan Steel Limited which was later merged with Tata Steel Limited.

These various acquisitions paved the way for Tata Steel Limited to expand its business into value-added products and providing integration to its core business. Finally, in a move to simplify its corporate structure and reduce the number of listed entities, Tats Steel Limited announced a Scheme of Amalgamation which will merge subsidiaries/associates into Tata Steel Limited.

Tata Steel Limited (“TSL” or “Transferee Company”) is primarily engaged in the business of manufacturing steel and offers a broad range of steel products including a portfolio of high value-added downstream products such as hot rolled, cold rolled and coated steel, rebars, wire rods, tubes, and wires. The equity shares of the company are listed on nationwide bourses. The registered office of TSL is located in the state of Maharashtra.

Tata Steel Long Products Limited (“TSLPL” or “Transferor Company-TSLPL”) is primarily engaged in the business of production and marketing of sponge iron, which is a single-end-use (steel making) and a single grade product. It has also one of the largest speciality steel plants in India in the SBQ (special bar quality) segment.TSLPL is the subsidiary of TSL holding 74.91% paid-up equity capital of TSLPL. The equity shares of TSL are listed on nationwide bourses. The registered office of TSLPL is located in the state of Odisha.

The Tinplate Company of India Limited (“TCIL” or “Transferor Company-TCIL”) is primarily engaged in the manufacturing of tinplate, tin-free steel and other related products having its plant located in Jamshedpur, Jharkhand. TCIL is the subsidiary of TSL holding 74.96% paid-up equity capital of TCIL. The equity shares of TCIL are listed on nationwide bourses. The registered office of TCIL is located in the state of West Bengal.

Tata Metalics Limited (“TML” or “Transferor Company-TML”) is primarily engaged in the business of manufacture and sale of pig iron and ductile iron pipes and allied accessories. It has its manufacturing unit at Kharagpur, West BengalTML is the subsidiary of TSL holding 60.01% paid-up equity capital of TML. The equity shares of TML are listed on nationwide bourses. The registered office of TML is located in the state of West Bengal.

TRF Limited (“TRF” or “Transferor Company-TRF”) is primarily engaged in the business of undertaking turnkey projects of material handling for the infrastructure sector and also in production of such material handling equipment. TRF is an associate of TSL holding 34.01% paid-up equity capital of TRF. The equity shares of TRF are listed on nationwide bourses. The registered office of TRF is located in the state of Jharkhand.

The Indian Steel & Wire Products Limited (“ISWPL” or “Transferor Company-ISWPL”) is primarily engaged in the business of manufacture of wire rods, TMT rebars, wires and wire products as an external processing agent of the Transferee Company and manufacturing and direct marketing of welding products, nails, rolls and castings.

ISWPL is the subsidiary of TSL holding 95.01% of the paid-up equity capital of ISWPL. The registered office of ISWPL is located in the state of West Bengal.

Tata Steel Mining Limited (“TSML” or “Transferor Company-TSML”) has its presence in the manufacture of ferrochrome and has its primary facility situated at Anantapur, Athagarh, District Cuttack. Further, through its successful acquisition of Rohit Ferro Tech Limited under the Insolvency and Bankruptcy Code, 2016, it has its manufacturing facility in Jajpur, Odisha and Bishnupur, West Bengal. Along with manufacturing Ferro Chrome, TSML has also pursued the commercial mining of Chrome ore and iron ore and have executed mining leases for three Chromite blocks.

TSMPL is a wholly owned subsidiary of TSL. The registered office of TSMPL is in the state of Odisha.

S & T Mining Company Limited (“STMCL” or “Transferor Company-STMCL”) was engaged, inter alia, in the business of acquiring coal blocks, carrying out exploration, development of mine, extraction and mining of coal from the identified blocks. However, S & T Mining has been non-operational since FY 2018-19.

STMCL is a wholly-owned subsidiary of TSL. The registered office of STMCL is in the state of West Bengal.

The Transaction

[rml_read_more]

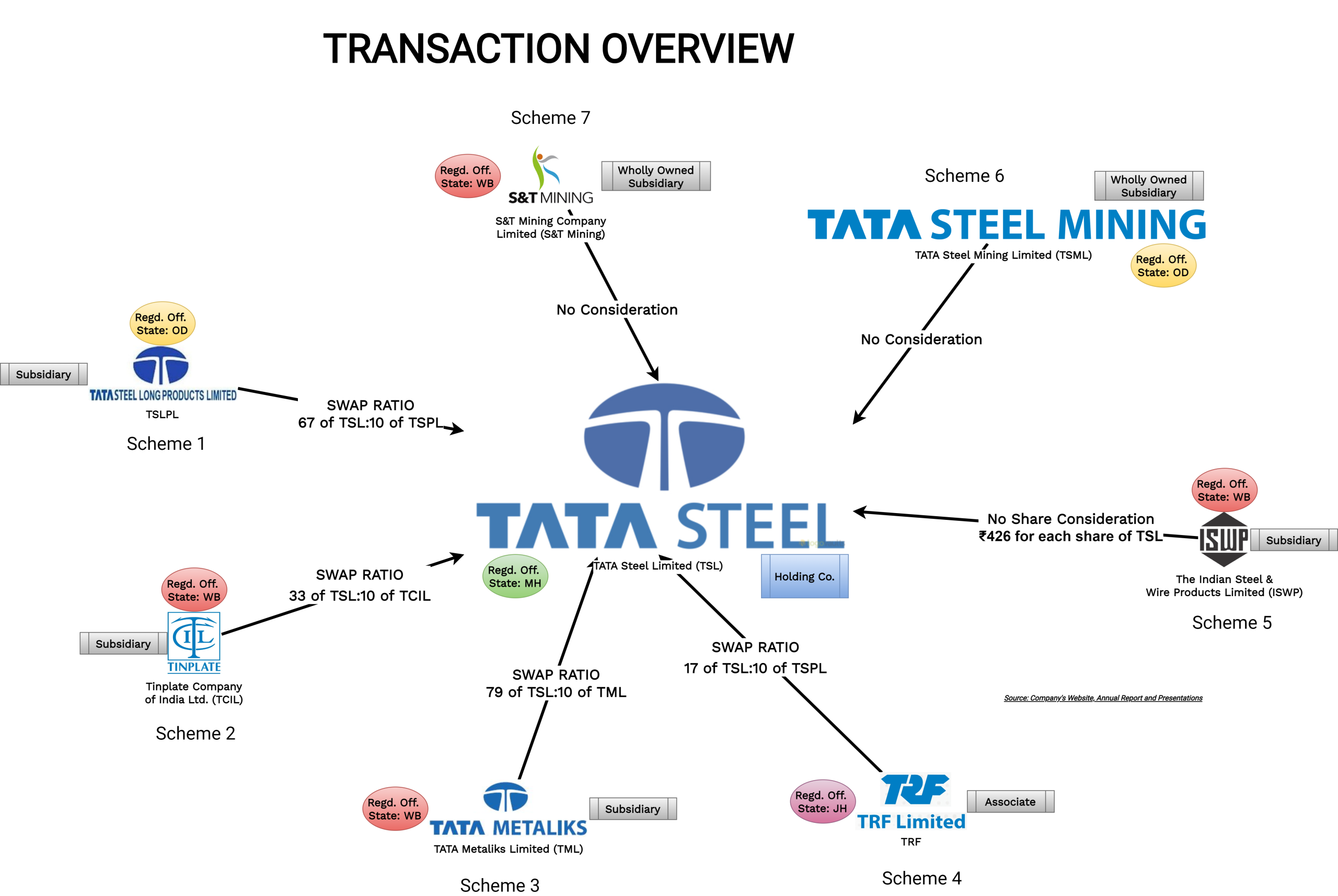

Under the “One-Tata Steel,” the board of directors of TSL along with its subsidiaries/associates approved seven different Schemes of Amalgamation (“Scheme”) which inter-alia provides for the amalgamation of respective subsidiary/associate with TSL.

Rationale as envisaged under the Scheme:

- Operational integration and better facility utilization

- Improving Customer Satisfaction, Services, and Achieving Greater Market Presence

- Centralized procurement and inventory management

- Efficiency in working capital and cash flow management

- Improving raw material security

- Faster execution of projects in pipeline

- Rationalization of Logistics Costs

- Simplified structure and management efficiency

- Sharing of best practices in Sustainability, Safety, Health and Environment

Each of these transactions shall be executed through a different scheme. Thus, effectively TSL shall file seven different Schemes in NCLT. The reason for not executing entire transaction through a composite scheme could be:

- Each of the transaction is separate and eliminate dependency/impact of delay in one transaction on other

- Registered office of some of the subsidiaries are in different states

- Optimising Stamp Duty

The Appointed Date for all the transactions is 1st April 2022 except for the TSML amalgamation which has appointed date as 1st April 2023.

Swap Ratio

| TSLPL | 67 equity shares of TSL of Re 1/- each fully paid up for every 10 equity shares of TSLPL of Rs. 10/- each fully paid up. |

| TCIL | 33 equity shares of TSL of Rs. 1/- each fully paid-up for every 10 equity shares of TCIL of Rs. 10/- each fully paid-up. |

| TML | 79 equity shares of TSL of Re. 1/- each fully paid up for every 10 equity shares of TML of Rs. 10/- each fully paid up. |

| TRF | 17 equity shares of TSL of Rs. 1/- each fully paid up for every 10 equity shares of TRF of Rs. 10/- each fully paid up. |

| ISWPL | No shares shall be issued to the shareholders of ISWPL. Consideration shall be discharged in cash payment of INR 426 per equity share by TSL. |

| TSML & STMCL | No shares will be issued as Transferor Companies are wholly owned subsidiaries. |

Change in paid-up capital of TSL

| Particulars | Pre | Post | |||

| No. of Shares | % | No. of Shares | % | ||

| Promoters | 414,35,86570 | 33.9% | 414,35,86,570 | 33.1% | |

| Public | 807,17,13,890 | 66.1% | 834,60,32,034 | 66.9% | |

| Total | 1221,53,00,460 | 100% | 1248,96,18,604 | 100% | |

As the size/valuation of the subsidiaries/associates getting merged with TSL is not material compared to the size/valuation of the TSL and significant stake is already held by TSL, there will not be any major impact on the shareholding pattern of the TSL (Post-Restructuring).

Financials of the Companies Involved

For the year ended on 31st March 2022

INR in Crore

All the subsidiaries/associates involved in the proposed transaction are too small compared to TSL. Though profitability margins of TSL are better than subsidiaries/associate, due to size, this will not have much impact on the merged TSL and existing EPS.

Inter-se Transaction for FY 2022

Being in similar/complementary businesses, Transferor Companies do undertake regular related party transactions with TSL & other fellow subsidiaries/transferor companies. Thus, consolidation will diminish GST, Transfer Pricing regulations, compliances on inter-se transactions.

Accounting Treatment

Except for TRF amalgamation, TSL will account the amalgamation in its books in accordance with “pooling of interest method” as laid down in the Appendix C of IndAs 103-Business Combination and other accounting principles as applicable. TRF being associate of TSL, the amalgamation will be accounted in the books of TSL in accordance with the “acquisition method” laid down in IndAs 103-Business Combination and other accounting principles as applicable.

Income Tax

All the transactions shall not have any tax implications on the Companies or shareholders except amalgamation of ISWPL with TSL. Section 47(vi) & 47(via) of the Income Tax Act, 1961 (ITA) provides that any amalgamation shall be tax exempted if it is in compliance with the provisions of section 2(1B) of ITA [Definition of Amalgamation]. One of the requirements under section 2(1B) of ITA is that shareholders holding not less than three-fourth in value of the shares in the transferor company (other than shares already held by transferee company) shall become shareholders of the transferee company by virtue of the amalgamation.

In the present case, shareholders of ISWPL shall receive consideration in cash and not shares of the transferee company. Further, the scheme pertaining to the amalgamation of ISWPL with TSL does not provide any reference to the amalgamation being compliant as per provisions of section 2(1B) of ITA.

Conclusion

Over a period, TSL has created value for its stakeholders through multiple acquisitions. The proposed move seems to be pursuant to the vision of “One Tata Steel”. Going ahead, this will not only streamline the corporate structure, but TSL may realise some synergies and reduction in cost.

Though the entire restructuring is to simplify structure, some of the aspects make it an interesting transaction. . One may need to evaluate the reasons for instead of having a single composite scheme, TSL executing the transaction through separate scheme for each of the transactions, and whether merger of ISWPL will have any tax implication on the company?