Tata Steel has acquired Bhushan Steel (BSL) through its wholly-owned subsidiary Bamnipal Steel Ltd (BNL) through a resolution under the Insolvency and Bankruptcy Code (IBC). Tata Steel has taken a controlling stake of 72.65% in BSL and paid the admitted corporate insolvency costs and employee dues, as required under IBC. Bhushan steel was one of the few resolved amongst 12 companies recommended by RBI under Insolvency and Bankruptcy Code.

Tata Steel Ltd (TSL) is part of Tata Group and a public limited company engaged in the business of manufacturing steel and offers a broad range of steel products including a portfolio of high value-added downstream products such as hot rolled, cold rolled and coated steel, rebars, wire rods, tubes and wires. The equity shares are listed on BSE and on NSE. The market cap of the company is Rs 57,123 crores (approx.).

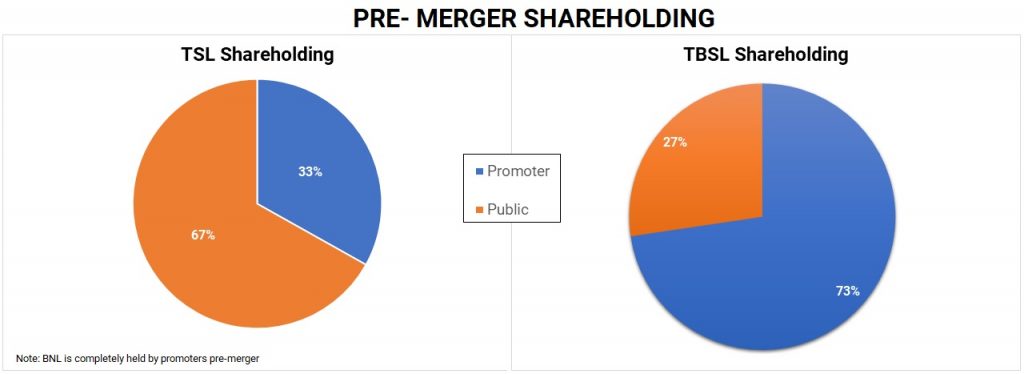

Bamnipal Steel Limited (BNL) is a public limited company incorporated on January 19, 2018 formed as an SPV (Special Purpose Vehicle), wholly owned subsidiary of TSL, in order to facilitate the acquisition of Tata Steel BSL Limited (TBSL) by way of the corporate insolvency resolution process (“CIRP”) prescribed under the Insolvency and Bankruptcy Code, 2016 (IBC Code). Pursuant to the order of the Adjudicating Authority dated May 15, 2018 (“IBC Order”), the TSL through the BNL acquired 72.65%of the equity share capital of the TBSL. At present, BNL does not have any operations.

Tata Steel BSL Limited (TBSL) formerly known as Bhushan Steel Limited is India’s third largest secondary steel producing company with an existing steel capacity of 5.6 million tonne per annum is engaged in the business of manufacturing steel and offers products such as hot rolled, cold rolled and coated steel, cold rolled full hard, galvanized coils and sheets, high tensile steel strips, colour coated tiles, precision tubes, large diameter pipes, etc. TBSL is subsidiary of BNL and equity shares of the company are listed on BSE and on NSE.

CIRP process of erstwhile Bhushan Steel Ltd

- CIRP process was initiated on July 26, 2017, under the provisions of the IBC Code. Pursuant to the initiation of the CIRP, TSL submitted its resolution plan for the resolution of Bhushan Steel and was selected as the highest compliant resolution applicant by the committee of creditors constituted under the IBC Code. On 15th May 2018, NCLT approved TSL’s resolution plan.

- Pursuant to the Resolution Plan, BNL subscribed to 72.65% of the equity share capital of TBSL for an aggregate amount of Rs 158.89 crore and provided additional funds aggregating to Rs 35,073.69 crore to TBSL by way of debt/convertible debt. The remaining 27.35% of TBSL’s share capital will be held by TBSL’s existing shareholders and the financial creditors who received shares in exchange for the debt owed to them.

- The acquisition is financed by combination of external bridge loan of Rs 16,500 crore availed by BNL and balance through investment by Tata Steel in BNL. The bridge loan availed by BNL is expected to be replaced by debt raised at BSL over time.

- The funds received by TBSL as debt and equity have been used to settle the sustainable debts owed to the existing financial creditors of TBSL, CIRP costs and employee dues, by payment of Rs 35,232.58 crore.

- The remaining unsustainable debts of Rs 25,285.46 crore were novated by the financial creditors to BNPL for a consideration of Rs.100 crores. BNPL, in its capacity as the promoters of TBSL, has waived off the unsustainable debts less cost of novation and the same has been recognised as equity contribution during the year ended March 31, 2019.

- 10% Redeemable Cumulative Preference shares of Rs 100 each amounting to Rs. 2,425.57 crore were redeemed for a total sum of Rs. 4,700. Gain arising out of redemption was recorded as exceptional item in the financial results for the year ended March 31, 2019.

- Operational creditors are to be paid Rs. 1,200 crores will be paid over a period of 12 months.

- Total capacity of TSBL is 5.6 Million tonne per annum

Transaction:

Amalgamation of BNL into TSL

BNL is a wholly-owned subsidiary of TSL, no consideration shall be payable pursuant to the amalgamation, and the equity shares held by the TSL on its own and together with its nominees in the BNL, shall stand cancelled without any further act, application or deed. Accordingly, the investment in the shares of the BNL, appearing in the books of accounts of the Transferee Company shall, without any further act or deed, stand cancelled.

Amalgamation of TBSL into TSL

- The consideration to be paid is by issue of 1 fully paid up equity share of Rs 10 each of TSL for every 15 equity shares of Rs 2 each to the equity shareholders of TBSL (other than BNL)

- Appointed date being 1st April 2019.

- Upon the Scheme becoming effective, the Transferor Companies (BNL and TBSL) shall stand dissolved without being wound up without any further act or deed.

- Merger will be tax natural as per the provisions of section 2(1 B) of Income Tax Act, 1961.

Rationale of the scheme

Amalgamation of BNL into TSL

- BNL was incorporated for the purpose of completing the acquisition of TBSL by way of the CIRP process prescribed under the IBC Code.

- BNL holds the equity investment in TBSL and is its holding company. Pursuant to the completion of the proposed amalgamation of the TBSL into the TSL, there is no need for BNL to exist as a separate legal entity. This amalgamation would also result in simplification of the group structure of the Transferee Company.

Amalgamation of TBSL into TSL

- Both companies are engaged in the business of manufacture and sale of steel and steel products and such restructuring will lead to simplification of group structure by eliminating multiple companies in similar business.

- Scheme would enable both the companies to realize benefits of greater synergies between their businesses, yield beneficial results and pool financial resources as well as managerial, technical, distribution and marketing resources of each other.

- Synergy of operations will be achieved as a result of sustained availability of raw materials as well as reduced procurement costs for TBSL. The proposed amalgamation would ensure iron ore security for TBSL from the captive mines of the TSL.

Accounting treatment

The Transferee Company shall account for the amalgamation of the Transferor Companies in its books of accounts in accordance with “Pooling of Interest Method” of accounting as laid down in Ind AS 103 (Business Combinations)

Shareholding Pattern

Valuation

TBSL is valued at approx. ₹3,929 crore based on weighted average of market price and discounted cash flow method and value attributable to public shareholder is approx. ₹1074 crores based on their holding in the company.

Financials

TSL has an operating revenue of ₹73,016 crore which is 3.5 times more than the TBSL and further PAT stood at ₹10,533 crore which is almost 10 times that of TBSL. Interest cost is very less in TSL as compare to TBSL which cleaned its balance sheet through IBC route. BNL does not have any operational income, hence not considered for the comparison.

Post-merger, interest cost will increase to 7% (in percentage of operating revenue) from its current level 3.87% of TSL, and there is only a slight decrease in PAT % from current level mainly because TBSL has past business losses which help to set of tax liabilities, this also leads to increase in combined EPS from current level of Rs. 87.48 / share to Rs. 100.05/share.

Table 1: Standalone Financials FY-18-19 (All figs in ₹Crores)

| Particular | TSL | TBSL | Synergy TSL + TBSL |

| Operating Revenue | 73,016.00 | 20,891.61 | 93,907.61 |

| EBITDA | 22,968.02 | 3,931.01 | 26,899.03 |

| EBIT | 19,165.06 | 2,489.27 | 21,654.33 |

| Interest | 2,823.58 | 3,752.18 | 6,575.76 |

| PAT | 10,533.19 | 1,713.09 | 12,246.28 |

| No of Shares (in Crs) | 120.41 | 109.34 | 122.41 |

| EPS | 87.48 | 15.67 | 100.05 |

Past acquisition of steel companies through IBC

From the table, it appears that Tata has paid more for acquisition of Bhushan steels in terms of value per million tonne per annum as compared to bids of Vedanta and Arcelor Mittal bid for other companies which were also in CIRP process.

Table 2: Comparison of Similar Acquisitions

| Sr. No. | Company | *Amount Paid(₹ Crores) | Plant Cap (MTA) | Value / MTA (₹ Crores) |

| 1. | Vedanta’s acquisition of Electro-steel steels | 5,320 | 1.5 | 3,546 |

| 2. | Arcelor Mittal acquisition of Essar Steel | 42,000 | 10 | 4,200 |

| 3. | Tata Steel acquisition of Bhushan Steel | 35,300 | 5.6 | 6,303 |

*payment to financial creditors

Conclusion

Tata Steel acquired Bhushan steel last year through IBC route and later renamed it to TBSL. The merger is anticipated step from the date of acquisition to realise substantial synergy and encash tax break at the earliest. Lead period between the acquisition and the merger is just to make sure that there no legal hassles which may arise to parent company. In fact, this is the leveraged buyout and financed largely through tax breaks and raising debt on The Target Company assets and minimal (around ₹300 crores) through equity contribution and internal accruals.

This acquisition added capacity of 5.6 MTPA to the current TSL steel production capacity which will enable the company to reach its target of 33 MTPA by 2025. Consolidation will also give TSL access to high-quality assets of TBSL such as widest cold rolling mill in India and complementary product portfolio with value-added products and presence in western India. Merger will help in better management and effective utilisation of resources, reorganising TBSL sales and marketing with distribution channel of TSL.

This merger is consolidation of same line business and value addition to stakeholders from this merger is to be seen in near future.

Add comment