Tide Water was founded almost 90 years ago by an eponymous US company in partnership with Andrew Yule. The US parent went through several takeovers until it ceased to exist by that name in the 1950’s.

Hostile takeover or any major change in the management through open offer by the acquirer considering divestment programme by Government and whether to exit at this price or higher price.

In 2009, the Union government decided to sell Andrew Yule’s holding in the lubricant maker along with two other business. As a part of government’s divestment program, two businesses are as follows:

- Phoenix Yule Limited – A 24% a joint venture between Phoenix & Yule engaged in conveyor belt manufacturing

- Dishergarh Power Supply Company Limited (DSPC)– 7.4% stake, a provider of power generation, transmission & control in Kolkata of Andrew Yule were sold at that time and when the valuation was likely depressed, but the sale of Tide Water was aborted.

However, in anticipation of the stake sale in Tide Water, two entities started to invest in the company’s shares. One of them was Standard Greases, which bought a substantial part of the shares sold by the existing Chevron Corp held in the name of four-star oil and gas co. Four Star’s stake in Tide Water was a legacy asset that came into its (Chevron’s) hands through a series of mergers and acquisition

The other one was Kolkata-based businessman Mahendra Kumar Jalan, who had even struck a deal with a foreign partner to jointly bid in the Tide Water stake sale after cornering at least 14% of its shares. Jalan eventually cashed out in 2011-12, selling most of his shares to Standard Greases because his partner lost interest in Tide Water.

In FY12 Tide Water acquired 100% shares of Veedol International Limited from Castrol Limited and Lubricants UK Limited, wholly owned subsidiaries of BP Plc. Through this acquisition, Tide Water got the global rights to a wide portfolio of registered trademarks for the master brand VEEDOL as well as its associated product sub-brands and iconic logos for INR 51 crore.

The acquisition of Veedol International Limited opened up opportunities for export and sale of lubricants under the “VEEDOL” brand to various countries. To leverage the salience of the Veedol brand in international markets, it has initiated a host of steps to market its products in the Middle East, Asia, and Europe. The three subsidiaries —. Veedol International Limited, Veedol International DMCC, and Veedol International BV —— generate revenue of around INR 90 crore.

STANDARD GREAVES

Founded in 1983, the Mumbai-based company is a leading manufacturer of lubricants in India. However, it doesn’t have a brand of its own. Now after the Tide Water acquisition of Veedol trademark with global use it fit to acquire.

TRANSACTION

Mumbai-based Standard Greases, which on September 22, 2015, announced a voluntary open offer for 26% of the company, has over the past eight years built a substantial stake of 23.24% in the company. Standard Greases offered to pay INR 16,632 per share, valuing the 26% stake at INR 376.73 crore. Standard Greases is launching the offer together with Janus Consolidated Finance, Alpha TC Holdings Pte, and Tata Capital Growth Fund as persons acting in concert.

ANALYSIS

Several companies have tried to seize control of this Kolkata-based maker of Veedol lubricants as it is run by a small state-owned enterprise with a minority stake of 28.68% and hardly any financial muscle.

The latest announcement by Standard Greases, which is tracking the company since last -8 years, has raised the following questions:

- Whether there is the possibility of a hostile takeover or any major change in the management due to this open offer?

- Whether Ministry of Heavy Industries/Tide Water management would agree to accommodate a nominee shareholder of Standard Greases on its board?

- Whether Ministry of Heavy Industries may exit at this price or higher price considering divestment program?

- Post offer, if Standard stake goes beyond 25%, whether it will have rights to classify itself as co-promoters, if the government does not exist and as a co-promoter will have rights to get a board seat?

- Exit for other Investors?

- Whether other government entities can acquire the stake in tide water?

MARKETS MOVEMENT

Shares of Tide Water jumped Rs 590, or 3.46%, on BSE on September 23, 2015, to close at Rs 17,636 each in a flat market—it is already trading at a premium of at Rs 1,000 on the price offered by Standard Greases. Tide Water is a classic example of a company with a small paid-up equity (of Rs 87.21 lakh), whose shares are thinly traded on both the BSE and the National Stock Exchange. Only a few hundred shares of the company are traded every day, and even small orders lead to massive swings. According to Tide Water’s own annual report, the company’s shares rose from a low of Rs 8,100 to Rs 19,680 and again fell to Rs 12,240, all in FY15 even without any significant surge or disruption in operations.

INDIAN INDUSTRY SCENARIO

The lubricants industry in India is dominated by national oil companies namely IOCL- Servo, BPCL-MAK, and HPCL that account for almost half of market share. Castrol is the largest private player in the lubricants business mainly catering to the automotive and industrial segments. Castrol a private MNC player holds 20% of the market share in Indian lubricant industry. It earns major revenues from the automotive segment (90%) with the majority of revenues from the car segment (40%) followed by 30% revenues from the motorcycle segment and 30% from the commercial vehicles segment. The industrial segment constitutes only 10% of total revenues. Tide Water’s market share stand at 4% in 2013 as latest data is not available. Rest of the market comprises of private multinationals like Shell, Exxon Mobil, Total, IPOL and numerous small and local players.

Castrol India and Tide Water and similar line of products compared to other government companies which are more diversified in another lubricant also.

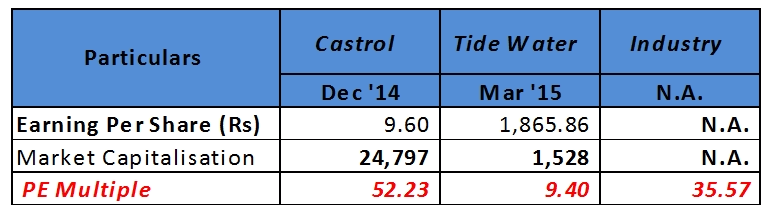

Market Capitalisation And PE Multiple

“The Castrol India commands a premium compared to its competitors dues its strong distribution network and focus on branding. Through the acquisition, Standard Greases wants a platform to expand the current market share of Tide Water and bring the value to all the stakeholders”

WHAT CURRENT SHAREHOLDING OF TIDE WATER SPEAKS?

Shareholding

Analysis of shareholding

The free float of Tide Waters shares (i.e. other than promoters and acquirer) in the market is approx. 33% percent and nearly 5% of the retail investors has also stated that they will stand behind the existing management. So, the free float after the said stands approx. at 28% for acquisition/offer. Out of 28%, approx. 5.75% is held by shareholders holding more than 1% each. The current promoters, government institutions, persons in support of promoters i.e. LIC, United insurance, Dutta & Trust stake is approx. 41.71%. Considering support of retails shareholders of about 5% and other undecided shareholders which are likely to be more than 5%, it is almost impossible for the acquirer, to have stake above 50% in any case.

Valuation Price offered just captures P/E multiple of about 9, and hence may not be attractive for the small shareholders to exit. In fact, they are at the moment, to get more value by selling in the market because market rise is higher and also it will be tax and cash efficient to sell in the market.

Way forward for Promotors of the Target Company

From the current position it seems there is neither any threat to existing management nor will there be any change, unless the government itself go for divestment of its stake. Even if the same happens in our opinion, it will be, substantially at a higher price. Instead of selling to the acquirer at current price, the government can sale to the other government entities like BPCL or HPCL which are already into this business and have financial muscle and business acumen and synergy to expand the business of the company and later may decide to exit the business by unlocking the real value of the company. It may decide to merge the company with any of the present government marketing company, though it may find it difficult to get the merger approved if acquired objects to the merger. However considering that the acquirer is a major supplier to the target company and also has 25% stake, the target company should consider giving one or two seats in the board to the acquirer.

Way Forward for The Acquirer

Based on the current position i.e. without any acquisition in the open offer, Standard Greaves cannot be classified as “promoters” as it is not possible to get itself reclassified as a promoter of the company as per the definition in the Companies Act 2013 and SEBI takeover Code.

From the above shareholding analysis, it seems it is impossible for the acquirer to reach 51% stake in the target company, so the open offer will enable the acquirer to consolidate its holdings and remain as a financial investor. It may get a board position and a say in management decisions depending upon a number of shares acquired and views of the present management. By following the procedure as per Section 160 of the Companies Act, 2013, they might be able to appoint their representative as Director on Board of Tide Water.

Considering the provisions of Sec 391 to Sec 394 of the companies Act, 1956, it is not possible for the acquirer to get itself merged with the target company if just the promoter does not accept the merger.

Going forward, the acquirer’s plan can be an acquisition of shares by convincing various bulk shareholders viz. PQR Consultants, Bakshu and also small shareholders to exit at the fair return and where it is able to have a controlling stake and consolidate the same with itself to capture substantial synergy benefits for all stakeholders.