The board of Transport Corporation of India (TCI) has approved the demerger of its Express Distribution division undertaking into wholly-owned subsidiary TCI Express Ltd. XPS (Express) Undertaking is engaged in the distribution and offers single window door-to-door and time bound solutions for customers’ urgent requirements. Express implies time sensitive movement. It caters to logistics requirements both in Indian and abroad. Customization of services and flexibility are the two unique features of TCI XPS, which gives the company an edge over others. The division serves the needs of businesses like e-commerce, automotive, engineering & electrical, telecommunication, electronics, pharmaceutical, and apparel.

About Transport Corporation of India (Demerged Company)

Incorporated in the year 1995, Transport Corporation of India is India’s leading end-to-end integrated supply chain and logistics solutions provider and a pioneer in the sphere of cargo transportation in India. Leveraging on its extensive infrastructure, strong foundation and skilled manpower, TCI offers seamless multimodal transportation solutions.

TCI Group has an extensive network of over 1400 company owned offices, a huge fleet of customised vehicles and managed warehouse space of 10.5 million sq. ft. and a strong workforce of 5000+.

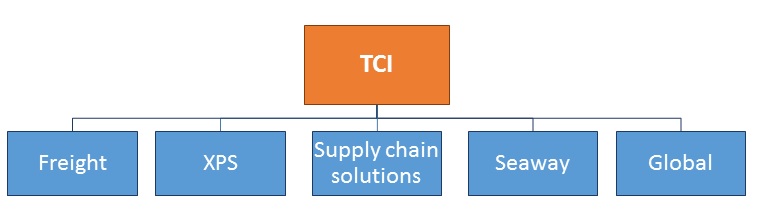

Initially started as a trucking company, TCI has grown and diversified into businesses spanning entire value chain of logistics activities through following main business undertaking

Transferred Undertaking

XPS (Express) Undertaking is engaged in the express distribution and offers single window door-to-door & time bound solutions for customers’ express requirements.Express implies time sensitive movement. It caters to logistics requirements both Indian and international. Customization of services and flexibility give TCI XPS a distinct edge over competitors. The division serves the unique needs of different businesses like E-commerce, Automotive, Engineering & Electrical, Telecommunication, Electronics, Pharmaceutical, and Apparel etc.

Residual Undertaking (To remain with demerged company)

TCI Freight Undertaking is engaged in surface transportation and trucking business. This division is fully equipped to provide total transport solutions for cargo of any dimension or product segment.

Supply chain solutions Undertaking is a single window enabler of integrated supply chain solution right from conceptualisation and designing the logistics network to actual implementation. The core services offering are Supply chain consultancy, inbound logistics, warehousing/distribution centre management & outbound logistics.

Seaways Undertaking is engaged in coastal shipping and equipped with four ships in its fleet and caters to the coastal cargo requirements.

Global Undertaking provides end-to-end logistics solutions across boundaries through wholly owned overseas subsidiaries and joint ventures.

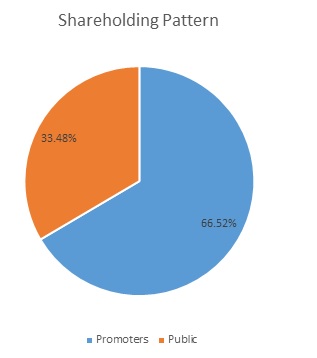

Current Shareholding Pattern of TCI

TCI Express Limited (The Resulting Company)

TCI Express Limited is wholly owned subsidiary of the demerged company. Currently, TCI Express Limited does not have any significant operations.

THE TRANSACTION

Demerger of XPS undertaking of Transport Corporation of India Limited into TCI Express Limited and consequent capital reduction under the said scheme.

Consideration

Resulting company to issue and allot one equity share of face value INR 2 each fully paid up to the shareholders of demerged company for every two equity shares of face value INR 2 each held by them in demerged company.

TCI Express Limited:

| Particulars | Post-demerger (Approx.) |

| No. of shares | 3,80,36,800 |

| Issued Capital | 7,60,73,600 |

Note: – During the scheme, shares held by demerged company in resulting company prior to demerger will get cancelled and share face value will get reduced to INR 2 form INR 10 each.

Appointed Date:

The appointed date for the Scheme has been fixed as April 1, 2016.

RATIONALE

- The current booming trends in e-commerce have completely changed the conventional retail logistics ways. The nature of the risks and competition with respect to the business of XPS undertaking is distinct from the other businesses of the demerged company and consequently, upon demerger, the XPS undertaking would be capable of attracting a different set of investors and strategic partner.

- The XPS undertaking has tremendous growth and profitability potential, more specifically in support of E-Commerce space where it requires focused leadership and management attention.

- The reorganisation by the proposed transaction will enable investors to separately hold the investment in businesses with different investment characteristics, thereby enabling them to select investments which best suits their investment strategies and risk profiles.

- The proposed demerger will enable the demerged company to focus on its remaining businesses and achieve greater synergies.

FINANCIALS

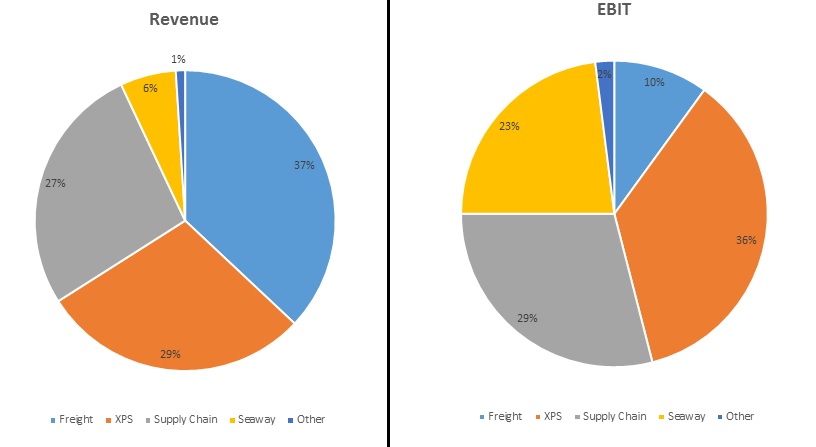

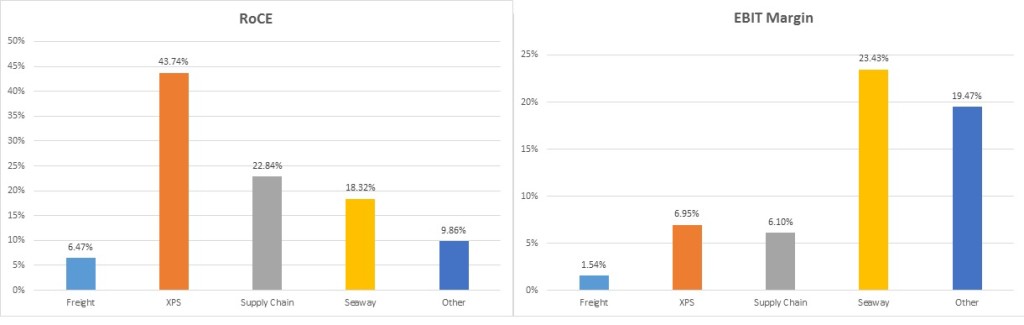

Segment wise break up (Standalone)

Total Assets & Liabilities of XPS Division

INR in crore

| Particulars | TCI (Standalone) |

XPS | Share of XPS in total | TCI (Other than XPS) |

| As on 31st March 2015 | ||||

| Assets | 1045 | 168 | 16.08% | 877 |

| Liabilities | 478.5 | 59.5 | 12.43% | 419 |

| Capital Expenditure | 140.8 | 5.29 | 3.76% | 135.51 |

| Revenue | 2209 | 659 | 29.83% | 1550 |

| EBIT | 127.35 | 45.91 | 36.05% | 81.44 |

| EBIT % | 5.77% | 6.97% | NA | 5.25% |

| PAT | 75.9 | 27.9 | 36.76% | 48 |

| PAT % | 3.44% | 4.23% | NA | 3.10% |

| Asset Turnover | 2.11 | 3.92 | NA | 1.77 |

XPS undertaking’s revenue grew by 9.85% against TCI’s consolidated growth rate of 7.76% for the financial year ended 31st March 2015.

Comparison with Peer

INR in crore

| Particulars | Consolidated | |

| TCI | GATI | |

| As on 31st March 2015 | ||

| Revenue | 2425.77 | 1662.68 |

| EBIT | 147.7 | 120.65 |

| EBIT % | 6.09% | 7.26% |

| PAT | 81.38 | 41.20 |

| PAT % | 3.4% | 2.5% |

| Operating cash flow (OCF) | 124.60 | 86.12 |

| OCF/PAT | 1.53 | 2.09 |

| Capital Employed | 981.62 | 542.73 |

| RoCE | 15.05% | 22.23% |

| Networth | 608.73 | 548.69 |

| Return on Networth | 13.37% | 7.51% |

| Total Assets | 1125.61 | 1343.85 |

| Asset Turnover Ratio | 2.16 | 1.24 |

| Total Debt | 283.64 | 395.27 |

| Debt/ Equity Ratio | 0.47 | 0.72 |

| Interest | 33.33 | 41.92 |

| Interest Coverage Ratio | 4.43 | 2.88 |

| Current Assets Ratio | 1.38 | 1.23 |

| Enterprise Value (Market Cap+Debt- cash & Cash Equivalent) |

2246.87 | 2234.33 |

| EV/EBIT | 15.21 | 18.52 |

| PE Ratio | 27.74 | 36.62 |

CONCLUSION

India’s E-commerce industry is growing at a rapid pace. Increasing smartphone and internet penetration in India are the key factor for double-digit growth in e-commerce. This large volume of traffic has opened up new growth opportunities in all facets of logistics. Today, E-commerce logistics service is the fastest developing business vertical for the logistics industry. With a clear objective to capitalise on the fast-growing e-commerce and high-value express business, said restructuring will create a focused entity with the right operational flexibility to create perspective for hyper growth.

Due to its established network of warehouses and branch network, the company will be one of the chief beneficiaries of the booming e-commerce industry. Demerging its most profitable undertaking will pave the way for TCI in future to invite some strategic partner into rapidly growing express undertaking. At the same time, dedicated management can help its conventional logistics business to grow moderately. The company has three managing directors and it seems post demerger there will be separate management with one managing director for each. It also looks most likely that resultant company will raise funds by way of equity dilution.