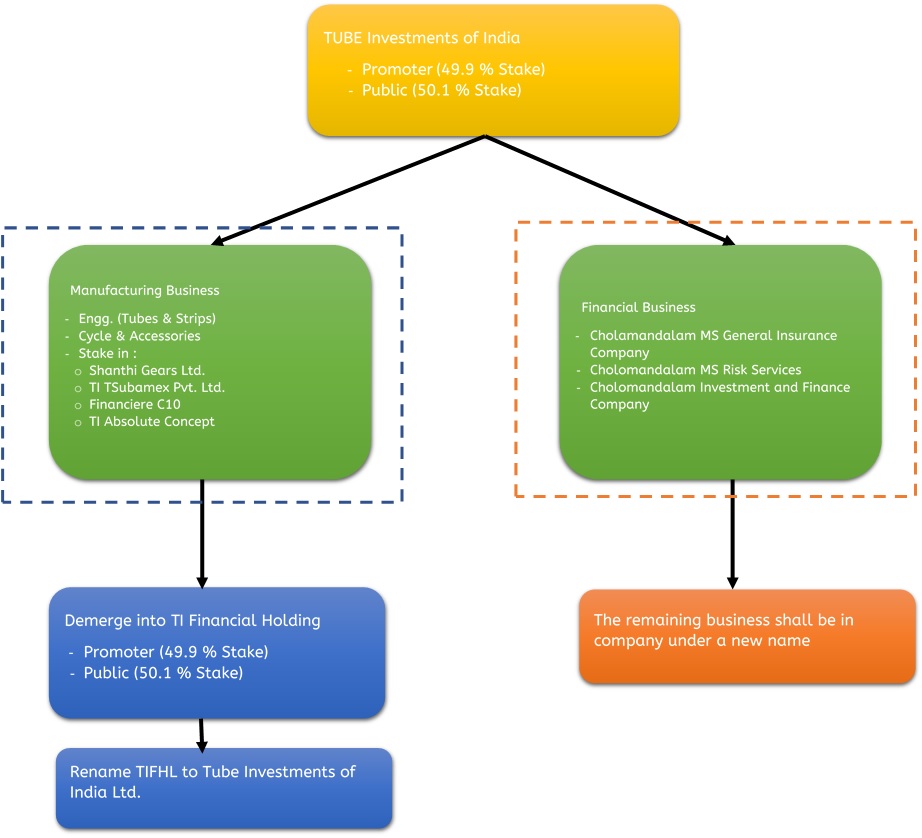

Tube Investment of India Ltd (TIIL) is a flagship company of the Murugappa group, is engaged in multiple business broadly classified into the following category

Manufacturing of tubes, strips, tubular, components, bicycles (second largest bicycle producer in India) and fitness products, chains for automobiles sector and industrials applications, roll-formed sections, and other metal formed products, industrial gears, designing and manufacturing of dies. The other manufacturing business is also carried out through subsidiaries Shanthi Gears Limited (Industrial gears), TI Tsubamex Private Limited (designing and manufacturing of dies) and Sedis (Industrial Chains).

Financial service business through subsidiaries, joint ventures, associates viz Non-Banking Financial Business (through Cholamandalam Investment and Finance Company Limited), Insurance Business (Cholamandalam MS General Insurance Company Limited), Chola MS Risk Service Limited (JV of Murugappa group with Mitsui Sumitomo Insurance Group of Japan (5th largest group insurance group across globe).

During the year 2015-16 company has sold 14 % shareholding in the M/s Cholamandalam MS General Insurance Company Limited (CMSGICL) to its joint venture partner M/s Mitsui Sumitomo Insurance company Limited, Japan for consideration of Rs 882.67 Crores and out of which Rs 820.78 crores was recognised as gain in the book (excess of sales consideration over the average carrying amount of TIIL investment in CMSGICL), post stake sale TIIL still holds 60%.

Major subsidiaries and their percentage holding as on March 2017:

Table 1: Murugappa Group % Shareholding (All Fig. in Rs. Crores)

| Company | % Shareholding | Total Income | PAT | Market Cap |

| Shanthi Gears Limited (SGL)* | 70.10% | 215 | 22.5 | 1,150 |

| Cholamandalam Investment and Finance Company Limited (CIFCL)* | 46.20% | 4,692 | 798 | 17,300 |

| Cholamandalam MS Risk Services Limited (CMSRSL) | 49.50% | 36.6 | 1.7 | N.A. |

| Cholamandalam MS General Insurance Company Limited (CMSGICL) | 60% | 2,762 | 208 | N.A. |

*Listed entities, current market capitalization on approx. basis.

Murugappa holding in CIFCL is 53.08 % (including holding through TIIL) and balance is held by public & other investors. CMSRSL & CMSGICL is a JV between Murugappa group, India and Mitsui Sumitomo Insurance Group, Japan.

Tube Investment Financial Holdings Limited (TIFHL) is a wholly owned subsidiary of TIIL, no business operation is carried out presently.

Scheme (Transaction Overview)

Demerger of the manufacturing business undertaking of Tube Investments of India Limited (TIIL or Demerged Company) into TI Financial Holdings Limited (TIFHL or Resultant company) with appointed date 1st April 2016. Exchange ratio will be issue of 1 fully paid up Equity Share of Re. 1 each of TIFHIL for every 1 fully paid up equity share of Rs. 2 each held in the TIIL.

Existing shares of TIFHIL will be cancelled and shareholding of resultant company will be mirror image of TIIL. Equity shares of the TIFHIL will be listed on the stock exchange subject to the regulatory approval. GDR holders (not listed) of TIIL will be issued GDRs of TIFHL and such GDRs will not be listed on any stock exchange unless required by any regulation or laws.

Employees covered under ESOP will be issued one stock option by the TIFHL for every stock option held in the TIIL. Stock options granted by the demerged company under the relevant existing stock option scheme would continue to be held by the employees concerned (irrespective of whether they continue to be employees of the demerged company or become employees of the Resultant company)

Financial Overview

Table 2: Segment-wise & Consolidated Financials for FY 16 – 17 (All Figures in Crores)

| Segment | Manufacturing | Financing | Unallocated | Total | |||

| Amt | % of total | Amt | % of total | Amt | % of total | Amount | |

| Revenue* | 4,984.3 | 40% | 7,450.47 | 60% | 2.02 | 0% | 12,434.77 |

| EBIT# | 302.82 | 17% | 1,484.84 | 83% | 0 | 0% | 1,787.66 |

| Assets | 2,667.97 | 7% | 36,388.16 | 92% | 525.22 | 1% | 39,581.35 |

| Liabilities | 929.08 | 3% | 31,251.52 | 97% | 3.58 | 0% | 32,184.18 |

| Capital employed | 1,738.89 | 24% | 5,136.64 | 69% | 521.64 | 7% | 7,397.17 |

| Finance cost## | 73.92 | – | – | – | – | – | 73.92 |

| PBT | – | – | – | – | – | 1,703.26 | |

| EBIT % | 6.08% | – | 19.93% | – | – | – | 14.38% |

| ROCE | 17.41% | – | 28.91% | – | – | – | 26.00% |

| Asset T/O | 1.87 | – | 0.20 | – | – | – | 0.31 |

*before elimination of inter segment revenue

# EBIT before considering share of loss from joint venture, exceptional items, inter segment eliminations

## Finance cost as reflected in standalone financials (which has manufacturing business) is almost same at consolidated level hence entire finance cost is assumed under manufacturing segment

Net worth of the assets of manufacturing business undertaking being transferred to the Resulting company will be around Rs. 950 crores.

Table 3: Financial Services Segment-Wise as on March 2017 (All figures in Rs. Crores)

| Segment | Insurance | Financial Service (NBFC) | Total | ||

| Amount | % Total | Amount | % Total | ||

| Revenue | 2,762.41 | 37% | 4,688.06 | 63% | 7,450.47 |

| EBIT | 297.36 | 20% | 1,187.48 | 80% | 1,484.84 |

| Assets | 6,646.23 | 18% | 29,741.93 | 82% | 36,388.16 |

| Liabilities | 5,620.20 | 18% | 25,631.32 | 82% | 31,251.52 |

| Capital employed | 1,026.03 | 20% | 4,110.61 | 80% | 5,136.64 |

| EBIT% | 10.76% | – | 25.33% | – | 19.93% |

| ROCE | 28.98% | – | 28.89% | – | 28.91% |

Note- Revenue is including inter segment and EBIT is before considering share of loss from joint venture and other un-allocable inter segment eliminations

Table 4: Manufacturing Services Segment-Wise (All figures in Rs. Crores)

| Engineering business | Cycle Business | Metal formed Business | ||||

| Particulars | 2016-17 | 2015-16 | 2016-17 | 2015-16 | 2016-17 | 2015-16 |

| Gross Sales (incl. Inter Unit) | 1,932 | 1,710 | 1,348 | 1,483 | 1,091 | 995 |

| EBITDA | 205 | 155 | 44.5 | 85.9 | 127 | 123 |

| % to gross sales | 11% | 9% | 3% | 6% | 12% | 12% |

| PBIT(Before Exceptional Item) | 146 | 94.5 | 35.7 | 78.8 | 92.3 | 86.3 |

| % to gross sales | 8% | 6% | 3% | 5% | 8% | 9% |

| Total Capital Employed | 629 | 591 | 290 | 264 | 432 | 413 |

| ROCE% | 23% | 16% | 12% | 30% | 21% | 21% |

Debentures

Non-Convertible debentures pertaining to manufacturing undertaking will be transferred to TIFHL Debenture /FCCB

Accounting Treatment

In the books of TIIL

- As on the appointed date, TIIL (demerged company) will transfer the book value of assets and liabilities pertaining to the manufacturing business undertaking to the TIFHL (resultant company)

- TIIL shall transfer the balances in Debenture Redemption Reserve and Hedge Reserve to the TIFHL and will retain securities premium account, capital redemption reserve and the capital reserve account. The general reserve shall be apportioned based on Net asset transferred and Net asset retained by the TIIL.

In the books of TIFHL

- TIFHL shall record the assets and liabilities pertaining of manufacturing business undertaking of demerged entity at their respective book values excluding revaluations, if any. Resultant company shall preserve the identity of the reserves.

- Shareholding of the demerged company in the TIFHL pre-demerger shall be cancelled and the amount of such capital, as stand cancelled, be credited to Capital Reserve.

- The Net assets transferred pursuant to the scheme, any difference will be adjusted against Capital Reserve or General Reserve of the resultant company.

Post-Merger Scenario

- Existing equity shares of TIFHL held by TIIL will be cancelled.

- Reduction of face value of Demerged Company from INR 2 each fully paid to INR1 each fully paid.

- Upon the sanction of the scheme, name of the resultant company will stand changed to “Tube Investments of India Limited” and the name of the Demerged company will stand changed to “TI Financial Holding Limited”

Capital Structure

Table 5: Shareholding Pattern (TIIL & TIFHL)

| Particulars | No. of Shares | % Shareholding |

| Promoter & Promoter Group | 9,14,33,440 | 49.90% |

| Institutional investors | 5,11,83,867 | 27.94% |

| Body corporate | 1,26,50,396 | 6.90% |

| Other Non-Institutional Investor | 2,72,45,858 | 14.88% |

| Total Public Shareholding | 9,10,80,121 | 49.71% |

| Shares held by Employee Trust | 7,03,680 | 0.38% |

| Shares underlying Depository Receipts | 42,30,630 | – |

| Total No of fully paid-up equity shares | 18,32,17,241 | 100.00% |

| Total shares (Incl. Shares underlying DRs) | 18,74,47,871 | – |

Note: Capital structure of the TIFHL post demerger will be the mirror image of TIIL.

Valuation

| Particular | Insurance | Other financial Service | Total financial service |

| Revenue | 2,762.41 | 4,688.06 | 7,450.47 |

| EBIT | 297.36 | 1,187.48 | 1,484.84 |

| PAT | 208.00 | 799.70 | 1,007.70 |

| Market Cap (excluding CMSRSL) | 6,935.26 | 17,300.00 | 24,235.26 |

| TIIL Share | 4,161.16 | 7,992.60 | 12,153.76 |

Conclusion

Demerger will definitely unlock the value for the shareholders of TIIL. This allows both the businesses which has quite different risks and return profile to pursue their plan in an optimum manner. Financial service undertaking has more than 90% asset base as compare to manufacturing undertaking, and it also has higher return on capital employed and a better EBIT % separating business will give higher valuation which is not capturing in the TIIL valuation currently.

Reason for demerger of Manufacturing undertaking is to strictly comply with definition of Going concern and undertaking as per Sec 2(19AA) of the Income Tax Act,1961, even though TIIL may end up paying more stamp duty.

Investors who wants to invest in specific business i.e. either in manufacturing or in financial business can now do so based on their investment strategies.

Currently, there is no dilution of interest due to this demerger but in future, if promoter wants to dilute their stake in any of the undertaking then they can do so without effecting another line of business.

In future, there may be possibility of merging Shanthi Gears Ltd (subsidiaries of the company) in the new TIIL and Cholamandalam into TIIL holding to unlock the value and captured synergies, second leg of restructuring should happen sooner than later.