Caravan Talkies, which is owned by UFO Movies through its subsidiary is taking both Bollywood and regional films to the hinterlands of the country where there is no proper cinema hall. The company is also helping brands to promote their products through their screens in rural areas.

UFO Moviez India Limited (UFO) is a listed company and engaged in the business of digital cinema distribution and in-cinema advertising. It wants to a leader in big screen entertainment and entered into a merger transaction with Qube in 2017 which was blocked by NCLT in January 2019 and the decision* is contested by UFO currently.

* Updated Oct 2019 The merger deal was blocked by the NCLT which eventually was favored in UFO but by this time the deal with Qube is off the table.

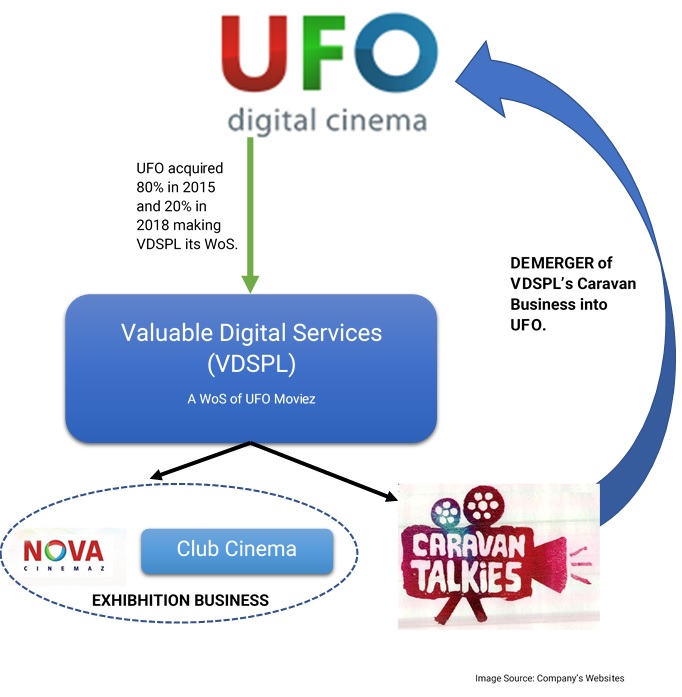

Valuable Digital Screens Private Limited (VDSPL) is engaged in the advertising business carried out through Caravan Talkies i.e. Caravan Talkies advertising business which contributes the major revenue for the company and exhibition business through Nova Cinemaz & Club Cinema.

Caravan Talkies; is a movie-on-wheels concept, wherein sundown non-ticketed shows (complimentary) are played at villages for India’s rural population situated in media dark areas. This platform provides an opportunity for brands to reach out and engage with rural audiences via consumer activations in a fun and receptive environment.

NOVA Cinemaz creates a one stop solution for the local populace to set-up movie theatres in their respective areas through a standardized model both in terms of infrastructure and experience. Club Cinema provides movie screenings of recently released films in clubs and community centers at private screens.

Transaction

VDSPL (“demerged company”) is demerging its “Caravan Talkies advertising business” into UFO (“resulting company)” through the scheme of arrangement.

“Caravan Talkies advertising Business” means the divisions, undertaking, businesses, activities and operation of VDSPL relating to advertising, activation and other related activities carried out through fleet of caravans. These activities are carried out on an open caravan that shows free movies in rural areas, thus providing digital platform for marketing and reaching to larger rural audience for its clients.

The demerged company VDSPL is a wholly owned subsidiary of the Resulting Company as on the date of board approval.

Appointed date for the transaction is 1st April 2019.

Earlier transaction

In 2015, UFO Moviez acquired 80% of VDSPL via

- 7105 shares from Valuable Technologies Limited (promoter company of UFO Moviez) at ~Rs 3800.

- Subscribed to additional 4475 Shares of VDSPL at the same price of ~Rs.3800.

While the original shares issued by VDSPL to Valuable Technologies Limited were at par.

In 2018 UFO Moviez acquired the remaining 20% (2895 shares) of VDSPL from Valuable Technologies Limited at ~Rs 2073 making VDSPL a WoS of UFO.

Total cost of acquisition of VDSPL was ~Rs. 5.59 crores including all related additional costs.

Rationale of Scheme

- UFO’s vision is to be the leader in big screen entertainment by enhancing value for all stakeholders and bringing joy to people’s lives, through innovation.

- The demerger will enable UFO to cater the needs of the advertisers across both rural and urban audiences thereby enabling them to plan their spends in a coordinated manner, through a common vendor.

- UFO will also get an advantage on its balance sheet in form of Unused losses and unabsorbed depreciation.

Operational Synergies

- The Caravan Talkies advertising business would have access to UFO’s large technical field support and warehouse facility. These warehouses would enable easy repairs and maintenance.

- Post Demerger Caravan Talkies gain access to UFO’s satellite-based delivery system for receiving movies and advertising content. This will result into savings of delivery cost.

Consideration

The entire issued, subscribed and paid up equity share capital of the Demerged company is held by the resulting company, so in scheme no shares of resulting company shall be issued.

Accounting Treatment

In the books of demerged company:

- Reduce the book value of all assets and liabilities and balance in profit and loss account pertaining to demerged undertaking.

- The intercompany balances will stand cancelled.

- The difference i.e. excess or shortfall, if any, if the net book value of assets over liabilities and balance in profit and loss account shall be recorded as the capital reserve.

In the books of resulting company:

The resulting company shall account for the demerged undertaking in its books of account in accordance with Appendix C ‘Business combinations of entities under common control’ of IND AS 103 for Business combinations prescribed under section 133 of the Companies Act, 2013, as notified in under the Companies (Indian Accounting Standard) Rules, 2015 and generally accepted accounting principles.

- Record the assets, liabilities and balance in profit and loss account pertaining to the demerged undertaking at book values.

- Intercompany balances will stand cancelled.

- The difference, being the excess or shortfall, if any, of book value of the assets over liabilities and the balance in profit and loss account pertaining to Demerged undertaking shall be adjusted against value of investment and capital reserve or retained earnings.

One need to understand that how treatment should be given to reserve as in the scheme only mentioned P&L account.

Table 1: In the books of demerged company (VDSPL)

| Particulars | Amount | Amount | ||||

| Liabilities | Dr. | 86,74,14,279 | ||||

| Reserve | Dr. | – | ||||

| To Assets | 33,49,64,094 | |||||

| To Reserve | 53,24,50,185 | |||||

Note: Assumed liability remaining after arrangement is INR 15,00,000 and assets remain after arrangement is INR 60,00,000.

Table 2: In the books of demerged company (UFO)

| Particulars | Amount | Amount | ||

| Assets A\c | Dr. | 33,49,64,094 | ||

| P&L A\c | Dr. | 53,24,50,185 | ||

| To Investment | ||||

| To Liabilities | 86,74,14,279 | |||

Financials

The Caravan Business contributed almost 94% to the turnover of VDSPL during FY 18-19.

Table 3: Financials of VDSPL as on 31.3.2019

| Particulars | Amount |

| Revenue | 25,67,20,730 |

| EBITDA | -91,43,459 |

| Net Worth | -52,79,50,185 |

| Unused Business Losses and Unabsorbed Depreciation | 46,83,19,000 |

After transaction net worth of UFO may be decreased by amount of debit balance of P&L account acquired.

Table 4: Networth of UFO (Pre and Post Transaction)

| Particulars | Amount |

| Net Worth as on 31st March 2019 | 4,92,43,37,000 |

| Debit Balance of P&L* | 58,83,83,185 |

| Net Worth After Transaction | 4,33,59,53,815 |

*Debit balance of P&L account includes impairment of Investment in VDSPL.

Conclusion

The real purpose of the scheme although as mentioned may not be as synergetic from an operational point of view. UFO acquired all the shares of VDSPL and made its WoS in 2018 by paying a premium from a related party and now wants to transfer just the dominant business of a WoS which has been incurring losses year on year (~Rs. 12 crores in FY-19 and ~Rs. 14 crores in FY-18)

Accounting treatment is also unique and whether can be considered in line with IND AS 103 also needs to be discussed. The current way results in its accumulated reserves coming down by more than 10%.

So, if any commercial reason cannot be attributed to the transaction, then one possible reason can be for getting tax break of losses incurred by the VDSPL in the tax returns of UFO Movies. Impairment of investments normally may not get tax breaks and tax breaks because of impairment will be just 1/10 of the cash losses incurred since inception.

Considering the above facts, whether the scheme will get approval from various authorities or not will be interesting to observe.

Add comment