After selling its cement business to UltraTech, JP can now concentrate on its core business and reduce the piling debt from its books

The cement industry is reporting a series of small and mid-sized acquisitions as it went through a period of slowdown and challenges surrounding land acquisition and regulatory clearances which decelerated launch of Greenfield projects. Pending infrastructure projects and a poor state of real estate have affected demand over the past few years. While several sellers were forced to divest assets due to stretched balance sheets, some opted out of the business due to strategic reasons. This is benefiting the large business houses with deep pockets who are looking to pick stressed assets at lower valuations.

Faced with rising bad loans and the Reserve Bank of India’s March 2017 deadline to clean up their debt-saddled books, banks have been promoting companies with large loans to sell assets.

Concrete Trouble

India’s largest cement-maker UltraTech Cements Ltd. (UT) had to call off a Rs 5,325 crore deal to buy Jaiprakash Associates Limited’s (JP) two cement plants in Madhya Pradesh (5 MTPA) as the Bombay High Court rejected the scheme of arrangement citing the new MMDR Act as the prime reason.

Under the Mines and Minerals (Development and Regulation) Act (MMDR Act), mining rights do not get automatically transferred to a new owner unless the acquisition is 100%. Ownership of mines can only be obtained in auctions. Major cement companies are expecting an amendment in the MMDR (Amendment) Act 2015, to allow the transfer of limestone mines automatically to the buyers in case of mergers and acquisitions.

Anatomy of the deal

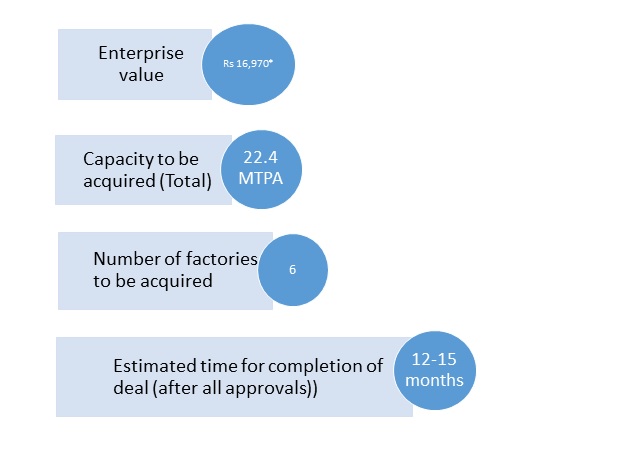

This will be the largest deal in the Indian cement sector and it comes two days after JP failed to get court approval for a transfer of rights to mine limestone in MP.

UltraTech Cement, an Aditya Birla Group Company, has acquired the 4.8-million tonne per annum (map) Gujarat unit of Jaypee Cement Corporation, for Rs 3,800 crore. As part of the deal, UltraTech will take over a debt of Rs 3,650 crore.

Click Here to read the full Article.

Possible structures

Considering various legal and compliance issues, the structure selected to transfer the undertaking along with mining rights for executing the transaction effectively can change. Structure below is based on the assumption that amendment in MMRDA Act will be passed/ not passed-

- If the amendment goes through

- It is a clear asset purchase (including mining rights) which may be structured by hiving off the entire cement capacity to be transferred into a stepdown subsidiary of JP and then 100% stake will be sold to UT.

- Other option would be to directly sell the cement plants through slump sale. Implications– In option A, there will be no implications on demerger of cement division to 100% subsidiary but capital gains (Income Tax) on slump sale based on the transaction value and the net worth of the divisions when the division is sold.

- If the amendment is rejected

The divisions can be transferred by carving out a separate entity that will own JP’s other businesses, such as hotels, construction and real estate which will apply for listing. The residual company left behind will own the cement division to be transferred which can be merged with UT and sale proceeds to be given to the bankers to the extent of sale proceeds of promoters holding. Implications– There will be no implications on demerger of other divisions (hotels, construction and real estate), though promoters of JP will end up paying some capital gains tax on the sale of shares.

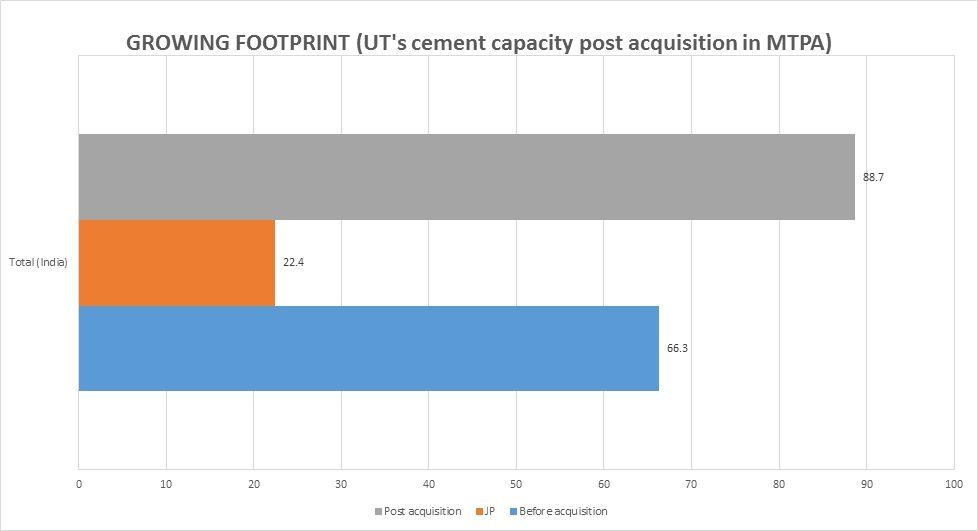

UltraTech Cements Ltd: The acquirer

Kumar Mangalam Birla’s cement flagship firm UltraTech Cement is part of the Aditya Birla Group and a subsidiary of Grasim Industries with a total capacity of around 67.7 MTPA. It is the largest manufacturer of concrete in India and the largest exporter of cement and clinker from India. UT accounts for a third of the Aditya Birla Group’s market capitalisation.

What’s in it for UltraTech?

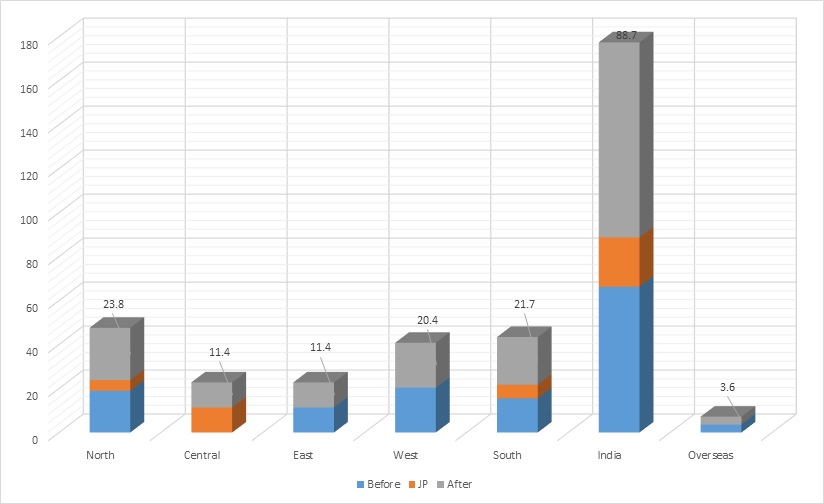

- Capacity: The deal will increase its installed capacity by a whopping 25% to 92.3 MTPA. UT will become one of the five largest cement makers in the world. Capacity per share would rise from 0.25 tonnes/share to 0.32 tonnes/share. EBITDA would reduce from around Rs. 68 crore/MTPA to Rs. 63 crore/MTPA.

- Valuation comparison:

Particulars MTPA Rs/tonne Comparable (Reliance Infra sold to Birla Corp) 5 9520 Earlier Deal between UT and JP (rejected) 4.8 7942 Current deal including the earlier deal 18.4 8967 Hence, based on the above figures and other analysis, the deal valuation seems to be in the favour of UT.

- Market share:

- Fund Raising: Assuming the company finances the deal through internal accruals of Rs 2,000 crore and funding the balance by 60% debt and 40% equity, its debt to equity ratio would rise to 0.87 from 0.40 and equity would be diluted by about 7% (assuming no preferential allotment). Alternatively, if it is assumed that deal is financed entirely by debt then debt equity ratio would rise to 1.29.

- Sustainability: Based on our calculations, capacity acquired for $132/tonne would require $21.6/tonne in EBITDA to generate a Return on Equity (RoE) of 14%. By contrast, the assets being acquired have reported an EBITDA/tonne of below $10/t. UT reported EBITDA/tonne above $15/t, which is still lower than what UTCEM is paying in this latest deal (to be EVA neutral).

Demand cycle at the cusp of acceleration, organic expansion getting costly and time-consuming and complementary market reach offered by JP’s portfolio of 12 plants to its existing asset base creates strong strategic sense. Shareholder value may decrease in the short term due to reduced EPS and increased debt equity ratio. However, over the long term the company may reap the positive effects of leverage.

Barring the increase in its debt and some dilution in earnings, UT appears to have netted a good catch in JP’s cement assets.

(Note: The figures above are calculated based on the operating capacity of 18.4 MTPA)

Amidst rising NPAs and CDRs, this one is a classic example of deals driven by bankers forcing companies to deleverage the balance sheet by sale of stressed assets

Jaiprakash Associates Ltd: The target

Noida-based Jaiprakash Associates Ltd. has a total cement capacity of 27.79 MTPA as on 31st March 2015.

After several failed attempts by JP to sell its cement business in the last two years, the lenders prevailed upon the company to sell a lion’s share of its portfolio in one shot.

Rationale for JP

- Outstanding debts and interest-If JP manages to sell the cement assets as per plan and utilise the proceeds fully for repayment, it would be able to prune its debt from Rs 24,126 crore as of March 31, 2015, to about Rs 7,000 crore. It can also renegotiate the terms and conditions of existing and proposed loans and advances.

- Market value and piling losses- A huge debt pile have ensured that JP trades as a penny stock. As of 26th February 2016, it had a market value of just Rs 1,637 crore (Rs 6.73/share). All the cement companies and divisions of JP group are in losses eroding the net worth of the company.

- Refinance- If MMRD Act gets the nod, the deal may also include a clause that UT will refinance JP’s borrowings at lower rates. This will bring down the future interest obligations of the company.

- Core concentration– JP Group is determined to leverage its expertise in the fields of engineering & construction, real estate and project execution, in a committed manner and such steps would further ‘cement’ its credentials of being a trustworthy organisation in the long run.

The bad for JP

- JP will lose its cement business which has been generating substantial cash flows.

- Pressure from the bankers and comparison to its earlier transaction with UT as well as comparable indicate that the deal was slightly less favourable to JP.

Shareholders value is currently less and may reduce further immediately after the sale but it may gradually rise in the long term due to concentration on core businesses and deleverage.

Conclusion

The deal will help UT to accelerate its position further in Indian and global markets and will ease off pressure on JP from the stakeholders and let it concentrate on other core businesses.

JP may also transfer some of their debt to Ultra-Tech which means that lenders now have exposure to a business group that’s regarded as being financially sounder than many others, thereby reducing the risk of defaults and also improving its capital adequacy ratio.

The proposed amendment regarding transfer provisions in MMDR Act will also allow mergers and acquisitions of companies. It will also help improve profitability and decrease costs of those firms that are dependent on the supply of mineral ore from captive leases.

The transaction also highlights the growing trend of lenders putting pressure on debt-laden business houses to sell assets and deleverage the balance sheet. Due to rising non-performing assets in the banking sector, it is a purely buyers’ market where the seller does not have much choice other than agreeing on the term sheet offered by the buyers.