India’s Cement Industry is poised for consolidation. In the recent past, we have seen multiple large & small acquisitions in the cement segment for consolidating positions. Moving towards the world trend, India will have dominant 3-4 companies controlling substantial cement capacity. Continuing the trend, recently, the Board of Directors of UltraTech approved the purchase of 32.72% equity stake of the promoters & their associates in India Cements Limited.

UltraTech Cement Limited (“Ultratech”) is the cement flagship company of the Aditya Birla Group. UltraTech is the third largest cement producer in the world, outside of China, with a total Grey Cement capacity of 154.86 MTPA. The equity shares of Ultratech are listed on nationwide bourses.

India Cement Limited (“India Cement”) is engaged in the manufacturing of cement. India Cements has a total capacity of 14.45 mtpa of grey cement. Of this, 12.95 mtpa is in the South (particularly Tamil Nadu) and 1.5 mtpa is in Rajasthan.

The equity shares of India Cement are listed on nationwide bourses.

The Recent Transaction:

Mr. Radhakrishna Damani, along with his brother and associate companies, held a 23% stake in India Cements. They began gradually increasing their stake in the company after 2015. Though not clearly stated, Mr. Damani tried hard to get control over India Cements.

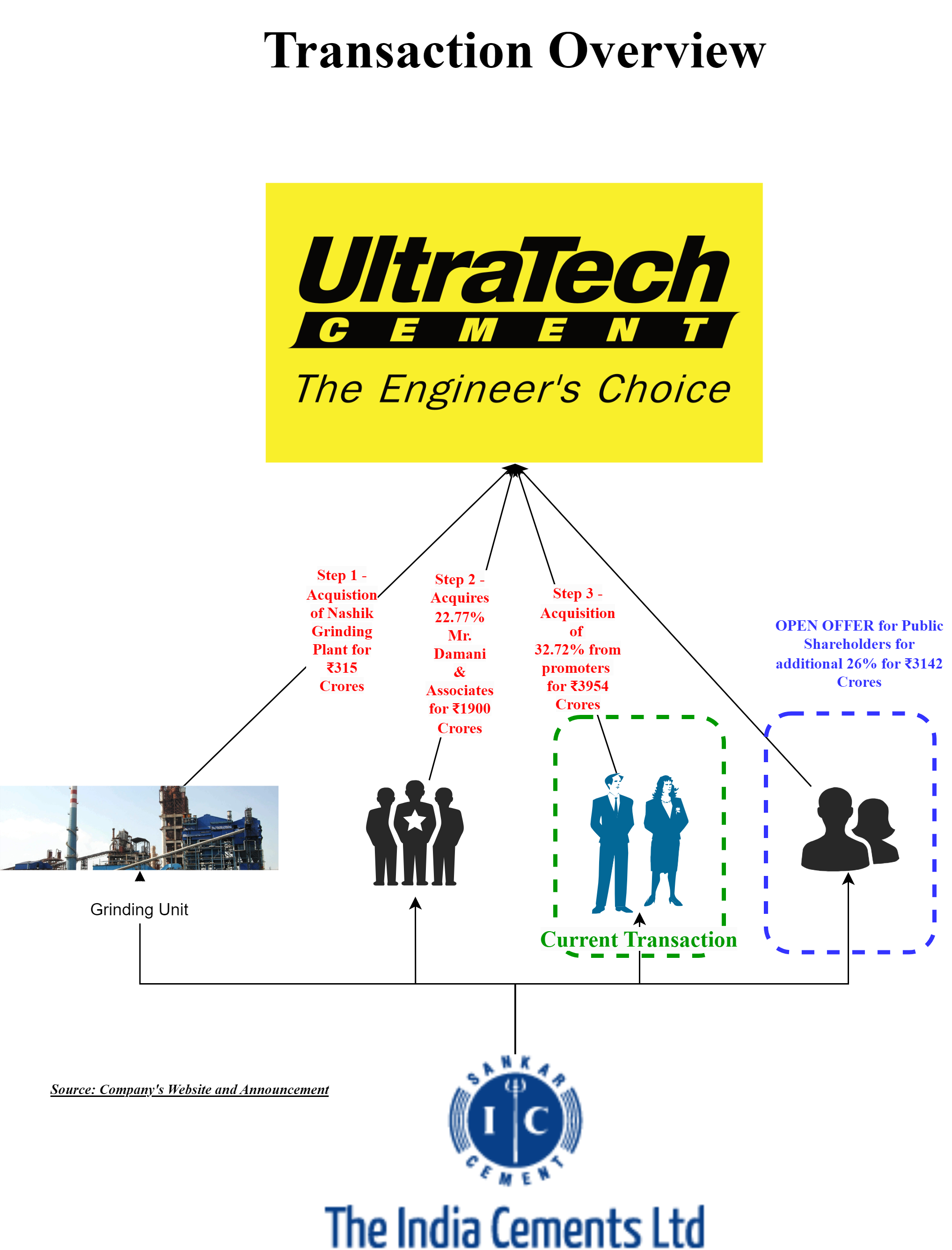

Ultratech & India Cement joined hands in April 2024, whereby India Cement announced selling their 1.2 mtpa grinding unit located in Nashik to Ultratech Cement for a consideration of INR 315 crore.

In June 2024, Ultra Tech made a financial investment in India Cements to acquire 22. 77% equity at a price of Rs 268 per share aggregating to INR 1900 crore from veteran investor Mr. Damani (Classified as a public shareholder). At the time of acquisition, Ultratech clarified that it was a purely financial investment. However, immediately after a month, Ultratech announced taking control over India Cement by purchasing the promoter’s share.

India Cement is one of the oldest cement companies in South India. Mr. Srinivasan, an existing promoter of India Cement & cement industry veteran, tried to expand the company however, few steps like venturing into shipping & coal ushered in turbulences for India Cement.

The Proposed Transaction

Post this financial investment by Ultratech, it was clear that Ultra tech would go & try for acquisition in the near future. Instead of any litigations, the promoter group of India Cement approached Ultratech for the acquisition of controlling interest in India Cement by acquiring their stake in the company. Pursuant to the same, Ultratech entered into a share purchase agreement to purchase 32.72% equity stake held by promoters & promoter group at INR 390 per share aggregating to INR 3954 crores.

The acquisition has triggered a mandatory open offer under the SEBI Takeover Code. Pursuant to the same, Ultratech has made an open offer to public shareholders of India Cement for the acquisition of 26% stake in India Cement for a consideration of Rs 390 per share. The Open Offer will be done after obtaining all regulatory approvals including the Competition Commission of India.

The acquisition flow for Ultratech:

Rationale:

One of the major rationales for acquisition is to strengthen its numero uno position in India Cement space. Post-acquisition of Ambuja Cements & ACC by Adani Group, we have seen couple of acquisitions smaller ones by Ambuja & ACC to strengthen their capacity. Even Ultratech is also acquiring many cement assets.

In addition to capacity expansion, India Cements comes with unique advantage. Given the limited availability of limestone in Tamil Nadu, it has resulted in restrictions on the setting up of new integrated units in Tamil Nadu. Ultratech’s last integrated unit in Tamil Nadu was acquired by its parent i.e., Grasim Industries Limited, in August 1998. The Underlying Transaction is therefore an endeavour to extend Ultratech’s footprint and presence in the highly fragmented, competitive, and fast-growing southern market in the country, particularly Tamil Nadu, where it has limited presence.

The operational efficiencies arising out of acquiring ready-to-use assets will reduce time to market vis-a-vis greenfield projects and will also provide the Acquirer with the opportunity to evaluate the optimization/ deferment of Ultratech’s existing capacity expansion plans in the southern market, given the ready-to-use assets of India Cement.

This acquisition will help augment Ultratech’s only integrated unit in Tamil Nadu i.e., Reddipalayam Cement Works (1.4 MTPA), which has a paucity of limestone with limited lifecycle availability.

Financials of Ultratech & India Cement

Being the largest cement company, Ultratech has better efficiencies & ratios compared to India Cement. Going ahead, Ultratech will try to squeeze available resources with India Cement and bring efficiencies par with that of Ultratech. India Cement has surplus assets additional land & shipping lines which can be hived off & debt will be paid.

For Ultratech, this is another acquisition which will be funded through a mix of internal accruals and debt. Given the size of India Cement, this acquisition may not immediately have any impact, however, may provide good growth opportunities & backward integration in the Southern market in the longer run.

Tentative Valuations

| Particulars | India Cement | Ultratech | JK Lakshmi Cement |

| Assigned Market Valuation (₹ Crores) | 12,000 | 3,29,300 | 9700 |

| Borrowings (₹ Crores) | 2611 | 10,297 | 2024 |

| Enterprise Value (₹ Crores) | 14,526 | 3,33,330 | 11,130 |

| Total Capacity (MTPA) | 14.45 | 154.86 | 16.5 |

| Enterprise Value per ton (₹) | 10,053 | 21,525 | 6745 |

Please note:

- Above calculations are tentative.

- Assigned market valuation for the acquisition of 22.7% equity stake was at 30% discount to the assigned valuation while acquiring the controlling stake & open offer price.

- Ultratech market valuation is as on 6th August 2024.

Ultratech will acquire India Cement at a much lower enterprise value per ton. Recently, Ultratech bought Kesoram having a total capacity of 10.75 MTPA at enterprise value per ton of INR 7070 & Century Textiles cement business at enterprise value per ton of INR 6073. In a way, it seems India Cement fetched a better valuation. those acquisitions were through demerger of the cement business and consideration was in the form of shares of UltraTech Cement.

Conclusion

This is one more Acquisition for UltraTech to reach its goal and particularly to service the south market. where UltraTech to become pan India cement producers. For regulatory reasons, it was stated that India Cement will continue to operate as a separate company.