At a time when most sectors are reporting a slowdown in business because of the Covid-19 pandemic, online education business or ed-tech is booming. More and more students are attending virtual classrooms and educational institutions are adopting digital learning. The ed-tech sector is now drawing the attention of investors as digital learning will grow and consolidate.

Facebook-backed Unacademy, a leading online learning platform in the country, has acquired a majority stake in the K-12 learning-focussed platform Mastree for $5 million (Rs 38 crore). This will be the company’s fourth acquisition. In June, it acquired medical education platform PrepLadder for $50 million, acquired online exam preparation startup Kreatryx in March and also acquired CodeChef, an online platform for coders.

For the records, in 2018, early-stage venture capital WaterBridge Ventures, which had invested $1 million in Unacademy in 2016, exited. It got a return of five times on its investment. Unacademy paid the money from the $21 million (Rs 144 crore) investment from Sequoia, Nexus and SAIF Partners as part of Series C round of funding.

In February 2020, Bengaluru-based Unacademy raised $110 million (Rs 787 crore) from Facebook, US-based private equity firm General Atlantic and other investors including Sequoia Capital India, Nexus Venture Partners, Steadview Capital and Blume. Even in June 2019, the company received funding of $50 million as part of its Series D round from Steadview Capital, Sequoia, Nexus, Blume and others. There are various media reports which say that Japanese investment giant SoftBank is in advanced talks to invest up to $200 million in the company at a valuation of $1.2 billion.

Acquisition of Mastree

Bangalore-based Mastree was founded by Shrey Goyal and Royal Jain in 2019. The company’s core business model is to help students and parents bridge the gap between foundational learning and the challenging transition to middle school. The company is building subscription products for Science, Technology, Engineering, Arts and Mathematics (STEAM) courses, for classes V to VIII, which will include live classes in small groups for mathematics, science, public speaking, creative writing, etc. Along with live classes, students can also utilise various features like doubt solving, unlimited personalised practice, quizzes, etc.

Acquisition of PrepLadder

The acquisition of PreLadder Pvt Ltd by Unacademy was done in a cash-and-stock deal for $50 million (Rs 374 crore). The acquisition of PrepLadder plays a strategic role for Unacademy in the medical entrance examinations category. Chandigarh-based PrepLadder was founded by Deepanshu Goyal, Vitul Goyal and Sahil Goyal in 2015. The company provides online preparation material for medical PG and Foreign Medical Graduates Examination and has over 86,000 active subscribers. It is an ideal example of creating value for a niche but premium audience.

About Unacademy Group

Unacademy is an education technology platform founded by Gaurav Munjal, Roman Saini, and Hemesh Singh in 2015. It started as a YouTube channel. Unacademy Group consists of Wifistudy, Kreatryx, PrepLadder, and CodeChef.The objective of the company is to bring quality and affordable education to students by enabling them to learn from India’s top educators. At present, the platform currently has over 20,000 educators, 30 million students and caters to over 35 exam categories. Unacademy has ventured into numerous fields like banking, CA, CAPF, UPSC, CLAT, CAT, JEE, pre-medica, etc.

Rising importance of ed-tech

After the Covid-19 pandemic, there has been an increasing adoption of digital learning and online classes right from schools, to colleges and universities and coaching centres for various exams. With social distancing norms likely to stay for some time, students will prefer to take online classes and complete their syllabus. While many start-ups are finding it difficult to raise capital, sectors like ed-tech and health-tech are seeing a lot of funding and consumer demand.

In fact, in July Vedantu, an interactive online tutoring platform where teachers provide school tuitions to students over the internet, raised a fresh $100 million in funding, led by US-based Coatue. Byju’s too raised fresh funds from US-based Bond and the online ed-tech company was valued at $10.5 billion. Similarly, Topper raised Rs 350 crore in July from Foundation Holdings and existing funders and the company’s total fundraising now stands at Rs 700 crore.

The importance of ed-tech will grow simply because many children in the country fail to achieve minimum standards because of poor-quality classroom teaching. Ed-tech can be a great aid to complement classroom teaching and the modules can help students to learn faster and in an interactive way. With growing internet connectivity and lower prices, ed-tech can reach every corner of the country.

Moreover, with artificial intelligence and virtual and augmented reality, lifelong learning will become the new norm and education modules will now have to be tailored to an individual’s needs. Ed-tech like online classes, adult learning apps, virtual learning, and online certification can redefine formal higher education and can transform the traditional career path of an individual at any age.

In fact, the rapid growth of Unacademy’s subscriber base and the acquisitions done clearly reflects the demand for quality online education in the country, especially at a time when all educational institutions are shut. However, the challenge for the ed-tech companies will be to sustain the momentum gained in the future once education institutions open after the Covid-19 pandemic eases out.

M&As in ed-tech

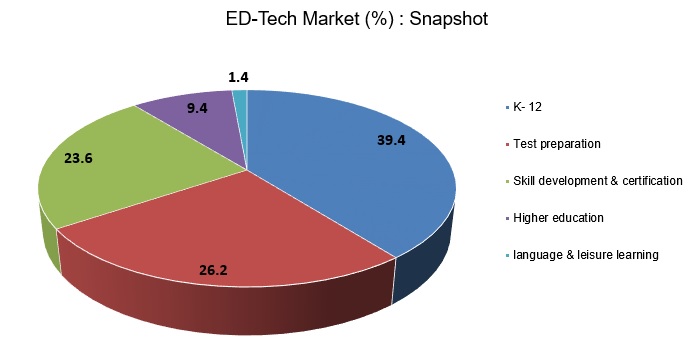

India’s online education market is expected to touch $2 billion by 2021 from $247 million in 2017, according to consultancy firm DataLabs by Inc42, because of cheap internet, rising use of smartphones, laptops and tablets and ever-growing demand for reskilling to stay ahead of the competition the education and job market.

Globally, according to Barclays Research, ed-tech expenditure is likely to rise over 12% every year to $342bn by 2025. It is still less than 5% of overall education expenditure, clearly indicating a huge potential ed-tech in the years to come. The government in India is taking a more favourable view of online learning and is expected to formulate conducive policies for the healthy growth of ed-tech startups.

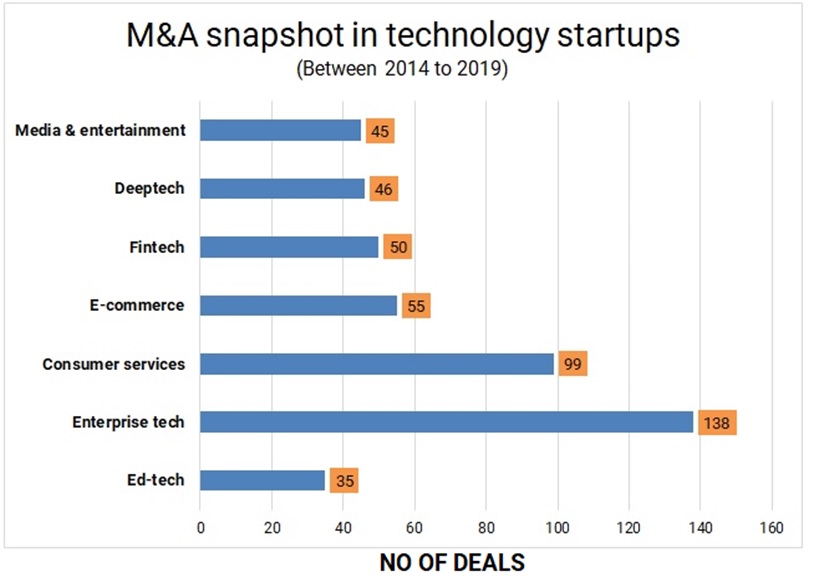

In India, the ed-tech sector will mature as more startups establish themselves either by offering a unique product or gaining market share through acquisitions. As offering unique products will become difficult beyond a stage, the presence of multiple players offering unique propositions will open the vistas for collaborative synergies and mergers. In order to scale up their business, ed-tech companies are aggressively going for mergers and acquisitions. Companies like Unacademy and Byju’s are aggressively pursuing M&A deals with several local startups and many others are in talks. In fact, DataLabs by Inc42’s The Future of India’s $2 bn Edtech Opportunity Report 2020 underlines that between 2014 and 2019 there were 35 ed-tech startups merger or acquisition. It is rising faster this year because of the Covid-19 pandemic.

Mergers in ed-tech will remain focused and companies will acquire those startups that have integrated hardware and software support, efficient and interactive content and pedagogy, captive subscribers and top-class educators. Companies with deep funding sources will acquire startups that have these features and will help to scale up the business, just the way Unacademy or Byju’s are doing.

While many startups have launched ed-tech companies, many have folded up, too. The same report by DataLabs by Inc42 shows that between January 2014 and September 2019, more than 4,450 ed-tech start-ups were launched in India. However, 1150, or 26% of the start-ups have closed their business. Around 194 ed-tech startups have raised funds, clearly indicating that those firms with solid content and efficient software support will be able to raise funds to grow their business. Most of the funding is for test preparation and online certification start-ups because more than 15 million students in India prepare for competitive exams and there is a huge market, especially in smaller towns. As many start-ups will find it difficult to create a steady revenue stream, there will be consolidation which will lead to more mergers and acquisitions.

Conclusion

The four acquisitions were done by Unacademy this year and growing funding appetite for the ed-tech companies with solid content and software support, clearly indicates that the sector is maturing and investors are willing to put money, especially when the entire education system is affected by Covid-19. If a company like Unacademy can have seamless programs to take students from K-12 to double graduate, opportunity will be huge, to reach there, it needs to have more such bolt-in acquisitions. With favorable market conditions and growing demand will make the ed-tech sector a lucrative opportunity for high-value returns for Indian start-up investors.

Add comment