In a move to simplify the promoter’s holding, Voltamp Transformer Limited (“VTL”) announced the amalgamation of promoter entity with VTL.

Voltamp Transformers Limited (VTL), established in 1963, has installed facility to manufacture oil-filled power and distribution transformers up to 160 MVA, 220 KV class, Resin impregnated Dry type Transformers up to 5 MVA, 11 KV class (In Technical collaboration with MORA, Germany) and Cast Resin Dry Type Transformers up to 12.5 MVA, 33 KV class (In Technical collaboration with HTT, Germany). The equity shares of VTL are listed on BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

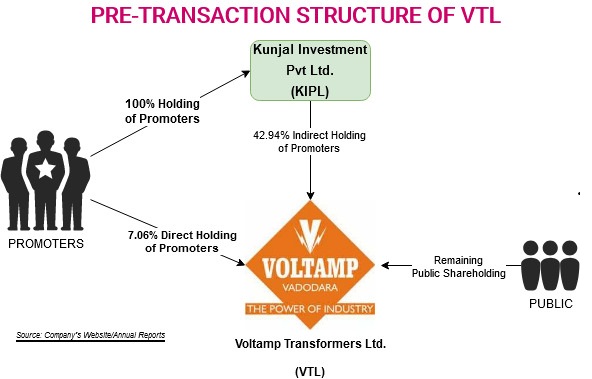

Kunjal Investment Private Limited (KIPL) is a promoter group company holding 43,44,474 equity shares aggregating to 42.94% in Voltamp Transformers Limited. Apart from equity shares of VTL, KIPL does not have any significant assets.

Current Structure of the group

Transaction Detail

Board of Directors of VTL, in their meeting held on 5th May 2020, approved a Scheme of Amalgamation of KIPL with VTL. The appointed date of the amalgamation is 1st June 2020. As a result of the amalgamation, VTL will issue 43,44,474 exactly equivalent existing shares held by KIPL of VTL and the earlier shares held by KIPL will get cancelled. Thus, there will be no change in the shareholding pattern or total number of shares of VTL post-amalgamation.

The proposed amalgamation of KIPL into VTL will result in promoters directly hold shares in VTL. Further, this simplification may result in some tax savings for the promoters on dividend from VTL. The scheme further mentions indemnifying VTL from any liability, claims etc of KIPL.

Re-Alignment of Shareholding Pattern of KIPL

As on 31st March 2019, the significant shareholders of the Company include Kunjal Patel, Lalitkumar H Patel (HUF) and Jwalin K Patel. However, the shareholding pattern as on 1st June 2020 (Appointed Date), the 99.52% shareholding of KIPL is held by Mr. Kunjal Patel and remaining by Mrs. Taral Kunjal Patel.

| Particulars | As on 31st March 2019 | As on 1st June 2020 |

| Kunjal Patel | 64.41% | 99.52% |

| Lalitkumar H Patel (HUF) | 16.30% | 0 |

| Jwalin K Patel | 18.75% | 0 |

Buyback of Shares of KIPL

On 24th February 2020, KIPL passed a Board Resolution for approval of buyback of up to 38 equity shares representing 2.92% of total paid-up capital of the company at a price of INR 42,06,647 per share. Through buyback, KIPL distributed INR 15.98 crores to its shareholders. The company further amended its MOA & AOA on the same date.

| Particulars | Number |

| Total No. of Shares before Buyback | 1301 |

| Total No. of Shares after Buyback | 1263 |

Transfer of Shares to KIPL

During the last 5 years, KIPL has acquired shares of VTL through open market and through int-se transfer amongst promoter group.

| Particulars | KIPL Stake | Other Promoter |

| KIPL stake in VTL as on 31st March 2015 | 37.57% | 9.91% |

| KIPL acquired from Kunjal Patel on 20th Feb 2020 | 0.84% | NA |

| KIPL acquired from Ayushi Patel on 23rd Dec 2019 | 0.85% | NA |

| KIPL acquired from Jwalin Patel & Kunjal Patel on 30th Sep 2019 | 1.66% | NA |

| As on 30th September 2020 | 42.94% | 7.06% |

In addition to above, KIPL from Market has acquired shares of VTL. Further, Kunjal Patel have also increased his shareholding in the Company. Apart from Kunjal Patel, all other promoters have transferred their stake to KIPL. The value of investment in VTL in the books of KIPL has gone up from INR 2.36 cr as on 31st March 2018 to INR 65.59 cr as on 8th May 2020.

One of the reasons for re-alignment of shares could be family arrangement as all other promoters transferred their entire shareholding to KIPL which indeed was significantly acquired by Kunjal Patel.

Transfer of Assets & Liabilities of KIPL

As on 31st March 2019, KIPL was holding significant value of investments in properties, Bonds, Equity Instruments, Mutual Funds, and vehicles etc. However, as on appointed date, the only significant assets held by the company is investment in VTL. One of the reasons for choosing Appointed Date as 1st June 2020 could be re-alignment of shareholding & other assets in KIPL.

Applicability of Grandfathering clause

Though the scheme will be tax neutral for all the stakeholders, the scheme may result in additional tax liability in the hands of promoters (for the 43,44,474 newly allotted shares) in case if they decide to sell the newly acquired shares in future.

The Financial Budget 2018 has withdrawn tax exemption provided under Section 10 (38) of Income Tax Act, 1961 in which long term capital gain (LTCG) arising from the sale of listed equity securities were exempted. Now Section 112A has been inserted which seeks to levy tax on LTCG. However, the investments made on or before 31st January 2018 have been “grandfathered” and the cost of acquisition is considered to be the cost as on 31st January 2018.

As per section 55(2) (ac), to claim the benefits of “grandfathering”, the equity shares required to be listed as on 31st January 2018. As a result of the restructuring, the earlier shares held by promoters (through KIPL) in VTL will get cancelled and new shares of VTL will get issued in exchange of promoters shares in KIPL. Equity shares of KIPL being unlisted as on 31st January 2018, one need to evaluate the chances of not getting the benefits of grandfathering when promoter will sell 43,44,474 newly allotted shares.

Though, it is unlikely that promoters will sell shares as those newly allotted shares are substantial part of their holding in the company.

Conclusion

Streamlining the promoters holding in listed company through collapsing the holding subsidiary structure by way of an amalgamation is a common practice. However, in 2018, Mumbai bench of NCLT rejected one similar scheme of Ajanta Pharma Limited stating that the re-structuring only benefits the promoters and not public shareholders. Allowing similar re-structuring is still uncertain, many other companies have filed similar re-structuring after the Mumbai bench’s decision.

The companies are completely trying to safeguard the interest of minority shareholders by incurring all expenditure relating to the restructuring by the holding company and indemnifying the listed entity for any liability or claims.

It looks KIPL started planning early and re-aligned its shareholding and sold/transferred its all other assets. The Scheme will not have any impact on the minority shareholders nor any commercial or strategic benefits to the company. The scheme seems to be the last step in redistributing or say to transfer all shares directly in the name of Shri Kunjal Patel. Though due to change in income tax provisions, it is most likely Shri Kunjal Patel will end up paying tax at higher rate as compared to a company if he decides to sell newly allotted shares in future.

Add comment