West Coast Paper Mills Ltd. (WCPML) has entered into a share purchase agreement to acquire about 51-60% stake in International Paper’s (IP) Indian unit, International Paper APPM Ltd. The stake will be acquired from existing promoters — International Paper Investments (Luxembourg), SARL Luxembourg and IP International Holdings Inc, US. The deal is expected to be completed by the end of the year.

International Paper APPM Ltd (IPAPPM), is one of the largest integrated paper and pulp manufacturers in India. The company produces writing, printing and copier papers for foreign and domestic markets. The company’s production facilities at Rajahmundry and Kadiyam have a total production capacity of 240,000 TPA. Before the acquisition by International Paper, the company name was Andhra Pradesh Paper Mills Limited (APPM).

West Coast Paper Mills Limited (WCPML) is one of the oldest and the largest producers of paper for printing, writing, and packaging in India. Established in 1955, the mill is located at Dandeli in Uttara Kannada district in Karnataka. The global quality paper produced by the company serves the needs of innumerable industries in printing, writing, publishing, stationery, notebooks and packaging sectors in India.

International Paper (IP), the promoter of IPAPPM, is a leading global producer of renewable fibre-based packaging, pulp and paper products with manufacturing operations in North America, Latin America, Europe, North Africa, India and Russia. It produces corrugated packaging products that protect and promote goods, and enable world-wide commerce; pulp for diapers, tissue and other personal hygiene products that promote health and wellness; and papers that facilitate education and communication.

The Transaction

The promoters of IPAPPM namely International Paper Investments (Luxembourg) S.a.r.l. and IP International Holdings Inc. (together known as IP) are holding ~55% and ~20 respectively, comprising 75% of the issued and paid up equity capital of the company on a fully diluted basis, have executed a Share Purchase Agreement (SPA) on May 29, 2019 with WCPML (Purchaser). As per the SPA, the purchaser has agreed to acquire such number of equity shares of the company from the sellers aggregating to a minimum of 51% and up to a maximum of 60% of the issued and paid up equity share capital of the company as per the terms and conditions stated in the SPA.

- Where the equity shares to be acquired by the acquirer in the Open Offer represent 5% or more of the voting share capital, the acquirer will acquire such number of equity shares held by the promoters which will represent a minimum of 51% (or up to a maximum of 55% at the sole discretion of the acquirer) of the voting share capital; or

- Where the equity shares to be acquired by the acquirer in the open offer represent less than 5% of the Voting Share Capital, the acquirer will acquire such number of Equity Shares held by the Promoters which will, including the Equity Shares to be acquired by the Acquirer in the Open Offer, result in a post-transaction shareholding of the acquirer of a minimum of 56% (or up to a maximum of 60% at the sole discretion of the Acquirer) of the Voting Share Capital.

Once this transaction closes, WCPM will be responsible for the operations of APPM, and International Paper will be a passive investor until such time that IP has sold its remaining shares in APPM.

Further, WCPML has also announced an open offer for acquiring 99,42,510 equity shares representing 25% of the equity capital of APPM at INR 450.63 per share. This amount to 63.83% premium over what WCPML is paying APPM’s existing promoters and 10% premium to present market price

History of APPM

In 1966, Mr. Somani had transferred his rights and obligations of Andhra Pradesh Paper Mills to the West Coast Paper Mills Ltd., which in turn transferred its ownership in 1981 to Digvijay Investments Ltd. controlled by Mr. L N Bangur (“Erstwhile Promoter”)

In a move to enter the Indian markets, International Paper acquired majority ownership in APPM in October 2011. IP acquired 75% stake for ₹1886 crore. It purchased 53.46% stake from the company’s erstwhile promoters—L.N. Bangur and his family for ₹1,145 crore and ₹276 crore for payment of non-compete fees. It further acquired 21.57% stake through an open offer for ₹466 crore. IP had paid a premium of about 205% i.e. ₹544 per share on its market price at that time.

Financials

Table 1: Financials of IPAPPM over the years (All Figs in ₹Crores)

| Particular | 2011 | 2016 | 2019 |

| Revenue | 588 | 1159 | 1427 |

| EBITDA % | 19.2% | 11.8% | 27.5% |

| EBIT % | 10.5% | 5.5% | 22.7% |

| PAT % | 0.0% | 3.2% | 14.0% |

| Networth | 480 | 451 | 763 |

| Total Borrowings | 381 | 447 | 12 |

| Capital Employed | 861 | 898 | 775 |

| Fixed Assets | 867 | 836 | 715 |

| RoE | 0 | 3.2% | 14.0% |

| RoCE | 7.2% | 7.1% | 41.8% |

| Fixed Asset Turnover | 0.67 | 1.38 | 1.99 |

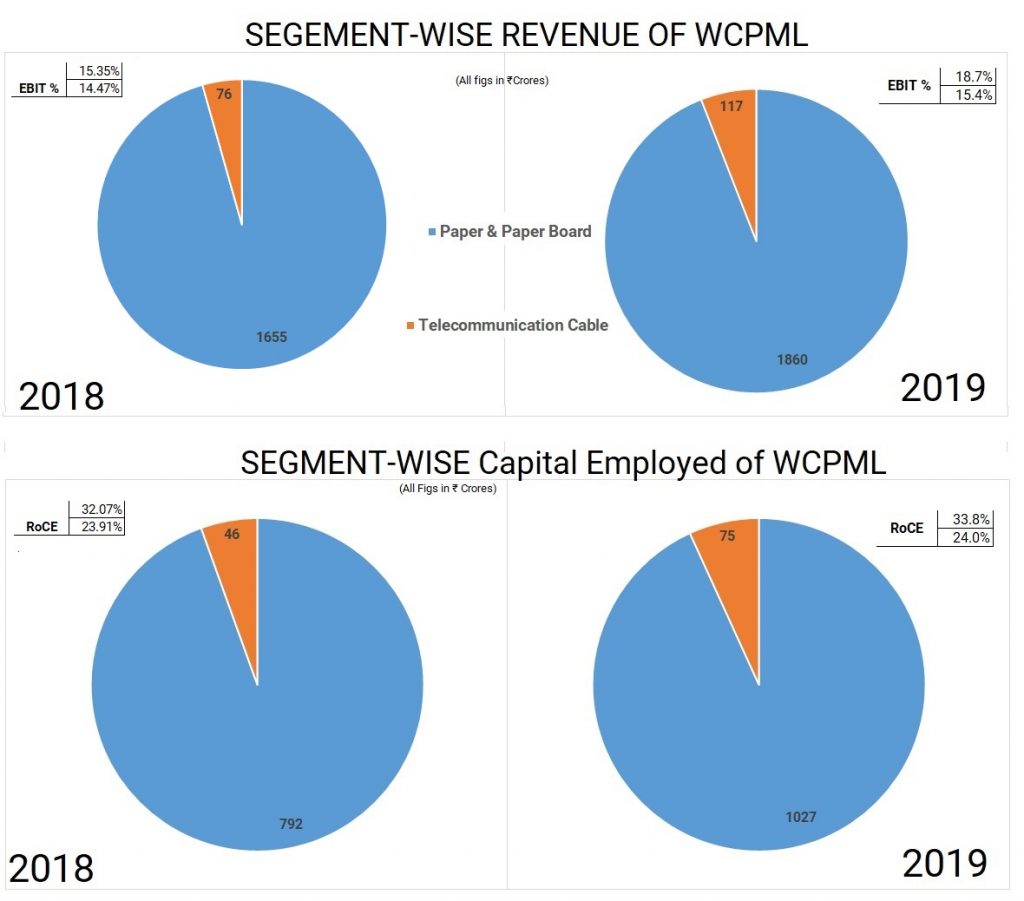

Table 2: Financials of West Coast Paper Mills (All Figs in ₹Crores)

| Particulars | 2018 | 2019 |

| Revenue | 1732 | 1977 |

| EBITDA % | 21% | 26% |

| EBIT % | 14.1% | 16.9% |

| PAT % | 13% | 15% |

| Networth | 838 | 1103 |

| Total Debt | 254 | 312 |

| Fixed Assets | 1036 | 1027 |

| ROE | 26.6% | 26.8% |

| ROCE | 22% | 24% |

| Fixed Asset Turnover Ratio | 1.67 | 1.93 |

Post IPAPPM acquisition, WCPML’ revenue from Paper & Paper Board business will be circa INR 3300 with EBIT margins of 20%. However, considering the incremental debt, WCPML’s return on Capital Employed from Paper & Paper Board business is likely to decline significantly. As on March 31, 2019, the surplus cash & Cash equivalent available with WCPML is around INR 230 crore. It has a total debt of more than INR 300 crore on its books. If it acquires 55% from the existing promoters of IPAPPM & 20% from the public, WCPML will be requiring around INR 950 crore.

Assuming, it will use all surplus cash to fund this acquisition, it will be required to arrange INR 720 more for this acquisition. If the remaining funds have been borrowed by the company, its debt-equity ratio will get changed from 0.30 to slightly lower than 1. Further, as per the latest filing by the company with the exchange, it will further be required INR 130 crore for cable business expansion.

Valuation

Loss/Gain for IP:

Table 3: Loss/Gain for International Paper

| Particulars | 2011 | 2019 |

| Total Consideration for 55% Stake (₹Crores) | 1392 | 601 |

| Gain/(Loss) in ₹ | -57% | |

| $ Rate | 48.78 | 69.58 |

| Total Consideration ($ Million) | 285 | 6 |

| Gain/(Loss) in $ | -70% | |

Table 4: Valuation Multiples

| Particulars | 2011 | 2019 |

| Deal Enterprise Value | 2,500 | 1,300* |

| Market Capitalisation | 1,125 | 1,700 |

| EV/EBITDA | 22.12 | 3.32 |

| *This is arrived using 55% WCPML will acquire from promoter @275 per share @ 20% from public @ 450.68 per share. | ||

IP paid a whopping premium to enter a high potential Indian market. Their plan was to integrate the international business with the Indian business. They took several steps to implement their global best practices in India. During the last eight years, they also changed the top management couple of times. WCPML is effectively buying control of IPAPPM at just 3.32 EV/EBITDA multiple vs 22 which IP paid in 2011. The consideration to be paid to the IP is significantly lower than its current market price. IPAPPM has started yielding a result for the company as operational profit margins improved from 10% to 23%.

Conclusion

The decision of International Papers to exit after nurturing and making one of the most efficient paper mills is difficult to understand. More puzzling is the fact that IP is exiting the business ~70% discount (in $ terms) to acquisition price. It seems that it is likely to be a result of global strategy to exit country or products. The relation of APPM & WCPML is not new. In 2012, IP was in talks with WCPML to acquire later. However, the deal couldn’t sail through.

For IP the deal is a result of its strategy to expand its packaging and cellulose fibre business. Considering the fact that IP has decided to sell its up to 60% stake at a significant discount to the current market price, it looks no other player is ready to acquire IPAPPM or not giving an appropriate consideration. In future, IP could sell its remaining stake at much better valuation helping them to minimise its losses.

This acquisition could give WCPML a golden opportunity to strengthen its arm. In future, they could demerge their cable business &merge IPAPPM with itself. It will be interesting to see how WCPML can able to pull out the synergies from this leverage acquisition.

Add comment