With an aspiration to grow in consumer wellness space, Ahmedabad based listed company Zydus Wellness Limited announced acquisition of an entity which is more than double in terms of revenue but almost equal to the price of its own. The move is going to do or die situation for the company.

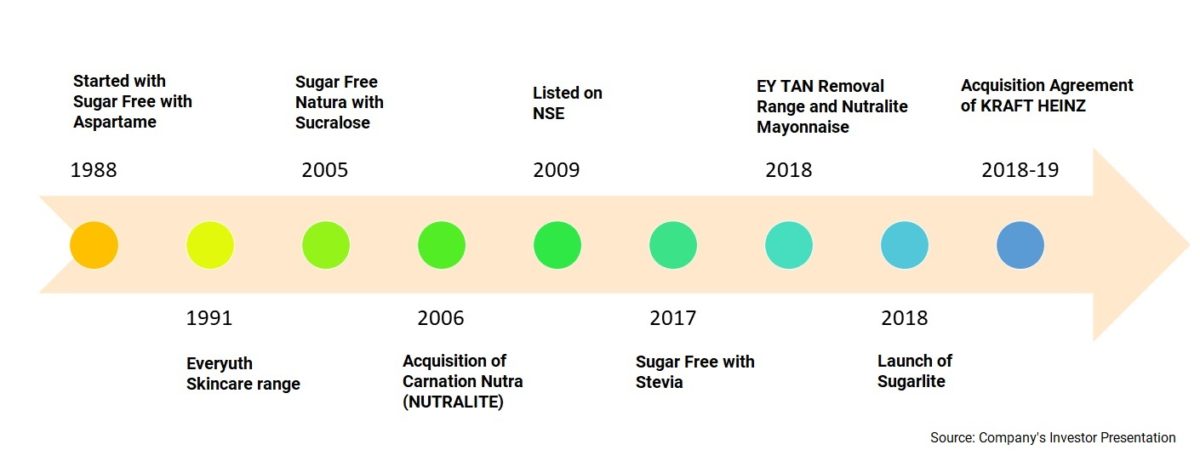

Zydus Wellness Limited (Zydus) is the listed entity of Zydus group and is one of the leading companies in the fast-growing Indian consumer health market. The company has grown over the years on the back of pioneering brands like Sugar-Free, EverYuth and Nutralite and innovations offering new benefits to consumers. Sugar-Free, the flagship brand of Zydus Wellness, launched in 1988, is currently having with over 93% market share.

The Kraft Heinz Company (Kraft) is the fifth-largest food and beverage company in the world. Company’s iconic brands include Kraft, Heinz, ABC, Capri Sun, Classico, Jell-O, Kool-Aid, Lunchables, Maxwell House, Ore-Ida, Oscar Mayer, Philadelphia, Planters, Plasmon, Quero, Smart Ones and Velveeta. In India, the group operated under Heinz India Private Limited (Heinz) with brands like Complan, Glucon D, Nycil, Sampriti Ghee and Ketchup.

In 1994, Heinz acquired this product portfolio from Glaxo India Ltd. for about $70 million. The division that time had annual sales of about $50 million, with products like Complan adult nutrition drinks, Glucon beverage mixes, Farex baby foods, Glacto infant formula and Nycil talcum powders.

The Transaction

The company has entered into definitive agreement to acquire 100% equity shares of Heinz India Private Limited, the subsidiary of Kraft Heinz jointly with Cadila Healthcare Limited (Cadila) on October 24, 2018.

The purchase consideration for the deal is ₹4595 crore. The acquisition of Heinz India brand includes Complan, Glucon D, Nycil and Sampriti Ghee. Combined together, the current market size for Zydus will become around 11,000 crore & it will have the share of 15%. The deal will be financed partly through the surplus cash available with Zydus and the remaining amount through 1/3 debt and 2/3 equity. The transaction is expected to close in early 2019, subject to regulatory approvals.

Table 1: Funding Bifurcation (All Figs in Crores)

| Particulars | Amount |

| Purchase Consideration | 4,595 |

| Surplus Assets | 561 |

| Assumed Utilisation | 500 |

| Remaining Funding* | 4,080 |

| Mix | |

| Debt @ 1/3 | 1,360 |

| Equity @ 2/3 | 2,720 |

*: After cash available with Heinz

Shareholding Pattern

Currently, Cadila Healthcare Limited, Promoters other listed company, holds 72.08% stake in the company and 100% stake of Heinz is held by its parent company. As told by the management during con-call, 2/3 of the deal is going to be financed through equity infusion by Private Equity players & partly by Cadila. Assuming the equity infusion takes place at INR 1200 per equity shares, the dilution will be around ~37%.

Table 2: Shareholding Changes post acquisition

| Particulars | Amount |

| Existing No. Of Shares | 3,90,72,089 |

| Fresh Equity Infusion @ | 1,200 |

| No. of shares will be issued | 2,26,67,800 |

| New Capital | 6,17,39,889 |

| % dilution | 36.7% |

Product Integration

Zydus’ Sugar-free has a market share of almost 93% in its segment. Most of the other products of Zydus also command significant market share in their own categories. However, the situation is quite different for Heinz. Their products are mainly into fragmented space. The largest brand amongst Heinz product is Glucon-D. However, there can be multiple product synergies available to Zydus. For e.g. Zydus can start Heinz product using sugar-free, cross-selling of products and can use each other’s distribution network to expand the product reach. Zydus can plan to bring the whole segmentation in Complan brand which was done by the other players in the same category. Currently, Sampkriti Ghee has presence only in B2B segment. Going forward Zydus can launch it in B2C segment. With two large manufacturing facilities in Aligarh and Sitarganj, Post -integration, the combined entity will have five manufacturing units, 1800 distributors and 2 million customer touch points.

Financials

Table 3: Financials of Zydus and Heinz (All figs in Crores)

| Particular | Heinz* | Zydus |

| Turnover | 1150 | 503.15 |

| EBITDA% | 19.6% | 25% |

| PBT | NA | 149.75 |

| PAT | NA | 136.52 |

| Enterprise Value | 4,595 | 3,914 |

| EV/EBITDA Multiple | 20.4 | 31.2 |

*Heinz figure are for twelve months ending on 30th June 2018.

As on 30.09.2018, the cash (including bank balance & investments) available with Zydus was around INR 560 crore. Both the companies are having negative working capital. Post- Acquisition, the margins are likely to be deceased for Zydus. Additionally, the interest payment will affect its profitability. It will be interesting to see how timely Zydus will manage to get back its current return on capital employed, post-acquisition.

Currently, Zydus is trading at the premium due to high margins on niche products, high ROCE and negative working capital etc. As Heinz is not a market leader of any of its product portfolio, Zydus paid 33% lower EBTIDA multiple and rightly so.

Conclusion

For Heinz, this acquisition will help them to focus on investing in and growing brands within their core categories mainly ketchup. For Zydus, this acquisition is the opportunity to go into high growth situation with multiple well-known brands. Since last few years, Zydus was looking for the target which fits into its strategy. It built a war chest of INR 560 crore. This acquisition will definitely be going to provide the best opportunity for Zydus to scale its operations rapidly but not without multiple challenges. Since the last couple of years, growth for Complan & Glucon D is stagnant. To bring them back on double-digit growth is going to be the key challenge for Zydus.

Further, Heinz is an American Company hence the integration in terms of culture, HR issues including pay scale and distribution channel of both the companies are going to be a tough task for the management. The strategy to have similar ROCE in the business of acquired brands has to be quite different as it has formidable competitors and customer profile looking at value proposition. Further, the regulators like Competition Commission of India approval is going to be important for the deal to get through. Only time will tell whether this bet by Zydus will help them to add more sugar to the company or become sour for the company.

Add comment