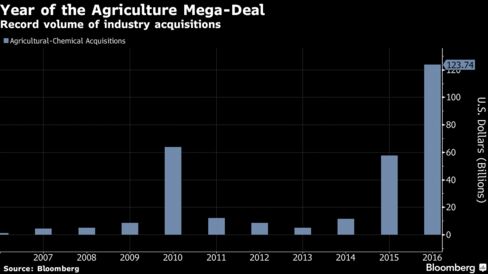

It’s unlikely to be easy sailing when Potash Corp. of Saskatchewan Inc. and Agrium Inc. take their plans to combine and become the world’s top fertilizer company in front of regulators.

The blame lies with the timing, said Jonas Oxgaard, a New York-based analyst at Sanford C. Bernstein & Co. The Potash-Agrium merger was announced Sept. 12, just two days before Bayer AG clinched a deal to by Monsanto Co. after a months-long chase. Both are among a string of global mega deals that are likely to transform the agriculture industry, something that has sparked protests from farmers.

Antitrust officials around the world, who are already grappling with a wave of consolidation across agriculture, will be forced to sort through a new layer of complexities following last week’s deals. The grain market rout has ignited a mergers-and-acquisitions wave as companies that count farmers as their customers deal with falling demand and lower prices.

String of Deals

Monsanto, the world’s largest seed company, accepted Bayer AG’s $66 billion takeover bid seven months after China National Chemical Corp. agreed to acquire Swiss pesticide maker Syngenta AG for about $43 billion. Meanwhile, DuPont Co. and Dow Chemical Co. plan to merge and then carve out a new crop science unit.

Shares of Agrium rose 0.5 percent to close at $90.04 in New York while Potash Corp. was down 0.2 percent at $15.96.

Potash Corp. and Agrium could face scrutiny over the combined company’s size, said Seth Bloom, president of Bloom Strategic Counsel, a Washington-based firm that deals with antitrust issues. He estimates that the new company would control the majority of North America’s potash production, which could draw the ire of regulators.

A combined company would control more than 30 percent of North American nitrogen and phosphate production, said Bloomberg Intelligence analyst Jason Miner. While it’s up to Canadian regulators to approve the $26 billion deal, U.S. producers have already raised concerns with federal agricultural officials in Washington about the scope of recent market consolidation, he said.

Possible Divestitures

“Some divestitures will certainly occur,” Miner said in a telephone interview. “It’s a question of how the U.S. can affect the Canadian thinking if it’s anti-competitive.”

Potash Corp. and Agrium expect the transaction will close in mid-2017 and are confident in the value created by the merger and operating efficiencies that will better serve customers, the companies said in an e-mailed statement.

Agrium Chief Executive Officer Chuck Magro declined to speculate on potential asset divestitures during a call with investors on Sept. 12, but he said the companies “have every bit of confidence that we can see this transaction go through as is.”

Agrium’s nitrogen and phosphate assets are concentrated in western North America while the majority of Potash Corp.’s similar assets are in the eastern half of the U.S., resulting in low regional market overlap, Paul Forward, a Stifel Nicolaus & Co. analyst, said in a note. While Agrium’s Vanscoy potash mine will add to Potash Corp.’s significant market concentration for the crop nutrient, that will be offset by large capacity additions coming online globally, he said.

Farm Groups

Some farmer groups in the U.S. have voiced concern about how industry consolidation may reduce choices and raise prices. Members of the National Farmers Union, the second-biggest organization of its kind, met legislators in Washington on Sept. 12 to protest against the deals. Farmer concerns could be a “big obstacle to the merger,” for Potash Corp. and Agrium, said Bloom of Bloom Strategic Counsel.

Regulators on both sides of the border should consider farmers when they review these deals, said Kolby Nichol, vice president of business development at Winnipeg, Manitoba-based Farmers Edge Inc., a precision agriculture company.

“If they’re looking to price out fertilizer and they have fewer people to talk to and fewer suppliers for that, that’s a concern” for farmers, Nichol said.

Recent Articles on M&A

Source: Bloomberg.com