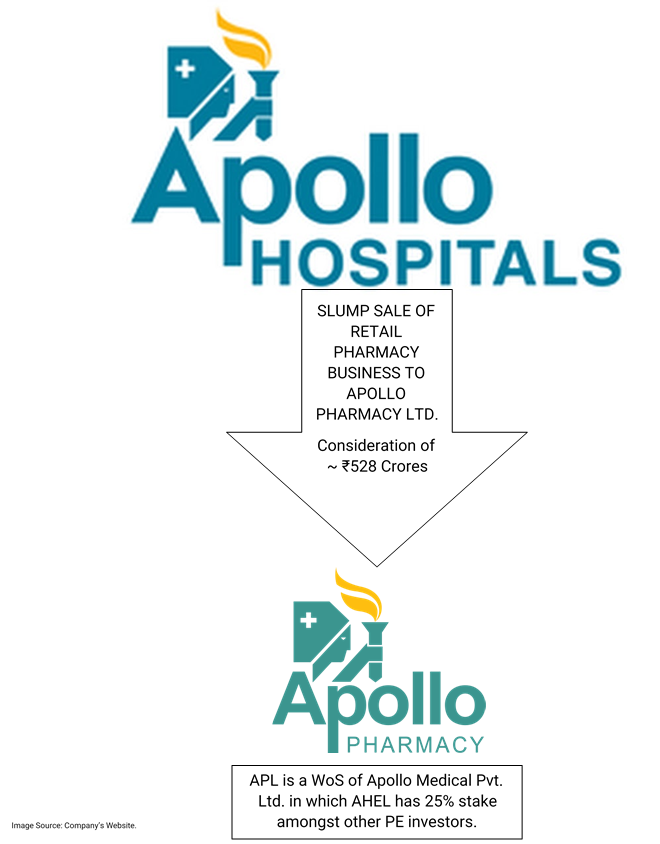

In order to streamline the group’s business and maximise shareholder value, the country’s largest private sector healthcare provider, Apollo Hospitals has spinned off its front-end retail pharmacy business into Apollo Pharmacies (APL), which in turn will be a wholly-owned subsidiary of Apollo Medicals Pvt Ltd (AMPL). Also, Apollo will enter brand licensing agreement with APL to licence the Apollo Pharmacy brand to the frontend stores and online pharmacy operations.

The reorganisation, according to the company, will not have a material impact on the financials of Apollo as the backend business related to the standalone pharmacies will continue to be held by Apollo. The reorganisation enables Apollo to be compliant with the norms of foreign direct investment (FDI) limits and further grow the pharmacy retail business. At present, retail pharmacy business comes under the category of multi-brand retail, where FDI is allowed up to 51%.

The organised pharmacy retail accounts for less than 5% of India’s $15 bn domestic pharmaceutical market which is estimated to grow 10-12% CAGR in the next five years, driven mainly by volume growth. Better growth in domestic sales will, however, depend on the ability of pharma companies to align their product portfolio towards chronic therapies for diseases such as cardiovascular, anti-diabetes, anti-depressants and anti-cancers as these diseases are increasing in the country because of various lifestyle changes.

[rml_read_more]

Apollo Hospital Enterprises Limited (AHEL) is a listed company engaged in the business of enhancing quality of life of patients by providing comprehensive, high quality hospital services on a cost-effective basis. The principle activities of the company include operation of multi-disciplinary private hospitals, clinics, and pharmacies.

Apollo Pharmacies Limited (APL) is an unlisted public company incorporated in 2016 till date having no business, engaged in the business of buying, selling, importing, exporting, distribution or dealing in a manufacturing, medical and pharmaceuticals products. APL is a wholly-owned subsidiary of Apollo Medicals Pvt Ltd (AMPL).

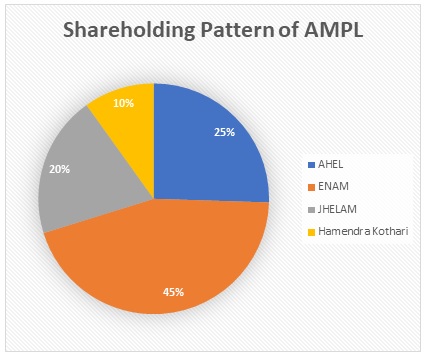

AMPL is a holding company of APL. AHEL holds a 25.5% stake along with three investors viz. Jhelum Investment Fund 1 (19.9%), Hemendra Kothari (9.9%) and ENAM Securities Pvt Ltd (44.7%) in AMPL.

The Transaction

In a move to separate its front-end pharmacy business, AHEL has sold its “Divestment Business” to APL through slump sale for a consideration of ₹527.8 Crore.

“Divestment Business” means the business of front-end retail pharmacy carried out at standalone pharmacy and front-end retail pharmacy activity carried out through online platform for retail pharmacy and includes without limitation the divestment assets, the divestment liabilities the divestment employees and approval for conducting the standalone pharmacy business and online platform for retail pharmacy business.

The back-end supply chain of AHEL’s pharmacy business will continue to be housed in AHEL. AHEL will be the exclusive supplier for APL under the long-term supplier agreement. AHEL will enter into a brand-licensing agreement with APL for the use of the Apollo Pharmacy brand. The fees for this arrangement will be decided annually.

The appointed date for the transaction is 1st April 2019.

Shareholding Pattern

AHEL shall have the right/obligation to acquire the shares of AMPL from the Investors in terms of such definitive agreements and in compliance with the regulatory framework that may be applicable at the time of said acquisition.

Rational of Scheme:

- Divesting standalone pharmacy business and utilizing the proceeds towards growth and enhancement of the other existing business.

- Enhancing strategic flexibility to build a variable platform solely focusing on each of the businesses.

- Creation of value for shareholders by acquiring ready-to-use assets, including business undertakings and reducing time to markets.

- Enhancing the private label business.

- Enabling foray into digital/online Pharmacy.

- The transaction done through this structure due to FDI in retail sector.

Financials

Table 1: Financials of AHEL for FY 17-18 (All Figs in ₹ Millions)

| Standalone Financial Results of AHEL | |||||

| Particulars | Pharmacy & Clinic | Healthcare & Other | TOTAL | Slump Sale | Remaining Pharmacy Business |

| Revenue | 32,688 | 39,267 | 71,955 | 4,903 | 27,785 |

| Results | 1,174 | 4,529 | 5,703 | 176 | 998 |

| Assets | 9,372 | 68,748 | 78,121 | 4,580 | 4,792 |

| Liabilities | 1,539 | 39,647 | 41,186 | 328 | 1,211 |

| Net Worth | 7,834 | 29,101 | 36,935 | 4,252 | 3,582 |

The Divestment Business represent ~45% of Standalone revenue and ~12.66% of Standalone net worth of AHEL. PBT for the FY17-18 stands at ₹3,301 Million.

Apollo pharmacy today has grown from ~170 outlets in FY 05 to 3167 as of September 30, 2018, in ~400 cities/town spread over 20 states and 4 Union territories and is currently serving about 3,00,000 customers daily through a dedicated employee strength of about 21000+. APL will target of over 5,000 pharmacy outlets over a period of five years with a goal of over Rs 10,000 crore in revenues.

15% of the SAP (Stand Alone Pharmacy) revenues, or approximately 5% to 6% of consolidated AHEL revenue, will be shifted to the front-end. This amounts to INR 600 crores at top line level. However, given the record of the SAP business, which is grown at 20% consistently, we are confident that there will be no significant impact on AHEL top line going forward.

Wellness Forever Medicare Private Limited had turnover of INR 518* crores in FY 2017-18 and EBITDA of ₹247* crores. however, it keeps all cash flow from efficient sourcing to direct sales to retail customers to itself and it has no cost towards payment of brand licence fees.

*Source: www.indiaratings.co.in

Taxability

As Slump sale is liable to tax under section 50B of Income Tax Act,1961 and Tax calculation is made as follows.

Table 2: Slump Sale Consideration (All Figs in ₹ Million)

| Particulars | Amount |

| Sales Consideration | 5278 |

| Less: Net Worth | 4252 |

| Capital Gain | 1026 |

The tax amount comes to approx. ₹211 Million.

Valuation

Valuation is made on the basis of Income Approach, on the basis of forecast balance sheet as at 1st April 2019.

After slump sale the net worth of AHEL is increased by approx. INR ~815 Million (Capital Gain net-off Income Tax).

Table 3: Net worth* Calculation (All figs in ₹ Millions)

| Particulars | AHEL |

| Pre arrangement Net worth as on 31st March 2018 | 17,968 |

| Post arrangement Net worth as on 31st March 2018 | 18,783 |

| Effect On Net worth | 815 |

*Net-worth = Equity Share Capital + Free Reserve (As per section 2(43) of the Companies Act, 2013) – Misc. Exp.

Post Transaction Strategy

AHEL will use funds to expand its existing business with right/obligation to reacquire the “Divestment Business” from the PE investor as it is having an agreement with PE investor.

AHEL will be the exclusive supplier for APL under a Long-term Supplier Agreement, and AHEL will enter Into a Brand Licencing Agreement with APL to licence the “Apollo Pharmacy” brand to the front-end stores and online pharmacy operations while the back-end business continues to be held by AHEL

The funding plan at APL for the reorganisation will enable sufficient funds to be retained for new business expansion apart from discharging the slump sale consideration. Further the funding to APL is made by PE investor with compliance in FDI.

Conclusion

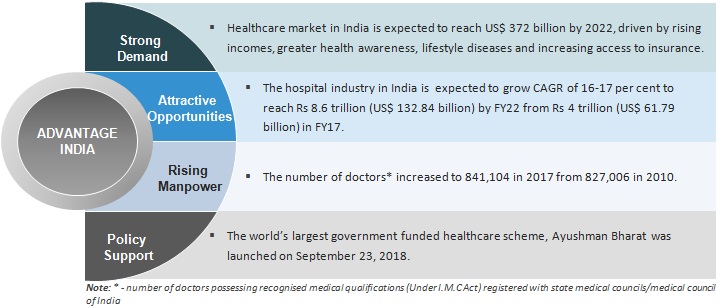

As the Hospital Industry in India is expected to reach INR 8.6 trillion by FY2022 from INR 4 trillion in FY2017, AHEL wants to more focus on hospital industry hence its slump sale its front-end retail pharmacy business to APL and proceeds received from this will be used to strengthen its hospital business.

While doing this, it also wants to encash its brand value and sourcing of all medicines and medical accessories i.e. back-end with itself to encash its relations with pharma companies and suppliers. expansion in front end business will be done by the new investors hence its cash flow does not get diverted to this non-core business. At the end, it has option to buy back share from the investors if AHEL feels it will enhance value in the long term.

You have brought up a very great points , thanks for the post.