In order to meet the disinvestment target of ₹80,000 crore for this financial year, the Cabinet Committee on Economic Affairs has given an in-principal approval for the strategic sale of 52.63% stake in Rural Electrification Corporation (REC) to Power Finance Corporation (PFC) along with transfer of management control. The proposed deal is likely to fetch the government around ₹15,000 crores and after the closure of the deal, REC will become a subsidiary of PFC.

The proposed deal is similar to the one where Oil and Natural Gas Corporation (ONGC) acquired the government’s entire 51.11% stake in oil refiner Hindustan Petroleum Corporation last year for nearly ₹37,000 crores. The upstream state-owned oil behemoth financed the deal with market borrowing of ₹25,000 crores. Also, the proposed deal will be along the lines of government’s idea to create large public sector companies by consolidating companies based of common factors and functions.

In an otherwise stressed sector, both REC and PFC reported robust profits in FY18 and paid hefty dividends to the government. The deal will require approval from the Competition Commission of India and Reserve Bank of India as both the companies operate in the same sector and are non-banking financial companies. The acquisition will increase the leverage of PFC and impact its return on assets and return on equity. The final modalities of the deal are being worked out by the government officials and the leverage of PFC is likely to be close to ₹15,000 crores.

While the acquisition is aimed at achieving the integration of power financing businesses of REC and PFC, the deal might cause value disruption in the power and renewable energy sectors as both the companies are main lenders to renewable energy sector. As at September-end, the government held 57.99% in REC and 65.64% in PFC. However, the government stake in REC came down to 52.63% after stake-sale through the exchange-traded funds.

Interestingly, PFC will not have to make any open offer to minority shareholders of REC after buying the government’s 52.63% stake in the company because it is a related party transaction. In fact, according to the Securities and Exchange Board of India takeover code, if a company acquires more than 25% in another listed company, then it has to make a mandatory open offer to minority shareholders to buy another 26% stake. But, last year after the ONGC-HPCL deal, the former was exempt from making an open offer to minority shareholders of HPCL.

About PFC

Power Finance Corporation Ltd., formed in 1986, is a Navratna CPSE (certified in 2007) and a leading non-banking financial corporation (infrastructure space). The company is under the direct administrative control of the ministry of power. It has a crucial role in the rise of India as a global entity in the power infrastructure financing space. Despite the challenges in the power and financial sectors, PFC has been able to maintain a healthy loan book.

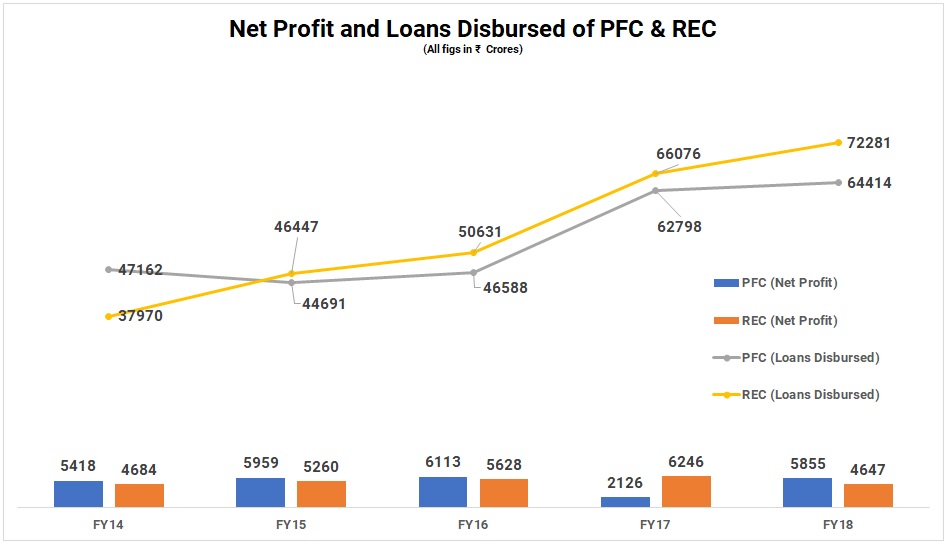

The company’s reserves and surplus were ₹372.21 billion, and cash and bank balance were ₹46 billion at the end of March 2018. It reported net profit of ₹5,855 crore in FY18, a jump of 175% as compared with FY17 and paid dividends of 78%.

In fact, PFC recorded a robust loan asset growth of 14% in FY18 due to highest ever disbursements of ₹64,000 crore in the year and the highest ever sanctions of ₹1,16,000 crores in FY18. Disbursements saw significant jump in the area of renewables and refinancing. Renewable business saw a growth of 260% from ₹2,500 in FY17 to ₹9,000 crores in FY18.

The company has ventured into irrigation schemes and have funded electrical and hydro mechanical components of irrigation schemes in Telangana.

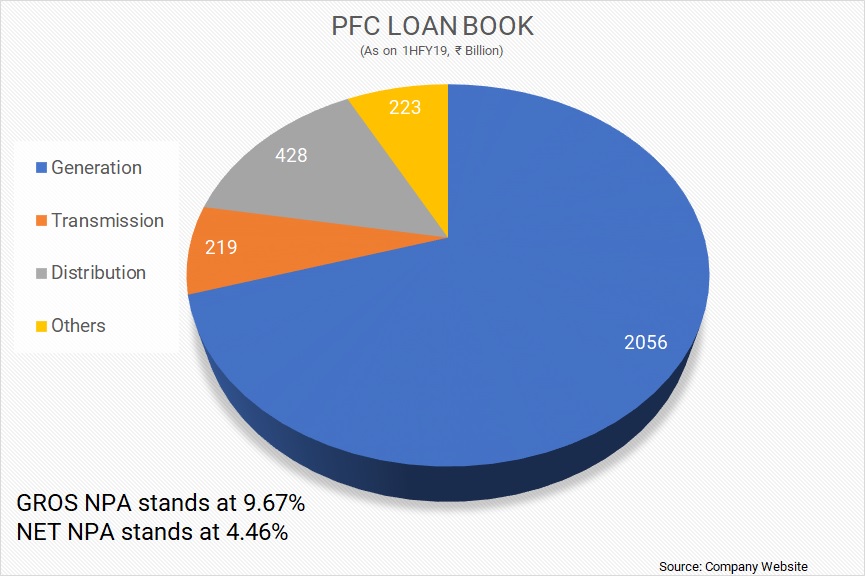

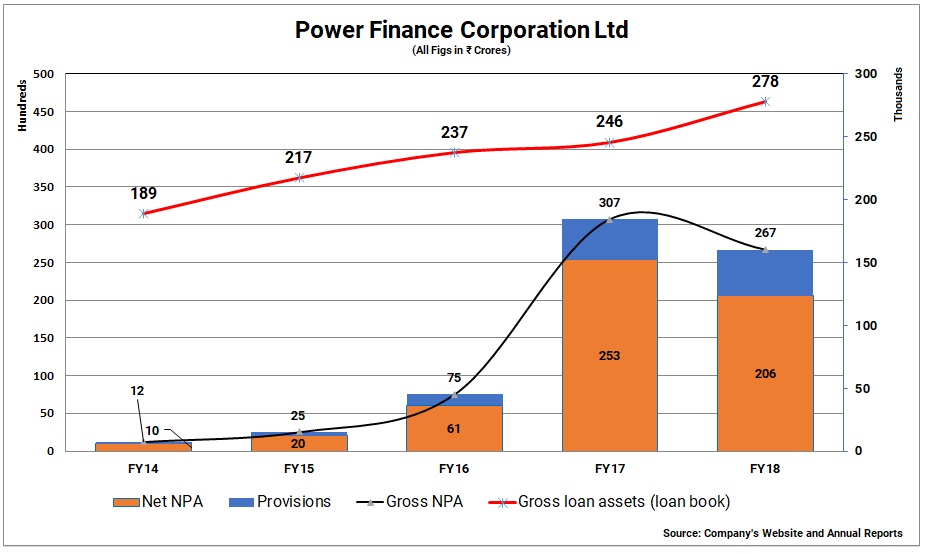

The company has a total loan book of ₹2.79 lakh crore. Out of which government owned projects are 82% that is ₹2.28 lakh crore. There is no financial stress in the government assets. The balance 18% is private sector, that is ₹51,000 crores. There is no stress in ₹20,000 crore that is 7%. Stressed projects are only ₹31,000 crores, that is 11%. So, 89% of the total asset book is not having any kind of stress. Out of the 11% stress projects, 55% are commissioned that is 10GW out of the stressed capacity of 18.4GW. Roughly, 50% have coal linkages and fuel supply agreements. On the resolution, four projects are in advanced stage of resolution amounting to ₹4,300 crores.

REC

The company was formed in 1969 to build infrastructure for rural electrification. It is a Navratna company under the administrative control of the ministry of power and has been rated Excellent in terms of the MoUs signed with the government for 22 consecutive years. The company funds its business with market borrowings of various maturities, including bonds and term loans apart from foreign borrowings.

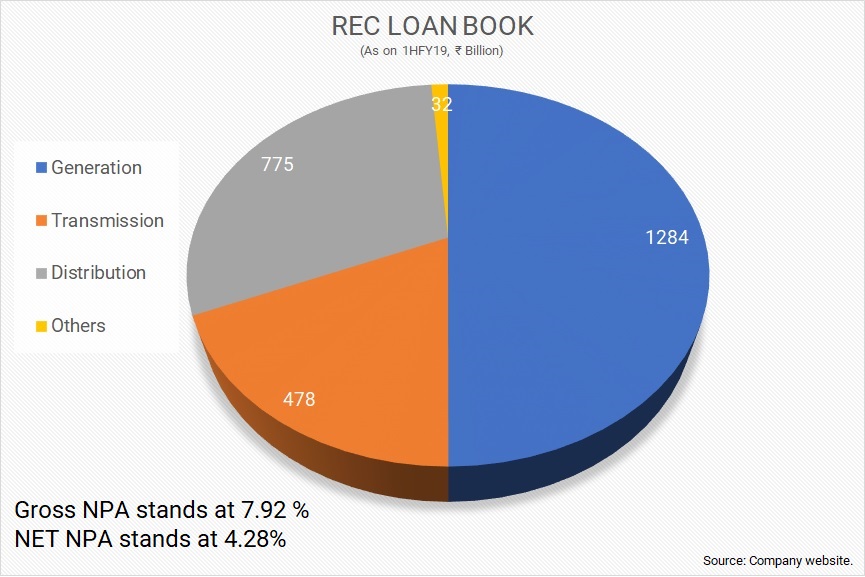

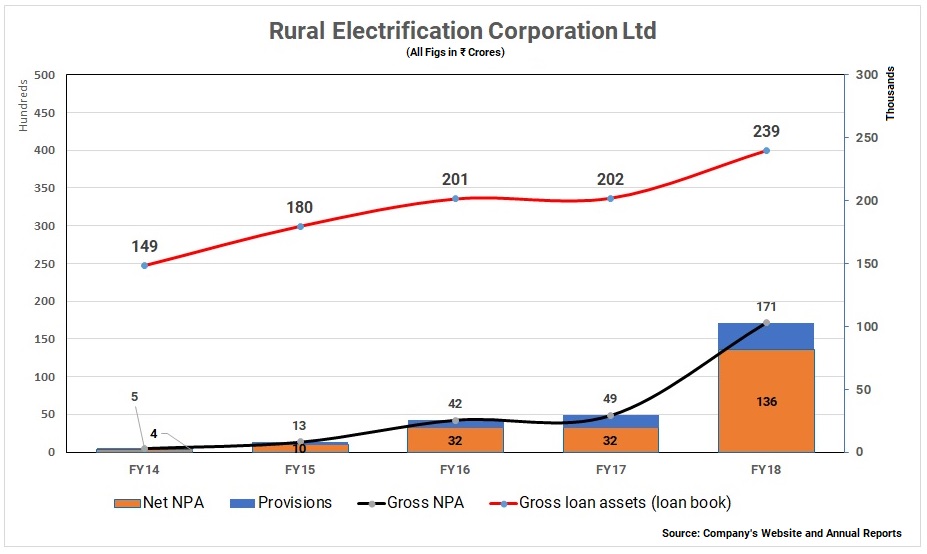

At the end of 2017-18, the total resources of REC were over ₹2.46 lakh crore. The net worth of the company was ₹35,490 crore and cash and bank balance were ₹1,773 crores at the end of March 2018. The company made a profit of ₹4,647 crore in FY18

In the three months to September 2018, the company reported a strong performance with profit after tax of ₹17.6 billion, which was 25.3% higher than the same quarter in FY18 because of marked-to market forex gains of ₹10.5 billion. Though PAT rose, operating performance too, remained robust with strong pick up in margins to 4% and improvement in asset quality. Loan growth of the company revived to 19% in Q2FY19 driven by a strong 76.2% growth in disbursements, especially by the state sectors. The growth in renewable segment – a key focus area for growth – was significantly higher because of favourable base. So, REC’s core business remains strong with improving asset quality and revival in loan growth.

Structure

The acquisition as mentioned above shall facilitate government to achieve its divestment targets. Under the transaction, not only the government gets large cash, but it shall also retain control of the company and business. The transaction doesn’t seem fair to the minority shareholders of either companies as there is no apparent monetary benefit neither an exit option via open offer. PFC will finance part of the consideration through borrowings which will impact its loan disbursement capacity and dividends for its shareholders in immediate future.

Ideally post -acquisition both companies should be merged to create a large entity with a bigger and stronger balance sheet, to provide loans on a much bigger value and borrow at a lower cost, even from the international market, but it does not seem likely as the government stake in merged entity will go below 50%. Since both the companies are well capitalised and profitable, the merger may defocus their core operations and cause disruptions in their business because of the common management. The government must put in place all the necessary safeguards so that both the companies can run independently.

Add comment