The Board of Directors of Bayer CropScience Limited and Monsanto India Limited, at its Meeting held inter alia, has considered the amalgamation of Monsanto India Limited with Bayer CropScience Limited.

Bayer, a German stock corporation, is a life sciences company with core competencies in the areas of health care and agriculture. The activities of Bayer have carried out in three divisions i.e. pharmaceuticals; consumer health; and crop sciences.

Bayer CropScience Limited (BCL) is the listed Indian arm of Bayer AG engaged in the business of manufacturing, selling, marketing of pesticides and pest control products, distribution of seeds and provision of services in the field of agriculture. Other than BCL, In India, Bayer also operates through various group companies.

Monsanto, incorporated in the United States of America, is an agricultural company, which provides seeds, biotechnology traits and crop protection, globally. In addition, Monsanto is active in providing digital farming solutions, globally. Monsanto is present in India through its subsidiaries viz; Monsanto India Limited, Monsanto Holdings Private Limited, Monsanto Investments India Private Limited and Mahyco Monsanto Biotech (India) Private Limited. In India, Monsanto provides: (a) high-yielding conventional and biotech agricultural and vegetable seeds; (b) weed control solutions; and (c) advanced traits and technologies.

Monsanto India Limited (MIL) is the listed Indian arm of Monsanto Company engaged in the business of production and sale of agricultural inputs, namely, chemicals and hybrid seeds. The company is listed on BSE & NSE.

Worldwide acquisition of Monsanto by Bayer

To establish its command on world’s seeds & Pesticides, Bayer had announced its intention to acquire Monsanto in May 2016 and signed an agreement with the US company for USD 128 per share in September 2016. Bayer acquired Monsanto at Enterprise Value of $ 66 billion (Net Debt). Bayer financed the transaction with a combination of Equity and debt.

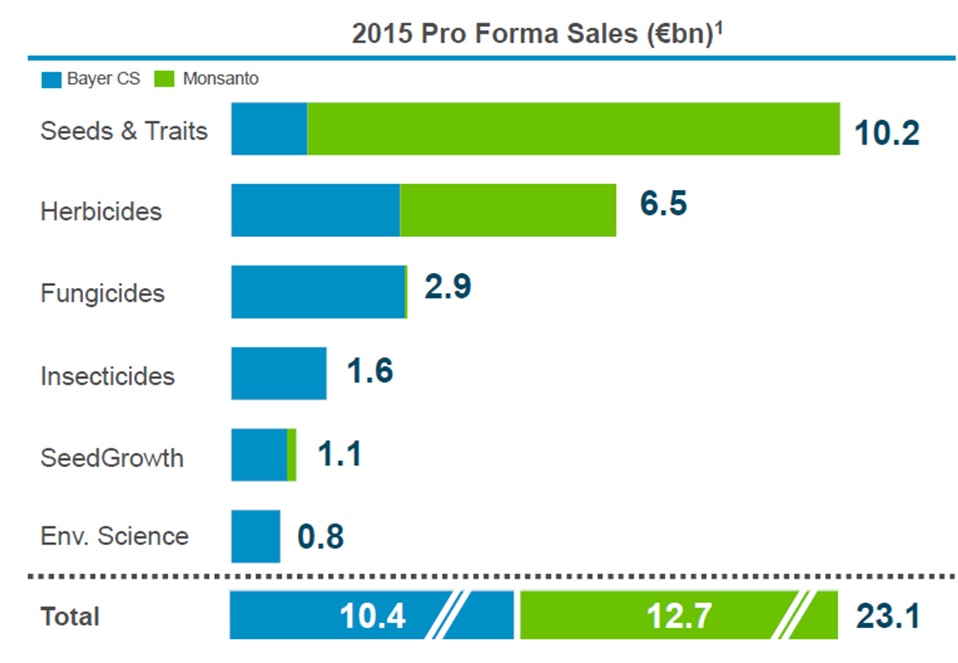

Bayer is a leader in crop protection portfolio & Monsanto is having a strong hold in conventional and biotech seeds, traits and digital agricultural tools. Monsanto has a significant presence in North & South America while Bayer has a strong presence in Europe. The acquisitions of Monsanto gave Bayer opportunity to offer a wide set of solutions to the farmers & expand its wings to American Continents.

Bayer successfully completed the acquisition of Monsanto in June 2018 after fulfilling one of the requirements of the U.S. Department of Justice that Bayer and Monsanto remain separate companies and continue to operate separately until completion of these divestments to BASF. As per the press release by Bayer, Monsanto will no longer be a company name. It is not yet clear whether they will merge the Monsanto with Bayer or will continue to operate it separately with a different name.

India Journey

Open Offer

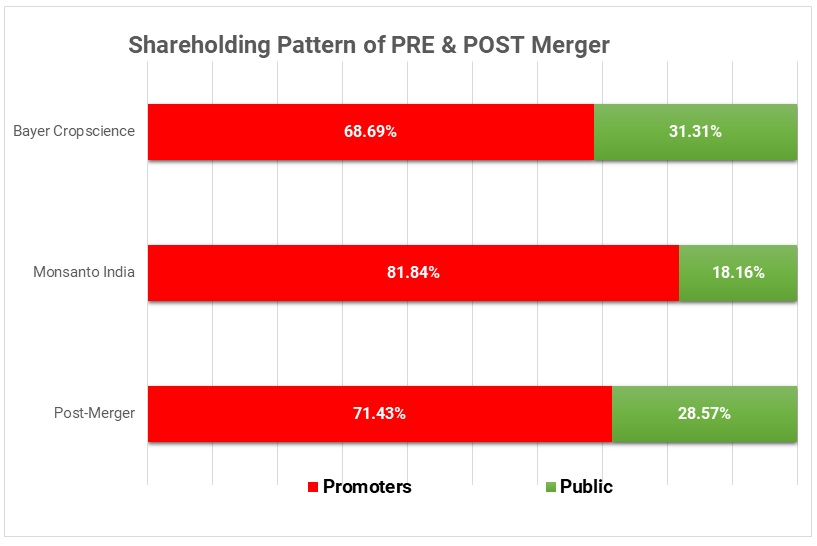

As a result of an indirect acquisition of voting rights & control over MIL, it was mandatory for the Bayer to make an open offer to the minority shareholders of MIL under the regulation of SEBI. Consequently, in July this year, Bayer AG along with BCL made an open offer to acquire 26% of the voting share capital of MIL at the price of ~₹2963 per equity share. Based on the equity shares tendered by the minority shareholders, BCL acquired 7.82% and Bayer AG 1.88% stake in the company. As on the 31st March 2018, the cash & equivalent available with BCL was around INR 420 crores. The company utilised the maximum amount i.e. INR 395 crores to buy 7.82% stake in MIL through the open offer. This could be the strategic decision by Bayer group to acquire maximum possible stake (up to surplus cash available) through BCL & rest through Bayer AG.

The Merger

After the completion of a global acquisition, Bayer has started the integration of their global operations. The merger of Indian operation is a result of their integration plan. Last months, the Board of Directors of both companies announced the merger of MIL with BCL.

BCL shall issue 2 equity shares of INR 10 each for every 3 equity shares of INR 10 each held by the shareholders of MIL. The appointed date for the transaction is 1st April 2019.

Shareholding Pattern

Post-Open offer, Bayer Group holds more than the maximum permissible promoter shareholding allowed by the SEBI. If they would have not decided to merge the entity, they were bound to reduced promoter’s shareholding in MIL to 75% within a prescribed time.

Financials

Table 1: Financials of the global entities (All Figs in ₹ Millions)

| Particular | Bayer | Monsanto |

| Net Sales | 26,61,140 | 9,36,960 |

| EBIT | 4,48,628 | 2,08,832 |

| Networth | 27,96,876 | 4,12,032 |

Notes: – The financials for Bayer & Monsanto are for the year ended on 31st December 2017 & 31 August 2017 respectively. The average conversion rate assumed is Euro 76 per INR & USD 64 per INR.

Table 2: Financials for the Indian Entities (FY18, All Figs in INR Crores)

| Particulars | MIL | BCL |

| Networth | 640 | 1,778 |

| Revenue | 672 | 2,787 |

| EBIT | 173 | 414 |

| PAT | 164 | 300 |

| Core RoCE | 54.9% | 31.08% |

The operating margins of MIL are significantly higher than BCL’s margins. Core RoCE of the combined entity is likely to be better than the existing RoCE of the BCL.

Valuation

| Particular | Monsanta India | Bayer Cropsciences |

| Assigned Value (As per Valuation Report) |

4,777 | 14,217 |

| Multiple | ||

| Revenue | 7.11 | 5.10 |

| EBITDA | 25.64 | 31.81 |

Bayer AG acquired Monsanto at EBITDA multiple (TTM) of 18.6X. Compared to the global entity, the Indian entity has got a premium of 38% over the global entity. This is probably because of growth opportunities in India are substantially higher as compared to global opportunity in the matured market.

End Note

Till date, there is no merger proposed at holding company level and Monsanto will continue to work as a subsidiary of Bayer AG. However, in India, they decided to merge their operations. The merger will lead to reaping benefits in terms of substantial savings in cost of compliances and marketing and distribution synergies, however unified organisation structure will also come with a lot of challenges major one being the integration. In India, CCI has already approved the merger.

It will be interesting to see how European and American business culture to blend with each other without creating hiccups as it happened in the case of Chrysler (the USA car Company) and Daimler (European Car company). As far as minority shareholders are concerned, Bayer has one other entity in the name of Bayer Biosciences Private Limited through which BCL does trading of seeds. Post-Merger, there can be a conflicting business which should be addressed.

Add comment