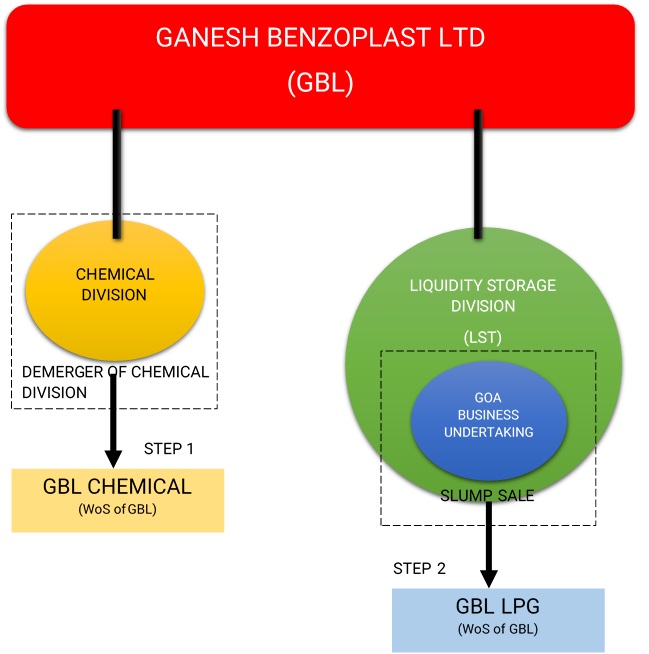

Mumbai-based Ganesh Benzoplast has decided to restructure and reorganise the company with the demerger of the chemical business. It has also segregated both the divisions — Chemical and LST business – by demerger. As both the divisions have totally different synergies, the demerger will ensure greater focus to the operation of each of the divisions and enhance profitability and generate maximum shareholder value.

Ganesh Benzoplast Ltd (GBL) is a public limited company, having two divisions, one being Liquidity storage Terminal division (LST) which is related to providing conditioned storage facilities (Liquidity storage Terminal division – LST) for bulk liquids and chemicals at JNPT, Cochin and Goa, In LST division, the Company has a combined storage capacity of more than 3,00,000 KL, for storage of all types of Liquid Products. And Chemical division which is related to manufacturing, export and import of premium range of speciality chemical, food preservatives and industrial lubricants having two factories at Tarapur (Maharashtra). The equity shares of the company are listed on BSE. Market cap of GBL is around Rs. 245.98 crores (approx.).

GBL chemical Ltd (GBL chemical) was incorporated on 23rd Oct 2018 to carry on the business of manufacturing and trading speciality chemicals.

GBL LPG Private Limited (GBL LPG) was incorporated on 28th Nov 2018 to carry on the business of LPG and liquidity storage terminal facility.

Transaction

Appointed date being 1st April, 2019 for both the transactions

Demerger of Chemical business undertaking of GBL to GBL chemical

- Consideration being 1 equity share of GBL chemical for every 1 equity shares held in GBL.

- Upon scheme become effective and upon issue of shares by the GBL chemical, existing 100,000 equity shares of Re 1/- each of the GBL chemical held by GBL will stand cancelled without any payment.

- Demerger of the chemical business undertaking shall comply with provisions of Section 2(19AA) of the Income tax Act, 1961.

- Post scheme, GBL chemical will be listed on BSE.

Slump sale of Goa Business undertaking of GBL to GBL LPG

- Sale shall be done at a lump sum consideration of ₹8 crores

- Consideration shall be discharge by GBL LPG by issuing and allotting 90,000 equity shares at Rs. 10/- each to GBL

- Upon scheme becoming effective name of company will be changed from Ganesh Benzoplast Ltd to “GBL Infra Ltd”.

Rationale

Demerger of chemical business

- GBL operates in two division namely Liquid Storage Terminal (LST) and chemical manufacturing division.

- Chemical division has totally different synergy & to ensure greater focus to the operation of the chemical division & to enhance profitability & generate maximum shareholder value

- GBL is in process of expanding product base & increasing the capacity utilisation of plant, upgradation of manufacturing facility & adding more product with great margin & higher demand in chemical segment.

- Further chemical business has a different set of regulations to comply with as compared with LST business which is the core business of GBL.

Slump sale of Goa Business undertaking of GBL to GBL LPG:

- GBL has liquid storage facility at Goa facility. Further GBL is in process of setting up a LPG terminal at its Goa facility. GBL has obtained license and requisite approval to carry on the LPG business.

- Hence with intention of have specialised focus on liquid storage business at Goa and LPG business and to meet financial requirement of Goa business undertaking management proposed to transfer the undertaking to its wholly owned subsidiary.

Shareholding Pattern

- GBL is having as at 31st December 2018 is Rs. 5.18 crores consisting of 5,17,84,293 equity shares of face value of Re.1 each.

| Particulars | No of Equity Shares | % holding |

| Promoter and Promoter group | 2,22,76,435 | 43.02% |

| Public | 2,95,07,858 | 56.98% |

| Total | 5,17,84,293 | 100% |

- The issued and subscribed equity share capital of GBL Chemical as at 31st December 2018 is Rs. 1 lac consisting of 1,00,000 equity shares of face value of Re.1 each. GBL chemical is wholly owned subsidiary of GBL.

- The issued and subscribed equity share capital of GBL LPG as at 31st December 2018 is Rs. 1 lac consisting of 10,000 equity shares of face value of Re.10 each. GBL LPG is wholly owned subsidiary of GBL.

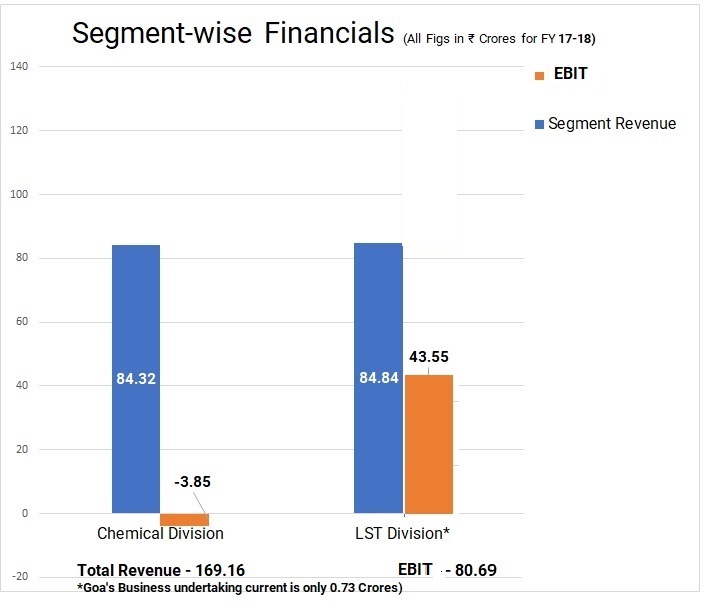

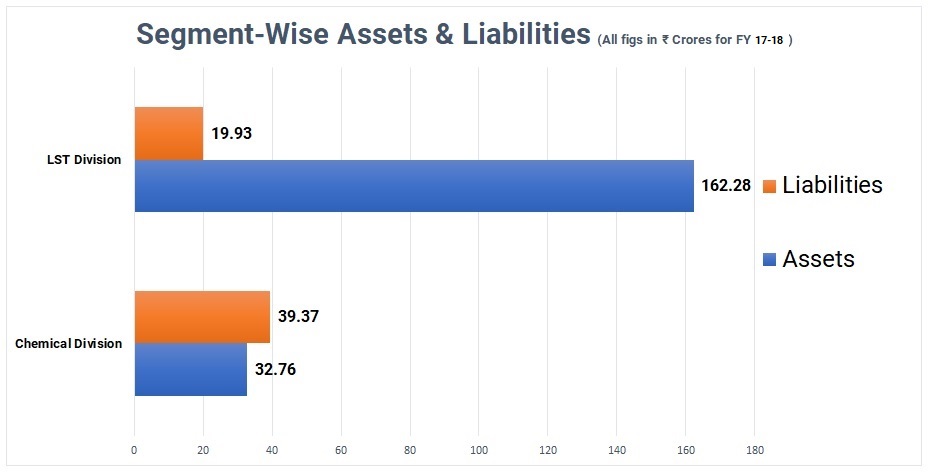

Financials

- Segment Assets & liabilities total included unallocated amount

- Turnover of Goa business undertaking is Rs. 0.72 crores representing 0.43% of turnover of GBL.

- Networth of Goa Business Undertaking is Rs.22.94 crores representing 28.43 % of net-worth of GBL as on 31st March, 2018

- For Mar-18, an exceptional income of Rs.50.92 crores on account of availing write back as per the sanctioned DRS (Debt Restructuring scheme) of the company.

- The capacity utilization at J.N.P.T. Tank Farm is 98.00 % and at Goa and Cochin capacity utilization is 50% and 80% respectively and management expects this pattern to continue in the future (As per Mar-18 Annual Report)

Demerger Analysis:

- Chemical division was loss making and has generated operational profit after a gap of almost 8 years, which is due to better capacity utilisation whereas LST division is generating better revenue

- Segment revenue was Rs. 84.32 crores which is around 50% of total revenue whereas segment liabilities were Rs. 39.37 crores which is around 42.23% of total segment liabilities (this exclude debts) total segment assets is Rs. 32.76 crores which is 13.76% of total assets (allocated & unallocated)

- Debt break-up is not available, but from the segment information it is clear that chemical division is having large share of liabilities then assets, hence it will create debit balance in capital reserve of new company GBL chemical post demerger.

- It will help GBL to strengthen its financials by shredding excess liabilities of chemical division

- Demerger will be tax neutral subject to compliance of provisions of Section 2(19AA) of the Income tax Act, 1961.

Slump Sale analysis

- Goa business undertaking which have storage facility and additionally company has also received approvals for setting up a LPG terminal at its Goa facility, management separated this undertaking with a view to capitalize in near future.

- At present there is hardly any contribution of Goa business in total revenue of the company.

- Further capacity utilisation of Goa facility is 50% and management expects this pattern to continue in the future (As per Annual report-Mar18)

- Storage tanks and machineries Goa has remaining useful life of 20 -27 years (As per Mar-18 Annual Report ), hence there is no major replacement cost in near future as of now.

- Even though transfer of net assets at book value of Goa undertaking is at Rs. 22.94 crores, but the fair value of goa undertaking is around 8 crore, from the transaction it looks GBL LPG wanted to book capital reserve in its books and then there will be an impairment of assets to the extent of net asset value Rs. 8 crore which will be routed through P&L/ adjusted in reserve.

Remaining Business:

- Post demerger and slump sale, GBL will be left with LST division which consists of Storage facility at Mumbai and Cochin only.

Accounting Treatment

For demerger:

- GBL chemical (Resultant company) shall account for the demerger of chemical business in its books as per “Pooling of Interest method” of Ind-AS 103. All assets and liabilities will be recorded at book value. The surplus/ deficit if any of the net asset value of chemical business over the face value of equity shares allotted would be adjusted in capital reserve.

- GBL (demerged company) will reduce book value of assets and liabilities of chemical division from its assets and liabilities. The excess of assets over liabilities will be first adjusted against capital reserve and balance if any from Profit & Loss Account. If the value of asset less then value of liabilities of chemical division then such difference will be credited to capital reserve.

For Slum Sale:

- GBL LPG (Transferee company) shall account for the slum sale of Goa Business undertaking in its books as per “Pooling of Interest method” of Ind-AS 103. All assets and liabilities will be recorded at book value. The surplus/ deficit if any of the net asset value of Goa Business undertaking over the face value of equity shares allotted would be adjusted in capital reserve.

- GBL (Transferor company) will reduce book value of assets and liabilities related to Goa Business undertaking from its assets and liabilities. The excess of assets over liabilities will be first adjusted against capital reserve and balance if any from Profit & Loss Account. Surplus if any shall be credited to capital reserve.

Taxation for slump sale of Goa Business undertaking:

In the scheme, transaction mentioned Slump sale but it is slump exchange as the consideration is discharged by allotting equity shares. Slump exchange is not taxable* amounting to no tax implication in the hands of GBL.

Further, it is to be seen whether this transaction will be chargeable or not in the hands of GBL LPG since it is not clear in section 56(2)(X) whether any assets as mentioned in section definition covers an undertaking or not.

*Ref: CIT v/s. Bharat Bijlee Ltd.

Conclusion

The company had Debt Restructuring Scheme in year 2018 and post write back of interest and liabilities, the company decided to make all businesses maintain its profitability and grow based on its own strength. GBL demerged its chemical division which is assets heavy and cyclical is demerged and listed on the stock exchange. With steady revenue stream and profitable existing LST division remains in the present company with approved ratios. Further slump exchange of Goa business at book value and getting approval for LPG terminal is done keeping in mind getting investor in GBL LPG at a later stage.

Add comment