In what seems to be last attempt, government has finally decided to revive by merging the two loss-making state-owned telecom companies Bharat Sanchar Nigam Ltd (BSNL) and Mahanagar Telephone Nigam Ltd (MTNL). The two telecom companies have been bleeding and their subscriber base dwindling as competitors such as Bharti Airtel, Vodafone Idea and Reliance Jio had rolled out pan India 4-G services and cut prices on voice and data.

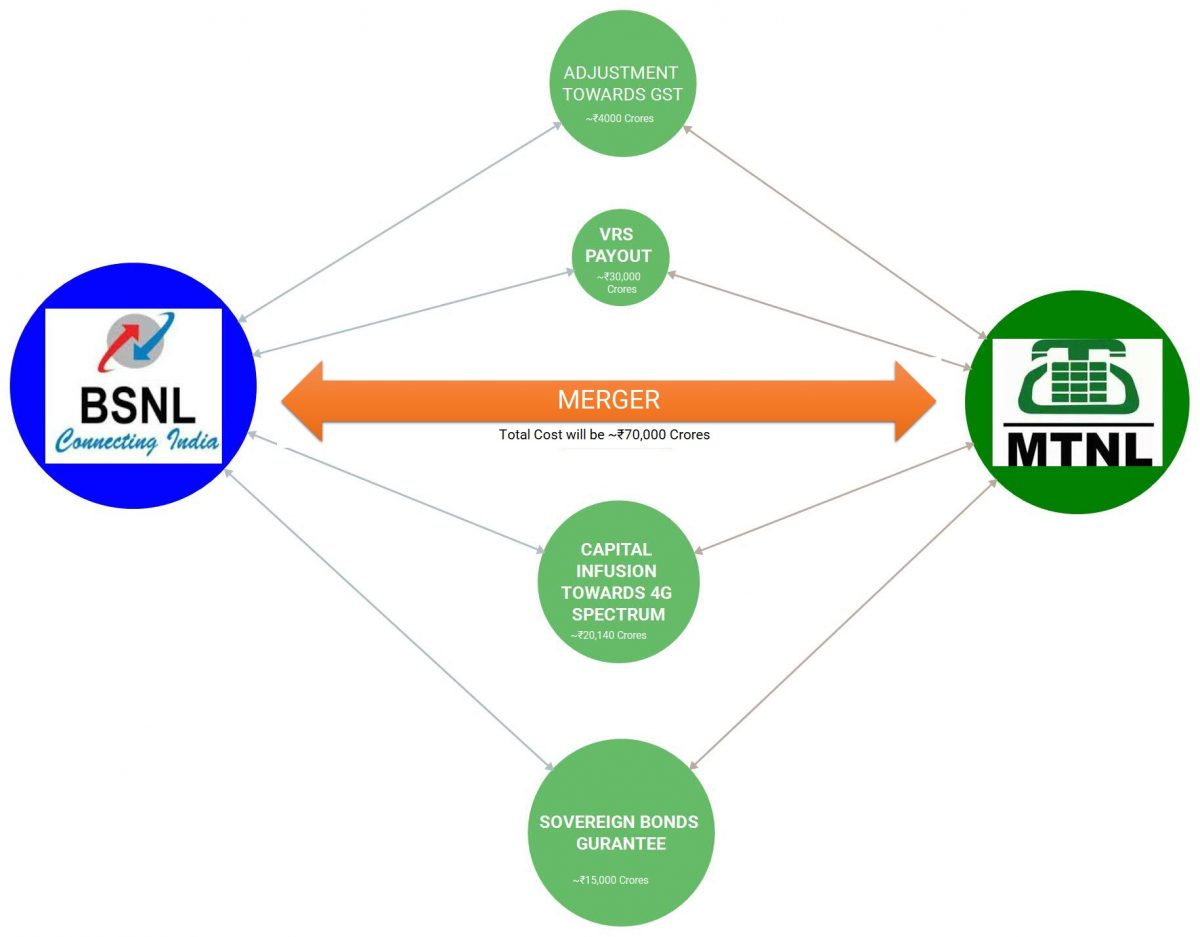

MTNL, which is largely present in cities such as Delhi and Mumbai, will act as a unit of BSNL until the merger is completed. While MTNL is listed, BSNL is not listed. The two companies have a total debt of Rs 40,000 crore. The merger bill will be about Rs 70,000 crore which includes voluntary retirement scheme (VRS), capital infusion, goods and service tax and bond guarantee. The Centre will raise Rs 15,000 core through sovereign bonds to strengthen the two-state run telecom companies and the government will monetise telecom assets worth of Rs 38,000 crore.

The government is offering voluntary retirement scheme (VRS) to the employees of the two companies, aged 50 years and above. The cost of the VRS, which is likely to be around Rs 17,000 crore, will be borne by the government through budgetary support. The government expects to complete the merger process by 24 months. With these measures, the government expects that BSNL will come out of the losses by 2023-24 while MTNL will be back to profits in 2025-26.

Given the precarious financial position of the two companies, the new proposal of the government will be acceptable to the company’s employees. The two companies together employ around two lakh people, a number that the government will eventually reduce through VRS. In contrast, leading private sector telecom companies such as Bharti Airtel employs around 17,000 people and Vodafone-Idea employs about 12,500 people. In fact, the VRS scheme, about 77,000 people in BSNL have opted and in the case of MTNL, 13,532 employees have opted for the VRS scheme till November 20.

Since the time the telecom sector was opened for private sector participation in 1995, the role of BSNL and MTNL started to diminish. In just over two decades, the mobile phone revolution has catapulted India to the second rank in wireless technology. The stifling competition which followed a tariff war started with the entry of Reliance Jio in September 2016. It saw weak private sector companies merging or exiting the business.

Synergy in the merger

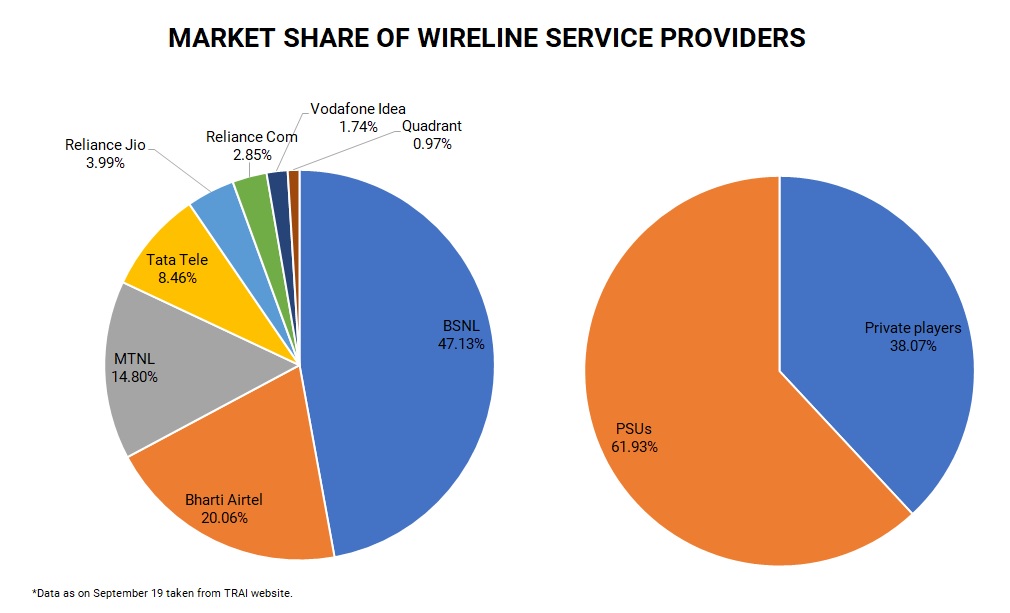

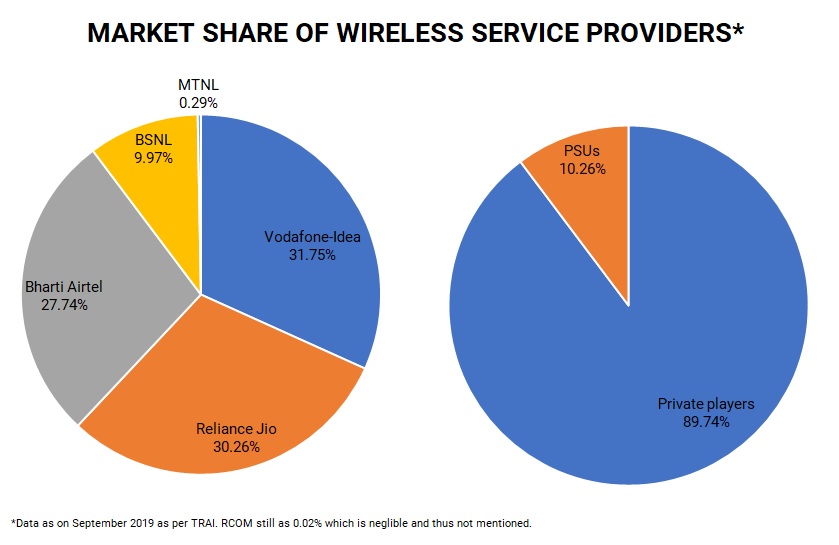

Given the fact that the combined customer share of BSNL-MTNL in the mobile market is a little over 10% and the two companies have 54% market share in wired broadband, the merger is expected to result in gaining a competitive edge in terms of technology, cost optimisation, market share and product innovation. The merger decision includes allotment of critical spectrum to the two companies for offering fourth-generation wireless services, including broadband.

The government will infuse Rs 20,00 crore of capital while also bearing the related GST levy of Rs 3,600 crore. The government aims to leverage the spectrum allotment to make BSNL and MTNL compete effectively in the domestic telecom market. The state-run BSNL operates on just 2G/3G technology and is yet to enter the 4G era. The government is making efforts to give an administrative allocation of 4G spectrum to BSNL pan India so that it can compete with private players.

As the two companies have been operating in isolation without any degree of competition, the merger will hopefully make the combined entity competitive and face the market challenges. However, changing the work culture of the merged entity will be a daunting task to make the merger work. The big issue that the government will have to tackle is the large workforce as the employee cost of BSNL is 75% and that of MTNL is 87% of total income.

At a time when there is fierce competition amongst all the three private sector telecom companies, survival of BSNL-MTNL will depend on how technology-efficient and customer-friendly the merged entity becomes. It also will have to augment the enterprise business, such as offering optical fibre, towers and network services to private sector companies. If the merger works, then it will provide a tough competition to the private sector telecom companies who have waged a price war amongst themselves in order to increase subscriber base. A successful revival of BSNL and MTNL will have a far-reaching implication for the industry because the three surviving private players are saddled with Rs 75,000 crore of dues due to loss of a legal challenge. The merger will also send a positive message to the markets that the Centre is keen to recoup the loss-making public sector undertakings. Ideally, the government should delist MTNL before the merger gets into the final lap.

While India may have a vibrant private telecom sector, on certain occasions it would be more secure and reliable to have a state-owned network and has presence across the country. On that front, the merged entity will have an advantage over the private sector peers. Secondly, for national security, communication network is a key element and BSNL plays an important role in connecting strategic establishments across the country. Moreover, there is a need for a public sector enterprise to work on basic research in telecom and microelectronics, which can create autonomous capability. The government can look at merging C-DoT and C-DAC to form the core of such a research entity.

Past attempts to merge

The latest decision to merge the two state-owned telecom companies is the third attempt. In 2002, NDA government under Atal Bihari Vajpayee attempted to merge the two companies. The then telecom minister Pramod Mahajan was of the view that MTNL operates in Delhi and Mumbai and would not survive unless it had access to a larger market. As there was no reason to have two pan-India state-owned telecom companies, the merger would bring in synergy. However, despite the government’s efforts, the deal did not get through because of structural complexities and the employees union was opposed to the idea of the merger.

In 2011, the government proposed to sell land assets and monetise the tower infrastructure. But that did not happen. Then in 2012, the government had set up a committee under Sam Pitroda to review the functioning of BSNL. The committee recommended to create a separate subsidiary company for tower related infrastructure to aggressively market to other public and private sector customers and unlock the whole potential value through strategic stake sale, M&A or separate IPO.

In 2015, the government again mooted the idea to merge the two state-owned telecom companies and commissioned IIM-Bangalore to do a feasibility study to suggest ways to merge the two. The Department of Telecommunications (DoT) had set a deadline of July 31 for closing the merger of MTNL and BSNL. But due to some reason or the other, it couldn’t happen even then.

About MTNL

The government had set up Mahanagar Telephone Nigam Limited (MTNL) in 1986 to upgrade the quality of telecom services, expand the telecom network, introduce new services and to raise revenue. It was established in Delhi and Mumbai. The company’s shares are listed on Bombay Stock Exchange, Global depository receipts on London Stock Exchange and American depository receipts on New York Stock Exchange. The government of India currently holds 57% stock in the company with the rest being held by public and institutional investors. As of September 2019, it has 65,73,534 subscribers (both wireline and wireless).

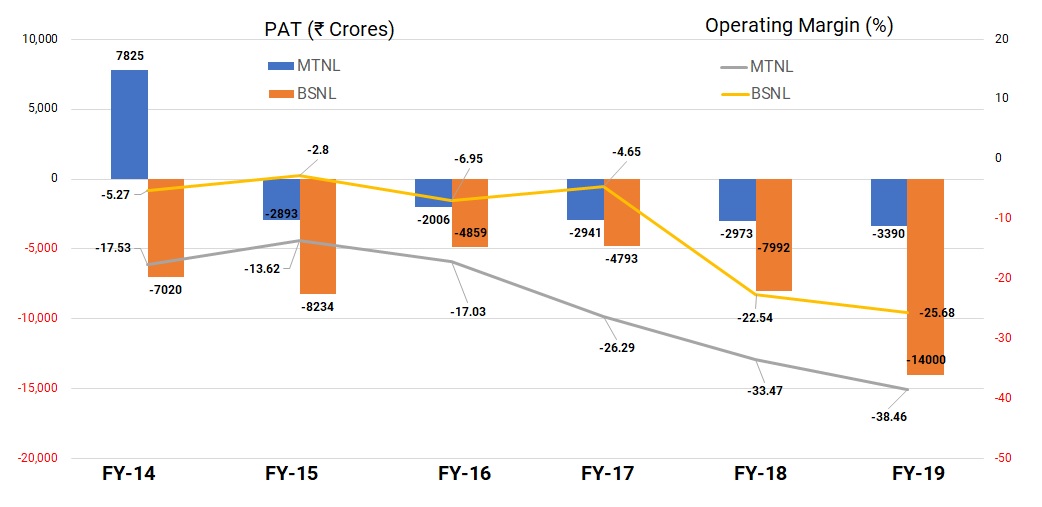

In 2001, the company launched GSM Cellular Mobile service under the brand name Dolphin and in the same year also launched Wireless in Local Loop (WLL) Mobile services under the brand name Garuda. In 2002, the company launched pre-paid GSM mobile services under the brand name Trump and in the same year MTNL’s Email on PSTN lines were introduced under the brand name mtnlmail. In fact, in 2003-04, MTNL reported net profit of Rs 1,277 crores as compared to Rs 877 crore in 2002-03, a 46% jump. After that the downfall started as the market in the two cities of Delhi and Mumbai was saturated in terms of subscribers. The losses of MTNL kept mounting because of cheap mobile rates offered by its competitors. The consolidated loss widened to Rs 3,388 crore for FY19 from Rs 2,971 crore in FY18.

About BSNL

The government had set up BSNL on September 15, October 2000 to provide telecom services and network management from the erstwhile Central Government Departments of Telecom Services and Telecom Operations. As on September 2019, BSNL has 12,71,01,521 subscribers (both wire and wireless). It’s network across the country except New Delhi & Mumbai. Whether it is inaccessible areas of Siachen glacier or North-Eastern regions of the country, BSNL serves its customers with a wide bouquet of telecom services namely Wireline, CDMA mobile, GSM mobile, internet, broadband, carrier service, MPLS-VPN, VSAT, VoIP, IN Services, FTTH, etc. It has set up a world class multi-gigabit, multi-protocol convergent IP infrastructure that provides convergent services like voice, data and video through the same Backbone & Broadband Access Network. During 2017-18, the turnover of BSNL is around Rs 25,071 crore. Just over a decade ago, BSNL’s annual revenues were around Rs 40,000 crore and net profit of Rs 3,000 crore. Brokerage firm Kotak Institutional Equities Research estimates BSNL’s accumulated losses to be over Rs 90,000 crore

Conclusion

The revival of the two companies will be difficult because of the highly technology driven industry. Not only that but to survive and grow the company should have innovative and dynamic marketing strategy. For that post-merger it needs strategic partner though the government may retain controlling stake in the merged entity. The government will have to draw up a quick plan to put the two companies, which are of strategic importance to the country, on a growth path and make them efficient to face the challenges.

Add comment