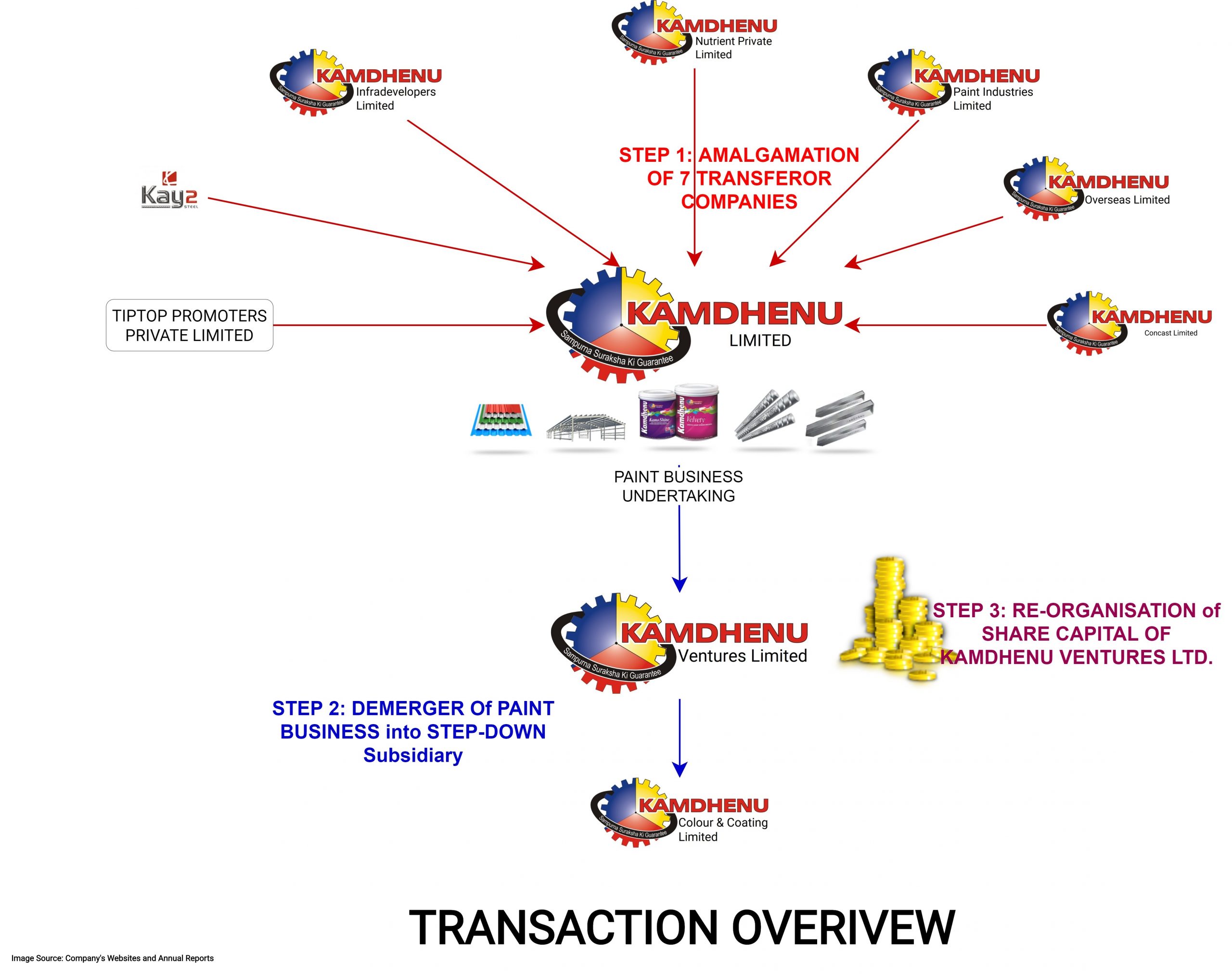

In a move to separate the Paint Business from its Core Steel Business, Kamdhenu Limited announced Scheme of Arrangement (“Scheme”) whereby, it will demerger its Paint Business to the newly incorporated step-down wholly-owned subsidiary of the Kamdhenu Limited.

The Scheme inter-alia also provides for amalgamation of Promoter entities (which together holds substantial stake in Kamdhenu Limited) in Kamdhenu Limited thereby collapsing the inter-company holding structure.

Though apparently, the transaction looks simple, the consideration, transaction structure and re-organisation of share capital post-transaction makes it complicated.

Kamdhenu Limited (“the Transferee Company/Demerged Company”) is engaged in manufacturing, branding, marketing and distribution of KAMDHENU brand products like Steel TMT bars, decorative paints and allied products. Thus, the Demerged Company has two distinct business segments-Steel Division and Paint Division.

In the Steel Business, Kamdhenu has its own TMT manufacturing plant at Bhiwandi from where it is catering to the market of Delhi and NCR. The rest of India is being catered by the Franchisee Network of the Company. Kamdhenu TMT is one of the largest selling TMT brands in India, in the retail segment.

In the Paint Business, the Demerged Company is into decorative paint segment wherein it manufactures all types of paints including interior, exterior, emulsions, textures, designer paints and all varieties of paints, competing with the leading paint manufacturers in India. The Company is also outsourcing Paint Products to meet Market Demand.

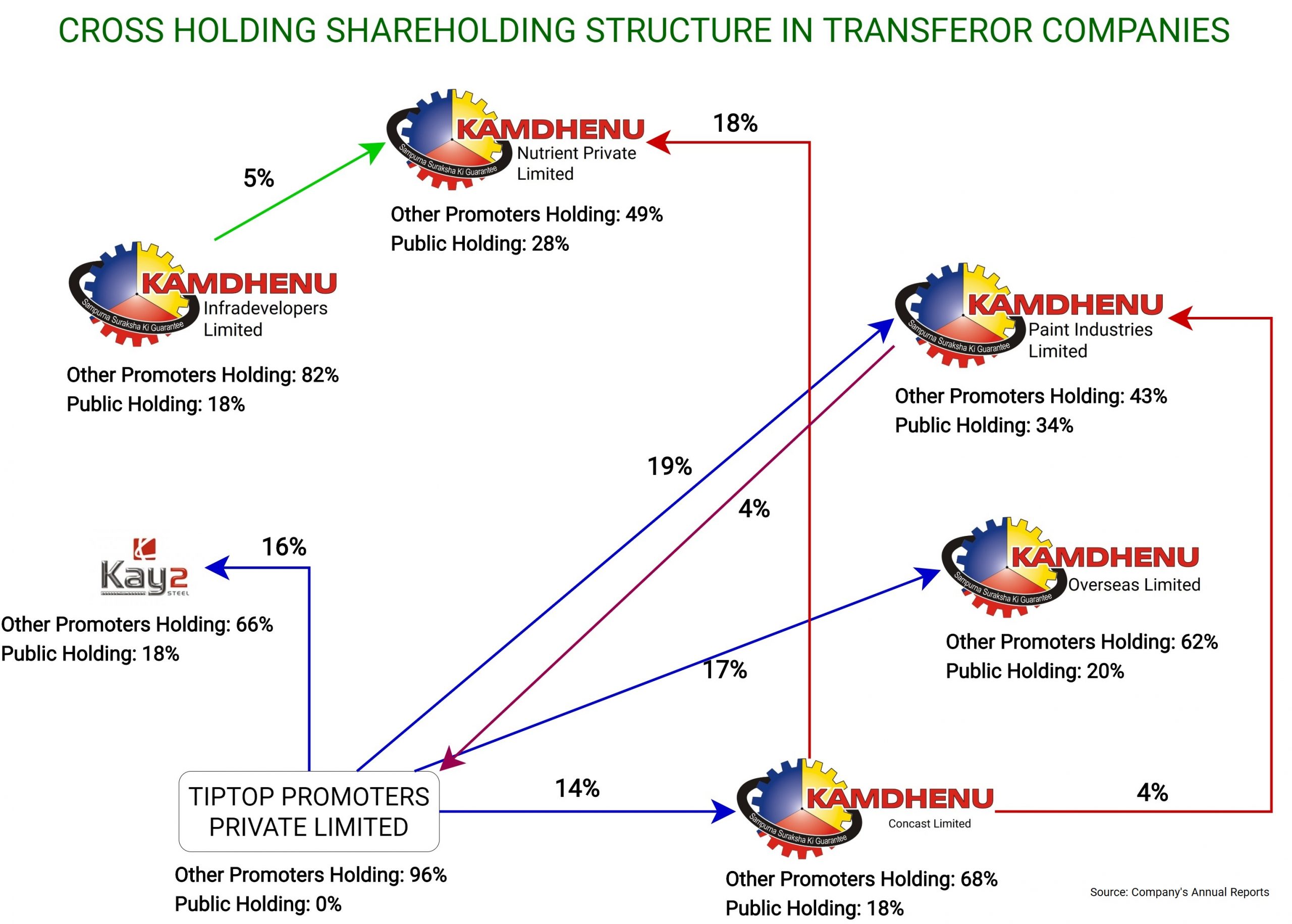

Kamdhenu Concast Limited (Transferor Company 1) is an unlisted closely held company. Presently, Transferor Company 1 is engaged in the marketing and branding of steel and allied products and other related activities. The Transferor Company 1 has also made investments in securities (including investment in Kamdhenu Ltd).

Kamdhenu Overseas Limited (Transferor Company 2) is an unlisted closely held company. Presently, Transferor Company 2 is engaged in the purchase, sale and trading of M .S. bar and other iron & steel products and other related activities. The Transferor Company No. 2 has also made investments in securities (including investment in Kamdhenu Ltd).

Kamdhenu Paint Industries Limited (Transferor Company 3) is an unlisted closely held company. The Transferor Company 3 was incorporated to carry on manufacturing of paint and other allied products. The Transferor Company 3 has also made investments in securities (including investment in Kamdhenu Ltd).

Kamdhenu Infradevelopers Limited (Transferor Company 4) is an unlisted closely held company. Presently, the Transferor Company 4 is engaged in agency business and other related activities. The Transferor Company 4 has also made investments in securities (including investment in Kamdhenu Ltd).

Kamdhenu Nutrient Private Limited (Transferor Company 5) is an unlisted closely held company. Presently, the Transferor Company 5 is engaged in agency business and other related activities. The Transferor Company 5 has also made investments in securities (including investment in Kamdhenu Ltd).

Kay2 Steel Limited (Transferor Company 6) is an unlisted closely held company. Presently, the Transferor Company 6 is engaged in providing business support services and other related activities. The Transferor Company 6 has also made investments in securities (including investment in Kamdhenu Ltd).

Tiptop Promoters Private Limited (Transferor Company 7) is an unlisted closely held company. Presently, the Transferor Company 7 is engaged in agency business and other related activities. The Transferor Company 7 has also made investments in securities (including investment in group companies).

Kamdhenu Ventures Limited (The Resulting Company 1) is the wholly-owned subsidiary of the Transferee Company. It has been recently incorporated for the purpose of the proposed Scheme of Arrangement.

Kamdhenu Colour and Coating Limited (The Resulting Company 2) is the wholly-owned subsidiary of the Resulting Company 1. It has been recently incorporated for the purpose of the proposed Scheme of Arrangement.

The Transaction

Step 1: Amalgamation of Kamdhenu Concast Ltd, Kamdhenu Overseas Ltd, Kamdhenu Paint Industries Ltd, Kamdhenu Infradevelopers Ltd, Kamdhenu Nutrients Pvt Ltd, Kay2 Steel Ltd and Tiptop Promoters Pvt Ltd (The Transferor Companies No. 1 to 7, respectively and together known as “Transferor Companies) with Kamdhenu Ltd (the Transferee Company).

Step 2: De-merger of Paint Business (the Demerged Business) of Kamdhenu Ltd (the Transferee Company) into Kamdhenu Colour and Coatings Ltd (the Resulting Company No. 2).

Step 3: Re-organisation of pre- Scheme Share Capital of Kamdhenu Ventures Ltd (the Resulting Company No.1).

Re-Organisation of paid-up share capital of the Resulting Company 1 (which is hold by Kamdhenu Limited) which consists of 30,400 Equity Shares of INR 10 each aggregating INR 3,04,000, will be cancelled and equal number of 9% Compulsorily Redeemable Preference Shares will be created in place of such cancelled equity share capital.

The Appointed Date for the transaction is 1st April 2020

Change in Registered Office

Most of the companies involved in the transaction has a register office in Jaipur/ Delhi. All the companies except for one of the Transferor Company which already has it registered office in Haryana have initiated process of Shifting Registered Office from Jaipur/Delhi/Kolkata to Haryana. The reason for the same could be to streamline the approval process and some stamp duty planning.

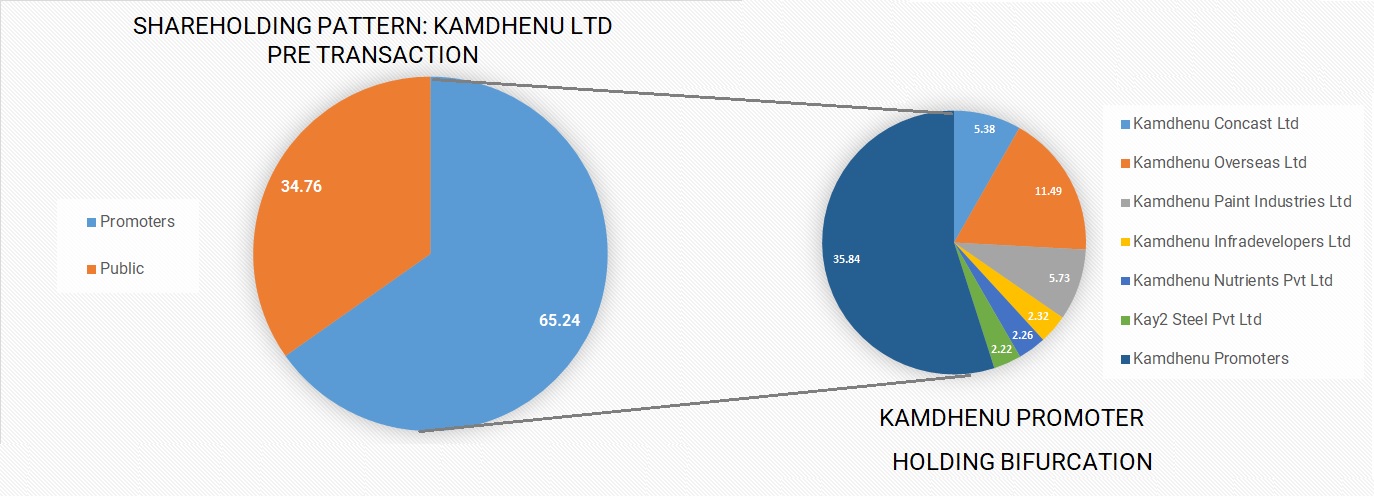

Shareholding Pattern

The Transferor Companies 1 to 6 are the promoter group companies of the Transferee Company. The Transferor Companies 1 to 6 are jointly holding 29.40% of the present share capital of the Transferee Company.

*: Out of 65.23%, 29.40% shareholding is held by the Transferor Companies.

The Shareholding pattern of the Transferor Companies is complex. There is cross-holding among many of the Transferor Companies. Further, apart from promoters, Public Shareholders also held some stake in many of the companies.

Swap Ratio

Consideration for Amalgamation:

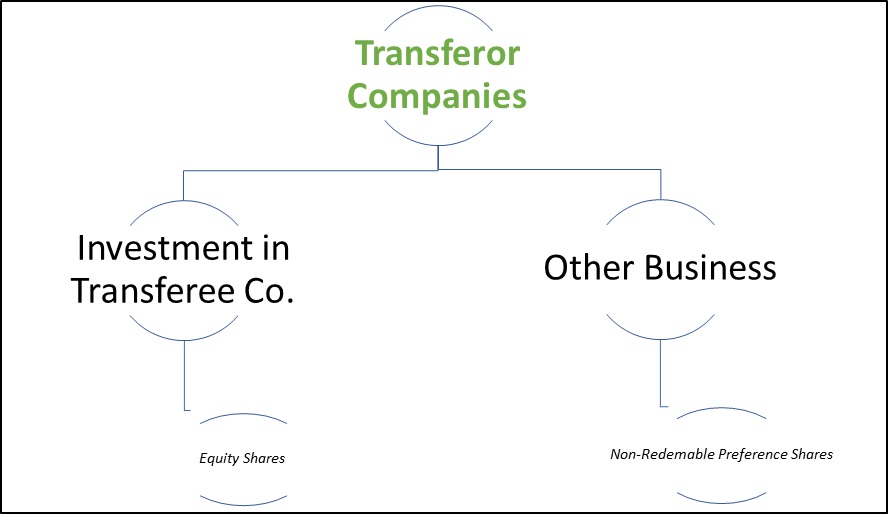

The consideration of the amalgamation of the Transferor Companies with the Transferee Company; in respect of the investment in the Transferee Company, the shareholders of the Transferor Companies will be issued, on a proportionate basis, exactly the same number of equity shares, as the Transferor Companies are holding in the Transferee Company i.e. the same number of equity shares held by the Transferor Companies of Transferee Company will be issued to the shareholders of the Transferor Company.

In respect to the remaining businesses of these Transferor Companies, the shareholders of the Transferor Companies will be issued Noncumulative Compulsory Redeemable Preference Shares (“CRPS”) in the Transferee Company of INR 10 each, on proportionate basis.

As a result of this;

Table 1: Share Swap Ratios

| Name of Transferor Company | Equity Shares in Transferee Co | For Every Equity Shares of Transferor Co |

| Kamdhenu Concast Ltd | 2351 | 1000 |

| Kamdhenu Overseas Ltd | 3697 | |

| Kamdhenu Paint Industries Ltd | 4887 | |

| Kamdhenu Infradevelopers Ltd | 4281 | |

| Kamdhenu Nutrients Pvt Ltd | 5454 | |

| Kay2 Steel Pvt Ltd | 4062 | |

| Tiptop Promoters Pvt Ltd | 2910 | |

| Name of Transferor Company | CRPS in Transferee Co | For Every Equity Shares of Transferor Co |

| Kamdhenu Concast Ltd | 5988 | 1000 |

| Kamdhenu Overseas Ltd | 6638 | |

| Kamdhenu Paint Industries Ltd | 3398 | |

| Kamdhenu Infradevelopers Ltd | 1875 | |

| Kamdhenu Nutrients Pvt Ltd | 1611 | |

| Kay2 Steel Pvt Ltd | 2082 | |

| Tiptop Promoters Pvt Ltd | 14375 |

The total number of Equity Shares to be issued by the Transferee Company to the Shareholders of the Transferor Companies will be equal to the aggregate number of Equity Shares of the Transferee Company held by the Transferor Companies. Hence, there be will be no change in the equity share capital of the Transferee Company post-transaction. However, as some stake in Transferor Companies are held by the public, the promoter holding in the Kamdhenu Limited post-transaction will be reduced to circa 58% from current circa 65%.

Compulsorily Redeemable Preference Shares to be issued will carry a coupon rate of 9% per annum. CRPS shall be redeemed in terms of the provisions of the Companies Act, 2013, at Par within a period of 5 years from the date of issue of such Redeemable Preference Shares with a call option available to the Issuer Company for early redemption. The CRPS will not be listed on exchanges.

Consideration for De-Merger:

The de-merger of Paint Business will be happened in Kamdhenu Colour & Coating Limited, however, the shares will be issued by its immediate holding company i.e. Kamdhenu Ventures Limited which in turns is the WoS of the Demerged Company.

The Resulting Company 1-Kamdhenu Ventures Ltd will issue 1 (one) Equity Share of INR 5 each, credited as fully paid-up, to the shareholders of the Transferee Company for every 1 (one) Equity Share each held in the Transferee Company-Kamdhenu Ltd.

There will be mirror-image shareholding after the proposed de-merger. The CRPS shareholders (issued on amalgamation), will be allocated in the ratio of 734: 266 in the course of de-merger between the Transferee Company and Resulting Company 1 for each 1000 CRPS they will get on the amalgamation.

- For every 1000 (one thousand) (9% Non-cumulative) Compulsorily Redeemable Preference Shares of 10 each in the Transferee Company after amalgamation; the Transferee Company will issue 734 (seven hundred thirty four) (9% Non-cumulative) Compulsorily Redeemable Preference Shares of 10 each, credited as fully paid up, in the Transferee Company.

- The Resulting Company 1 will issue 266 (two hundred and sixty-six) (9% Non-cumulative) Compulsorily Redeemable Preference Shares of 10 each, credited as fully paid up, to the Preference Shareholders of the Transferee Company for every 1000 (one thousand) (9% Non-cumulative) Compulsorily Redeemable Preference Shares of 10 each held in the Transferee Company Kamdhenu Ltd, after amalgamation.

The new equity shares issued pursuant to the demerger will be listed on the exchanges. The new CRPS issued on de-merger will have same terms & conditions as CRPS issued during the Amalgamation.

Re-organisation of existing shares of the Resulting Company 1:

The Transferee Company holds INR 3,04,000 divided into 30,400 Equity Shares of INR 10 each in Resulting Company 1. It is proposed that upon the Scheme becoming effective, the Resulting Company 1 will have 100% mirror Equity Shareholding as that of the Transferee Company. Upon the Scheme becoming effective, the pre-Scheme issued and paid up share capital of the Resulting Company 1 which consists of 30,400 Equity Shares of 10 each aggregating 304,000 will get converted into equal number i.e. 30,400 9% Compulsorily Redeemable Preference Shares of 10 each aggregating to INR 3,04,000.

Financials

In 2008, the Company forayed into decorative paints business. Paint division contributes about 22% in the total revenue of the company.

Table 2: Segment-Wise Financials of Kamdhenu Ltd. for FY-19-20 (All Figs in INR Crores)

| Particulars | Paint | Steel |

| Revenue | 270 | 962 |

| EBIT | 8 | 55 |

| Segment Assets | 199.1 | 210.7 |

| Segment Liabilities | 157.3 | 66.7 |

| Capital Employed | 41.8 | 144 |

| RoCE | 20% | 38% |

The Remaining Net-worth of the Transferor Companies (excluding inter-company investment) is as below:

Table 3: Networth of Transferor Companies (All Figs in INR Crores)

| Particulars | Net-worthINR in CR |

| Kamdhenu Concast | 3.99 |

| Kamdhenu Overseas | 5.47 |

| Kamdhenu Paint | 0.84 |

| Kamdhenu Infradevelopers | 0.27 |

| Kamdhenu Nutrient | 0.17 |

| Kay2 Steel | 0.3 |

| Tiptop Promoters | 3.85 |

| Total | 14.89 |

Table 4:

The Revenue and the Networth (including investments) of the Transferor Companies:

| Particulars | Kamdhenu Limited |

Kamdhenu Concast |

Kamdhenu Overseas |

Kamdhenu Paint |

Kamdhenu Infradevelopers |

Kamdhenu Nutrient |

Kay2 Steel |

Tiptop Promoters |

| Revenue-FY19 | 1232 | 18 | 2 | – | – | – | – | – |

| Networth | 181 | 9 | 8 | 4 | 1 | 1 | 1 | 8 |

Most of the remaining networth derived by the transferor companies is through investment in other group companies & immovable properties. Most of the Transferor Companies have minuscule income. The consideration received by the promoters for the above will be CRPS. As a result, Promoters will effectively cash out by selling those assets to the listed company will become the owner of the same. One needs to see to what extent those assets are useful to the listed company for its core business.

Assets & Liabilities of the Demerged Undertaking:

Table 5: Assets & Liabilities of Kamdhenu Ltd. as on 30.9.2019 (All Figs in INR Lacs)

| Particulars | Steel Business | Paint Business | Total |

| Assets | |||

| Non-Current Assets | 9,173 | 2,846 | 6,327 |

| Current Assets | 33,286 | 16,683 | 16,604 |

| Total | 42,460 | 19,529 | 22,931 |

| Liabilities | |||

| Non-Current Liabilities | 2,511 | 754 | 1,757 |

| Current Liabilities | 20,794 | 13,685 | 7,109 |

| Total | 23,305 | 14,439 | 8,866 |

| Net Assets | 19,155 | 5,090 | 14,064 |

Upon demerger, circa 26% of the net worth will get transferred to the Paint Business. Further, the above figures are excluding the assets & liabilities which will get transferred as a result of the amalgamation. Interestingly, one will notice the other business of the Transferor Companies consists of mainly investment in other companies and few small properties. The management should explain the minority shareholders how these investments will be beneficial for the Steel Business. However, in any case, post amalgamation, steel business will have additional burden of dividend and redemption of 9% preference shares.

Conclusion

Though the move to separate Paint Business from the Company’s Core Steel Business looks to simplify both businesses as well as pave the way for their independent growth, the transaction structuring leaves with some questions.

Primarily it will unable promoters to have a direct holding in both businesses, give exit to the outside shareholders of transferee companies by giving listed company shares, cash out other assets and get handsome return of 9% till CRPS are redeemed.

Instead of demerging into directly into proposed listed Resulting company 1, Kamdhenu decided to demerge it into the subsidiary of the proposed listed Resulting company and hence Paint Business will be listed indirectly through Shell Holding company. This structuring could be with a view to avoid any SEBI takeover code implications in the future if management decides to invite some strategic partner in the paint business at operating level with more than 25% stake. It is to be seen how and to what extent the structure will create value for public shareholders.

Add comment