In order to raise funds for expansion, Goldman Sachs promoted renewable power generation company ReNew Power will list on NASDAQ through a business combination with RMG Acquisition Corporation II (RMG II). In a public statement, ReNew announced the execution of a definitive agreement with RMG II for a business combination that would result in ReNew becoming a publicly listed company on the NASDAQ. Post the listing, ReNew will be armed with more than enough capital to fully fund the company’s business plan projections for 2025 and beyond.

With an ambitious target of the Indian Government of building 450 GW of renewable capacity by 2030, renewable sector in the country is poised for enormous growth in the coming decade. With a transition in the renewable sector gathering pace, the companies present in the sector has pulled up the gears.

On February 24 2021, ReNew Power Private Limited (ReNew) announced its listing on NASDAQ through a merger with Special Purpose Acquisition Company (SPAC). Reverse listing through SPAC is a usual scenario for many US-based companies. However, with this announcement, many India-based companies will likely evaluate a similar mechanism to get themselves listed. In this article, we have captured the key rationale for listing ReNew through SPAC, transaction structure, regulatory aspect of the deal and way ahead for the company.

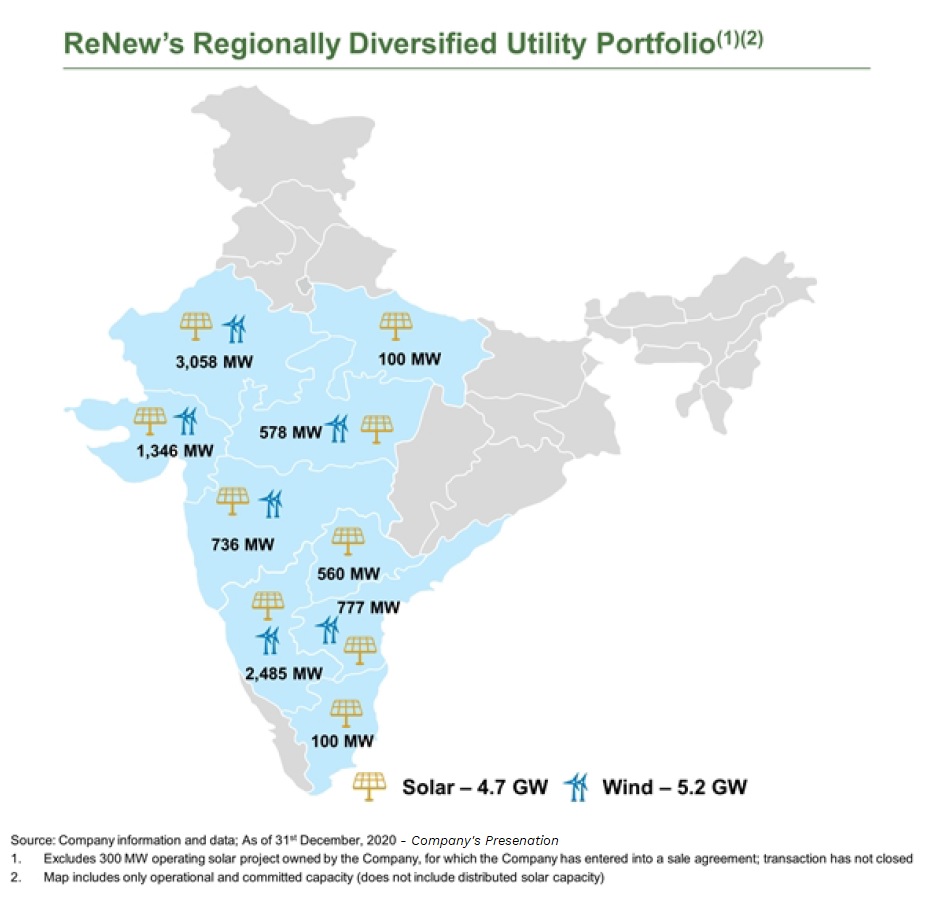

The former COO of Suzlon Energy Limited, Sumant Sinha started ReNew in 2011. Today, ReNew is India’s leading pure-play renewable energy producer. It has over 100 operational utility-scale wind and solar energy projects spread across nine states in India. ReNew is presently the only company in the Indian renewable energy sector with over 5 GW of operational capacity.

In 2012, with funding of $60 million, ReNew commissioned 1st project with 25.2 MW in Gujarat. Later, it raised funds through equity as well as Green Bonds on several occasions and grew its capacity to 5.4 GW with additional 4.5 GW capacity to come in next couple of years.

Funding History of ReNew

Throughout its journey from 2012, it has raised funds several times through combination of equity allotment as well as through debt. At various stages, the founder in pursuit of expansion, diluted their equity to global investors and scaled up the company. Today, the founder owns only 6.9% equity stake in ReNew.

Snapshot of Equity & Debt Raised by the ReNew in past:

| Financial Year | Fund Type | Amount(in $ million) |

| 2012 | Equity | 60 |

| 2013 | Equity | 150 |

| 2014 | Equity | 110 |

| 2015 | Equity | 70 |

| 2016 | Equity | 196 |

| 2017 | Equity | 286 |

| Bonds | 475 | |

| 2018 | Equity | 247 |

| 2019 | USD Bonds | 435 |

| 2020 | Right Issue (Equity) | 300 |

| USD Bonds | 840 | |

| 2021 | USD Bonds | 325 |

| Total | 3494 |

Its shareholders include:

| Name of the Shareholder | Equity % in the Company | Shareholder Since |

| Founders | 6.9% | Inception |

| Goldman Sachs | 48.6% | 2011 |

| CPPIB (Canada Pension Plan Investment Board) | 16.2% | 2018 |

| ADIA (Abu Dhabi Investment Authority) | 15.9% | 2016 |

| JERA (JERA Power RN B.V) | 9.1% | 2017 |

| Global Environment Fund | 3.3% | 2014 |

Apart from equity shares, ReNew has also issued Compulsorily Convertible Preference Shares (CCPS) to some of its investors.

What is SPAC and brief description of RMG II

A Special Purpose Acquisition Company (SPAC) is created to merge with a private company and thereby bring it public. SPAC does not do any business on its own. It’s a shell company which gets publicly listed firm with a circa two-year lifespan during which it is expected to find a private company with which to merge and thereby bring public. One of the key reasons why SPAC are getting momentum is because SPACs have been touted as a cheaper way to go public than an IPO.

In its IPO, a SPAC sells units consisting of a share, a warrant, and in some cases, a right to a fraction of a share. SPACs uniformly set prices of units at $10. The proceeds of a SPAC’s IPO are placed in trust and invested in Treasury notes.

RMG Acquisition Corporation II is a blank check company/Special Purpose Acquisition Company formed in 2020. RMG II raised $345 million in its December 14, 2020, IPO. Like a typical SPAC capital structure, as on date, RMG II has issued:

- 34,500,000 RMG II units each consisting of one RMG II-Class A Share and one-third of one RMG II Warrant

- 11,500,000 RMG II Warrants

- 7,026,807 RMG II Private Warrants

The Transaction

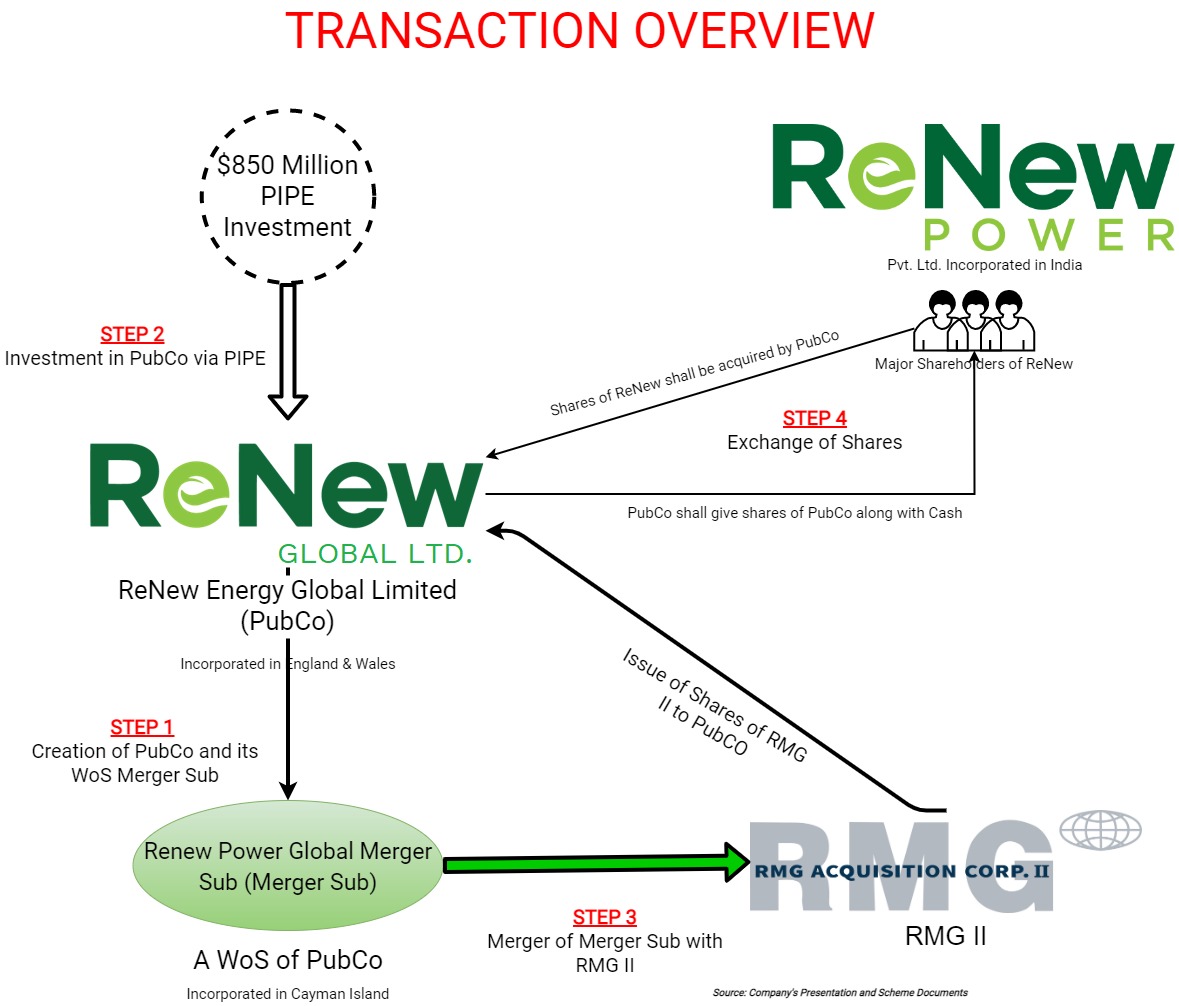

In nutshell, the operational company, ReNew will get indirectly listed on bourses through “Exchange of Shares” by the existing shareholders of ReNew with a listed company, ReNew Energy Global Limited. ReNew Energy Global Limited which will before exchange, will buyout the shares/units of RMG II and get itself listed. The transaction will be carried out in tranches:

- Incorporation of SPV & Investment by certain investors in SPV

- Merger of SPAC with SPV

- Exchange of Operational Company’s share & indirect listing of Operational Company

Step1: Incorporation of Special Purpose Vehicles

ReNew Energy Global Limited (PubCo), a private limited company registered in England & Wales is incorporated owned by third party with nominal one share as a capital. Renew Power Global Merger Sub (Merger Sub) is incorporated as a wholly-owned subsidiary of PubCo in Cayman Island.

Step 2: Investment by certain Investors in PubCo

Like a typical SPAC structure, when a SPAC proposes a merger, its shareholders have a right to redeem their shares at a particular value. To keep the minimum cash balance in SPAC after redemption, SPAC does raise funds from investors in the form of Private Investment in Public Entity (PIPE). In this case also, certain marquee institutional investors including funds and accounts managed by BlackRock, BNP Paribas Energy Transition Fund, Mr. Chamath Palihapitiya, Sylebra Capital, TT International Asset Management Ltd, TT Environmental Solutions Fund and Zimmer Partners (together known as PIPE) will subscribe for an aggregate amount of 85.5 million PubCo Class A Shares for consideration in an aggregate amount of $855 million (the “PIPE Investment Amount”) immediately prior to the Merger of ReNew with PubCo.

Step 3: Merger of Merger Sub with RMG II

Merger Sub will get merge with RMG II. Following the merger, the shareholders of RMG II will exchange their shares in RMG II for shares of PubCo. As a result of this, shareholders of RMG II become shareholders of PubCo and RMG II will become a wholly-owned subsidiary of PubCo.

Consideration:

| Particulars | Action on Merger of RMG II with Merger Sub |

| Shares held by PubCO in Merger Sub | Will get cancelled |

| RMG II Units | shall be automatically detached and the holder thereof shall be deemed to hold one RMG II Class A Share and one-third of an RMG II Warrant. |

| RMG II Class A share | Shall be cancelled in exchange for the issuance by PubCo of one PubCo Class A Share |

| RMG II Class B Share | Shall be cancelled in exchange for the issuance by PubCo of one PubCo Class A Share |

| RMG II Warrants (Public and Private) | Each RMG II Warrant shall remain outstanding but shall be automatically adjusted to become a warrant to purchase 1.0917589 whole PubCo Class A Shares |

Immediately following such cancellation, RMG II shall issue 34,500,000 RMG II Class A Shares and 8,625,000 RMG II Class B Shares to PubCo in consideration for such issuance by PubCo of PubCo Class A Shares.

Immediately following the occurrence of the Merger, RMG II shall extend the entire cash available with it in a form of a loan to PubCo.

Step 4: Exchange of ownership of ReNew

Certain Shareholders of ReNew shall transfer to PubCo, and PubCo shall acquire the shares of the ReNew. PubCO as consideration for acquiring shares of ReNew will give:

- Shares of PubCo and

- Cash Payment

Certain equity Shares held by founder, employees and equity shares issued on conversion of CCPS held by some investors in ReNew will continue to remain as it. Founder and certain other investors of ReNew will subscribe to a different class of shares issued by PubCo. Further, the investors along with founder shall have an option to transfer the equity shares so received in ReNew for Conversion of CCPS to PubCo for a consideration to be received in form of the different class of shares of PubCo.

Effectively, Share Capital of PubCo will have:

- Class A shares will be issued to the maximum persons/shareholders and which will get listed

- One Class B Share

- Class C Shares

- One Class D Share

Out of which, Class C share will not have any voting powers. Other classes have different voting rights and conversion ratio. Different class of shares will offer ownership, management and distribution flexibility as well as may result in some tax advantage.

Further, some part of the consideration is contingent upon the redemption of shares of RMG II, however the same will not have any effect on consideration payable to the promoter. Effectively, this has been done to maintain the cash balance in PubCo at the same time maintaining the amount payable to the Promoters of ReNew.

Number of Shares offered and Issue of various class of shares to shareholders of ReNew:

| Shares of PubCO | ||||||||

| Particulars | Number of Equity Shares held in ReNew | % | ReNew Shares Transferred | Class A Shares | Class B Share | Class C Share | Class D Share | Cash Consideration (in US$) |

| GS Wyvern Holding Limited (Goldman Sachs) | 18,47,09,600 | 48.6% | 18,47,09,600 | 2,17,66,529 | – | 10,54,41,472 | – | 24,20,00,000 |

| Canada Pension Plan Investment Board | 6,16,08,099 | 16.2% | 6,16,08,099 | 4,18,67,691 | – | – | 1 | 9,20,00,000 |

| Abu Dhabi Investment Authority | 6,04,87,804 | 15.9% | 7,52,44,318 | 5,33,70,916 | – | – | – | 9,00,00,000 |

| JERA Power RN B.V. | 3,44,11,682 | 9.1% | 3,44,11,682 | 2,85,24,255 | – | – | – | – |

| Founder | 2,62,89,804 | 6.9% | 74,79,685 | – | 1 | – | – | 6,20,00,000 |

| RMG II Shareholders | – | 0.0% | – | 86,25,000 | – | – | – | – |

| GEF SACEF India | 1,23,75,767 | 3.3% | 1,23,75,767 | 88,58,421 | – | – | – | 1,40,00,000 |

| Total | 37,98,82,756 | 100% | 37,58,29,151 | 16,30,12,812 | 1 | 10,54,41,472 | 1 | 50,00,00,000 |

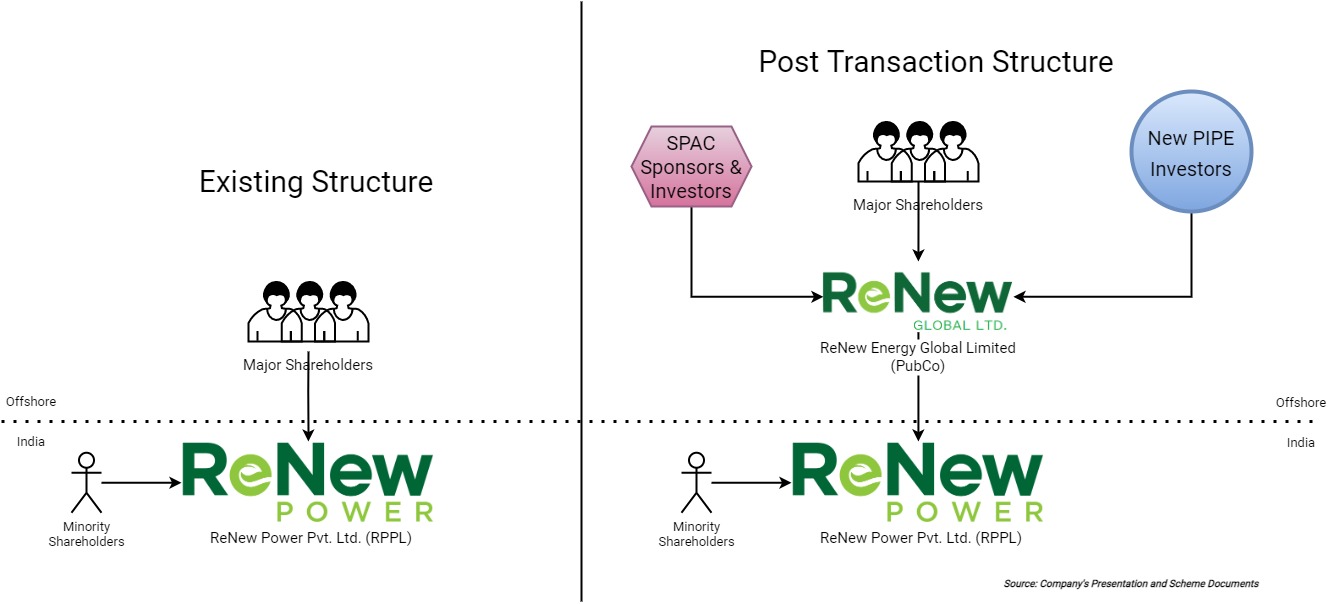

Structure (Post-Transaction)

To achieve operational efficiencies and optimal returns, founders along with some other investors will continue to hold direct stake in ReNew.

The minority shareholders (founders along with some other investors) will hold circa 9.1% stake in ReNew and the remaining will be held by PubCo. There will be “Put Option” available to the Founders. This will not only give liquidity to Founders but also an option to take exit if desired in the coming period.

Founders being Indian Resident, keeping shares in ReNew as it will also likely to reduce regulatory as well as tax challenges.

Shareholding Pattern

Post-transaction ReNew shareholders will become the major shareholders of the combined entity cumulatively holding circa 70%.

Post-transaction, ReNew, apart from its own cash, will have cash equal to $ 345 of RMG II cash held in trust (subject to the redemption) plus $885 million came through PIPE which will be used to fund the attractive near-term growth opportunities and reduce existing leverage. ReNew will be armed with more than enough capital to fully fund the company’s business plan projections for 2025 and beyond. This means that ReNew will not need to raise any additional capital over the intermediate-term, unless growth materially exceeds expectations or new business, or accretive acquisition opportunities present themselves. ReNew’s leadership will remain intact, with Sumant Sinha as Chairman & Chief Executive Officer of the combined company, overseeing its strategic growth initiatives and expansion.

Legal & Taxation Aspect

Listing through SPAC model will have its own challenges. The Indian government is trying to liberalise the regulations for any outbound re-structuring. However, there are still a lot of intricacies are involved. Major hurdles for any outbound re-structuring will be two folds, one is the limit set-out by Reserve Bank of India and the second will be Taxes. Though inbound/merger between two companies are exempted under Income Tax, an outbound merger i.e. the Indian company merging with foreign will still attract taxes. Further, there is cap set by RBI for doing investment in foreign entity which needs to be examined before structuring such transaction. Another issue which needs attention is “Round Tripping”.

In current scenarios, most of the existing shareholders will exchange their shares with a company incorporated in England & Wales and in consideration, will receive shares and cash. As most of the shareholders who are exchanging shares are not Indian Residents, swapping will not have any significant regulatory challenges. The resident shareholders (Founders & Employees) will retain most of their shares in ReNew. The “Exchange” transaction will likely attract capital gains however, with designed structure, shareholders likely to optimise the same.

Overall, the transaction is designed in such a way that ReNew will continue to be a separate entity and what will get listed is a holding company. This must have been structure to avoid any regulatory challenges and achieve optimal returns for existing shareholders.

Financials

Snapshot of Consolidated Financials of ReNew for FY 2020 & FY 2016 (All figs in ₹ crore)

| Particulars | 2020 | 2016 |

| Property, Plant & Equipment | 30,124 | 6,162 |

| Cash & Cash Equivalent | 4,428 | 1,572 |

| Networth | 7,109 | 3,470 |

| Borrowings | 33,571 | 5,832 |

| Total Income | 5,321 | 858 |

| EBITDA | 4,464 | 771 |

| EBITDA % | 83.9% | 89.9% |

| PAT | -502 | 89 |

Valuation

The transaction gives enterprise value to ReNew of circa $7846 million.

| Particulars | Amount (in US $ million) |

| Equity Value (assigned to the transaction) | 4370 |

| Existing Debt | 4816 |

| Existing Cash | 730 |

| Other Cash | 610 |

| Enterprise Value | 7846 |

Based on certain Indian peers, the valuation of ReNew looks undervalued. However, one must consider the future contracts available with companies.

| Particulars | Capacity (MW) | Equity value(US $ mn) | Equity value per MW (US $ mn) |

| Adani Green | 7019 | 24077 | 3.43 |

| Greenko | 6048 | 5750 | 0.95 |

| Renew | 9863 | 4370 | 0.44 |

Adani Green Valuation as on 19th February 2021.

Conclusion

The proposed transaction marks for the first major overseas listing of an Indian company via much popular SPAC route in USA. Previously, ReNew tried to make an IPO in India however, due to poor market conditions they withdrew it. To provide exit with a good return to private investors, it becomes essential for the private company to get it listed. With a splendid opportunity available for the companies present in Renewable Sector especially in India, ReNew has really blazed a new trail.

Listing in USA will not only pave the way for attracting global capital but also likely to offer better exit opportunities for the existing investors. With a focus towards ESG investing, incoming period, one may witness good response to ReNew.

Structures like SPAC allows private innovative businesses to get it listed when they matures, have substantial revenue and easily understandable business model, to get listed very quickly without rigorous scrutiny and at same time, SPAC do provides for infusion of cash in the company which otherwise one of the key reasons for any IPO.

India is the third largest power market in the world which has exponential growth opportunities for renewable power. Having said that, looking at expansion of players like Adani Green & others, ReNew will witness a strong competition. With this structure, ReNew has now placed itself in a different league. It will be interesting to see how ReNew folds itself with a new avatar.

Last year, the Indian government cleared its intentions to provide Indian companies with an opportunity to list in foreign without much of a requirement. Recently, the chairman of the International Financial Services Centres Authority also said the regulator will soon come up with SPAC regulatory framework to facilitate start-ups to raise capital through the sale of equity. With ReNew being the first Indian company to start this, one thing is pretty sure that a plethora of Indian companies now will explorer a similar modus-operandi in coming period.

Add comment