Loss making wind turbine maker Suzlon Energy has finally completed its debt restructuring. The company has met all the stiff conditions put forth by its lenders. After the restructuring, the company’s term debt has been lowered and the interest rate reduced. The balance debt of secured consortium lenders has been replaced by optionally convertible debenture of the company and compulsorily convertible preference shares of its subsidiary. The debt restructuring is likely to help in cash flow and give the Tantis some headroom to ramp up the business.

Suzlon Energy Limited (‘SEL’ or ‘the Company’) listed company is primarily engaged in the business of manufacturing of wind turbine generators (‘WTGs’) and related components of various capacities.

Resolution Plan

With a view towards resolution of the indebtedness of the Borrowers, the Lenders had entered into an inter-creditor agreement dated July 1, 2019 (“ICA”). Pursuant to the ICA, the lenders have unanimously approved a resolution plan in terms of which the existing facilities are to be restructured. On March 27, 2020, the Resolution Plan was approved by 100% of the consortium lenders subject to certain conditions precedent.

On 5th June 2020, Borrowers have entered into the Framework Restructuring Agreement (FRA) to give effect to the resolution plan. On June 30, 2020, the Resolution Plan was implemented upon completion of compliance of all condition’s precedent to the satisfaction of the consortium lenders and Resolution Plan is effective from June 30, 2020.

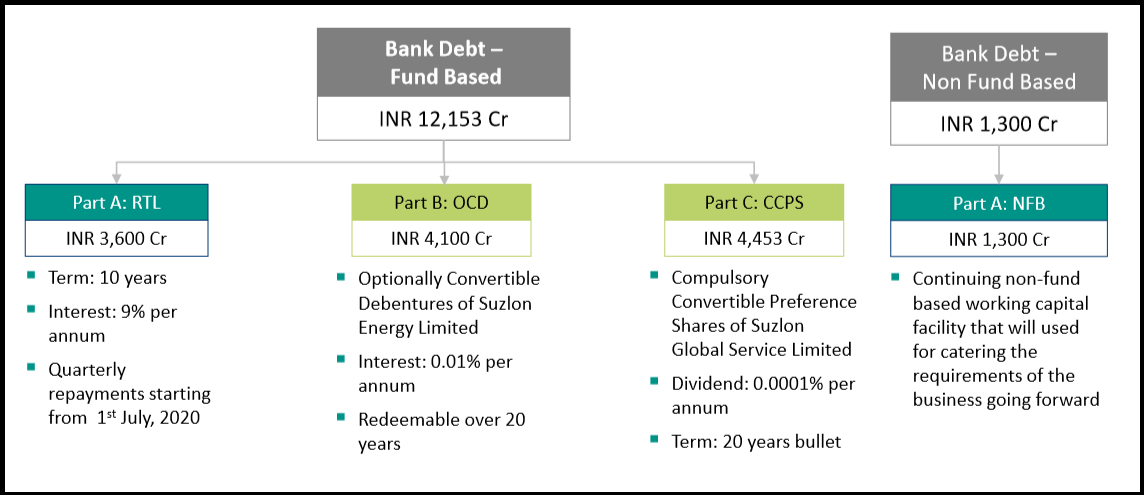

The key features of the Resolution Plan:

The existing loan facilities of STG (Suzlon The Group) are restructured in the following manner and divided into 3 parts:

Part A – Part of Existing facilities other than FCCB to the extent of ₹ 5,188.41 Crore is restructured as follows:

- Repayment of Rupee Term Loan (‘RTL’) of ₹3,600 Crore in 40 structured quarterly installments commencing from September 2020 to June 2031 at the rate of interest of 9.00% per annum.

- Repayment of Rupee Term Loan under the project-specific facility of ₹261 Crore on or before December 31, 2020.

- Continuation of existing non-fund based working capital facilities of INR 1,300 Crore.

Part B – Balance Existing facilities to the extent of INR 4,100 Crore is converted into 410,000 nos. 0.01% Secured Optionally Convertible Debentures (‘OCD’) of face value of INR 100,000 each of Company issued to Lenders.

Terms of OCD:

- Initial tenure of OCD is 10 years

- At the end of initial tenor, holders of OCDs shall have the obligation to subscribe to the new series of OCDs having tenor of 10 (ten) years.

- Conversion option: In case of default in redemption, the holders of OCDs shall have the option to convert the defaulted redemption amount into equity shares of the Company. However, in case of default in servicing OCDs, the OCD holders shall have an option to convert OCDs into equity shares of the Company.

- Conversion price determined as per ICDR regulations.

Part C: Balance of Existing facilities

To the extent of INR 4,453.01 Crore is converted in to 4,45,301nos 0.0001% Unsecured Compulsorily Convertible Preference Shares (‘CCPS’) of face value of INR 100,000 each of Suzlon Global Services Limited (SGSL)

Terms of CCPS:

- Issued at par

- CCPS holders having a put option on SEL for the CCPS issued by SGSL up to 3 months after effective date.

- From effective date and till fifth anniversary of issuance of CCPS, the promotors of STG shall have option to buy CCPS from the holders through secondary market at price yield return at least discount rate prescribed by RBI.

- In future but within a period of 5 years from the issuance of CCPS if any capital raise by offer for sale, such proceeds first use to buy back the entire outstanding CCPS.

- If put option does not exercise and no exit provided to CCPS holders within a period of 5 years, then CCPS holders may exercise the right to put option on SEL.

99,71,76,872 equity shares of face value of INR 2 each of the Company i.e. SEL for an aggregated consideration of INR 1per Lender.

FCCB restructuring

Restructuring of foreign currency convertible bonds (FCCB) with bondholders i.e. rollover/conversion into equity shares of the Company or by issuing of new bonds to FCCB holders.

| Particulars | Amount (INR Crores) |

Principal Outstanding | 1,290 |

Accrued Interest till 30th June 20 | 112.50 |

Total as on 30th June 2020 | 1,402.50 |

Less: a) Converted in Equity shares of SEL | 450 |

b) Debt reduction | 682.50 |

c) Issue New Bonds | 270 |

Terms of New Bond:

- Coupon rate 4% (*Out of 4.00% coupon ,1.25% shall be paid on half yearly basis and balance 2.75% shall be accrued and added to the face value)

- Maturity date June 2032

- Conversion rate Rs. 75/USD

- Conversion share price Rs. 2.61

Preferential issue

- Issuance of 49,85,88,439 warrants of SEL to the Lenders as security towards achieving upgrade of the account within a period of 18 months from the implementation date.

- In addition to above, the company have also issued 4,998 fully paid up CCDs having a face value of Rs. 1,00,000/- each (INR 49.98 Crores) on preferential basis to promoters and certain persons

| Particulars | |

| Conversion Ratio/ other Conversion Terms | 1. Each CCD shall be convertible into 38,314 equity shares of the Company having a face value of Rs.2/- each. However, in annual report mentioned that converted into 40,816 equity shares at a conversion price of Rs. 2.45 on or before Dec. 26, 2021. 2. Conversion of CCDs shall be at the option of the Proposed Allottees. 3. The CCDs shall carry ‘nil’ interest 4. The CCDs shall not carry any voting rights |

Key Terms of Consortium Debt Restructuring

Financials

| Particulars | 2017-18 | 2018-19 | 2019-20 | Jun-20 |

| Revenue from operation | 8195 | 5075 | 3000 | 528 |

| PBT | -840 | -1571 | -2618 | -382 |

| Interest | 1581 | 1270 | 1367 | 159 |

| Depreciation | 342 | 342 | 419 | 71 |

| EBITDA | 1082 | 41 | -832 | -153 |

| Net Worth | -6957 | -8503 | -11042 | – |

| EBITDA/Revenue | 13% | 1% | -28% | -29% |

As per above details the borrowing of the company increased continuously while defaults in making payment to lenders on time it mandates for this restructuring.

| Particulars | Pre-Restructuring | Post restructuring | ||

| Rupee Debt | 12153 | Rupee Term Loan | 3600 | |

| 0.01% OCD | 4100 | |||

| 0.0001% CCPS of Suzlon Global Services Limited (SGSL*) | 4453 | |||

| FCCB | 1403 | 4% New Bonds | 270 | |

| ~53 crore shares @6.77 per shares | 359 | |||

| Total | 13556 | 12781.81 | ||

*SGSL is a WoS (Wholly Owned Subsidiary) of SEL.

Post restructuring net debt position of the company will reduce by ~₹5500 Crores. Therefore, it is beneficial from the company in terms of lower finance cost.

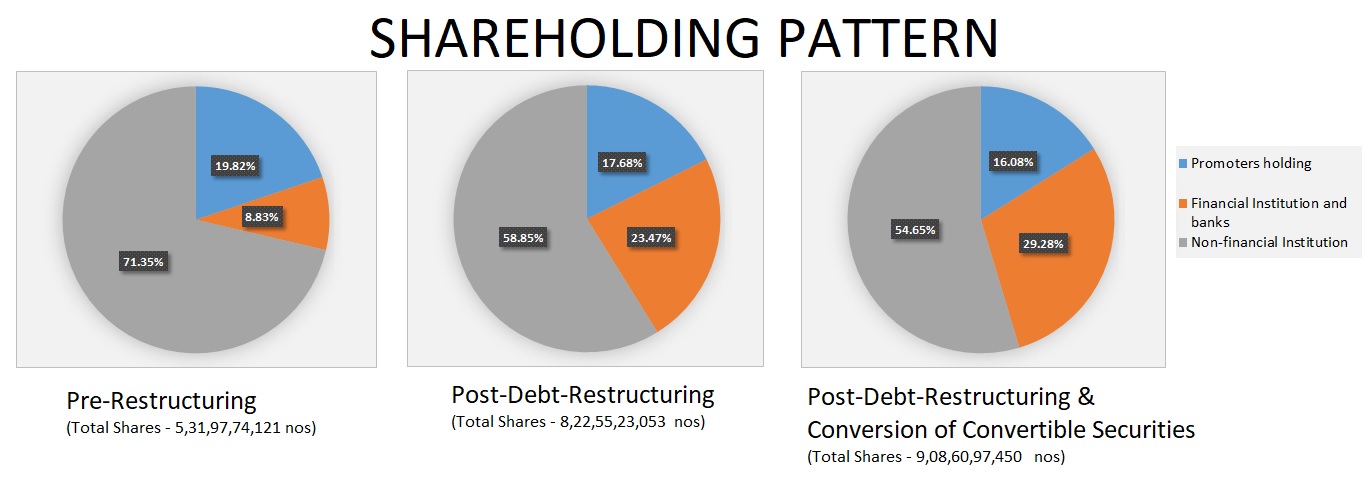

Shareholding Pre and Post restructuring

After implementation of the scheme, promotors shareholding dilute by 2.60% and stake of financial institution increased from 8.82% to 23.58%. However, shareholding of the public dilutes around 15%.

Details of some of the allottees equity shares on preferential basis

| Major Shareholders | Nos. issued | Already Held | Total |

| Rambhaben Ukabhai | 19,15,70,881 | 15,89,01,093 | 35,04,71,974 |

| Dilip Shanghvi | 13,40,99,217 | 70,00,00,000 | 83,40,99,217 |

| Sudhir Valia & Vijay Parekh | 15,00,00,000 | 29,00,54,295 | 44,00,54,295 |

| Indrani Patnaik | 7,66,28,352 | – | 7,66,28,352 |

| Rajesh Omkarnath Malpani | 5,74,71,264 | 7,500 | 5,74,78,764 |

| Amrik Singh And Sons Crane Services Private Limited | 9,57,85,441 | – | 9,57,85,441 |

| Others | 44,38,70,132 | 86,74,346 | 42,25,44,478 |

| Total | 1,14,94,25,287 | 1,15,76,37,234 | 2,30,70,62,531 |

The company did a fundraising of ₹300 crores by issuing these preferential shares.

Conclusion:

Like some STEEL companies, which under IBC were acquired by strategic buyers, in the present transaction also, operating business is getting in the hands of financial investors and original promotors still getting chance to run the company, though their stake is substantially reduced. Innovative structuring of debt in holding company with lot of optionality including lenders getting shares SEL and promise to list SGSL after 16 years. It gives lease of life to the business and in the process all its stakeholders to get their reasonable returns. only time will tell whether Tanti i.e. promotors in their second inning will be able to perform better.

Add comment