Infosys Ltd, the country’s second-largest software services provider, which regained lost ground and demonstrated consistent performance, is on an acquisition spree as it has set its sights on the next goal to become the industry bellwether once again. This calendar year (2020) till September end, Infosys has acquired three companies abroad clearly demonstrating the company’s commitment to complement its present services to its clients and fill the technology gap.

In September, Infosys announced the acquisition of Czech Republic-based enterprise service management consultancy GuideVision for $35.5 million. In the same month, Infosys headed by Salil Parekh announced to buy Kaleidoscope Innovation, an Ohio, US-based company that designs and develops medical devices as well as consumer and industrial products for $42 million.

In March this year, Infosys announced that it completed the acquisition of Simplus (Outbox Systems Inc), one of the fastest-growing Salesforce Platinum Partners in the US and Australia for $250 million. The announcement of the acquisition was made on February 10, 2020. It was the first acquisition by Infosys in 2020 and second-biggest overall, after its $350-million purchase of Zurich-based Lodestone Holding AG in 2012.

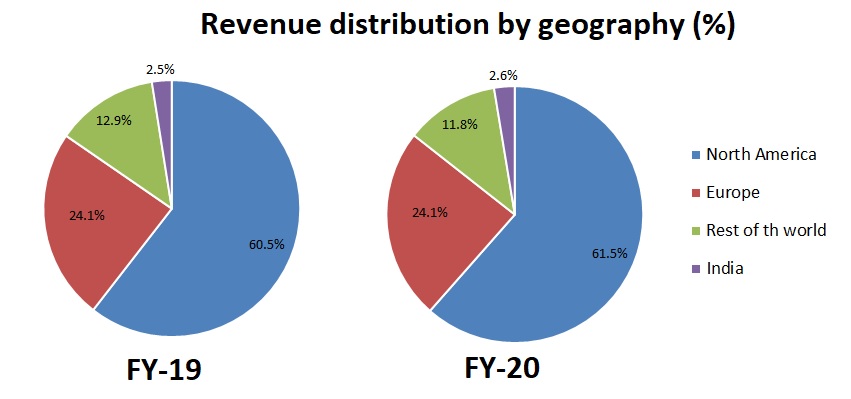

In fact, under the leadership of Salil Parekh, Infosys has stepped up M&A deals to augment its skills in new-age technology such as cloud computing, design engineering and digital transformation. While most of Infosys’s acquisitions have been in smaller ticket size, the intent is to scale up the business. Infosys’s domestic rivals such as Wipro Ltd, Cognizant Technology Solutions and HCL Technologies Ltd have done several acquisitions in the past to grow their business. To be sure, Cognizant Technology Solutions has done seven deals this year and in July alone Wipro made two acquisitions within weeks after its new CEO Thierry Delaporte took over.

Acquisition of GuideVision

The acquisition of GuideVision by Infosys is a smart move to build capabilities relevant to the digital priorities of its clients. The acquisition will help strengthen Infosys’ Cobalt offerings portfolio of cloud services and further strengthen nearshore delivery presence in Europe. GuideVision offers a unique combination of strategic expertise, innovative technological knowledge and agile methodology. The company is an award-winning enterprise service management consultancy specialized in offering strategic advisory, consulting, implementations, training and support on the ServiceNow platform.

The company’s end-to-end offerings, including SnowMirror – a proprietary smart data replication tool for ServiceNow instances – enables over 100 enterprise clients to simplify complex business and IT processes. Moreover, GuideVision’s training academy and nearshore capabilities in Czech Republic, Hungary, Poland, and presence in Germany and Finland will strengthen Infosys’ ServiceNow capabilities for its clients in Europe.

Even for GuideVision, the acquisition brings in lots of benefits. It brings an extended portfolio of services that the company can offer to its clients in the European market. Prague-based GuideVision was set up in 2014 with offices in many European countries. The company’s revenue rose to €12.9 million in 2019 from €10.4 million in 2018. $35.5 million consideration for the acquisition is almost 3 times revenue 2019. The acquisition is expected to close during the third quarter of fiscal 2021, subject to customary closing conditions.

Acquisition of Kaleidoscope Innovation

The acquisition of Kaleidoscope Innovation (100% of the equity share) will help Infosys to expand its engineering services portfolio by strengthening its presence in medical devices, consumer and industrial markets across the United States. This acquisition will strengthen Infosys’ digital offerings, especially in medical devices, a sector that is expected to witness significant investments and consumerization in the post-Covid-19 pandemic era.

The acquisition will bring Infosys a diverse talent pool with extensive knowledge of design and engineering. The company leverages a deep understanding of clinical environments, strong product development capabilities across domains, and a consultancy-style approach addressing human factors and product design. Kaleidoscope designs microsurgical instruments, devices used in minimally invasive surgery, drug delivery devices for ophthalmic therapies and user-centric wearables.

For Kaleidoscope Innovation, the acquisition will enable it to scale quickly and bring expanded offerings in artificial intelligence, analytics, and digital infrastructure to its clients. For over three decades, clients have partnered with Kaleidoscope to improve the human experience. The company offers both consultancy-style and onsite services, across a full breadth of disciplines to meet their client’s needs. The acquisition is expected to close during the second quarter of fiscal 2021.

Acquisition of Simplus

The acquisition of Simplus (Outbox Systems Inc) and the acquisition of Fluido (announced in September 2018) will help Infosys to elevate its position as an end-to-end Salesforce enterprise cloud solutions and services provider. In 2018, Infosys acquired Fluido, a firm with core competence in Salesforce software for the European market. In fact, Simplus will bring knowledge and solution across a variety of industries including high-tech, financial services, retail, healthcare, life sciences and manufacturing. The company has over 4,500 projects and a customer satisfaction rating in the top 1% of all Salesforce partners. It has offices across North America, Sydney, Melbourne, London, and a large delivery center in Manila.

Infosys paid $250 million (approximately Rs 1,892 crore) for the deal. The deal break-up as per the FY20 annual report — $180 million comprising cash consideration, $20 million contingent consideration and $50 million additional performance bonus and retention payouts payable to the employees of Simplus over the next three years, subject to their continuous employment with the group and meeting certain targets. The acquisition of Simplus will strengthen Infosys’ cloud-first digital transformation capabilities and will be key to staying relevant to the digital priorities of its clients.

Infosys’ M&A moves

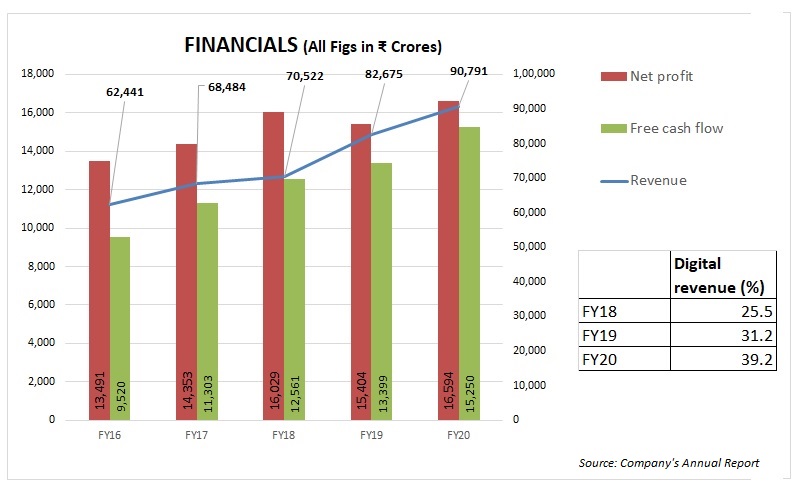

Infosys’ acquisition moves clearly indicate the current management’s aggressive approach of taking an inorganic route to enhance capabilities in future growth areas. As Infosys had announced a plan to double its cloud and data services as part of its digital transformation, it is moving in that direction to consolidate its position. Going forward, cloud services will be a substantial part of revenue for the company.

In the annual general meeting held virtually in June this year, Salil Parekh has underlined that Infosys is looking at acquisitions with a digital focus be it in the cloud or data and is looking at acquisitions in multiple geographies. Infosys chairman Nandan Nilekani too, said the company would look at tuck-in acquisitions and look at captives. In FY20, Infosys spent Rs 3,000 crore to acquire or take a majority stake in some companies as it moved to extend capabilities into emerging technologies and focused industry sectors. In FY19, Infosys spent Rs 1,170 crore to acquire majority stakes in three companies.

For the last few years, IT services companies are witnessing growing opportunities from new software vendors. This has led to acquisitions as clients move away from paying large upfront license fees for software and hosting on-premises servers. Infosys is on the right track to gauge the opportunities and are looking for suitable acquisitions which fit into their scheme of things.

Conclusion

For large IT companies, it is difficult to grow organically unless it continues to acquire niche businesses having technology pool, new geography, tuck in and bolt-on acquisition even to service its present clients fully and integrated manner. In the current context, a digitally refreshed organisation can drive value at scale. By leveraging cutting-edge digital and artificial intelligence solutions, organisations can overcome the time and efficiency constraints of the integration process. As Infosys has embarked on a path of inorganic growth, it must strive for speedy post-merger integration and to capture synergies of cross-selling as those niche companies are not available cheap. Finally, all those acquisitions, to create value, should add impetus to its overall business making the company more valuable to more customers.

Add comment