The shopping spree for the Adani Group seems to be unstoppable. Recently, Adani Group announced yet another acquisition in cement space. This time it is Orient Cement Limited. Within no time Adani Group has become second largest cement producer in India. After the marquee acquisition of Ambuja Cements Limited and ACC Limited, the Adani Group is in a rush to acquire all small cement companies to be in a race to become numero uno in cement space.

Ambuja Cements Ltd (“Ambuja”) is one of India’s leading cement companies and a member of the diversified Adani Group. Ambuja, with its subsidiaries ACC Ltd, Penna Cement Industries Ltd and Sanghi Industries Ltd, has taken the Adani Group’s cement capacity to 88.9 MTPA, with 20 integrated cement manufacturing plants, 20 cement grinding units and 12 bulk terminals across the country. The equity shares of Ambuja Cements Limited are listed on nationwide bourses.

Adani Group is India’s one of the leading conglomerate groups having diversified interest ranging from Mines to Airports to Power to Cement. The group is led by Mr. Gautam Adani. In past, Adani Group has facilitated enormous returns to stakeholders through multiple restructurings and business growth. Currently, the group has a couple of operating listed and unlisted entities.

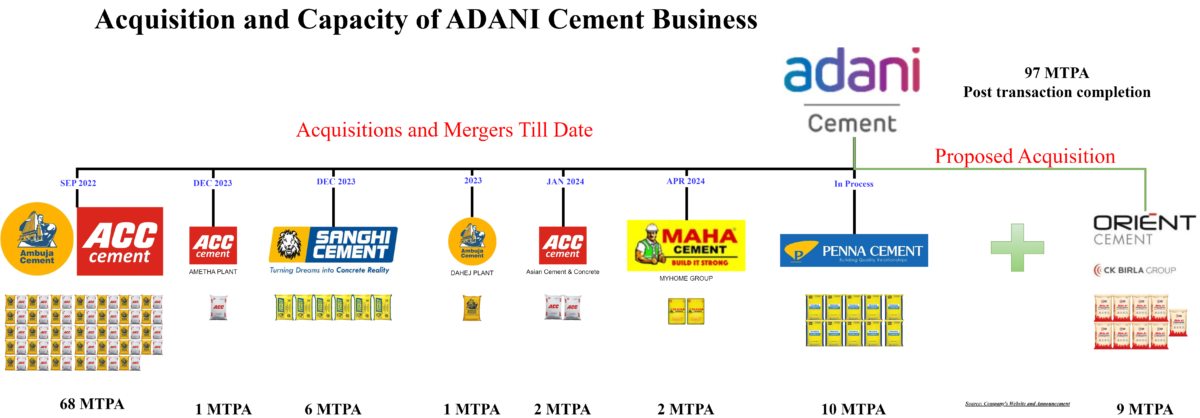

In 2022, Adani Group announced acquisition of entire equity stake held by Holcim Group in Ambuja Cement Limited and ACC Limited. This marked the foray of Adani Group into the cement business and directly placed them after Ultratech Cement, India’s largest cement manufacturer. To grow its cement business Adani Group has acquired the following entities in the last 2 and half years:

- Ambuja Cements Limited

- ACC Limited

- Sanghi Industries Limited

- Penna Cement

- Merger with Adani Cementation Limited

- My Home Group-Grinding Unit

- Latest being Orient Cement Limited

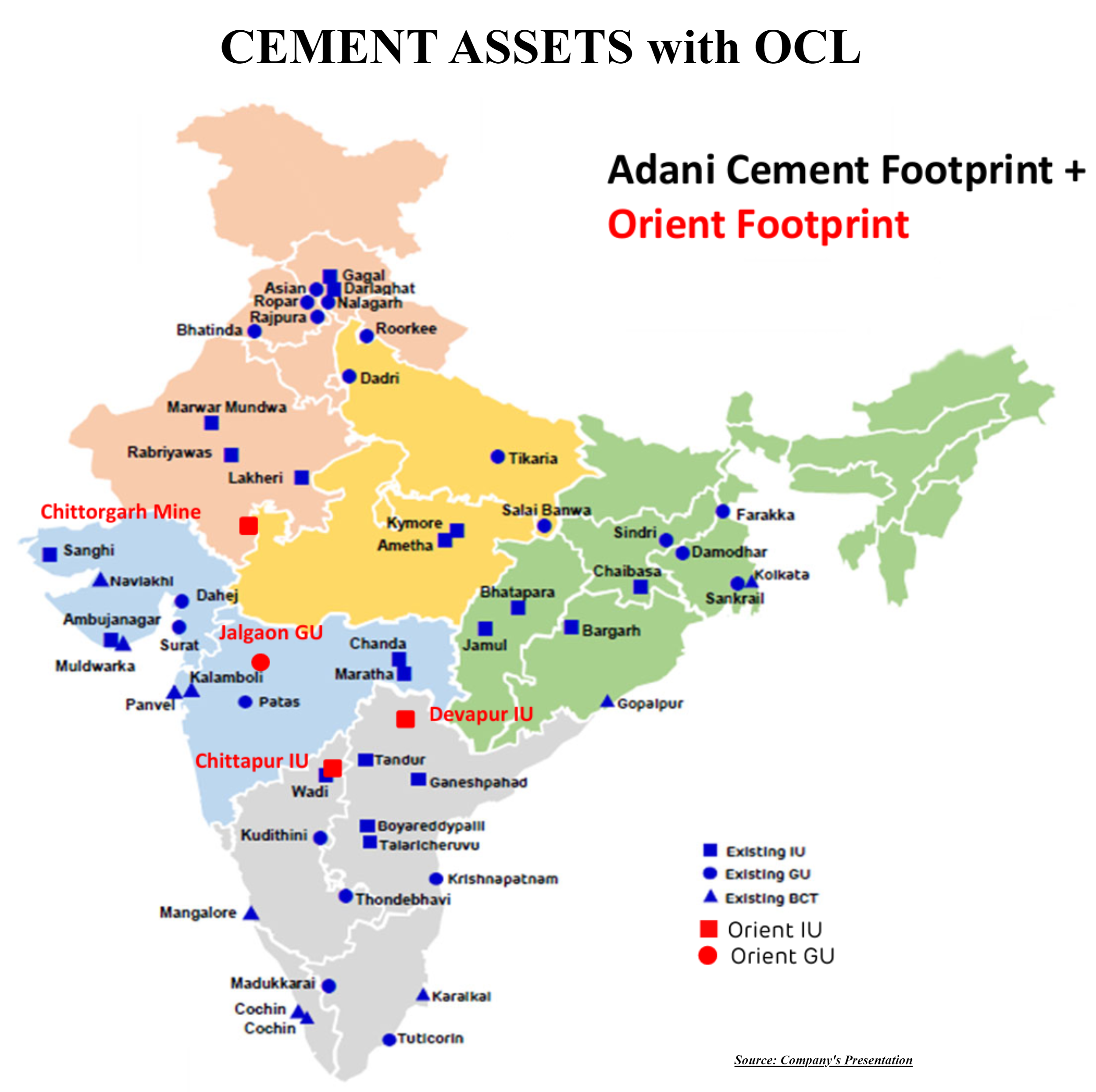

Orient Cement Limited (“Orient” or “OCL”) is a CK Birla group company engaged in the manufacturing of cement and allied products. OCL has 5.6 MTPA clinker capacity and 8.5 MTPA cement capacity along with statutory clearance to increase the clinker capacity by another 6.0 MTPA and cement capacity by another 8.1 MTPA. In addition, OCL also has a limestone mining lease in Chittorgarh for setting up an Integrated Unit (IU) with clinker of 4 MTPA and a split Grinding Unit (GU) of 6 MTPA in North India. The equity shares of OCL are listed on nationwide bourses.

Details of Recent Transaction

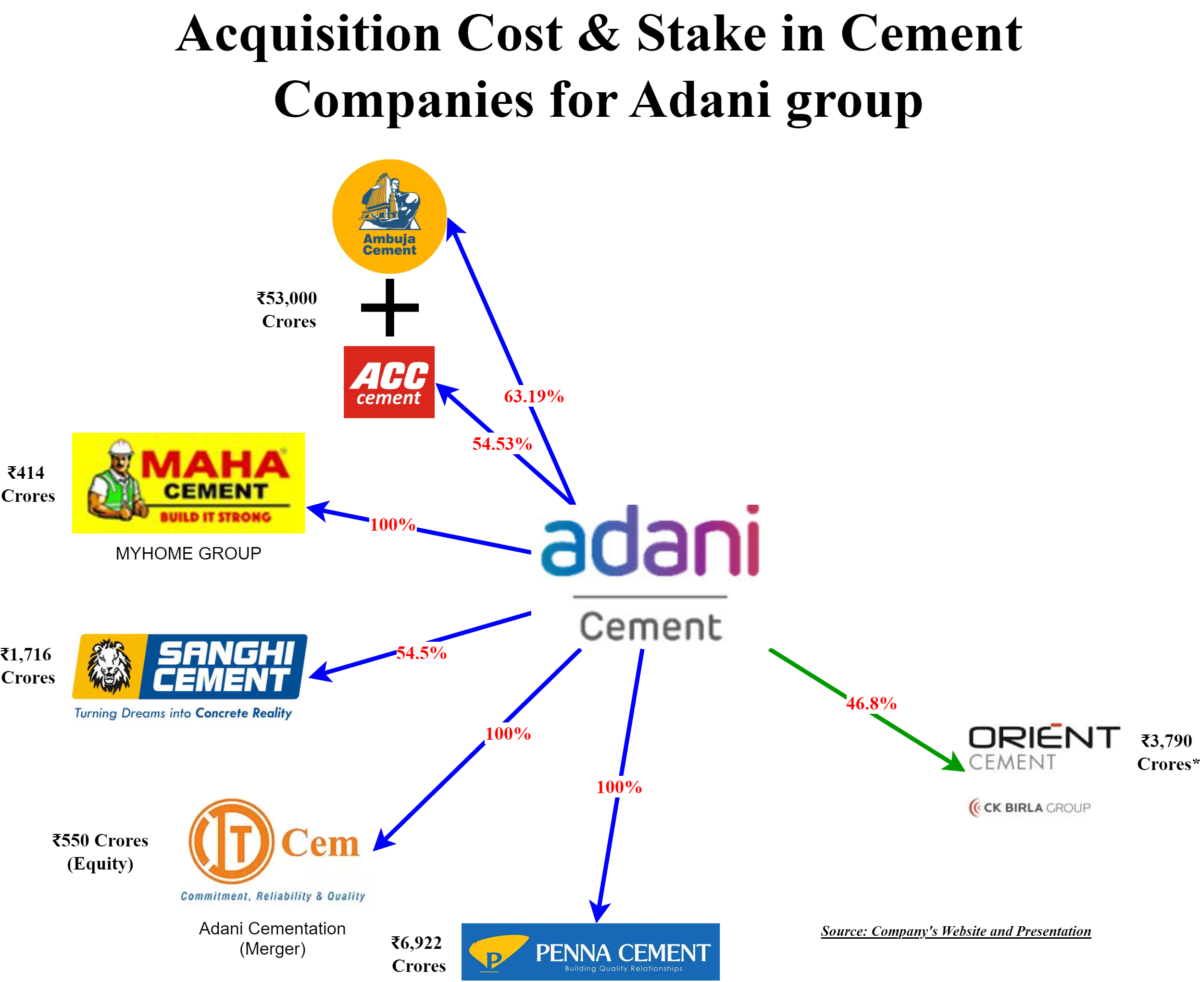

The board of directors of Ambuja Cement Limited has announced that it has signed a definitive agreement with the promoters of OCL to acquire a 46.8% equity stake in OCL. Ambuja has signed two Share Purchase Agreements:

- One with promoters which shall entitles Ambuja to acquire 37.9% stake in OCL for a consideration of INR 3070 crore

- Other with institutes relating to promoters (which are classified as public shareholders) to acquire 8.90% stake for a consideration of INR 720 crore

Cumulative, Ambuja Cement will spend INR 3790 crore to acquire 46.8% stake in OCL. The above acquisition will trigger open offer requirements pursuant to SEBI Takeover Code regulations. In pursuant thereof, Ambuja will give an open offer to acquire 26% stake from public shareholders for INR 395.4 per share (same as what was offered to promoters and others) totalling INR 2112 crore.

Major object for this acquisition:

Ambuja Cement has laid-off a plan to double its capacity to 140 MTPA by 2028. To achieve its plan, Ambuja is consistently hunting for acquisitions.

OCL is the latest one. The acquisition enables Ambuja to expand its presence by 8.5 MTPA in the key markets of South and West India. On a national scale, Ambuja’s market share in consolidating Cement Industry will rise by 2%. Furthermore, OCL has an additional 8.1 MTPA capacity which is in to ready-to-execute phase, and construction can be started immediately. The locations of OCL are in close vicinity of existing Ambuja locations with some grinding units in new locations.

Acquisition Cost

With considering the open offer proposed to be made, Ambuja will require circa INR 5900 crores to acquire OCL. In past, Ambuja has spent a significant amount to acquire other key acquisitions.

- Penna Cement is including capacity which was in progress.

- Adani later increased their stake by infusing net circa INR 15,000 crore in Ambuja

After the acquisition of Ambuja Cement by Adani Group in 2022, Adani Group has infused more than 20,000 crores in Ambuja Cements to have war chest with Ambuja. All later acquisitions are done through Ambuja and mostly funded through cash & internal accruals available with Ambuja & ACC.

Way ahead for Adani Group:

After acquisitions, Adani Group tries to replace excessive cost of third-party debt if any taken by target entity with its own fund infusion which offers flexibility for target companies to run its day-to-day operations. In Penna Industries, Ambuja has invested INR 4235 crore by subscribing 0. 01% Optionally Convertible Debentures (OCD) of Penna Cement & Marwar Cement Limited (wholly owned step-down subsidiary of Penna Cement) respectively. In Sanghi, Ambuja earlier provided inter-company deposits which later changed to 8% non-convertible redeemable preference shares.

In addition, with synergies and economies of scale at play, group focuses on the reduction of overall cost of production to improvise profitability and returns. The group is essential working for power cost reduction, lead time reduction etc. to improvise overall returns for its cement business. With Sanghi Industries Limited, it executed master supply agreement which entails improving capacity and selling entire production to Ambuja. Meanwhile, Sanghi brand has been discontinued. For others, basis the market scenario it may take call to continue brands or merge brands with Ambuja.

With Orient acquisition, Ambuja will have three major subsidiaries which will be listed. At appropriate time (sooner) Adani Group may announced merger of all with Ambuja. The challenge for Adani Group will be to retain promoters’ stake in Ambuja post-merger. Whenever they will be in a position to maintain desire stake, the merger will likely to be announced.

Why are Birla’s selling?

India cement industry undergoing consolidation cycle. There is strong wave of acquisitions done by large players like Ambuja & Ultratech Cement. In few years we may have only 4-5 players dominating 90%+ cement capacity in India. With small size, managing overall operations and keeping the balance sheet healthy becoming challenge. Further, the valuations offered by large players becoming too enticing. With cashing out, promoters may use the funds for their core business and personal use.

Valuations

Tentative valuation multiples for some of the key acquisitions by Adani Group in the cement sector:

| Particulars | Enterprise Value | Capacity | EV/MTPA |

| Ambuja + ACC | 1,00,000 | 68 | 1470 |

| Sanghi | 5100 | 6.1 | 836 |

| Penna | 10,422 | 14 | 744 |

| OCL | 8100 | 9 | 900 |

Recently, India Cement’s Limited got acquired by Ultratech Cement Limited. The assigned EV/MTPA for India Cement was around circa INR 1000 crore.

Financial Position of OCL & Ambuja

Conclusion

Cement is a commodity item hence logistic; transportation and marketing cost optimisation only can improve EBITDA margin. This compels major players to have all India presence quickly. As cement is capital intensive and long gestation industry, acquisition at fair price will enable the acquirer to have increased EBITDA and additional cash flow to create greenfield and brownfield capacity.

No doubt, the deal provides handsome opportunities for promoters of the target company but one really needs to debate whether it gives equivalent benefits to minority shareholders of respective acquired target entities. it is more so due to legal hurdles; The acquirer is not able to merge with itself the acquired target companies. The merger will enable minority shareholders to share fortunes with the growth of the acquirer.